- Canada

- /

- Construction

- /

- TSX:ATRL

How Leading the I-80 Digital Corridor Project Has Changed AtkinsRéalis Group’s (TSX:ATRL) Investment Story

Reviewed by Sasha Jovanovic

- The Nevada Department of Transportation and the Interstate 80 Corridor Coalition recently announced that AtkinsRéalis has been appointed as lead consultant for the US Department of Transportation’s SMART Grant: I-80 Enhancing Corridor Communications Roadmap Project, which will create the first cross-country digital infrastructure corridor in the US connecting eleven state transportation agencies and three toll authorities.

- By spearheading a 2,900-mile digital infrastructure initiative, AtkinsRéalis is establishing a replicable model for smarter, connected transportation in the US, a move that highlights its expanding presence in transformative mobility projects.

- We'll consider how leading this multi-state digital infrastructure corridor could shape investor perceptions of AtkinsRéalis' expertise in advanced transportation systems.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

AtkinsRéalis Group Investment Narrative Recap

To own AtkinsRéalis Group shares, it’s important to have conviction in its ability to secure and deliver on major, multi-year infrastructure and engineering projects as global digital, transport, and energy systems modernize. While leading the I-80 corridor project showcases AtkinsRéalis’ technical expertise and its role in shaping U.S. digital infrastructure, in the near term this development does not materially alter the primary catalyst for the stock, sustained backlog growth in core nuclear and engineering services contracts, nor does it directly reduce risks tied to project delays or regional revenue volatility.

Among recent announcements, the November 6 engagement with Hydro One Networks to expand the Bowmanville Switching Station ties directly to growth in nuclear infrastructure, reinforcing the company's focus on recurring revenue opportunities in sectors backed by public policy commitments. This complements the broader catalyst of accelerating nuclear and power grid projects, which remain central to the investment outlook for AtkinsRéalis.

However, investors should also pay close attention to trends in organic revenue growth outlooks, especially if there are signs of contraction or regional headwinds …

Read the full narrative on AtkinsRéalis Group (it's free!)

AtkinsRéalis Group's narrative projects CA$12.8 billion in revenue and CA$896.4 million in earnings by 2028. This requires 7.4% yearly revenue growth and a CA$1.6 billion decrease in earnings from the current CA$2.5 billion.

Uncover how AtkinsRéalis Group's forecasts yield a CA$114.39 fair value, a 32% upside to its current price.

Exploring Other Perspectives

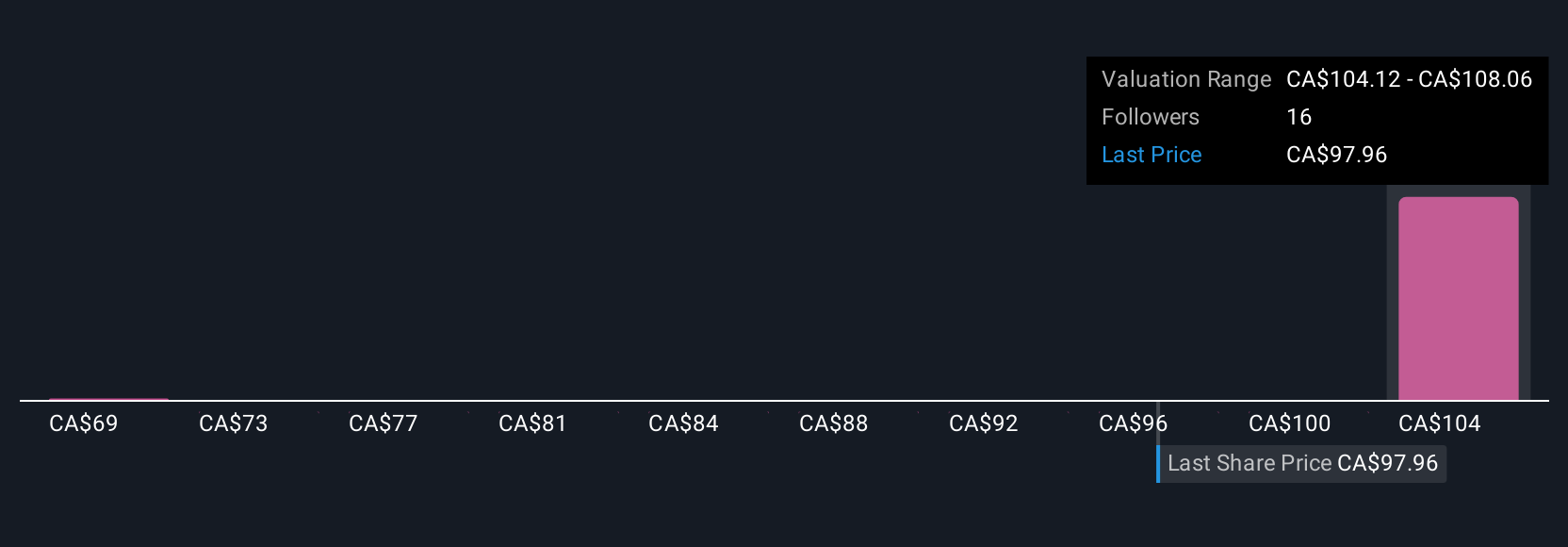

Simply Wall St Community members recently posted three fair value estimates for AtkinsRéalis Group, ranging widely from CA$68.73 to CA$114.39 per share. While these opinions illustrate just how much future potential is up for debate, recent wins in digital and nuclear infrastructure could strengthen the company’s pipeline, inviting you to consider how differing growth forecasts might play out in your own research.

Explore 3 other fair value estimates on AtkinsRéalis Group - why the stock might be worth 21% less than the current price!

Build Your Own AtkinsRéalis Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AtkinsRéalis Group research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free AtkinsRéalis Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AtkinsRéalis Group's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ATRL

AtkinsRéalis Group

Provides professional services and project management, and capital investment services in United Kingdom, Canada, the United States, Saudi Arabia, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026