- Canada

- /

- Construction

- /

- TSX:ATRL

How A £400 Million UK Nuclear Submarine Deal At AtkinsRéalis Group (TSX:ATRL) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In early December 2025, Rolls-Royce Submarines Limited appointed AtkinsRéalis Group Inc., alongside Frazer-Nash and Assystem, to deliver nuclear propulsion and engineering capabilities under a framework agreement worth up to £400 million over five years, with an option to extend for two more years.

- This Capability Assured Strategic Partnership embeds AtkinsRéalis deeper into the UK’s Defence Nuclear Enterprise and AUKUS-related submarine programs, broadening its role in high-complexity nuclear propulsion, safety assurance, and lifecycle engineering services for allied navies.

- We’ll now examine how this multi-year UK submarines framework, anchored in nuclear propulsion and engineering services, may influence AtkinsRéalis’ investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

AtkinsRéalis Group Investment Narrative Recap

To own AtkinsRéalis, you need to believe it can compound value through higher margin nuclear and complex engineering work, while managing project and acquisition risk. The new Rolls-Royce Submarines framework reinforces the near term nuclear growth story, but does not remove the key risks around lumpy nuclear revenues, potential project delays and the possibility that softer Engineering Services growth in the US and EMEA could pressure the earnings trajectory.

The December 2025 CASP award builds directly on the January 2025 appointment as Rolls-Royce Submarines’ joint fissile design partner in Derby. Together, these roles deepen AtkinsRéalis’ integration into the UK Defence Nuclear Enterprise and AUKUS programs, which sit at the center of the current nuclear growth catalyst, but also amplify the concentration risk if future nuclear program timing or scope were to change.

Yet investors should also weigh how increased dependence on large nuclear programs could affect results if...

Read the full narrative on AtkinsRéalis Group (it's free!)

AtkinsRéalis Group's narrative projects CA$12.8 billion revenue and CA$896.4 million earnings by 2028. This requires 7.4% yearly revenue growth and an earnings decrease of about CA$1.6 billion from CA$2.5 billion today.

Uncover how AtkinsRéalis Group's forecasts yield a CA$114.53 fair value, a 31% upside to its current price.

Exploring Other Perspectives

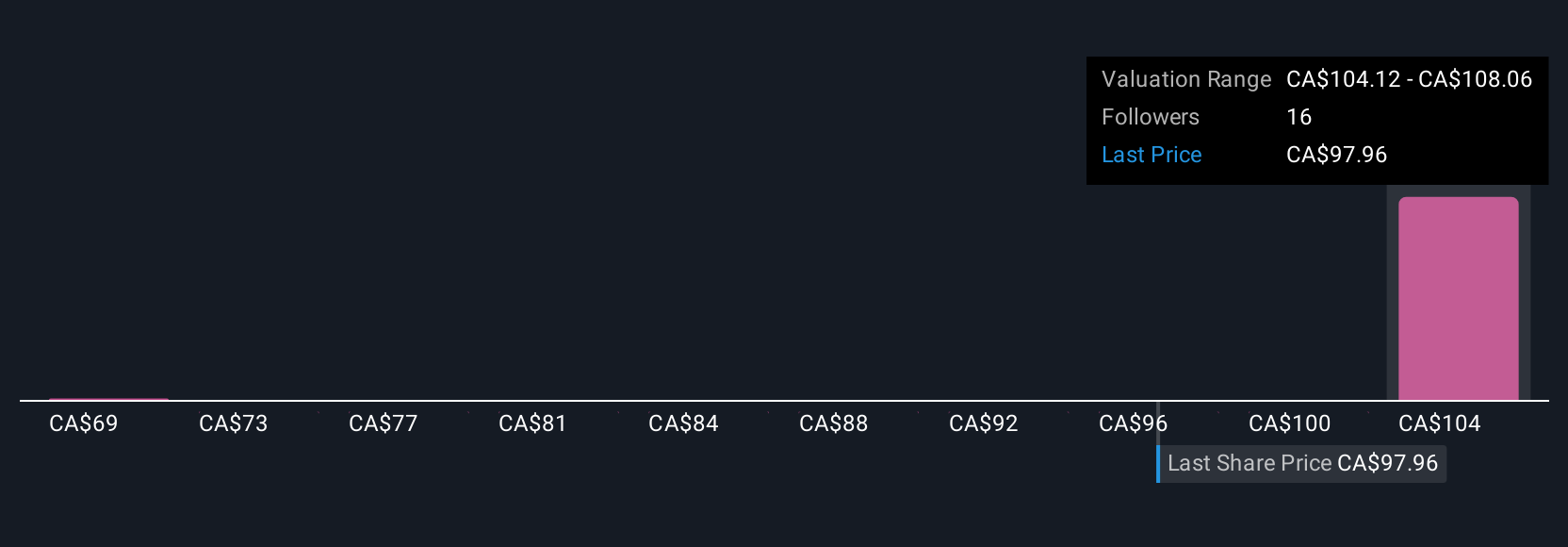

Three Simply Wall St Community fair value estimates for AtkinsRéalis span from CA$68.73 to CA$114.53, underlining how far apart individual views can be. When you set these side by side with the growing reliance on large, complex nuclear contracts, it becomes clear why many investors choose to compare several viewpoints before deciding how this story might influence future performance.

Explore 3 other fair value estimates on AtkinsRéalis Group - why the stock might be worth as much as 31% more than the current price!

Build Your Own AtkinsRéalis Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AtkinsRéalis Group research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free AtkinsRéalis Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AtkinsRéalis Group's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ATRL

AtkinsRéalis Group

Provides professional services and project management, and capital investment services in United Kingdom, Canada, the United States, Saudi Arabia, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026