Will TD Bank's (TSX:TD) Regional Strategy in North Florida Reinforce Its U.S. Growth Ambitions?

Reviewed by Sasha Jovanovic

- TD Bank recently appointed Mike Phillips as North Florida Commercial Market President, effective November 3, 2025, to lead commercial banking operations across the greater Orlando, Tampa/St. Petersburg, Jacksonville, Gainesville, Ocala, Daytona, Lakeland, and Melbourne areas.

- This move highlights TD's focus on growing its commercial banking presence in a region with significant economic activity, drawing on Phillips' 30 years of industry experience and leadership within the bank.

- We'll explore how Phillips' leadership and focus on regional integration could influence TD Bank's broader investment narrative and growth strategy in the U.S.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Toronto-Dominion Bank Investment Narrative Recap

Shareholders in Toronto-Dominion Bank are generally buying into a story of steady fee and lending income, operational efficiency gains from digital initiatives, and disciplined cost control. The recent appointment of Mike Phillips as North Florida Commercial Market President is unlikely to move the needle on TD’s most important near-term catalyst, managing regulatory asset growth and containing compliance costs, but it does reinforce the bank’s longer-term commitment to U.S. expansion. The greatest present risk remains persistent regulatory scrutiny and related cost pressures, which could weigh on net margins as digital rivals gain ground.

Among recent announcements, TD Bank’s launch of a new Wealth Virtual Assistant stands out for its relevance to underlying business catalysts. Investments in technology like this reflect continued efforts to enhance operational efficiency, improve client retention, and compete more effectively with fintechs, a critical area given growing digital competition identified as a key risk for TD’s future revenue growth.

Yet, despite a focus on growth, investors should consider the ongoing impact of regulatory asset caps and higher compliance costs, which...

Read the full narrative on Toronto-Dominion Bank (it's free!)

Toronto-Dominion Bank is projected to reach CA$62.5 billion in revenue and CA$14.2 billion in earnings by 2028. This outlook assumes a 0.5% annual decline in revenue and a CA$6.1 billion decrease in earnings from the current level of CA$20.3 billion.

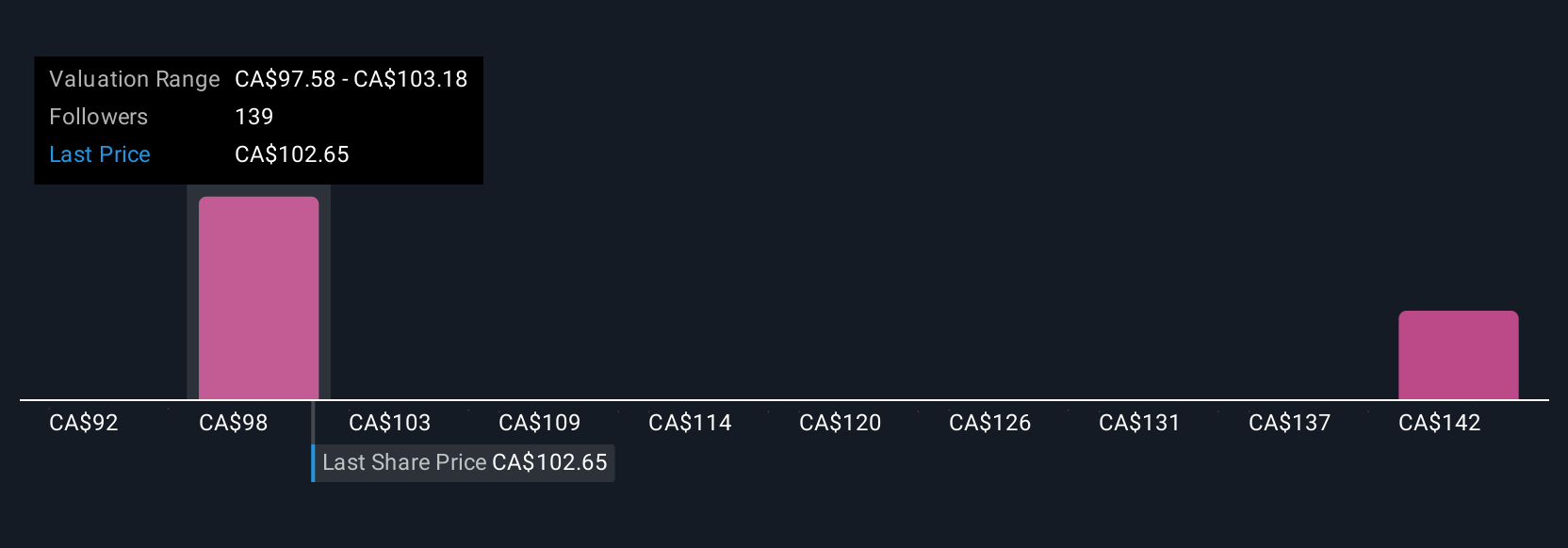

Uncover how Toronto-Dominion Bank's forecasts yield a CA$112.86 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for TD Bank run from CA$93 to CA$159 based on six individual analyses. With views this different and the persistent risk from digital challengers and higher compliance costs, now is the time to explore several perspectives before reaching a conclusion.

Explore 6 other fair value estimates on Toronto-Dominion Bank - why the stock might be worth 20% less than the current price!

Build Your Own Toronto-Dominion Bank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Toronto-Dominion Bank research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Toronto-Dominion Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Toronto-Dominion Bank's overall financial health at a glance.

No Opportunity In Toronto-Dominion Bank?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toronto-Dominion Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TD

Toronto-Dominion Bank

Provides various financial products and services in Canada, the United States, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives