RBC (TSX:RY) Valuation in Focus After Q3 Growth, Dividend Strength, and HSBC Canada Integration

Reviewed by Simply Wall St

Royal Bank of Canada (TSX:RY) is drawing increased attention after its strong growth across all major segments in Q3 2025, along with steady dividend payments and a well-capitalized position. The market also recognizes RBC’s successful integration of HSBC Canada.

See our latest analysis for Royal Bank of Canada.

RBC’s recent $214.09 share price reflects stronger investor sentiment, particularly following its stream of fixed-income offerings and the successful integration of HSBC Canada. With a 24.28% year-to-date share price return and a 25.93% total shareholder return over the past twelve months, momentum appears to be building for Canada’s largest bank as it maintains a lead over peers in terms of long-term gains.

If RBC’s growth streak has you rethinking your strategy, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

But with RBC now trading near its analyst price target and reporting robust results across all divisions, investors are left to wonder: is there further upside ahead, or has the market already priced in future growth?

Most Popular Narrative: 2% Undervalued

Royal Bank of Canada’s most widely followed narrative places its fair value just above the current share price, suggesting modest mispricing. The narrative builds on expectations of sustained business strength and integration benefits, setting the stage for long-term growth. This outlook relies on several specific growth drivers.

Strategic advancements in AI, digitalization, and cost management are boosting customer engagement, efficiency, and long-term profitability across RBC's core businesses. Expansion in wealth management and successful U.S. growth, enhanced by acquisitions, is diversifying revenue streams and fueling sustainable, higher-margin income.

Want to know what’s driving this bold valuation? There’s a story behind the rising profit margins and ambitious growth targets that power this estimate. The narrative hints at aggressive expansion and innovation, with assumptions that could surprise you. Dive into the full narrative to uncover which big bets and forecasts underpin that fair value calculation.

Result: Fair Value of $219.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent economic pressures and elevated credit losses could undermine RBC's positive outlook. These factors pose real challenges to the current bullish narrative.

Find out about the key risks to this Royal Bank of Canada narrative.

Another View: Is the Market Pricing Right?

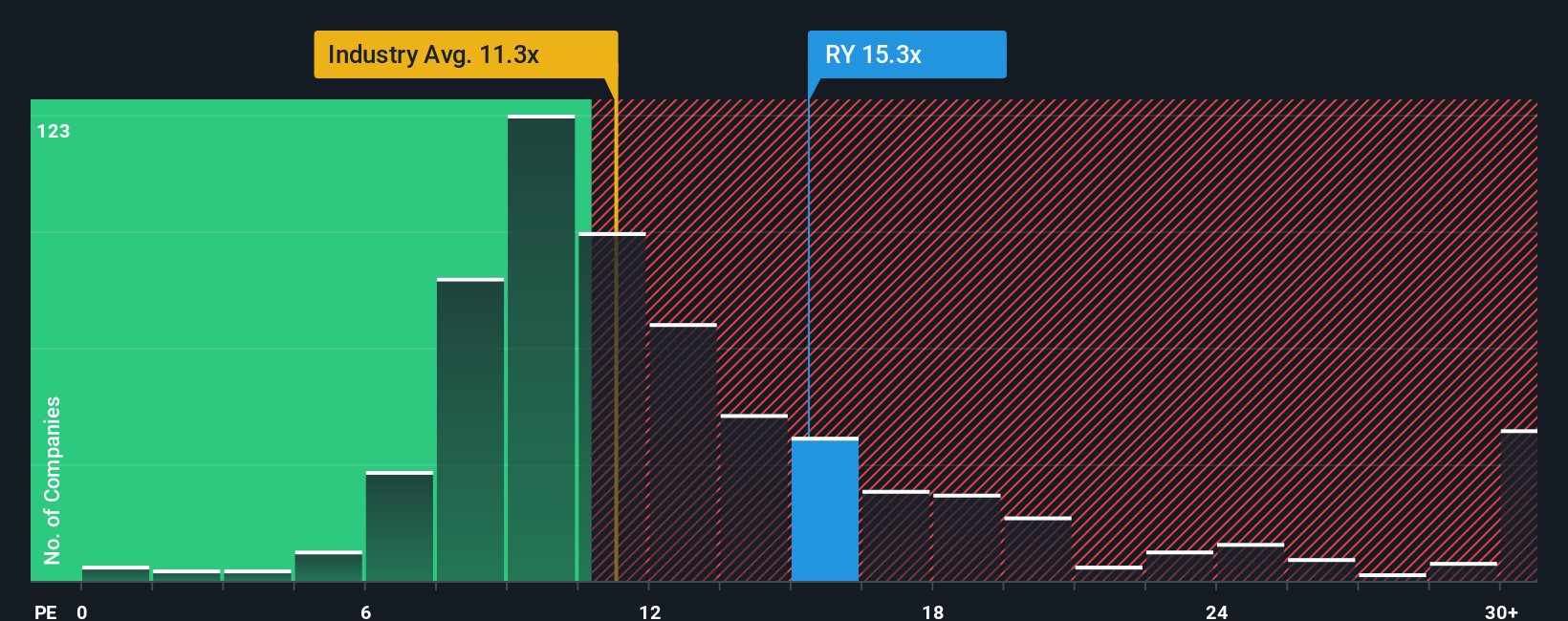

Looking through a different lens, RBC’s price-to-earnings ratio stands at 16.1x. This is notably higher than the North American banks industry average of 11.5x, its peer average of 14.2x, and above its fair ratio of 14.9x. This suggests the stock could be priced with optimism, leaving less room for upside if growth stalls. Does this premium signal solid confidence or should investors be cautious?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Royal Bank of Canada Narrative

If you’re not convinced by the prevailing narrative or want to dig into the numbers yourself, you can craft your own view from the ground up in just a few minutes, starting with Do it your way.

A great starting point for your Royal Bank of Canada research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t miss the opportunity to broaden your portfolio with fresh ideas. The Simply Wall Street Screener uncovers real opportunities waiting for you to seize them.

- Boost your income stream by checking out these 14 dividend stocks with yields > 3% with robust yields over 3% and reliable payout histories.

- Ride the AI wave by targeting these 25 AI penny stocks, which feature innovative companies transforming industries with intelligent solutions and automation.

- Capitalize on value by focusing on these 923 undervalued stocks based on cash flows that the market may have overlooked, giving you a potential edge ahead of the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RY

Royal Bank of Canada

Operates as a diversified financial service company worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026