Did New Leadership and Debt Issuance Just Shift Bank of Nova Scotia's (TSX:BNS) Investment Narrative?

Reviewed by Sasha Jovanovic

- The Bank of Nova Scotia recently completed a US$20 million fixed-income offering of 5.075% senior notes due 2040 and made significant executive appointments to advance strategic objectives, with Phil Thomas assuming the roles of Group Head & Chief Strategy and Operating Officer and Shannon McGinnis named Chief Risk Officer.

- These moves reflect the bank's focus on enhancing risk management and operational efficiency, ahead of the anticipated release of its fiscal fourth-quarter earnings.

- We will explore how these executive leadership changes may influence Bank of Nova Scotia's ongoing investment narrative and risk outlook.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Bank of Nova Scotia Investment Narrative Recap

For shareholders, the central thesis of owning Bank of Nova Scotia stock centers on its diversified banking platform in Canada and Latin America, combined with a strong dividend track record and measured expansion in wealth management. The recently completed US$20 million fixed-income offering and new executive appointments signal operational focus, but do not materially alter the near-term catalysts, particularly momentum around upcoming quarterly earnings, or shift the pressing risks from economic volatility in key international markets.

Of the recent announcements, the appointment of Shannon McGinnis as Chief Risk Officer is particularly relevant, as it underscores the importance of risk oversight with the bank's notable exposure to Latin America. Enhanced risk management will be critical as investors track the potential for credit losses and earnings volatility, especially amid anticipated macroeconomic uncertainties impacting loan performance in these regions.

But against this backdrop, it's just as important for investors to be mindful of how possible regulatory changes in Latin American markets could ...

Read the full narrative on Bank of Nova Scotia (it's free!)

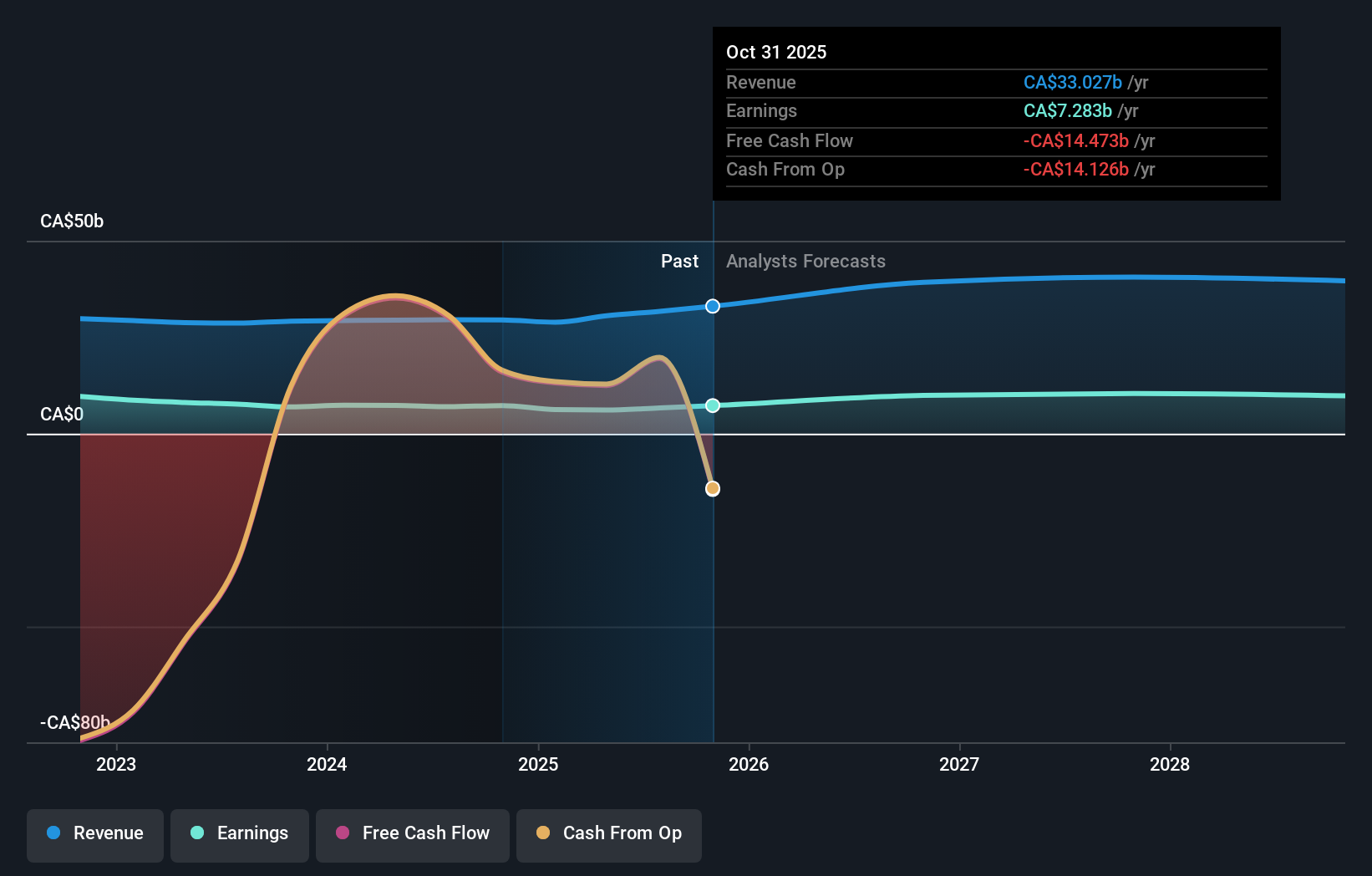

Bank of Nova Scotia's narrative projects CA$39.8 billion revenue and CA$10.0 billion earnings by 2028. This requires 7.9% yearly revenue growth and a CA$3.3 billion earnings increase from CA$6.7 billion.

Uncover how Bank of Nova Scotia's forecasts yield a CA$92.21 fair value, a 4% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 10 fair value estimates for Bank of Nova Scotia, ranging from CA$75.22 to CA$123.66 per share. While many anticipate revenue growth in high-potential markets, the risk from Latin American economic swings could shape the company’s long-term trajectory, take a look and see how your view compares.

Explore 10 other fair value estimates on Bank of Nova Scotia - why the stock might be worth as much as 29% more than the current price!

Build Your Own Bank of Nova Scotia Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bank of Nova Scotia research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Bank of Nova Scotia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bank of Nova Scotia's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Nova Scotia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BNS

Bank of Nova Scotia

Provides various banking products and services in Canada, the United States, Mexico, Peru, Chile, Colombia, the Caribbean and Central America, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026