BMO (TSX:BMO) Net Interest Margin Gain Reinforces Efficiency‑Focused Bull Narratives

Reviewed by Simply Wall St

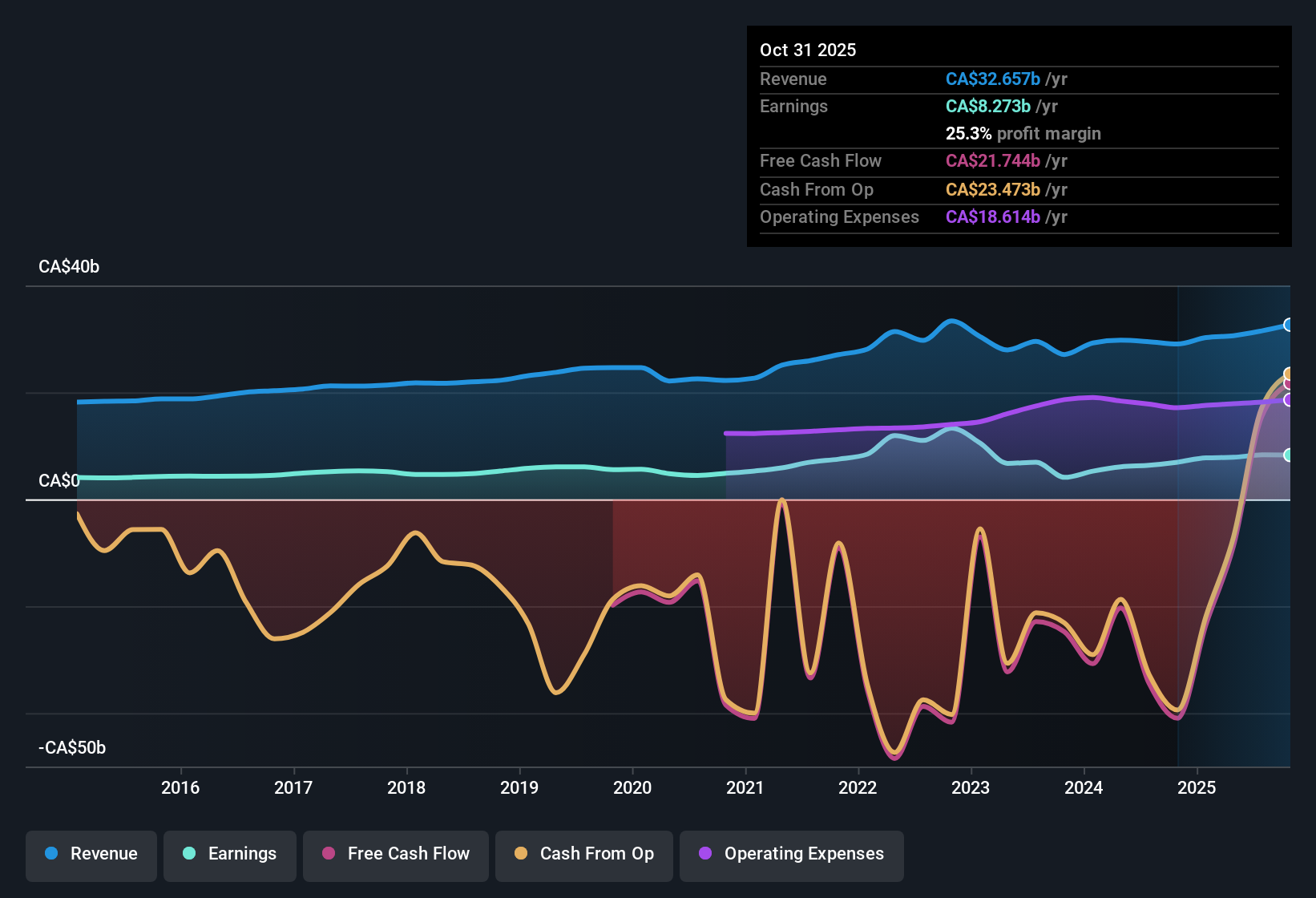

Bank of Montreal (TSX:BMO) has put solid numbers on the board for Q3 FY 2025, with revenue of about CA$8.2 billion and EPS of CA$3.14 anchoring its latest update. The bank has seen revenue move from roughly CA$7.3 billion in Q3 FY 2024 to about CA$8.2 billion in Q3 FY 2025, while EPS shifted from CA$2.49 to CA$3.14 over the same period, setting the stage for margins that look increasingly supportive of the current earnings story.

See our full analysis for Bank of Montreal.With the headline figures in place, it is time to set these results against the most common narratives around BMO to see which storylines hold up and which ones the latest margins start to challenge.

See what the community is saying about Bank of Montreal

Margins Improve as Costs Ease Back

- Net interest margin has edged up from 1.52% in Q3 FY 2024 to 1.69% in Q3 FY 2025, while the cost to income ratio has moved down from 57.3% to 55.8%. This points to more revenue being kept as profit before provisions.

- Consensus narrative talks about digital and AI investments and integration of deals like Bank of the West improving efficiency. The shift in net interest margin and cost to income over the last year supports that idea, even as:

- Rising expenses remain visible in the still mid 50s cost to income ratio, which fits with the view that tech and staff spending can run ahead of revenue in some periods.

- The stronger margin also lines up with fee based and payment related growth described in the consensus view, which tends to be higher margin than plain lending.

Credit Quality Watch, 6.9 Billion In Non Performing Loans

- Non performing loans have risen from about CA$6.0 billion in Q3 FY 2024 to roughly CA$7.0 billion in Q3 FY 2025, and the allowance for bad loans is described at 74% of these balances, which is on the low side for coverage.

- Bears in the consensus narrative focus on softer Canadian growth and ongoing credit pressures, and the combination of higher non performing loans and a 74% allowance coverage leans in their direction, because:

- Exposure to areas like unsecured retail and commercial real estate is flagged in the narrative, and the higher non performing balance is consistent with that risk needing continued attention.

- A coverage level below 100% means future provisions could still be needed if those stressed loans do not cure, which is exactly the type of drag bears worry about for net income and returns.

Big Earnings Jump, Modest Growth Forecasts

- On a trailing twelve month basis, net income excluding extra items is about CA$8.3 billion and EPS is CA$11.43, up 30.4% over the past year, yet forward earnings are only forecast to grow around 1% per year and revenue about 1.9%, both slower than the broader Canadian market.

- Bullish elements of the consensus story highlight acquisitions, digital platforms, and sustainable finance as growth engines, and the 30.4% earnings lift plus a 26.3% net margin improvement support that momentum, even as:

- The forecast step down to roughly 1% annual earnings growth shows analysts are not extrapolating this strong year, which keeps the bullish case more about stability than hyper growth.

- At a share price of CA$176.82 and a trailing P E of 15.2 times versus a DCF fair value of about CA$223.88, the valuation gap still leaves room for bulls who think recent profitability can be sustained.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bank of Montreal on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers from another angle? Turn that view into a concise narrative in just a few minutes by starting here: Do it your way.

A great starting point for your Bank of Montreal research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternatives

Despite stronger recent earnings, BMO faces rising non performing loans, relatively thin allowance coverage, and only modest forecast growth that could cap long term returns.

If those credit and growth constraints make you cautious, use our solid balance sheet and fundamentals stocks screener (1936 results) today to focus on financially stronger businesses built to withstand tougher cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Montreal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BMO

Bank of Montreal

Engages in the provision of diversified financial services primarily in North America.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026