Bank of Montreal (TSX:BMO) Announces Leadership Changes to Enhance U.S. and Canadian Growth

Reviewed by Simply Wall St

Recent executive and board changes at Bank of Montreal (TSX:BMO), including appointments aimed at improving client service and fueling growth in Canada and the U.S., seem to have resonated positively with investors. The company's share price rose by 10% over the past month, a performance that aligns with general market trends. Additionally, the announcement of quarterly dividend increases and a share buyback program indicates a focus on enhancing shareholder value. These factors, together with the broader market's positive response to robust economic data and strong corporate earnings, have added momentum to BMO's stock price movement during this period.

You should learn about the 1 risk we've spotted with Bank of Montreal.

The recent executive and board changes at Bank of Montreal could have a significant effect on its long-term performance by potentially fostering improved client service and fueling growth. The share price increase over the past month aligns well with these developments. Moreover, the company's commitment to dividend growth and share buybacks could enhance shareholder value, positively impacting revenue and earnings forecasts. Such initiatives, especially following the Bank of the West acquisition, might strengthen capital allocation and improve net interest margins.

Over the past five years, Bank of Montreal's total shareholder return, including both share price appreciation and dividends, reached a very large 155.46%. This demonstrates a robust performance over a substantial period, providing investors context for the company's recent short-term gains. In comparison, the past year's performance surpassed both the Canadian Banks industry and the broader Canadian market, indicating strong competitive positioning and resilience in varying market conditions.

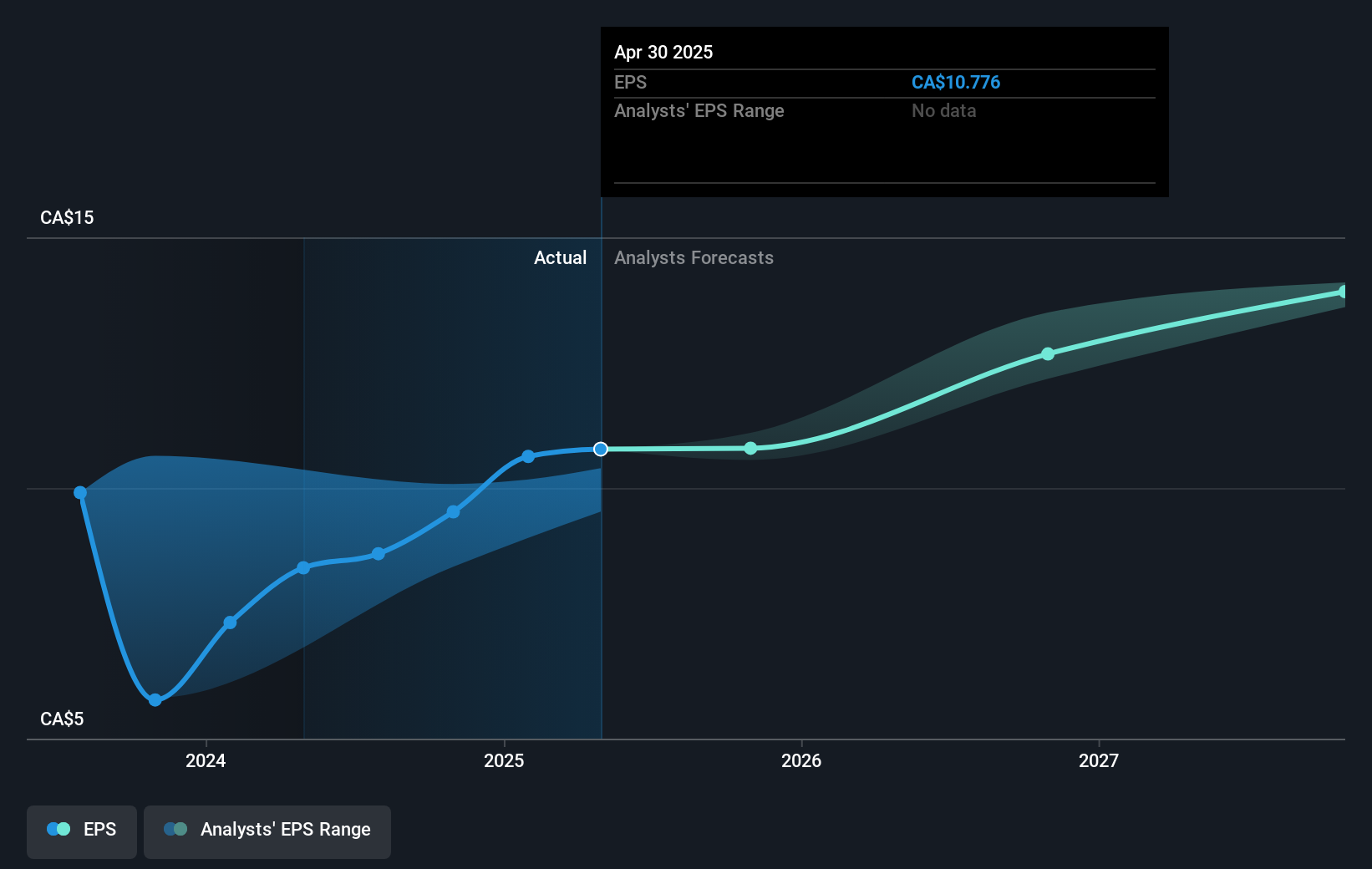

Despite the recent 10% rise in share price, Bank of Montreal's current valuation positions it close to the analyst consensus price target of CA$150.00, which presents a 12.1% potential upside from its current price of CA$131.85. However, it remains critical to assess whether the expected improvements in revenue—anticipated to grow to CA$38.0 billion—and earnings of CA$9.5 billion by 2028 will align with analysts' forecasts. The company's ongoing strategies, including digital advancements and U.S. deposit growth, are essential to realize these projections. Nevertheless, external risks such as geopolitical uncertainties and potential credit challenges may influence future outcomes. Investors are encouraged to continually monitor the unfolding effects of these strategic changes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Montreal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BMO

Bank of Montreal

Engages in the provision of diversified financial services primarily in North America.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives