- Brazil

- /

- Consumer Durables

- /

- BOVESPA:MRVE3

There's Reason For Concern Over MRV Engenharia e Participações S.A.'s (BVMF:MRVE3) Massive 29% Price Jump

MRV Engenharia e Participações S.A. (BVMF:MRVE3) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. Looking further back, the 16% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

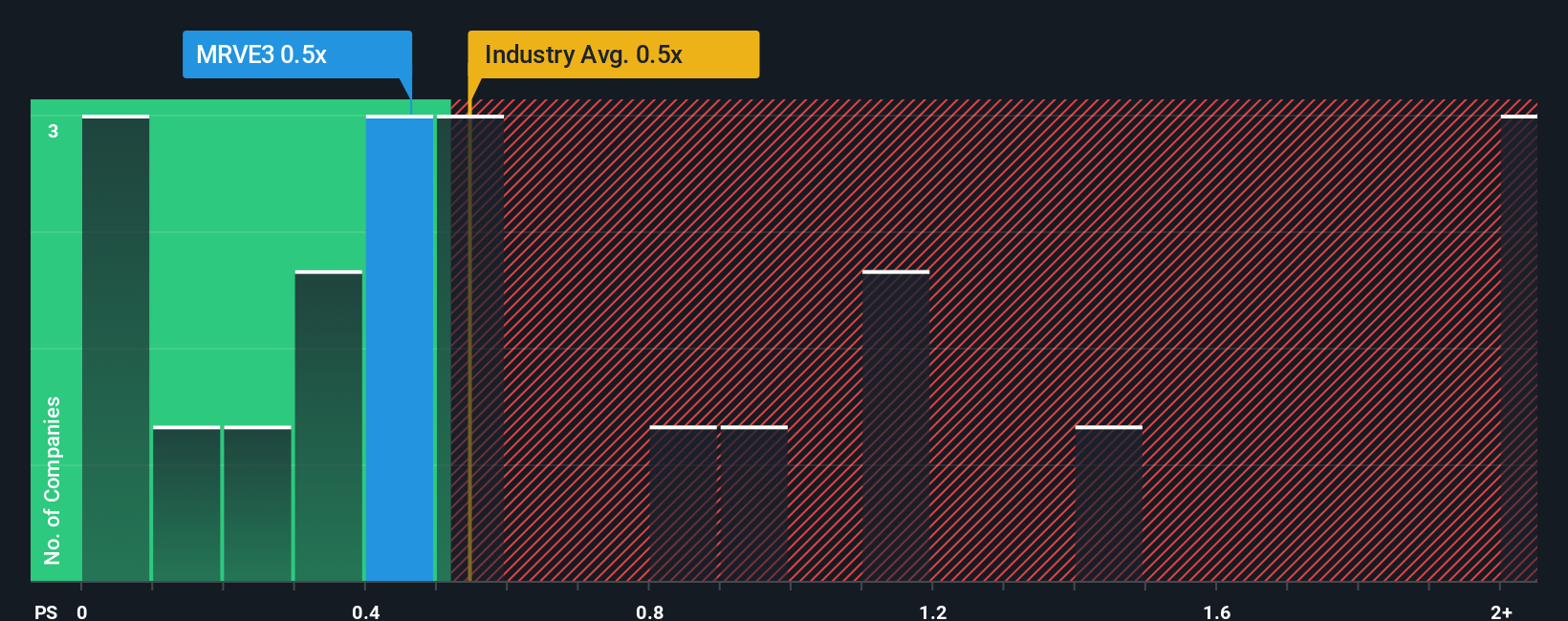

Even after such a large jump in price, it's still not a stretch to say that MRV Engenharia e Participações' price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Consumer Durables industry in Brazil, where the median P/S ratio is around 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for MRV Engenharia e Participações

How MRV Engenharia e Participações Has Been Performing

With revenue growth that's inferior to most other companies of late, MRV Engenharia e Participações has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on MRV Engenharia e Participações will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, MRV Engenharia e Participações would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 21% last year. The strong recent performance means it was also able to grow revenue by 41% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 8.6% per annum over the next three years. That's shaping up to be materially lower than the 16% per annum growth forecast for the broader industry.

With this in mind, we find it intriguing that MRV Engenharia e Participações' P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does MRV Engenharia e Participações' P/S Mean For Investors?

Its shares have lifted substantially and now MRV Engenharia e Participações' P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at the analysts forecasts of MRV Engenharia e Participações' revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware MRV Engenharia e Participações is showing 2 warning signs in our investment analysis, and 1 of those shouldn't be ignored.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:MRVE3

MRV Engenharia e Participações

Operates as a real estate developer in Brazil and the United States.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives