- Italy

- /

- Commercial Services

- /

- BIT:FILA

European Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As European markets experience a steady rise, with the STOXX Europe 600 Index climbing 2.35% and major indices in Germany, Italy, France, and the UK also showing positive momentum, investors are increasingly looking toward dividend stocks as a way to enhance portfolio stability amid subdued inflation levels across the eurozone. In this environment of cautious optimism, selecting dividend stocks with strong fundamentals can provide both income and potential growth opportunities for investors seeking to navigate these evolving market dynamics.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.32% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.48% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.12% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.86% | ★★★★★★ |

| Evolution (OM:EVO) | 4.75% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.19% | ★★★★★★ |

| d'Amico International Shipping (BIT:DIS) | 9.84% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.48% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.68% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.52% | ★★★★★☆ |

Click here to see the full list of 217 stocks from our Top European Dividend Stocks screener.

We'll examine a selection from our screener results.

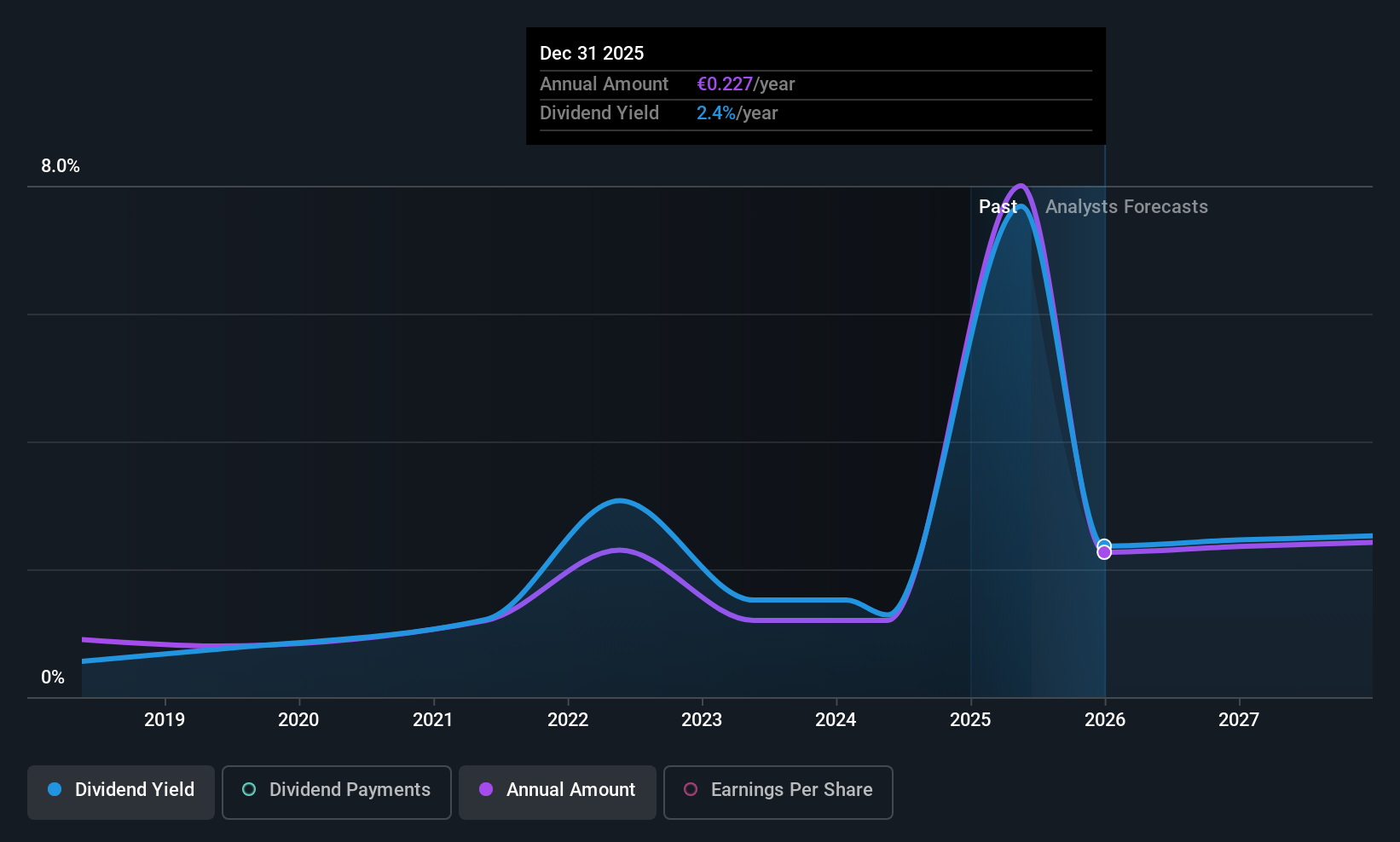

F.I.L.A. - Fabbrica Italiana Lapis ed Affini (BIT:FILA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: F.I.L.A. - Fabbrica Italiana Lapis ed Affini S.p.A., with a market cap of approximately €498 million, is engaged in the production and distribution of art materials and writing instruments.

Operations: F.I.L.A. - Fabbrica Italiana Lapis ed Affini S.p.A. generates revenue primarily from its Office Supplies segment, totaling €584 million.

Dividend Yield: 8.2%

F.I.L.A. offers an attractive dividend yield of 8.16%, ranking in the top 25% among Italian dividend payers, with dividends well-covered by earnings due to a low payout ratio of 30.3%. However, its dividends have been volatile over the past decade and recent financial results show declining revenue and net income, with EUR 460.87 million in sales for the first nine months of 2025 compared to EUR 493.42 million last year, raising concerns about sustainability despite trading below fair value estimates by analysts.

- Delve into the full analysis dividend report here for a deeper understanding of F.I.L.A. - Fabbrica Italiana Lapis ed Affini.

- The valuation report we've compiled suggests that F.I.L.A. - Fabbrica Italiana Lapis ed Affini's current price could be quite moderate.

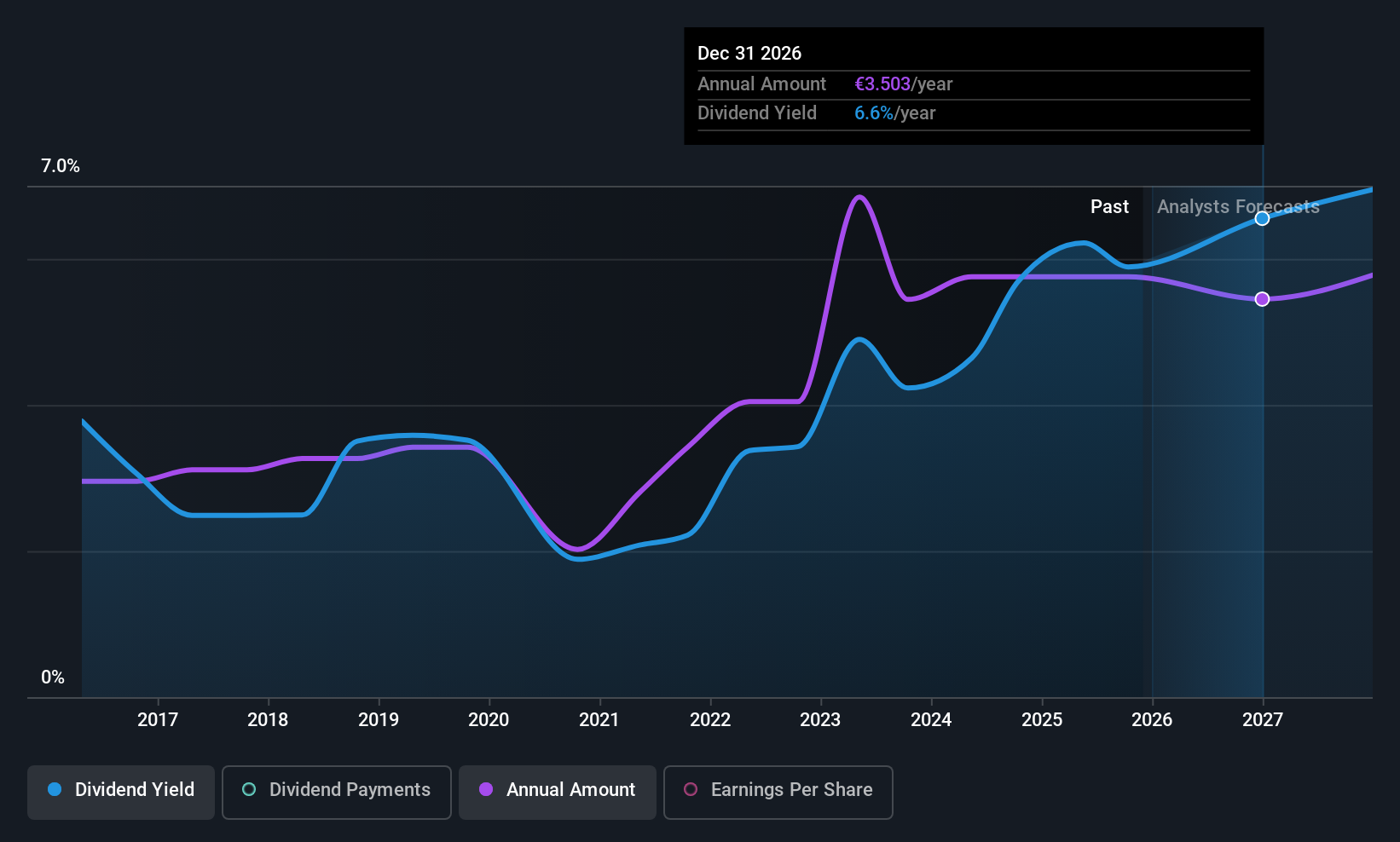

Melexis (ENXTBR:MELE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Melexis NV designs, develops, tests, and markets advanced integrated semiconductor devices primarily for the automotive industry across various global regions, with a market cap of €2.13 billion.

Operations: Melexis NV generates its revenue from the development and sale of integrated circuits, amounting to €822.53 million.

Dividend Yield: 7.0%

Melexis offers a notable dividend yield of 6.98%, placing it among the top 25% in Belgium, though its dividends are not well-covered by free cash flow and have been volatile over the past decade. Recent earnings show a decline, with Q3 sales at €215.29 million compared to €247.86 million last year, impacting net income and profit margins. Despite these challenges, Melexis is investing in AI through an expanded partnership with Google Cloud to enhance operational efficiency and innovation.

- Click here to discover the nuances of Melexis with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Melexis shares in the market.

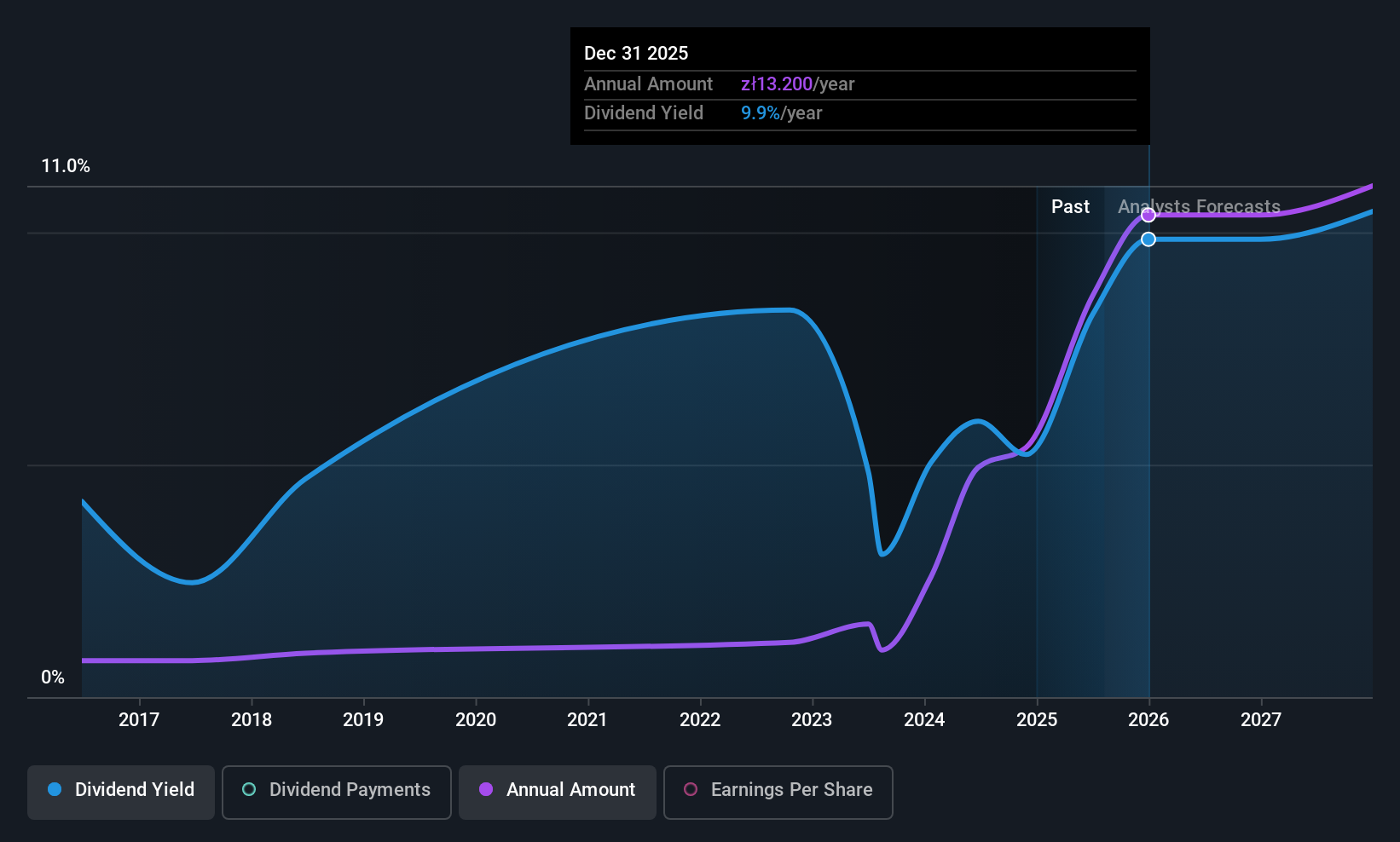

Rainbow Tours (WSE:RBW)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Rainbow Tours S.A. is a tour operator active in Poland, the Czech Republic, Greece, Spain, Turkey, Slovakia, Lithuania, and internationally with a market capitalization of PLN1.93 billion.

Operations: Rainbow Tours S.A. generates revenue from its operations as a tour operator across various countries, including Poland, the Czech Republic, Greece, Spain, Turkey, Slovakia, and Lithuania.

Dividend Yield: 8.3%

Rainbow Tours' dividend yield of 8.3% ranks in the top quartile of Polish dividend payers, supported by a sustainable payout ratio of 59.4%. However, its dividends have been volatile over the past decade. The company trades below estimated fair value and analysts predict a price rise. Recent Q3 results show sales growth to PLN 1,956.53 million but stable net income at PLN 160.05 million year-over-year, indicating potential challenges in profitability despite revenue increases.

- Unlock comprehensive insights into our analysis of Rainbow Tours stock in this dividend report.

- Our valuation report unveils the possibility Rainbow Tours' shares may be trading at a discount.

Seize The Opportunity

- Click this link to deep-dive into the 217 companies within our Top European Dividend Stocks screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:FILA

F.I.L.A. - Fabbrica Italiana Lapis ed Affini

F.I.L.A. - Fabbrica Italiana Lapis ed Affini S.p.A.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026