- Belgium

- /

- Retail REITs

- /

- ENXTBR:ASCE

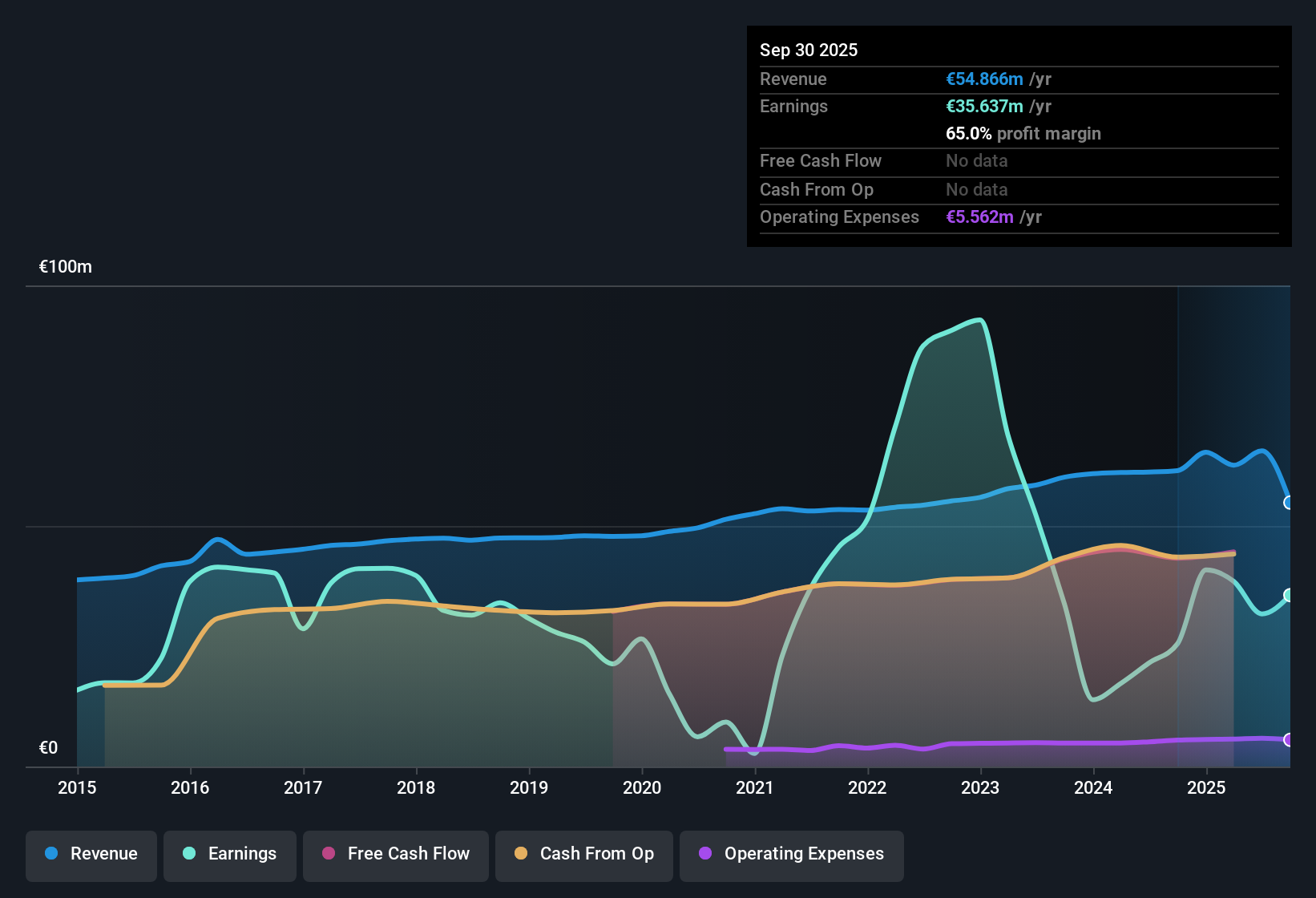

Ascencio (ENXTBR:ASCE) Net Profit Margin Climbs to 65%, Reinforcing Dividend-Focused Investor Narrative

Reviewed by Simply Wall St

Ascencio (ENXTBR:ASCE) just published its FY 2025 half-year results, reporting total revenue of €34.2 million and basic EPS of €2.83 for the period. Looking back, revenue figures moved from €33.1 million in the first half of 2024 to €28.4 million in the second half, and then up to the latest €34.2 million. EPS was €0.87, €3.00, and €2.83 over the same spans. Margins remain a core focus for investors as these latest numbers land, framing expectations for what comes next.

See our full analysis for Ascencio.Next up, we’ll stack these headline results against prevailing investor narratives to see which themes get confirmed and which ones face new questions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Surge to 65%

- Ascencio’s reported net profit margin of 65% over the past twelve months marks a considerable jump from 41.5% in the previous year. This signals a major turnaround in profitability compared to the five-year trend.

- Recent commentary underscores how, while current margins heavily support the investment case for reliable income, the sustainability of such high levels draws fresh attention to sector-wide headwinds such as rising interest rates and commercial property pressures.

- This margin expansion provides a firm base for high dividends. The dividend yield is currently at 8.21% according to the latest filing.

- Investors may weigh these improvements against broader retail real estate challenges. Shifts in consumer behavior and higher financing costs could compress future margins.

Discounted Valuation and Dividend Yield

- Shares currently trade at €52.40, reflecting a 20.1% discount to DCF fair value. The trailing Price-to-Earnings ratio of 9.7x is well below the European Retail REITs sector average of 16.5x.

- Market outlook emphasizes that this notable valuation gap, combined with an 8.21% dividend, appeals to value and income-driven investors. However, the slow forecast annual earnings growth of 8.4% tempers expectations relative to Belgian market peers.

- The discount to DCF fair value highlights a potential mispricing but could also factor in sector risks and limited near-term growth prospects.

- Despite the high yield, ongoing monitoring is needed given debt coverage concerns indicated by financial analysis and peer-level comparison.

Growth Forecast Trails Market Momentum

- Analysts project Ascencio’s earnings to grow at 8.4% annually, with revenue expansion at just 1.9% per year. Both figures lag expectations for the Belgian broader market.

- Current analysis contends that, although the company’s asset-heavy model and diversification across Belgium, France, and Spain provide income defensiveness, the muted growth outlook may limit capital appreciation potential for those seeking market-beating momentum.

- Forecasted earnings and revenue growth rates fall short of sector averages, which may deter growth-focused investors despite steady fundamentals.

- The focus on essential retail assets helps minimize downside risk, but projected momentum is modest compared to fast-growing alternatives.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Ascencio's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Ascencio’s muted earnings and revenue growth forecasts, combined with debt coverage concerns, could limit upside for investors seeking strong, reliable momentum.

If predictable long-term gains matter to you, check out stable growth stocks screener (2074 results) to focus on businesses consistently compounding earnings and revenue, minimizing surprises along the way.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:ASCE

Ascencio

A company incorporated under Belgian law, specialising in commercial property investments, and more specifically, supermarkets and retail parks.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.