- Australia

- /

- Electric Utilities

- /

- ASX:ORG

Origin Energy Limited's (ASX:ORG) CEO Compensation Is Looking A Bit Stretched At The Moment

Shareholders of Origin Energy Limited (ASX:ORG) will have been dismayed by the negative share price return over the last three years. In addition, the company's per-share earnings growth is not looking good, despite growing revenues. In light of this performance, shareholders will have a chance to question the board in the upcoming AGM on 18 October 2022, where they can impact on future company performance by voting on resolutions, including executive compensation. Here's our take on why we think shareholders might be hesitant about approving a raise at the moment.

Check out the opportunities and risks within the XX Electric Utilities industry.

How Does Total Compensation For Frank Calabria Compare With Other Companies In The Industry?

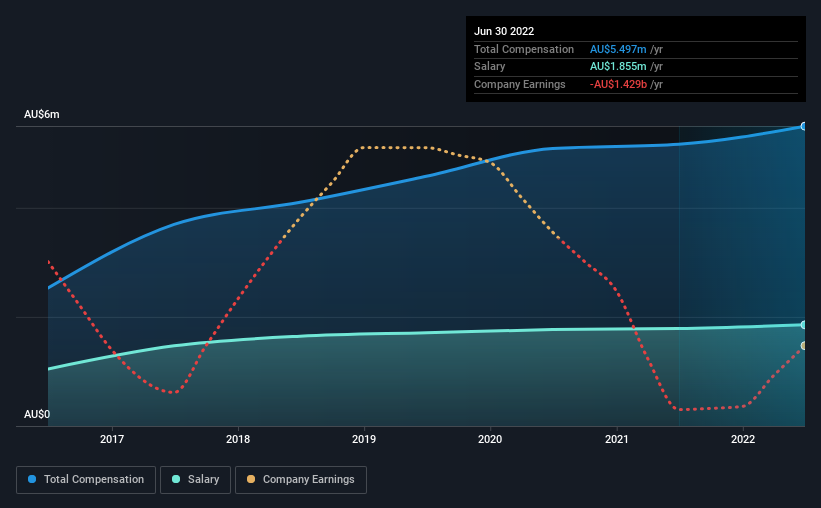

Our data indicates that Origin Energy Limited has a market capitalization of AU$9.5b, and total annual CEO compensation was reported as AU$5.5m for the year to June 2022. That's a modest increase of 6.4% on the prior year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at AU$1.9m.

In comparison with other companies in the industry with market capitalizations ranging from AU$6.3b to AU$19b, the reported median CEO total compensation was AU$2.5m. Accordingly, our analysis reveals that Origin Energy Limited pays Frank Calabria north of the industry median. What's more, Frank Calabria holds AU$7.4m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | AU$1.9m | AU$1.8m | 34% |

| Other | AU$3.6m | AU$3.4m | 66% |

| Total Compensation | AU$5.5m | AU$5.2m | 100% |

On an industry level, around 63% of total compensation represents salary and 37% is other remuneration. Origin Energy pays a modest slice of remuneration through salary, as compared to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Origin Energy Limited's Growth Numbers

Over the last three years, Origin Energy Limited has shrunk its earnings per share by 100% per year. It achieved revenue growth of 20% over the last year.

The decrease in EPS could be a concern for some investors. But on the other hand, revenue growth is strong, suggesting a brighter future. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Origin Energy Limited Been A Good Investment?

Since shareholders would have lost about 22% over three years, some Origin Energy Limited investors would surely be feeling negative emotions. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

The returns to shareholders is disappointing along with lack of earnings growth, which goes some way in explaining the poor returns. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 1 warning sign for Origin Energy that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ORG

Origin Energy

An integrated energy company, engages in the exploration and production of natural gas, electricity generation, wholesale and retail sale of electricity and gas, and sale of liquefied natural gas in Australia and internationally.

Flawless balance sheet and undervalued.