- Australia

- /

- Infrastructure

- /

- ASX:ALX

Assessing Atlas Arteria (ASX:ALX) Valuation Following Executive Restructuring and Strategic Refocus

Reviewed by Simply Wall St

Atlas Arteria (ASX:ALX) has announced a major overhaul of its executive team, reducing the number of leaders from six to four and broadening each role’s responsibilities to better support the company’s strategic priorities.

See our latest analysis for Atlas Arteria.

Recent executive changes signal Atlas Arteria’s renewed push for efficiency, and the market seems to have taken notice. The company has seen a 7.1% 30-day share price return after a period of softer momentum earlier this year. Over the past year, total shareholder return sits at 14.5%, reflecting a modest but steady long-term trajectory as new leadership settles in and strategic ambitions take center stage.

If you’re watching how company shakeups can spark opportunity, it’s worth broadening your watchlist and discovering fast growing stocks with high insider ownership.

With shares now trading just shy of analyst targets and the company showing signs of sustained growth, investors may be asking themselves if Atlas Arteria is undervalued or if the market has already priced in its turnaround potential.

Price-to-Earnings of 24.8x: Is it justified?

Atlas Arteria's share price of A$5.10 reflects a price-to-earnings (P/E) multiple of 24.8x, which positions the stock as relatively good value compared to some peers, but more expensive than the global infrastructure industry overall.

The price-to-earnings multiple measures how much investors are willing to pay for a dollar of the company’s earnings. It is a common way to judge whether a stock is trading at an attractive price based on current or expected profitability, especially for established businesses like Atlas Arteria.

Right now, Atlas Arteria’s P/E of 24.8x is below its peer average of 30.5x, suggesting the market still sees some room for upside. However, it stands noticeably above the global infrastructure industry average of 15.5x, which raises the bar for future growth and sustained profitability. Compared to the estimated fair P/E ratio of 29.7x, there is a potential for upside if growth forecasts play out as projected. The market could see the valuation move closer to the fair ratio if momentum continues.

Explore the SWS fair ratio for Atlas Arteria

Result: Price-to-Earnings of 24.8x (UNDERVALUED)

However, slower revenue growth and recent underperformance over the last three years may present challenges for Atlas Arteria’s ability to deliver on its upside potential.

Find out about the key risks to this Atlas Arteria narrative.

Another View: What Does the SWS DCF Model Say?

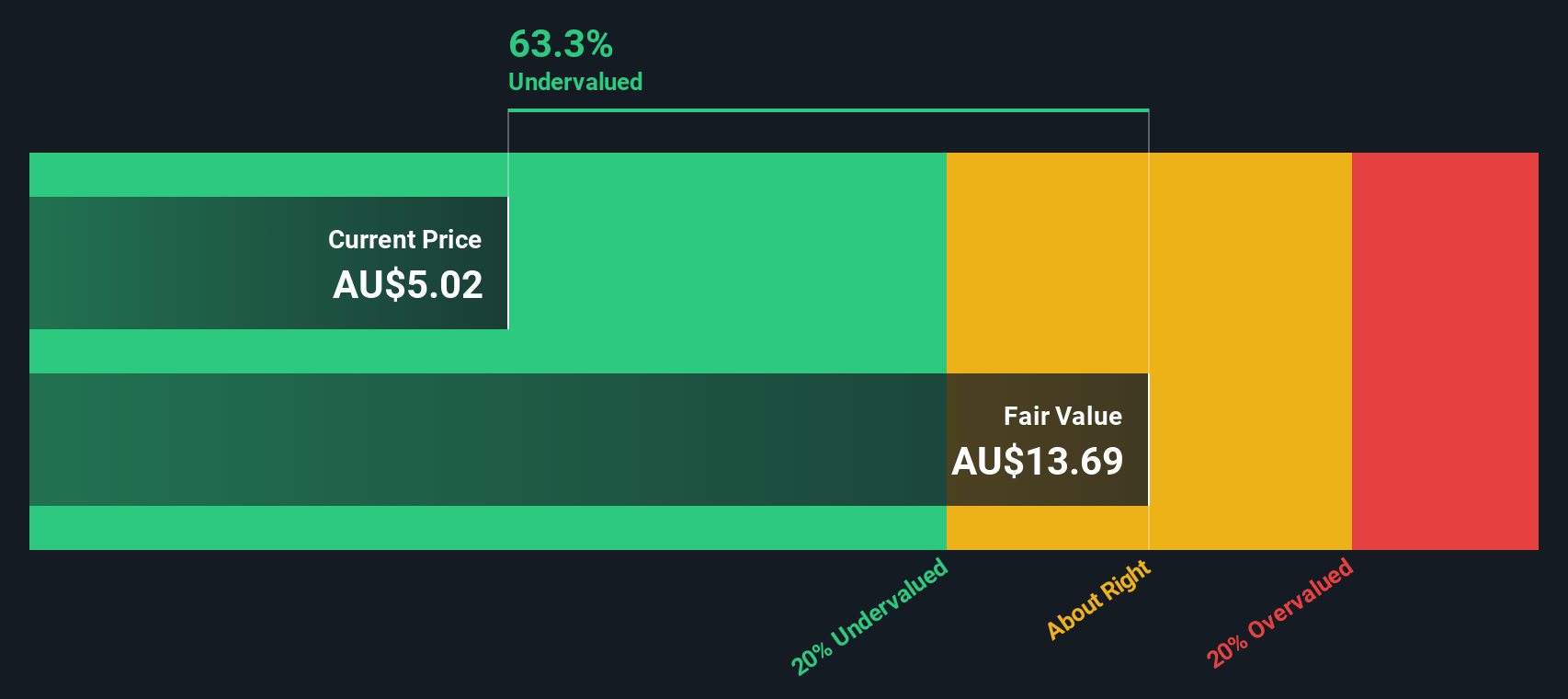

Looking beyond earnings-based valuations, our DCF model provides a notable contrast. According to this approach, Atlas Arteria’s shares are trading at a significant 62.8% discount to their estimated fair value of A$13.72. This suggests the stock could be far more undervalued than it appears on the surface.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Atlas Arteria for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 858 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Atlas Arteria Narrative

If you have a different perspective or want to dig deeper into the numbers yourself, you can easily build your own story from scratch in just a few minutes. Do it your way

A great starting point for your Atlas Arteria research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your portfolio’s potential. Make sure you’re keeping an eye on investments with fresh momentum and game-changing possibilities using the Simply Wall Street Screener.

- Tap into stable dividend opportunities that can boost your income. these 15 dividend stocks with yields > 3% currently offers standout yields above 3%.

- Catch the next wave of transformation in medicine and patient care through these 32 healthcare AI stocks which is making breakthroughs in health-focused artificial intelligence.

- Ride the cutting edge of innovation and stay ahead of trends by targeting these 25 AI penny stocks which are positioned for explosive AI-driven growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ALX

Atlas Arteria

Owns, develops, and operates toll roads in France, Germany, and the United States.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives