The Australian market recently experienced technical issues with the ASX announcements outage, affecting several companies and contributing to a slight downturn in the S&P/ASX 200 index. In this environment, investors may be keen to identify high-growth tech stocks that demonstrate resilience and potential for expansion despite broader market challenges.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pureprofile | 10.51% | 37.56% | ★★★★★☆ |

| Infomedia | 7.00% | 20.05% | ★★★★★☆ |

| Pro Medicus | 19.70% | 21.18% | ★★★★★☆ |

| Immutep | 104.12% | 46.46% | ★★★★★☆ |

| Clinuvel Pharmaceuticals | 22.04% | 26.15% | ★★★★★☆ |

| BlinkLab | 104.90% | 101.40% | ★★★★★★ |

| Wrkr | 52.49% | 88.00% | ★★★★★★ |

| Artrya | 50.54% | 61.25% | ★★★★★☆ |

| PYC Therapeutics | 10.34% | 24.39% | ★★★★★☆ |

| FINEOS Corporation Holdings | 9.22% | 57.85% | ★★★★☆☆ |

Click here to see the full list of 23 stocks from our ASX High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

FINEOS Corporation Holdings (ASX:FCL)

Simply Wall St Growth Rating: ★★★★☆☆

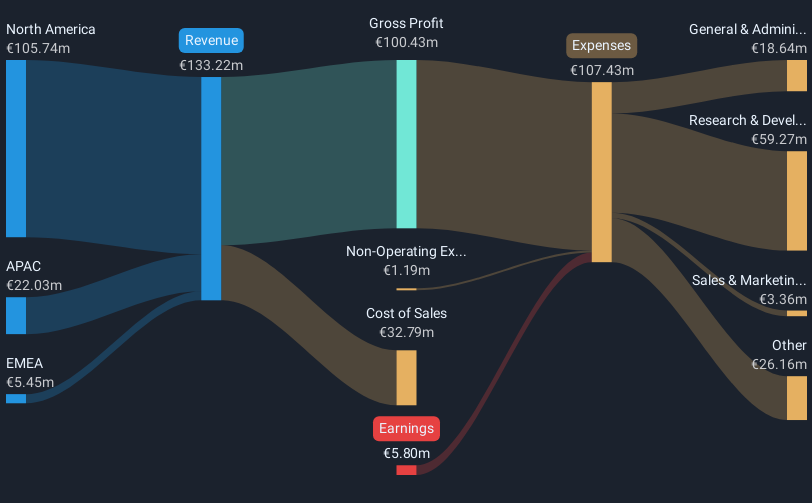

Overview: FINEOS Corporation Holdings plc develops and sells enterprise claims and policy management software for life, accident, and health insurers as well as employee benefits providers across North America, the Asia Pacific, the Middle East, and Africa with a market cap of A$1.01 billion.

Operations: FINEOS Corporation Holdings generates revenue primarily from its Software & Programming segment, amounting to €135.90 million. The company operates across various regions, including North America and the Asia Pacific.

FINEOS Corporation Holdings plc (FINEOS) is navigating a transformative phase with its recent executive reshuffles and strategic focus on enhancing governance and market strategy. Despite being currently unprofitable, FINEOS is expected to pivot into profitability within three years, with earnings potentially growing at an impressive annual rate of 57.85%. This growth trajectory is bolstered by a solid revenue increase forecast of 9.2% annually, outpacing the Australian market's average of 6%. The company's commitment to innovation and adaptation in a competitive tech landscape was evident from their recent presentation at the Automic Invest 2025 conference, highlighting their proactive approach in leadership and strategic direction changes slated for early 2026. These developments could significantly influence FINEOS’s position in the high-growth tech sector in Australia, setting a robust foundation for future financial health and industry competitiveness.

Nuix (ASX:NXL)

Simply Wall St Growth Rating: ★★★★☆☆

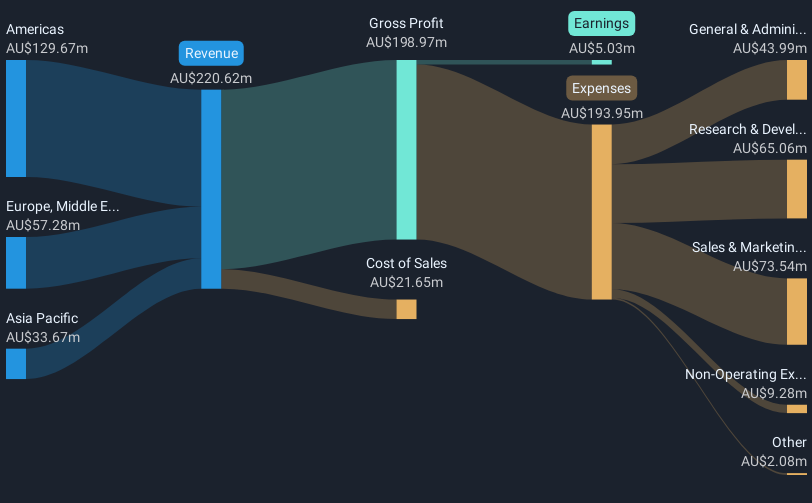

Overview: Nuix Limited offers investigative analytics and intelligence software solutions across various regions including the Asia Pacific, the Americas, Europe, the Middle East, and Africa with a market capitalization of A$625.81 million.

Operations: Nuix Limited generates revenue primarily through its Software & Programming segment, contributing A$221.50 million. The company's focus on investigative analytics and intelligence software solutions spans multiple regions globally.

Nuix Limited, amid recent executive changes and strategic amendments to its constitution, is setting a course for profitability with an expected earnings growth of 44.16% annually over the next three years. This shift is underscored by a robust revenue growth forecast of 8.9% per year, outpacing the broader Australian market's average. Nuix’s adaptation to virtual shareholder meetings reflects a broader industry trend towards digital engagement, enhancing accessibility and compliance with updated regulations. These strategic moves are pivotal as Nuix navigates its path within the competitive tech landscape, aiming to solidify its market position through enhanced governance and operational flexibility.

- Delve into the full analysis health report here for a deeper understanding of Nuix.

Gain insights into Nuix's past trends and performance with our Past report.

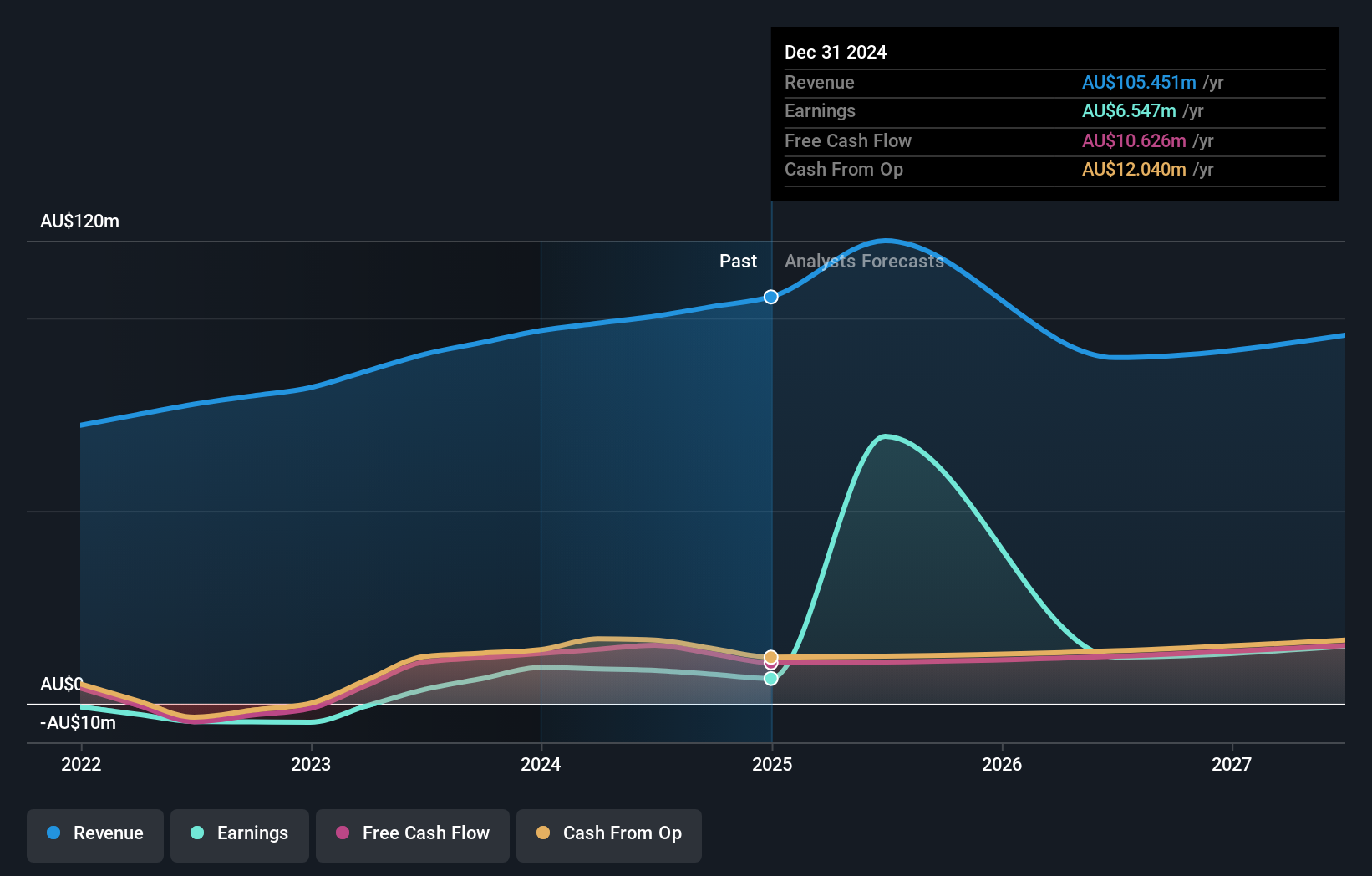

RPMGlobal Holdings (ASX:RUL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RPMGlobal Holdings Limited develops and provides mining software solutions across various continents, including Australia, Asia, the Americas, Africa, and Europe, with a market cap of A$1.09 billion.

Operations: RPMGlobal Holdings generates revenue primarily from its Software segment, contributing A$73.96 million, and its Advisory services, which bring in A$24.77 million. The company focuses on delivering specialized mining software solutions across multiple continents.

RPMGlobal Holdings demonstrates a dynamic growth trajectory with an anticipated annual revenue increase of 15%, significantly outpacing the Australian market average of 6%. This growth is complemented by an impressive forecast for earnings, expected to surge by 55% annually. Despite a challenging past year where earnings fell sharply, the firm's commitment to innovation is evident in its R&D spending, crucial for maintaining competitiveness in the evolving tech landscape. Recent strategic moves, including key director re-elections and enhanced shareholder communications at their AGM, underscore RPMGlobal's adaptability and focus on long-term value creation amidst a rapidly shifting technology sector.

- Dive into the specifics of RPMGlobal Holdings here with our thorough health report.

Understand RPMGlobal Holdings' track record by examining our Past report.

Next Steps

- Gain an insight into the universe of 23 ASX High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FCL

FINEOS Corporation Holdings

Engages in the development and sale of enterprise claims and policy management software for life, accident and health insurers, and employee benefits providers in North America, the Asia Pacific, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026