- Australia

- /

- Metals and Mining

- /

- ASX:PRN

3 ASX Penny Stocks Under A$3B Market Cap To Watch

Reviewed by Simply Wall St

Australian shares are poised for a slight uptick, despite recent disruptions on the ASX that have left traders cautious. In times of market uncertainty, investors often look to smaller companies with strong financials as potential opportunities for growth. Penny stocks, although an outdated term, still signify these smaller or newer firms that may offer value and growth prospects; we'll explore three such stocks that stand out in today's market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.39 | A$111.77M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.595 | A$75.24M | ✅ 3 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.83 | A$51.68M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.82 | A$433.41M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.47 | A$256.3M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.07 | A$36.87M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.93 | A$3.34B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.23 | A$1.37B | ✅ 3 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.40 | A$133.31M | ✅ 3 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.46 | A$645.2M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 407 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Praemium (ASX:PPS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Praemium Limited, with a market cap of A$411.45 million, offers wealth management and advisory solutions both in Australia and internationally.

Operations: The company's revenue is primarily generated from its Software & Programming segment, amounting to A$103.04 million.

Market Cap: A$411.45M

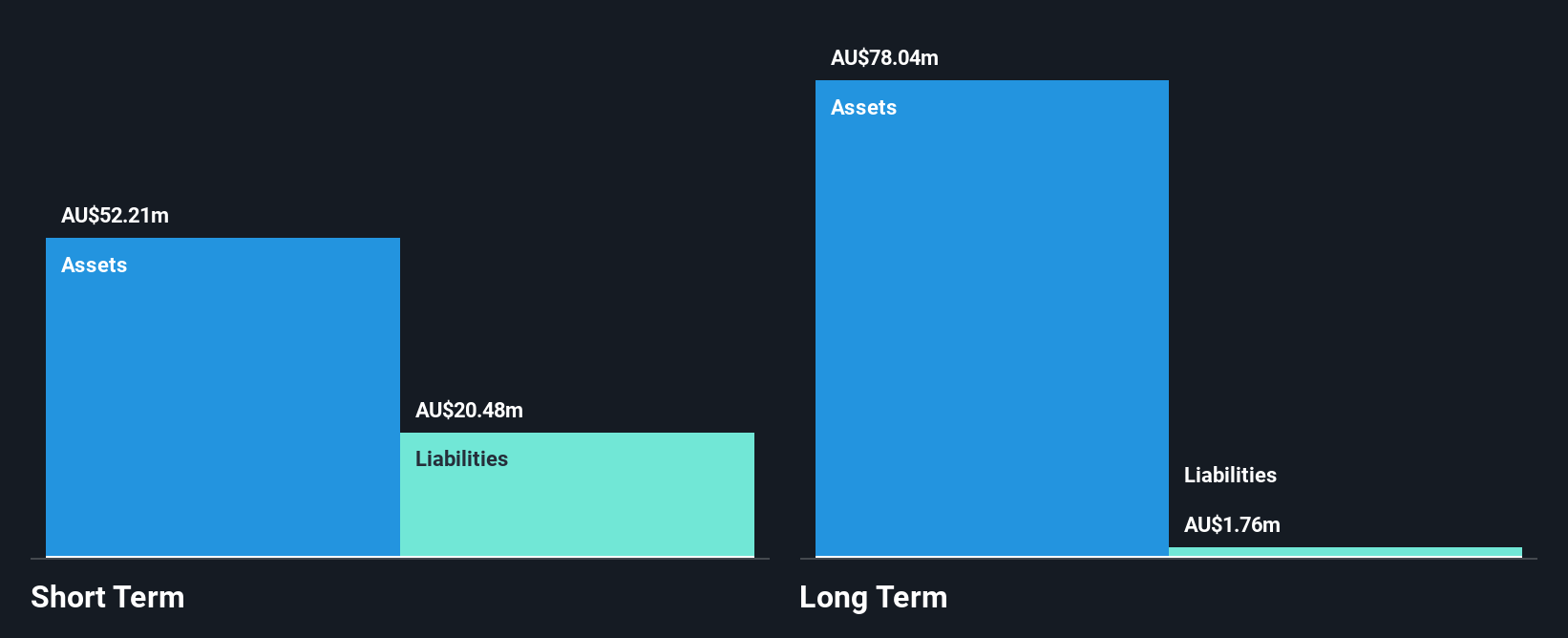

Praemium Limited, with a market cap of A$411.45 million, is positioned in the wealth management sector and has shown impressive earnings growth of 55% over the past year, outpacing industry averages. The company maintains a debt-free status with strong short-term asset coverage over liabilities and stable weekly volatility. However, its dividend yield is not fully supported by free cash flows. Recent developments include the appointment of Emma Stepcic as CFO and inclusion in the S&P Global BMI Index, which may enhance visibility among investors. Despite these strengths, Praemium's Return on Equity remains modest at 12.1%.

- Navigate through the intricacies of Praemium with our comprehensive balance sheet health report here.

- Assess Praemium's future earnings estimates with our detailed growth reports.

Perenti (ASX:PRN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Perenti Limited is a global mining services company with a market capitalization of A$2.70 billion.

Operations: Perenti generates revenue through its Drilling Services (A$778.13 million), Contract Mining Services (A$2.52 billion), and Mining and Technology Services (A$225.71 million) segments.

Market Cap: A$2.7B

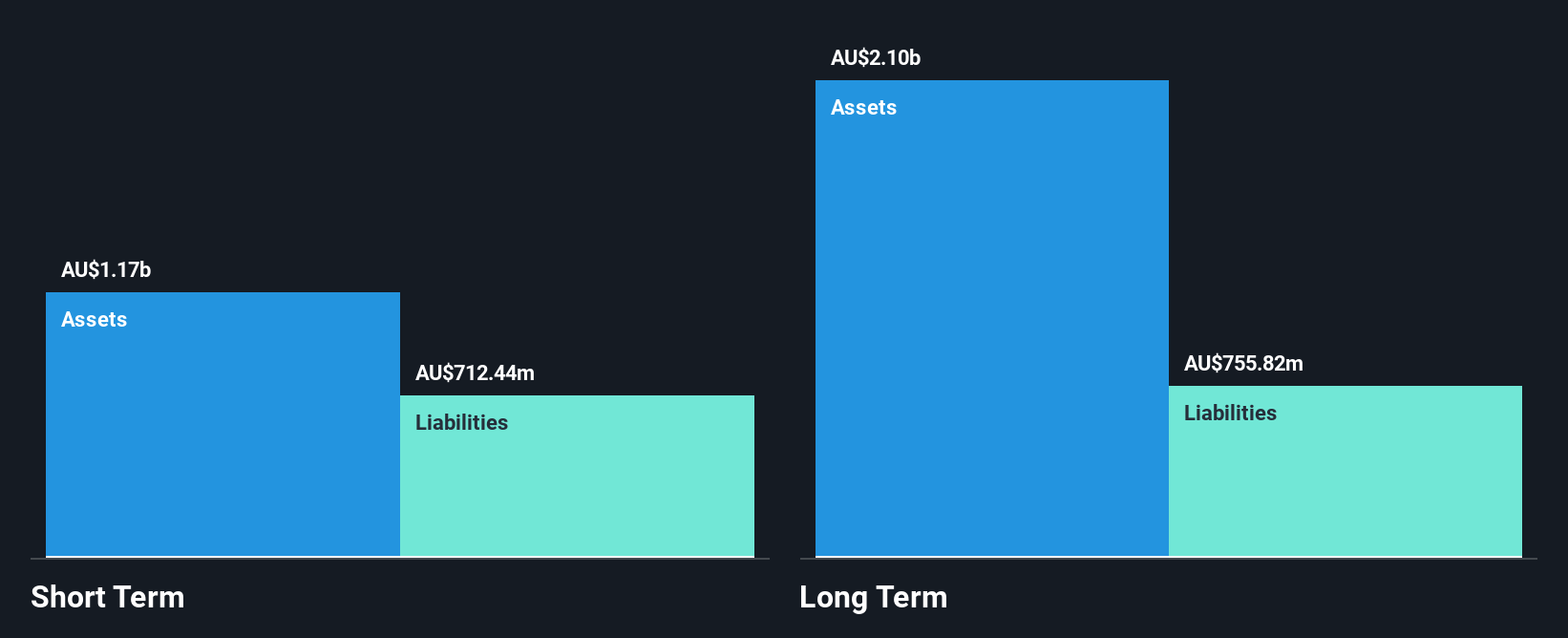

Perenti Limited, with a market cap of A$2.70 billion, has been added to the S&P/ASX 200 Index, potentially increasing its visibility. The company has announced a share buyback program covering up to 9.09% of its issued capital, reflecting management's confidence in its valuation. Despite experiencing significant earnings growth over the past five years and maintaining satisfactory debt levels with strong cash flow coverage, Perenti's Return on Equity remains low at 7.4%. Earnings are forecasted to grow annually by 18.54%, although recent growth has not matched historical averages due to large one-off gains impacting results.

- Click to explore a detailed breakdown of our findings in Perenti's financial health report.

- Gain insights into Perenti's outlook and expected performance with our report on the company's earnings estimates.

Vysarn (ASX:VYS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vysarn Limited offers water services across sectors such as resources, urban development, government and utilities in Australia, with a market cap of A$329.65 million.

Operations: The company's revenue is derived from three primary segments: Industrial (A$60.50 million), Technology (A$25.98 million), and Advisory (A$20.02 million).

Market Cap: A$329.65M

Vysarn Limited, with a market cap of A$329.65 million, has demonstrated robust earnings growth over the past five years, averaging 36.1% annually, outpacing the Metals and Mining industry. The company's financial health is solid; it holds more cash than total debt and its operating cash flow covers debt significantly. Despite a slight decline in net profit margins from 10.5% to 10%, Vysarn's valuation appears attractive as it trades below estimated fair value by 31.4%. While Return on Equity is low at 10.8%, earnings are expected to grow by 18.59% per year, supported by an experienced management team and board.

- Get an in-depth perspective on Vysarn's performance by reading our balance sheet health report here.

- Gain insights into Vysarn's future direction by reviewing our growth report.

Seize The Opportunity

- Embark on your investment journey to our 407 ASX Penny Stocks selection here.

- Ready For A Different Approach? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PRN

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026