DUG Technology (ASX:DUG) shareholder returns have been , earning 28% in 1 year

The simplest way to invest in stocks is to buy exchange traded funds. But if you pick the right individual stocks, you could make more than that. To wit, the DUG Technology Ltd (ASX:DUG) share price is 28% higher than it was a year ago, much better than the market return of around 3.4% (not including dividends) in the same period. So that should have shareholders smiling. We'll need to follow DUG Technology for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

Since it's been a strong week for DUG Technology shareholders, let's have a look at trend of the longer term fundamentals.

See our latest analysis for DUG Technology

DUG Technology wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

DUG Technology actually shrunk its revenue over the last year, with a reduction of 12%. The stock is up 28% in that time, a fine performance given the revenue drop. We can correlate the share price rise with revenue or profit growth, but it seems the market had previously expected weaker results, and sentiment around the stock is improving.

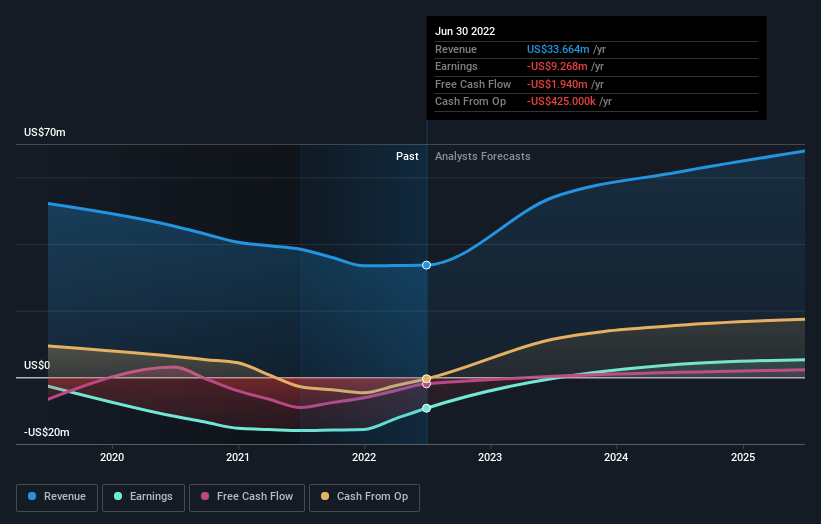

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

DUG Technology shareholders should be happy with the total gain of 28% over the last twelve months. A substantial portion of that gain has come in the last three months, with the stock up 90% in that time. This suggests the company is continuing to win over new investors. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with DUG Technology (at least 1 which is concerning) , and understanding them should be part of your investment process.

We will like DUG Technology better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:DUG

DUG Technology

Dug Technology Ltd, a technology company, provides hardware and software solutions for the technology and resource sectors in Australia, the United States, the United Kingdom, Malaysia, and the United Arab Emirates.

Undervalued with reasonable growth potential.