The Australian market has seen a mixed start to the week, with the XJO making gains yet remaining below its recent highs, as sectors like materials lead while real estate lags. In this environment of uncertainty and sector-specific movements, growth companies with high insider ownership can be attractive options for investors seeking alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 11.7% | 91.2% |

| Pointerra (ASX:3DP) | 23.4% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Image Resources (ASX:IMA) | 22.3% | 92.5% |

| Gratifii (ASX:GTI) | 17.8% | 137.7% |

| Findi (ASX:FND) | 33.6% | 91.2% |

| Echo IQ (ASX:EIQ) | 18% | 49.9% |

| BlinkLab (ASX:BB1) | 35.5% | 101.4% |

| Adveritas (ASX:AV1) | 18.8% | 96.8% |

| Acrux (ASX:ACR) | 15.1% | 121.1% |

We'll examine a selection from our screener results.

Beetaloo Energy Australia (ASX:BTL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beetaloo Energy Australia Limited, along with its subsidiaries, is involved in the production and sale of oil and natural gas in Australia, with a market capitalization of A$402.36 million.

Operations: The company generates revenue through its activities in producing and selling oil and natural gas within the Australian market.

Insider Ownership: 22.5%

Earnings Growth Forecast: 100.9% p.a.

Beetaloo Energy Australia, recently added to the S&P/ASX Emerging Companies Index, is poised for significant revenue growth at 103.7% annually, outpacing the market average. Despite a net loss of A$9.08 million in H1 2025 and past shareholder dilution, insider confidence remains high with substantial insider buying over the last three months. The company expects profitability within three years but currently operates with less than a year of cash runway and minimal revenue (A$14K).

- Navigate through the intricacies of Beetaloo Energy Australia with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Beetaloo Energy Australia's share price might be on the expensive side.

Catapult Sports (ASX:CAT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Catapult Sports Ltd is a sports science and analytics company that develops and supplies technologies to enhance athlete and team performance across Australia, Europe, the Middle East, Africa, the Asia Pacific, and the Americas with a market cap of A$1.99 billion.

Operations: The company's revenue is derived from its Tactics & Coaching segment, which generated $36.66 million, and its Performance & Health segment, contributing $63.47 million.

Insider Ownership: 15.5%

Earnings Growth Forecast: 69.3% p.a.

Catapult Sports is forecast to achieve revenue growth of 13.8% annually, surpassing the Australian market average of 5.6%. While expected to become profitable within three years, its return on equity is projected to remain modest at 10.4%. Recent governance changes include appointing Jim Orlando as Lead Independent Director, enhancing board effectiveness and shareholder engagement. The company's name change from Catapult Group International Ltd reflects a strategic rebranding approved by shareholders in August 2025.

- Unlock comprehensive insights into our analysis of Catapult Sports stock in this growth report.

- Our expertly prepared valuation report Catapult Sports implies its share price may be too high.

Telix Pharmaceuticals (ASX:TLX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Telix Pharmaceuticals Limited is a commercial-stage biopharmaceutical company specializing in the development and commercialization of therapeutic and diagnostic radiopharmaceuticals, with a market cap of A$5.08 billion.

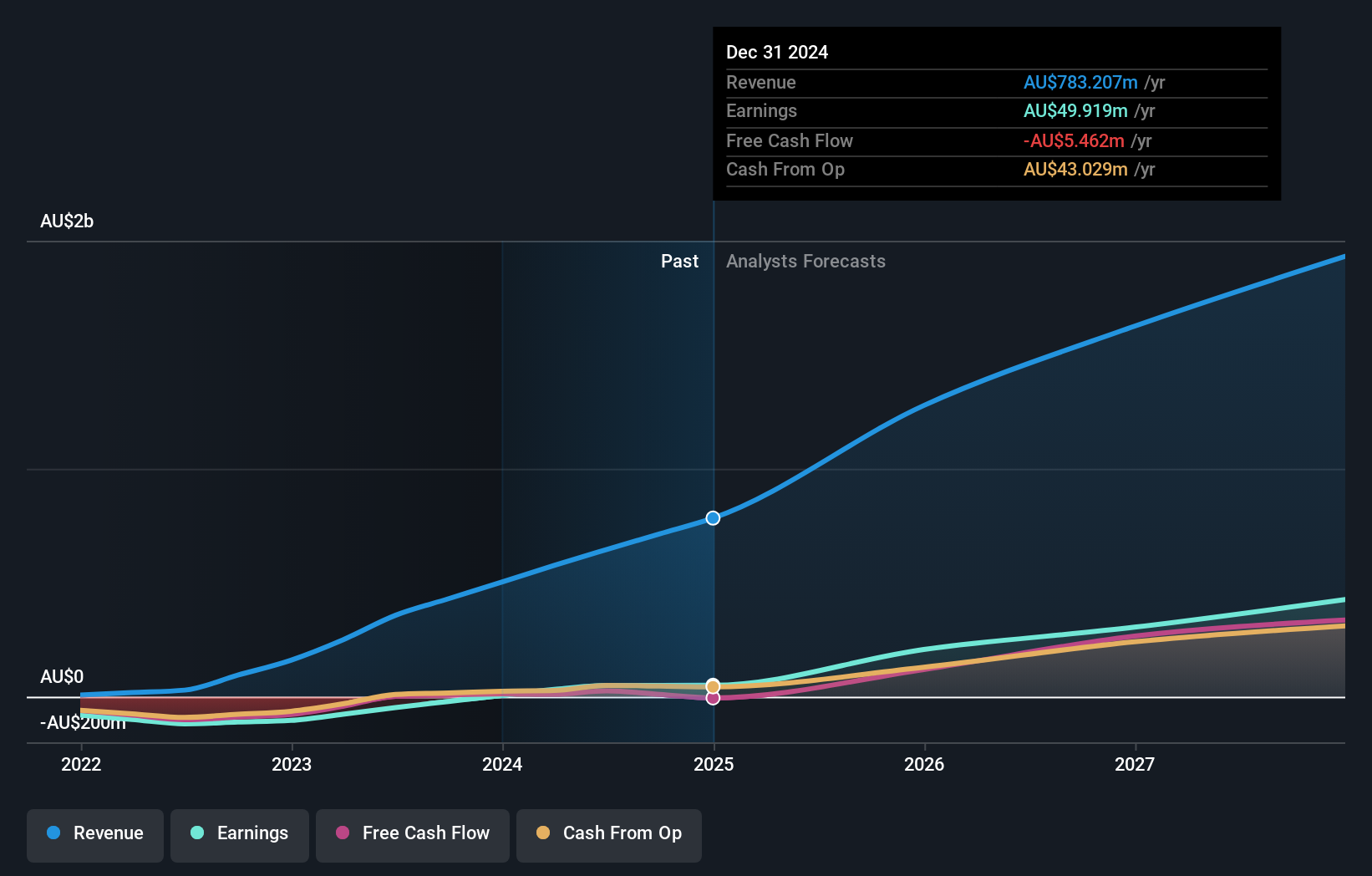

Operations: Telix Pharmaceuticals Limited generates revenue through its segments of Therapeutics ($7.29 million), Precision Medicine ($575.13 million), and Manufacturing Solutions ($115.57 million).

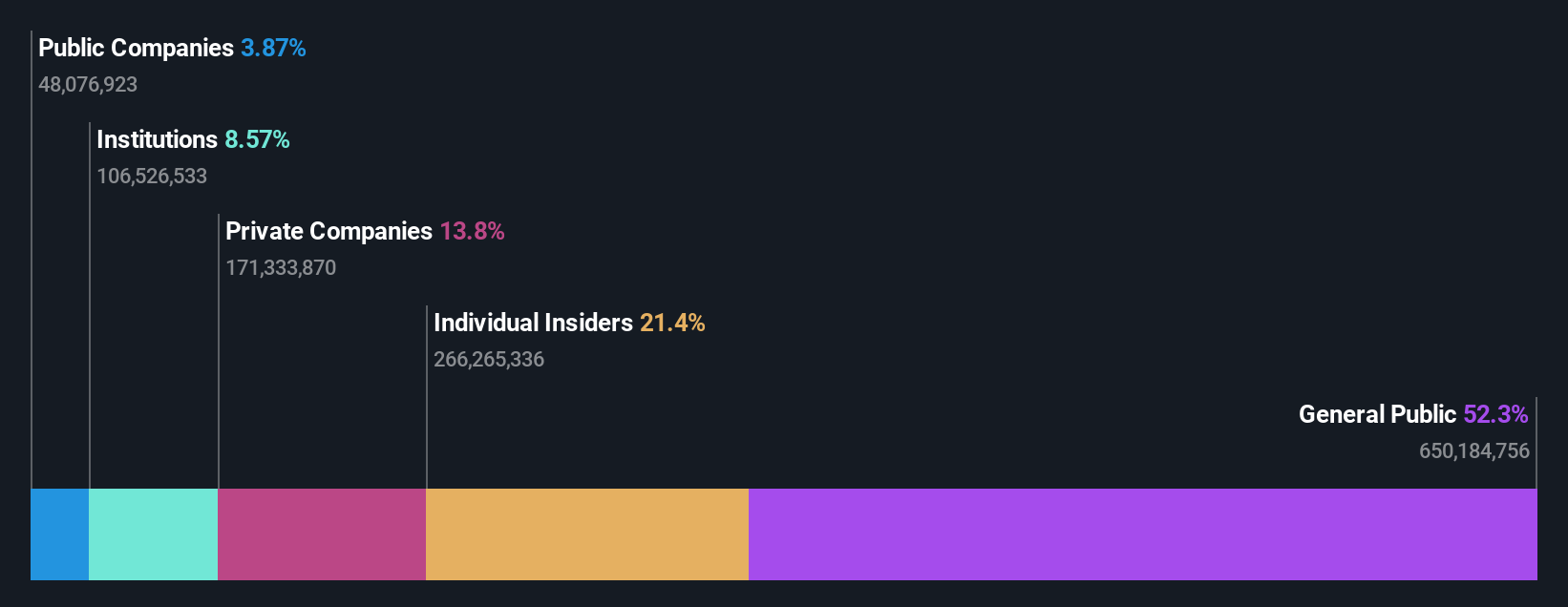

Insider Ownership: 14.9%

Earnings Growth Forecast: 45.8% p.a.

Telix Pharmaceuticals is positioned for significant growth, with earnings expected to rise 45.8% annually, outpacing the Australian market average. The company is actively advancing its product pipeline, including a Phase 3 trial for prostate cancer diagnostics and resubmission plans for TLX101-CDx with the FDA. Despite recent regulatory setbacks affecting TLX250-CDx, Telix remains focused on resolving issues and expanding its market presence through strategic product developments and manufacturing capabilities.

- Get an in-depth perspective on Telix Pharmaceuticals' performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Telix Pharmaceuticals implies its share price may be lower than expected.

Summing It All Up

- Dive into all 105 of the Fast Growing ASX Companies With High Insider Ownership we have identified here.

- Seeking Other Investments? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Telix Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TLX

Telix Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on the development and commercialization of therapeutic and diagnostic radiopharmaceuticals.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives