Is Wesfarmers’ High ROE and Global Anko Push Broadening Its Earnings Base (ASX:WES)?

Reviewed by Sasha Jovanovic

- Wesfarmers recently highlighted a high 31.2% return on equity, while Kmart’s Anko brand and Wesfarmers Health accelerated their international and healthcare expansion plans across markets including Canada, the US, the Philippines and the Priceline network.

- This combination of strong capital efficiency and diversified growth initiatives in retail and healthcare points to an increasingly broader earnings foundation for the group.

- We’ll now examine how Wesfarmers’ strong return on equity reshapes its existing investment narrative around cost control, growth and risk.

Find companies with promising cash flow potential yet trading below their fair value.

Wesfarmers Investment Narrative Recap

To own Wesfarmers, you need to believe it can keep turning solid retail brands and selective growth bets into attractive returns on capital. The latest 31.2% ROE print and acceleration of Anko and Health expansion support this thesis, but they do not materially change the near term focus on defending margins against cost inflation or the execution risk in newer healthcare and lithium investments.

The most directly relevant recent development is Wesfarmers Health’s push to expand the Priceline network alongside broader healthcare investments, which now sit beside the Anko rollout as key growth platforms. Together with recent earnings growth to A$2,926.0 million on A$45,700.0 million of revenue, these moves reinforce how management is trying to broaden profit drivers beyond the traditional Australian and New Zealand retail base.

Yet while growth looks broader, investors should also be aware of execution risk in newer divisions like Health and Covalent lithium, where...

Read the full narrative on Wesfarmers (it's free!)

Wesfarmers' narrative projects A$51.6 billion revenue and A$3.5 billion earnings by 2028. This requires 4.1% yearly revenue growth and about A$0.6 billion earnings increase from A$2.9 billion today.

Uncover how Wesfarmers' forecasts yield a A$80.82 fair value, in line with its current price.

Exploring Other Perspectives

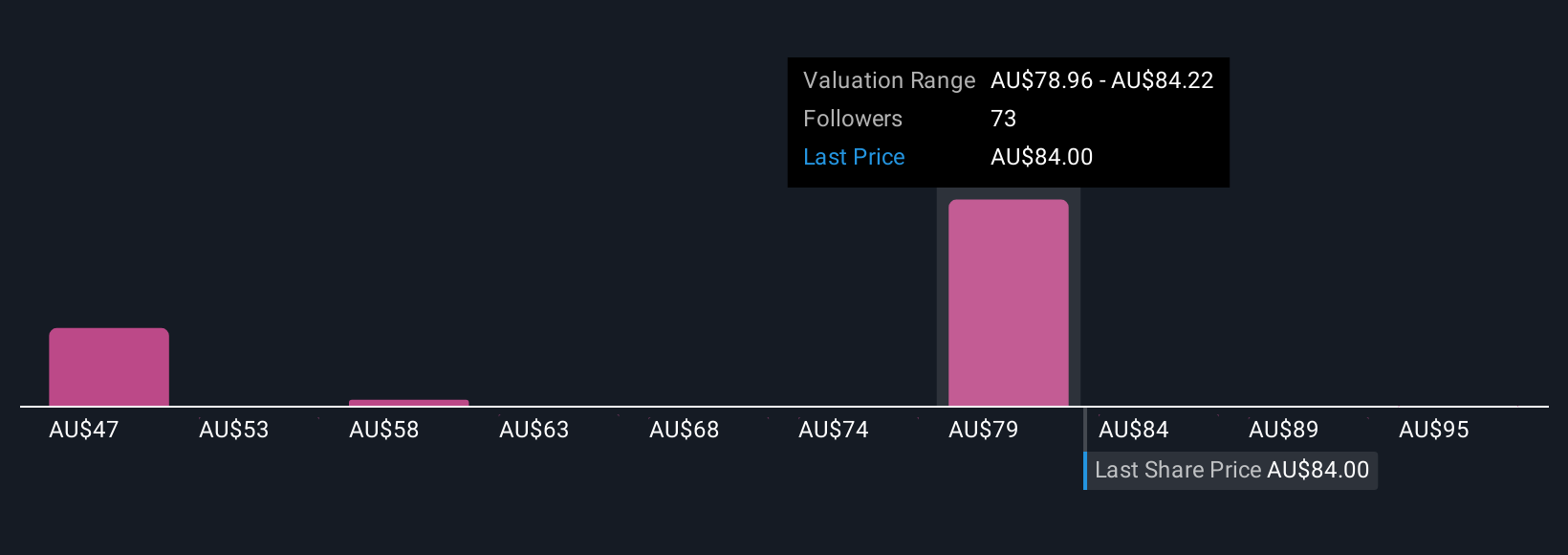

Nine members of the Simply Wall St Community value Wesfarmers between about A$44 and A$100 per share, showing how far opinions can stretch. Against that backdrop, concerns about cost inflation and margin pressure invite you to weigh several different views on how resilient Wesfarmers’ earnings could be over time.

Explore 9 other fair value estimates on Wesfarmers - why the stock might be worth as much as 23% more than the current price!

Build Your Own Wesfarmers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wesfarmers research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Wesfarmers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wesfarmers' overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wesfarmers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WES

Wesfarmers

Engages in the retail business in Australia, New Zealand, and internationally.

Outstanding track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026