- Australia

- /

- Metals and Mining

- /

- ASX:TYX

3 Penny Stocks On The ASX With Market Caps Larger Than A$10M

Reviewed by Simply Wall St

The ASX200 has seen a slight uptick, rising 0.1% to 8,212 points as it recovers from previous losses, with the Staples sector leading the charge. In such a fluctuating market, identifying promising stocks requires a keen eye for financial robustness and potential growth. Penny stocks, though an older term, remain relevant as they often represent smaller companies that could offer unique opportunities for investors seeking both value and growth potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.57 | A$66.82M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.795 | A$126.84M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.825 | A$100.95M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.85 | A$298M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.70 | A$833.14M | ★★★★★☆ |

| West African Resources (ASX:WAF) | A$1.715 | A$1.95B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$58.82M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$92.11M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.90 | A$115.04M | ★★★★★★ |

Click here to see the full list of 1,029 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Ridley (ASX:RIC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ridley Corporation Limited operates in Australia, providing animal nutrition solutions, with a market capitalization of A$817.86 million.

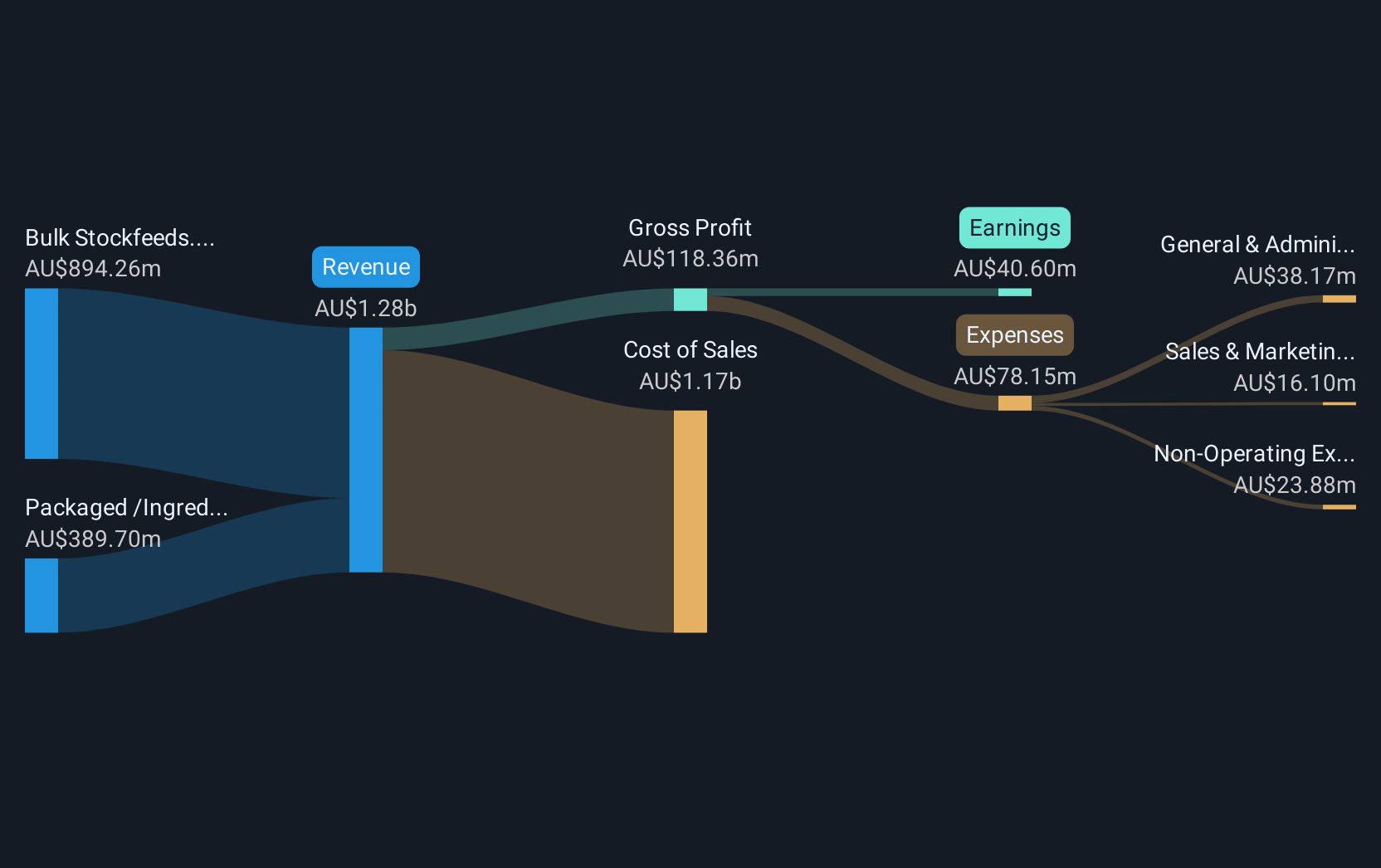

Operations: The company's revenue is derived from two main segments: Bulk Stockfeeds, contributing A$886.59 million, and Packaged/Ingredients, generating A$376.31 million.

Market Cap: A$817.86M

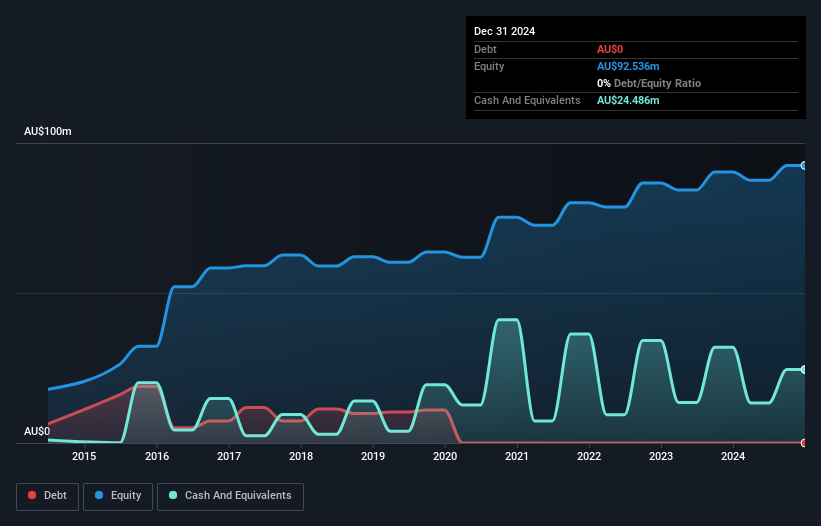

Ridley Corporation Limited, with a market cap of A$817.86 million, operates in the animal nutrition sector and has shown significant earnings growth over the past five years. Despite a recent dip in earnings growth, Ridley's interest payments are well covered by EBIT, and its debt is adequately managed by operating cash flow. The company has reduced its debt-to-equity ratio from 56.7% to 46.4% over five years and maintains stable weekly volatility at 4%. Recent board changes include Dan Masters joining as a non-executive director, while a share buyback program aims to enhance shareholder value.

- Dive into the specifics of Ridley here with our thorough balance sheet health report.

- Examine Ridley's earnings growth report to understand how analysts expect it to perform.

Shaver Shop Group (ASX:SSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shaver Shop Group Limited is a retailer of personal care and grooming products operating in Australia and New Zealand, with a market cap of A$166.39 million.

Operations: The company generates revenue from retail store sales of specialist personal grooming products amounting to A$219.37 million.

Market Cap: A$166.39M

Shaver Shop Group Limited, with a market cap of A$166.39 million, operates debt-free and has stable short-term assets exceeding both its short and long-term liabilities. Despite a recent decline in earnings growth by 10.1%, the company maintains high-quality earnings and trades at good value compared to industry peers. The board and management team are experienced, with average tenures of 8.3 years and 10.4 years respectively. However, insider selling has been significant recently, while the dividend track record remains unstable despite declaring a fully franked dividend consistent with last year’s payout levels.

- Click to explore a detailed breakdown of our findings in Shaver Shop Group's financial health report.

- Learn about Shaver Shop Group's future growth trajectory here.

Tyranna Resources (ASX:TYX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tyranna Resources Limited is involved in the exploration and development of mineral properties, with a market capitalization of A$13.15 million.

Operations: The company's revenue segment includes Exploration Angola, generating A$0.06 million.

Market Cap: A$13.15M

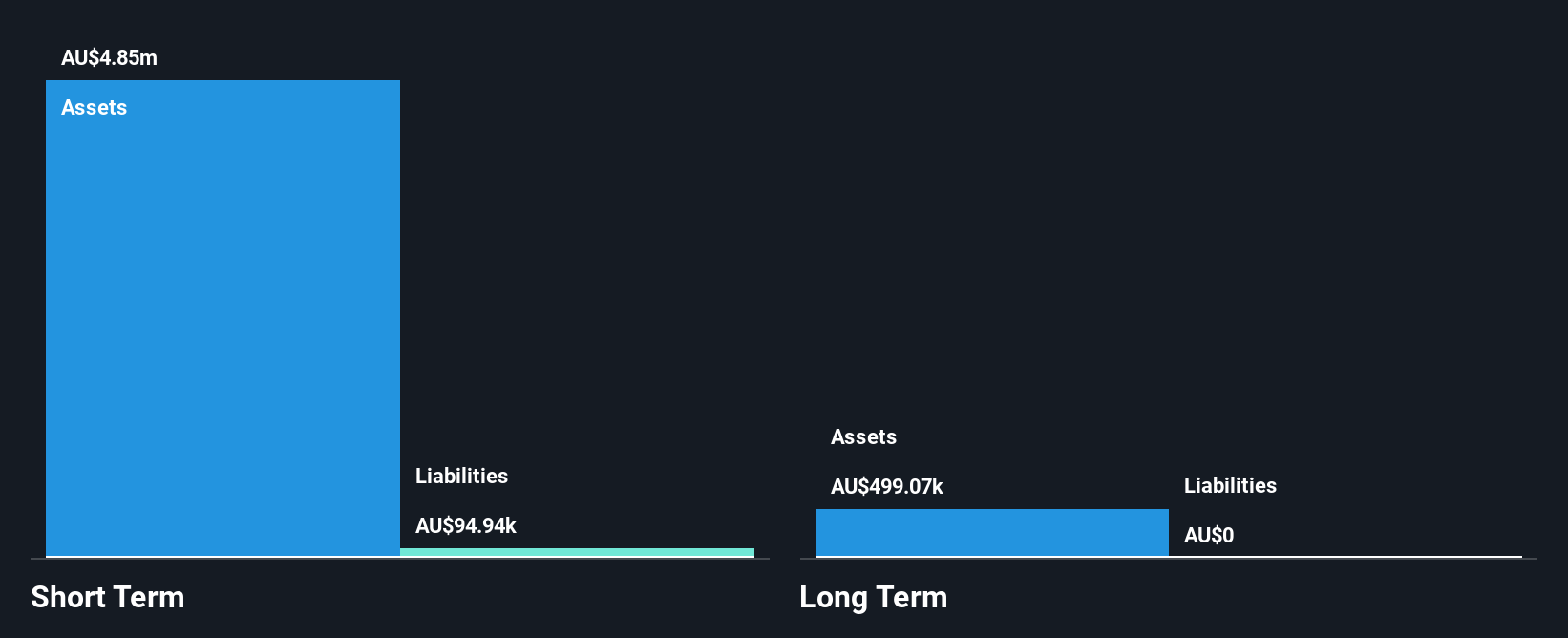

Tyranna Resources Limited, with a market cap of A$13.15 million, remains pre-revenue, generating only A$0.06 million from exploration activities in Angola. The company operates debt-free and has short-term assets of A$7.6 million exceeding its liabilities significantly, yet it reported a net loss of A$42.47 million for the year ended June 30, 2024. Despite having no long-term liabilities and an experienced management team with an average tenure of 4.8 years, Tyranna's share price has shown high volatility recently and its earnings have declined by 37.6% annually over the past five years.

- Jump into the full analysis health report here for a deeper understanding of Tyranna Resources.

- Examine Tyranna Resources' past performance report to understand how it has performed in prior years.

Taking Advantage

- Dive into all 1,029 of the ASX Penny Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tyranna Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TYX

Tyranna Resources

Explores for and develops mineral properties in Australia and internationally.

Flawless balance sheet slight.