Here's Why We Think Anatara Lifesciences Ltd's (ASX:ANR) CEO Compensation Looks Fair

Key Insights

- Anatara Lifesciences will host its Annual General Meeting on 20th of November

- CEO David Brookes' total compensation includes salary of AU$150.0k

- The overall pay is 68% below the industry average

- Anatara Lifesciences' three-year loss to shareholders was 65% while its EPS grew by 51% over the past three years

The performance at Anatara Lifesciences Ltd (ASX:ANR) has been rather lacklustre of late and shareholders may be wondering what CEO David Brookes is planning to do about this. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 20th of November. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. We think CEO compensation looks appropriate given the data we have put together.

See our latest analysis for Anatara Lifesciences

Comparing Anatara Lifesciences Ltd's CEO Compensation With The Industry

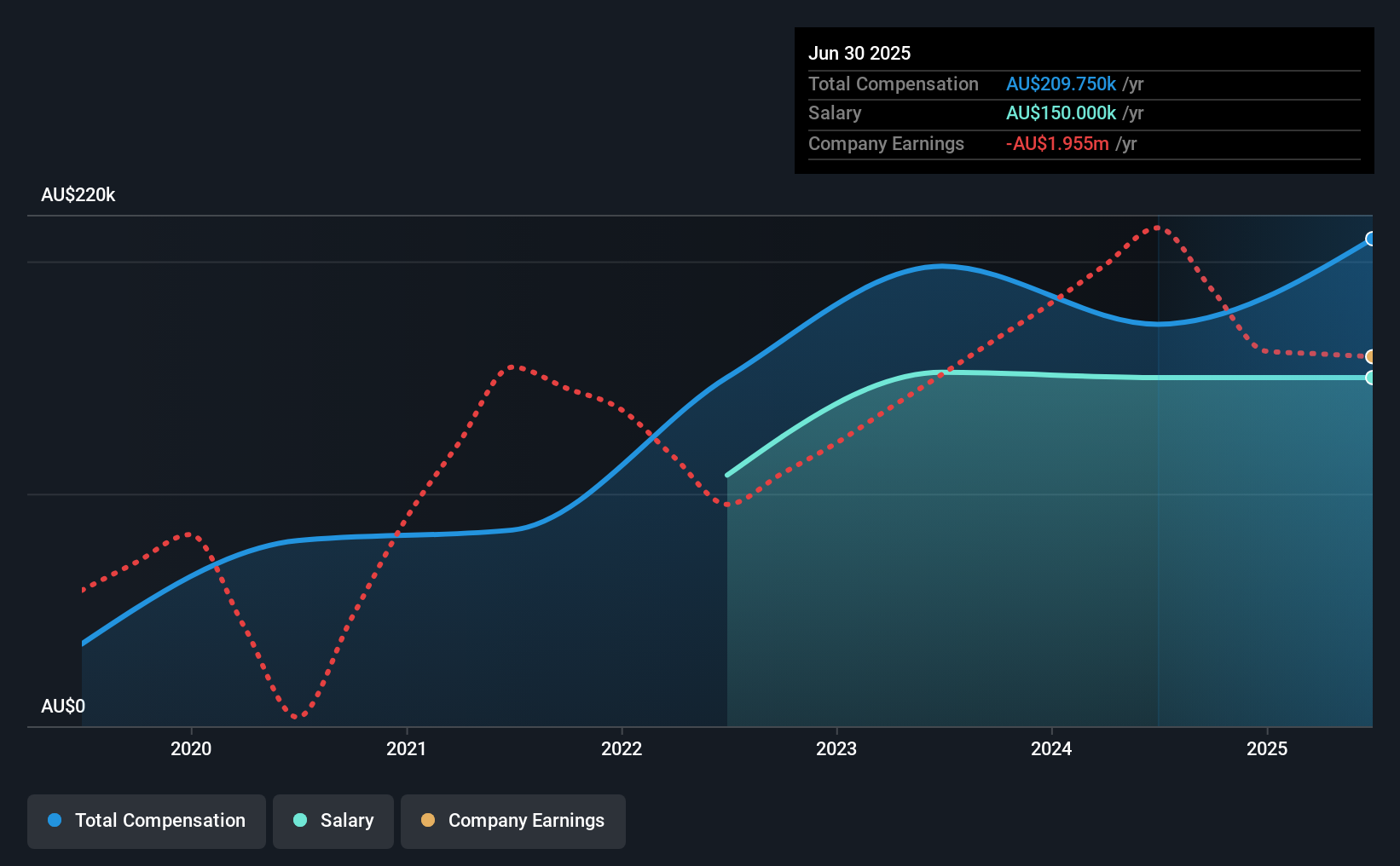

Our data indicates that Anatara Lifesciences Ltd has a market capitalization of AU$3.2m, and total annual CEO compensation was reported as AU$210k for the year to June 2025. Notably, that's an increase of 21% over the year before. Notably, the salary which is AU$150.0k, represents most of the total compensation being paid.

In comparison with other companies in the Australian Biotechs industry with market capitalizations under AU$305m, the reported median total CEO compensation was AU$649k. Accordingly, Anatara Lifesciences pays its CEO under the industry median. Moreover, David Brookes also holds AU$85k worth of Anatara Lifesciences stock directly under their own name.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | AU$150k | AU$150k | 72% |

| Other | AU$60k | AU$23k | 28% |

| Total Compensation | AU$210k | AU$173k | 100% |

Talking in terms of the industry, salary represented approximately 59% of total compensation out of all the companies we analyzed, while other remuneration made up 41% of the pie. Anatara Lifesciences pays out 72% of remuneration in the form of a salary, significantly higher than the industry average. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Anatara Lifesciences Ltd's Growth Numbers

Anatara Lifesciences Ltd has seen its earnings per share (EPS) increase by 51% a year over the past three years. In the last year, its revenue is up 51%.

This demonstrates that the company has been improving recently and is good news for the shareholders. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Anatara Lifesciences Ltd Been A Good Investment?

Few Anatara Lifesciences Ltd shareholders would feel satisfied with the return of -65% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

The fact that shareholders are sitting on a loss is certainly disheartening. This diverges with the robust growth in EPS, suggesting that there is a large discrepancy between share price and fundamentals. A key focus for the board and management will be how to align the share price with fundamentals. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

CEO pay is simply one of the many factors that need to be considered while examining business performance. In our study, we found 4 warning signs for Anatara Lifesciences you should be aware of, and 3 of them shouldn't be ignored.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ANR

Anatara Lifesciences

Engages in the research, development, and commercialization of evidence-based solutions for gastrointestinal diseases in Australia.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives