- Australia

- /

- Specialty Stores

- /

- ASX:ABY

3 ASX Penny Stocks With Market Caps Under A$800M To Consider

Reviewed by Simply Wall St

As the Australian market braces for the crucial consumer price index release, investors are keenly observing how this will influence the Reserve Bank's upcoming cash rate decision. In such a climate, penny stocks—though an outdated term—continue to capture interest as they often represent smaller or newer companies with unique growth potential. This article explores three compelling ASX penny stocks that stand out for their financial resilience and potential opportunities in today's market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.475 | A$136.13M | ✅ 4 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.915 | A$56.98M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.83 | A$434.94M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.75 | A$276.77M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.047 | A$54.98M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.077 | A$40.56M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.96 | A$273.31M | ✅ 3 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.47 | A$649.44M | ✅ 5 ⚠️ 1 View Analysis > |

| Clover (ASX:CLV) | A$0.63 | A$105.21M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 420 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Adore Beauty Group (ASX:ABY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Adore Beauty Group Limited operates an integrated content, marketing, and e-commerce retail platform in Australia and New Zealand with a market cap of A$112.28 million.

Operations: The company generates A$198.82 million in revenue from selling beauty and personal care products through its online platform.

Market Cap: A$112.28M

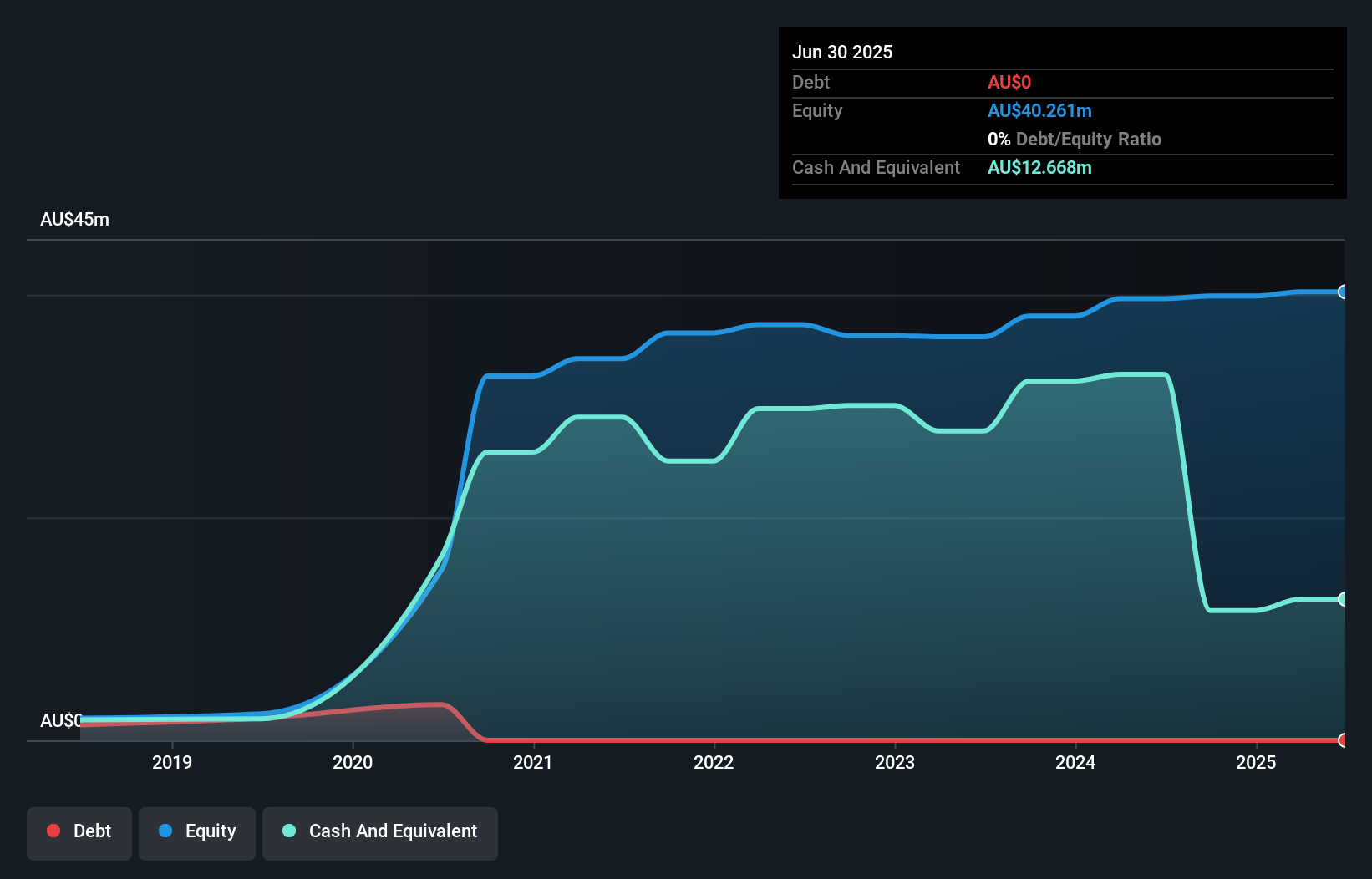

Adore Beauty Group, with a market cap of A$112.28 million, operates an e-commerce platform generating A$198.82 million in revenue. Despite a challenging year with negative earnings growth of -65%, the company remains debt-free and its short-term assets exceed both short- and long-term liabilities. Recent board changes include the retirement of Chair Marina Go and Co-Founder Kate Morris, signaling potential shifts in leadership dynamics. Earnings guidance for fiscal 2026 suggests improved EBIT margins between 2.5-3.5%. The company's financial stability is bolstered by experienced management and stable weekly volatility at 8%.

- Click to explore a detailed breakdown of our findings in Adore Beauty Group's financial health report.

- Explore Adore Beauty Group's analyst forecasts in our growth report.

Civmec (ASX:CVL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Civmec Limited is an investment holding company that offers construction and engineering services across the energy, resources, infrastructure, marine, and defense sectors in Australia with a market cap of A$751.70 million.

Operations: The company's revenue is derived from three main segments: Energy (A$65.19 million), Resources (A$641.23 million), and Infrastructure, Marine & Defence (A$104.17 million).

Market Cap: A$751.7M

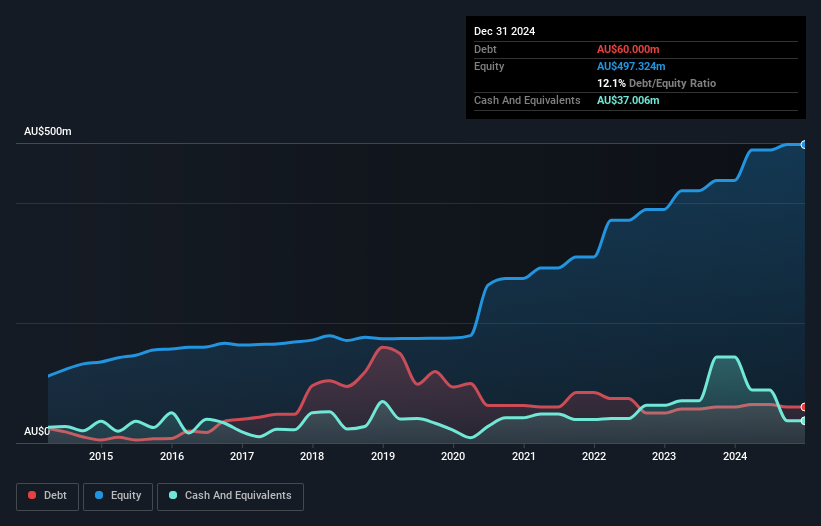

Civmec Limited, with a market cap of A$751.70 million, operates across multiple sectors including energy and infrastructure, generating significant revenue of A$810.59 million for the year ending June 2025. Despite recent earnings contraction and lower net profit margins compared to the previous year, Civmec maintains financial stability with short-term assets exceeding liabilities and debt well covered by cash flow. The company has reduced its debt-to-equity ratio over five years while offering dividends to shareholders. However, challenges include negative earnings growth in the past year and a relatively inexperienced management team with an average tenure of 1.1 years.

- Get an in-depth perspective on Civmec's performance by reading our balance sheet health report here.

- Evaluate Civmec's prospects by accessing our earnings growth report.

Sports Entertainment Group (ASX:SEG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sports Entertainment Group Limited operates in the sports media content and entertainment sector in Australia, with a market cap of A$78.64 million.

Operations: The company's revenue is primarily derived from its Media Australia segment, generating A$81.14 million, followed by Complementary activities at A$18.69 million, Sports Teams contributing A$8.57 million, and Head Office operations at A$1.84 million.

Market Cap: A$78.64M

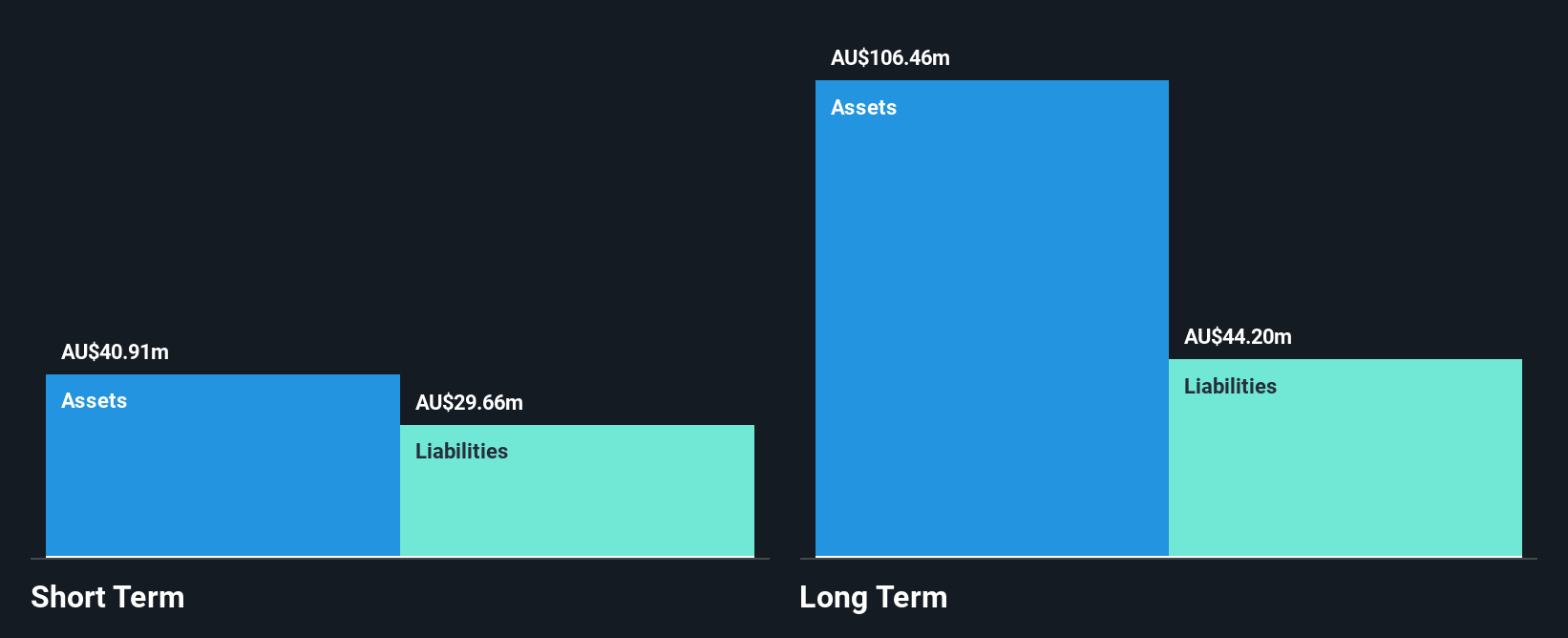

Sports Entertainment Group Limited, with a market cap of A$78.64 million, operates primarily in the sports media sector. The company reported A$110.24 million in sales for the fiscal year ending June 2025, up from A$107.89 million the previous year, while net income increased significantly to A$22.99 million from A$3.12 million. Despite being unprofitable overall, SEG maintains a positive free cash flow and has a cash runway exceeding three years if current conditions persist. Its short-term assets cover liabilities effectively; however, long-term liabilities are not fully covered by these assets despite reduced debt levels over five years.

- Dive into the specifics of Sports Entertainment Group here with our thorough balance sheet health report.

- Evaluate Sports Entertainment Group's historical performance by accessing our past performance report.

Summing It All Up

- Dive into all 420 of the ASX Penny Stocks we have identified here.

- Ready To Venture Into Other Investment Styles? The end of cancer? These 27 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ABY

Adore Beauty Group

Operates an integrated content, marketing, and e-commerce retail platform in Australia and New Zealand.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives