Global markets have experienced a muted response to new U.S. tariffs, with little distinction in performance between large-cap and small-cap stocks, while growth stocks have shown modest resilience. Amid this backdrop, small-cap companies offer unique opportunities for investors seeking potential value, especially when insider buying suggests confidence in the company's prospects.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Nexus Industrial REIT | 7.0x | 3.1x | 21.12% | ★★★★★☆ |

| Daiwa House Logistics Trust | 11.5x | 7.0x | 27.37% | ★★★★★☆ |

| Hemisphere Energy | 5.1x | 2.1x | 11.07% | ★★★★☆☆ |

| Sagicor Financial | 10.7x | 0.4x | -176.40% | ★★★★☆☆ |

| Saturn Oil & Gas | 2.8x | 0.5x | -184.98% | ★★★★☆☆ |

| Seeing Machines | NA | 2.9x | 44.11% | ★★★★☆☆ |

| A.G. BARR | 19.2x | 1.8x | 47.03% | ★★★☆☆☆ |

| CVS Group | 44.4x | 1.3x | 39.53% | ★★★☆☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 5.7x | 1.8x | 11.83% | ★★★☆☆☆ |

| DIRTT Environmental Solutions | 10.8x | 0.7x | 9.49% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

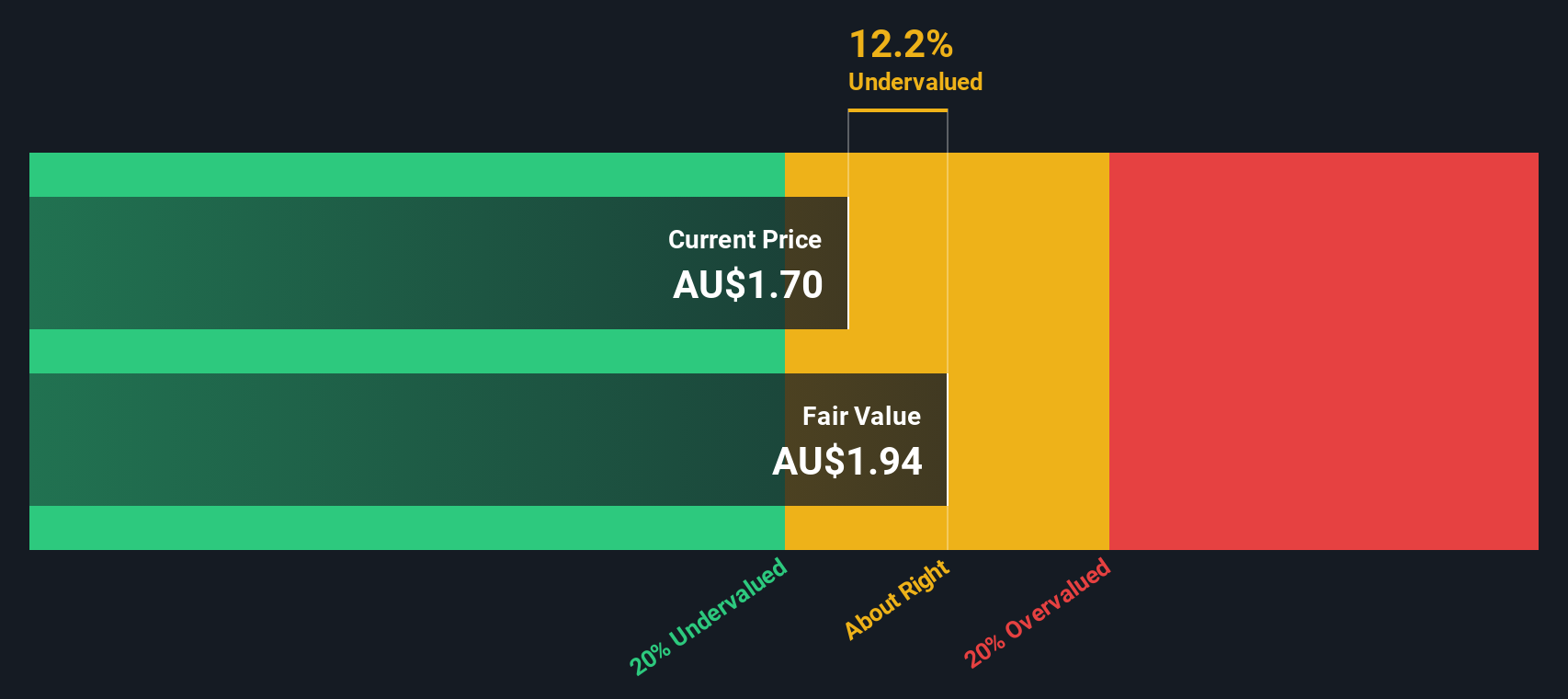

Nine Entertainment Holdings (ASX:NEC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Nine Entertainment Holdings operates as a diversified media company in Australia, with business segments including broadcasting, publishing, streaming through Stan, and real estate services via Domain Group. It has a market capitalization of approximately A$3.96 billion.

Operations: Nine Entertainment Holdings generates revenue primarily from its Broadcasting, Publishing, Stan, and Domain Group segments. Broadcasting is the largest contributor with A$1.25 billion in revenue. The company's gross profit margin saw a notable fluctuation over time, peaking at 26.83% before declining to 16.73%.

PE: 28.7x

Nine Entertainment Holdings, a dynamic player in the media industry, is currently perceived as undervalued. The company forecasts earnings growth of 20.92% annually, suggesting potential for future expansion. Insider confidence is evident with recent share purchases by key figures within the past year. While reliant on external borrowing, which poses risks compared to customer deposits, strategic board changes with Timothy Longstaff's appointment aim to bolster governance and oversight from June 2025 onward.

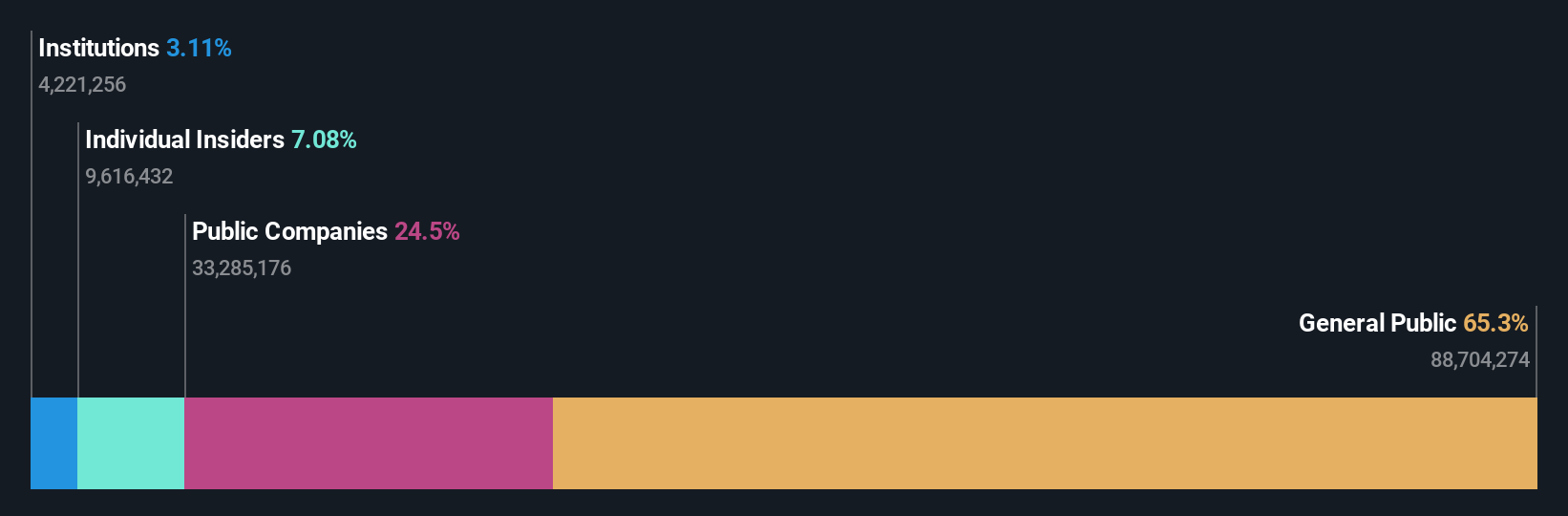

Sagicor Financial (TSX:SFC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sagicor Financial is a financial services company with operations spanning life insurance, banking, and asset management across its segments in the Caribbean, United States, and Canada, with a market capitalization of $1.25 billion.

Operations: Sagicor Financial's revenue streams are primarily from Sagicor Canada, Sagicor Jamaica, and Sagicor Life. The company's cost of goods sold (COGS) has fluctuated significantly over the periods observed. Notably, the gross profit margin reached a high of 52.64% in September 2023 before declining to 36.46% by December 2024. Operating expenses have consistently impacted net income across various periods, with notable non-operating expenses also affecting profitability outcomes.

PE: 10.7x

Sagicor Financial, a smaller player in the financial sector, has announced a share repurchase program to buy back up to 9.3 million shares, signaling potential insider confidence. Despite reporting a drop in net income to US$6.7 million for Q1 2025 from US$26.25 million the previous year, they maintain shareholder value with dividends of US$0.0675 per share paid recently. Earnings are projected to grow annually by 17.65%, though profit margins have significantly decreased from last year's levels of 31.7% to 3.9%.

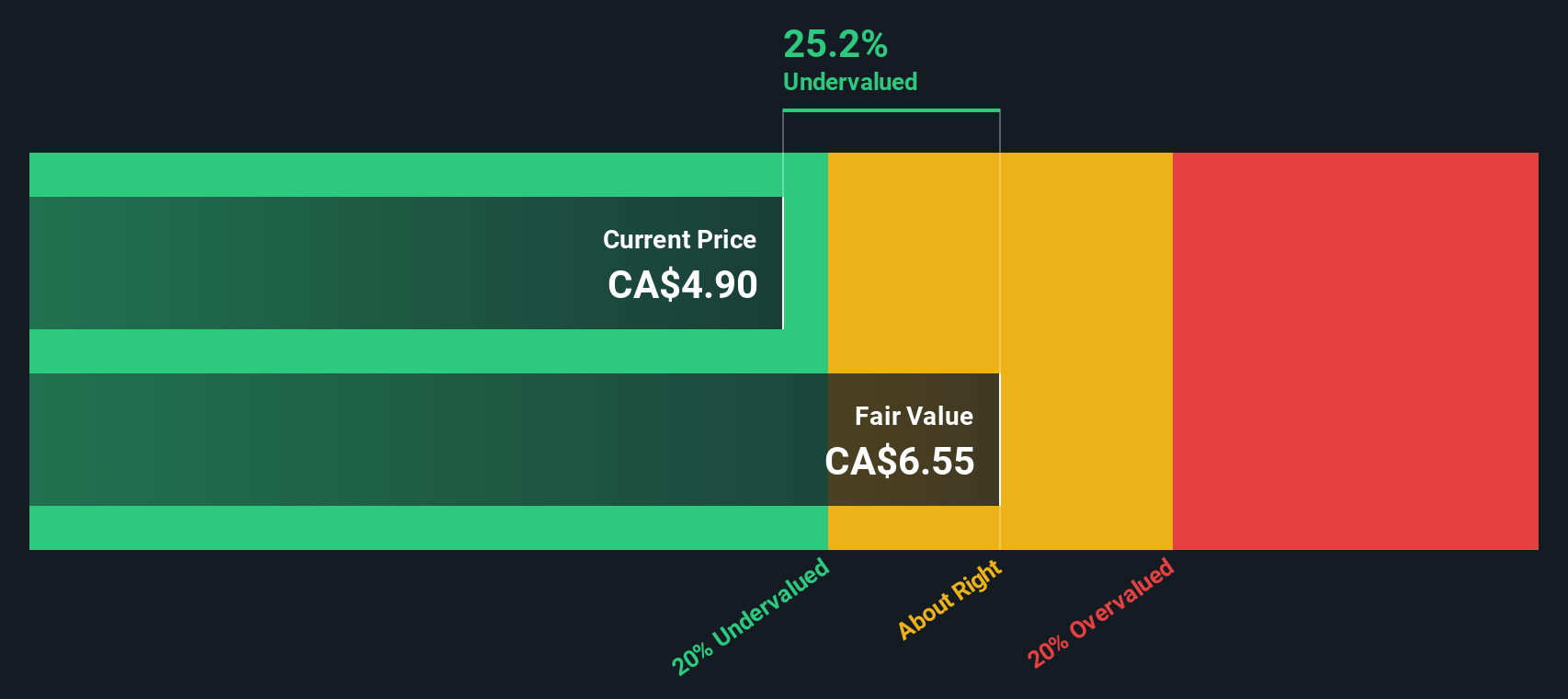

Tamarack Valley Energy (TSX:TVE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tamarack Valley Energy is a Canadian company focused on the exploration and production of oil and gas, with a market cap of approximately CA$2.25 billion.

Operations: Tamarack Valley Energy generates revenue primarily from oil and gas exploration and production, with the most recent reported revenue at CA$1.44 billion. The company's gross profit margin has shown a notable trend, reaching 79.98% as of March 2025.

PE: 9.8x

Tamarack Valley Energy, a smaller player in the energy sector, shows potential despite challenges. Recent insider confidence is evident as an independent director acquired 135,000 shares for approximately C$506,250 between January and June 2025. The company has also repurchased over 38 million shares this year for C$145 million. While facing regulatory penalties and forecasted earnings decline of around 33% annually over the next three years, Tamarack maintains strong liquidity with access to substantial credit facilities.

- Unlock comprehensive insights into our analysis of Tamarack Valley Energy stock in this valuation report.

Gain insights into Tamarack Valley Energy's past trends and performance with our Past report.

Turning Ideas Into Actions

- Investigate our full lineup of 125 Undervalued Global Small Caps With Insider Buying right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SFC

Sagicor Financial

Provides insurance products and related financial services in Jamaica, Barbados, Trinidad, Tobago, other Caribbean region, and the United States.

Good value second-rate dividend payer.

Market Insights

Community Narratives