- Australia

- /

- Diversified Financial

- /

- ASX:HLI

Top ASX Dividend Stocks To Consider In December 2025

Reviewed by Simply Wall St

As the Australian share market remains rangebound with the XJO hovering around 8,500 points and bond yields nearing year-long highs, investors are navigating a complex landscape influenced by inflationary pressures and sector-specific movements. In this environment, dividend stocks can offer stability and income potential, making them an attractive option for those looking to balance growth with consistent returns amidst fluctuating market conditions.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Treasury Wine Estates (ASX:TWE) | 6.90% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 5.81% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.86% | ★★★★★☆ |

| Steadfast Group (ASX:SDF) | 3.83% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.72% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 5.67% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 7.51% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.39% | ★★★★★☆ |

| EQT Holdings (ASX:EQT) | 4.44% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 6.90% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top ASX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

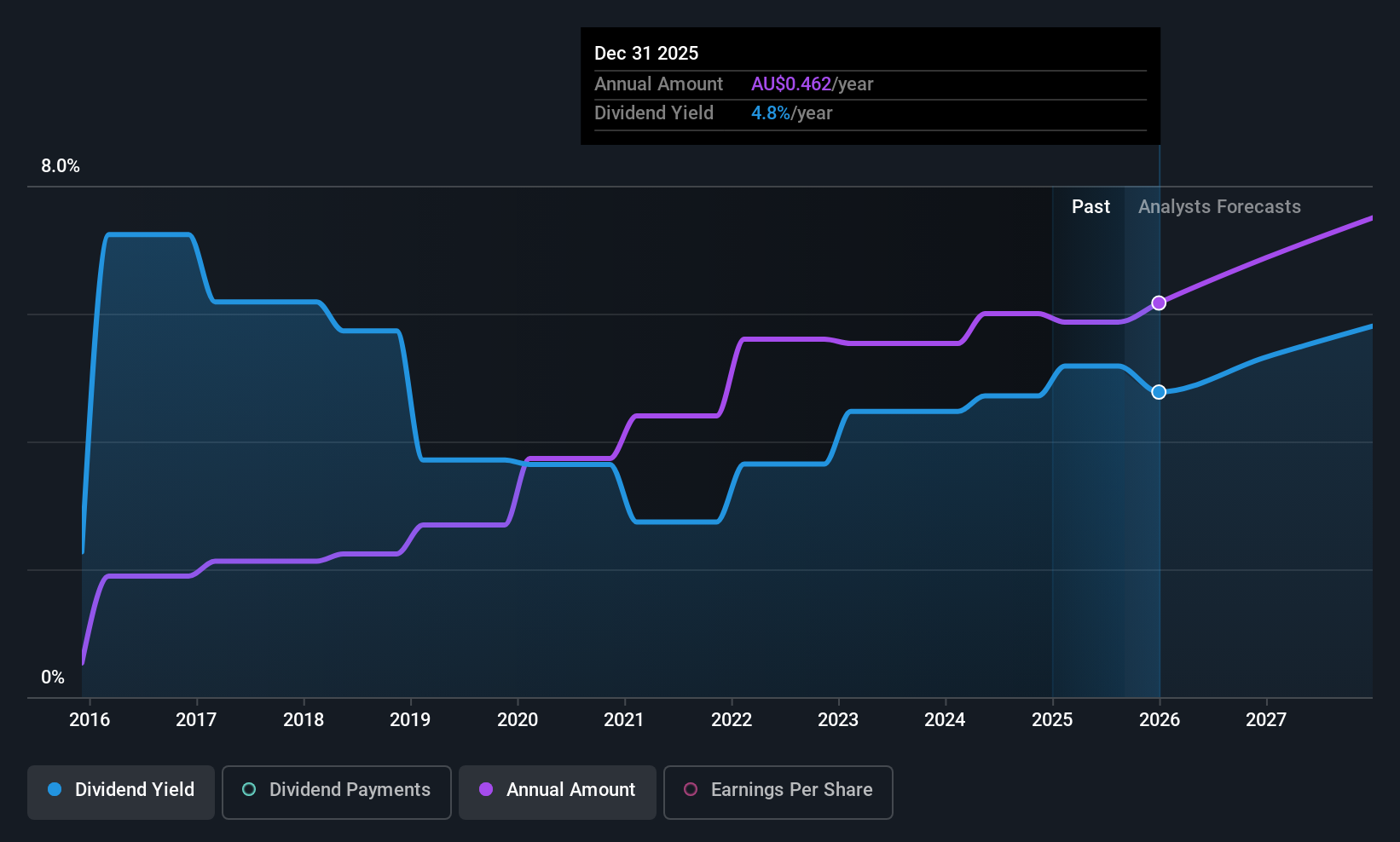

Dicker Data (ASX:DDR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dicker Data Limited is a wholesale distributor of computer hardware, software, and related products for corporate and commercial markets in Australia and New Zealand, with a market cap of A$1.92 billion.

Operations: Dicker Data Limited generates revenue primarily from its wholesale distribution of computer peripherals, amounting to A$2.44 billion.

Dividend Yield: 4.2%

Dicker Data's dividends have been stable and reliable over the past decade, with recent affirmations of a A$0.11 per share dividend for Q3 2025. However, its dividend yield of 4.15% is lower than the top quartile in Australia and not well covered by earnings or cash flows, despite being covered by free cash flow at an 83.2% payout ratio. The company has a high debt level but trades at a good value relative to peers with a P/E ratio of 23.2x, below the industry average.

- Dive into the specifics of Dicker Data here with our thorough dividend report.

- Our valuation report unveils the possibility Dicker Data's shares may be trading at a discount.

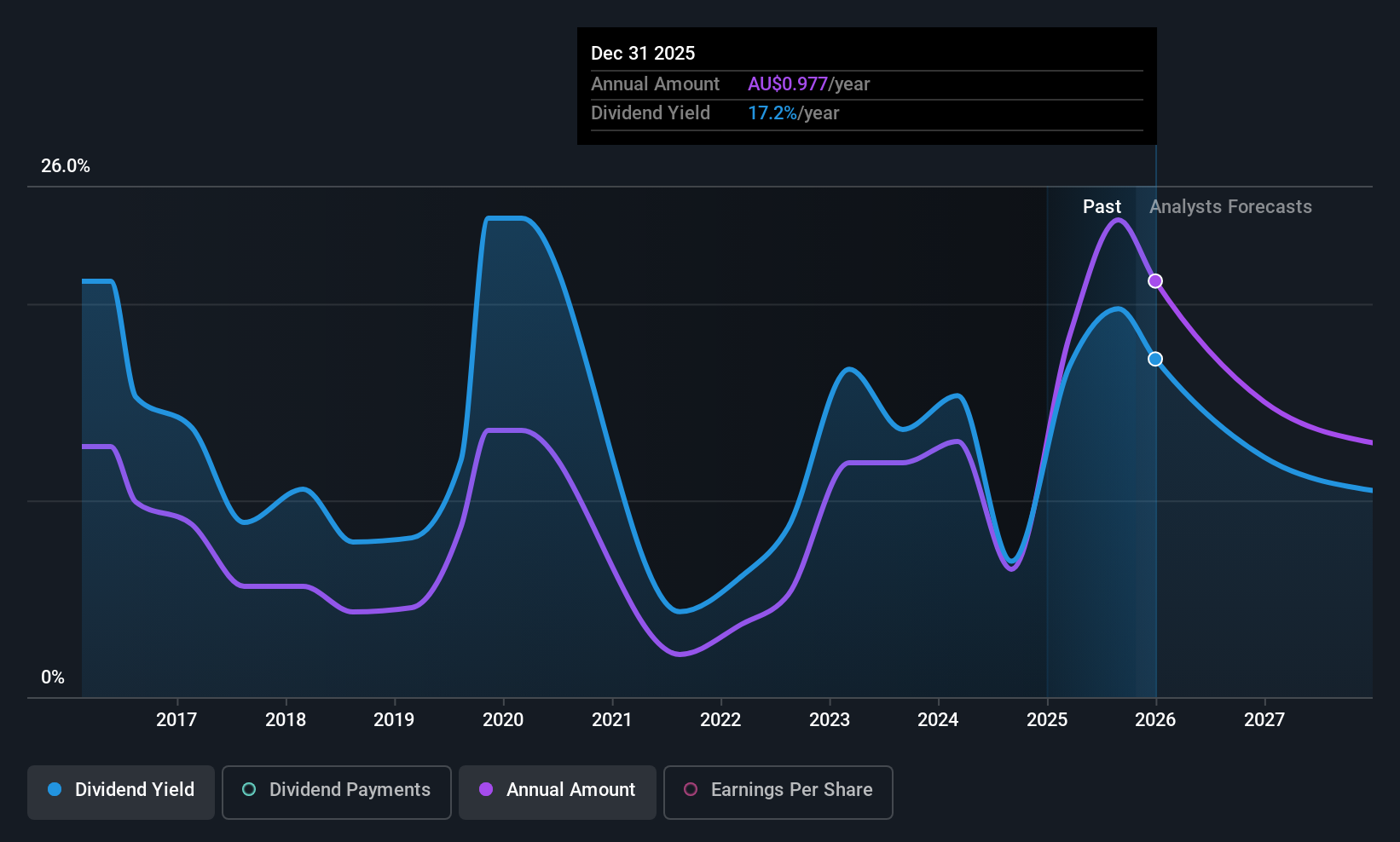

Helia Group (ASX:HLI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Helia Group Limited, operating primarily in Australia, is engaged in the loan mortgage insurance business and has a market cap of A$1.53 billion.

Operations: Helia Group Limited generates revenue of A$559.63 million from its loan mortgage insurance operations in Australia.

Dividend Yield: 19.9%

Helia Group offers a high dividend yield of 19.86%, placing it in the top 25% of Australian dividend payers, but this is not well covered by cash flows with a high payout ratio of 209.7%. While earnings grew by A$19.4% last year, future declines are expected. The company's dividends have been volatile over the past decade despite some growth, and its current valuation is attractive at 68.1% below estimated fair value.

- Click here to discover the nuances of Helia Group with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Helia Group shares in the market.

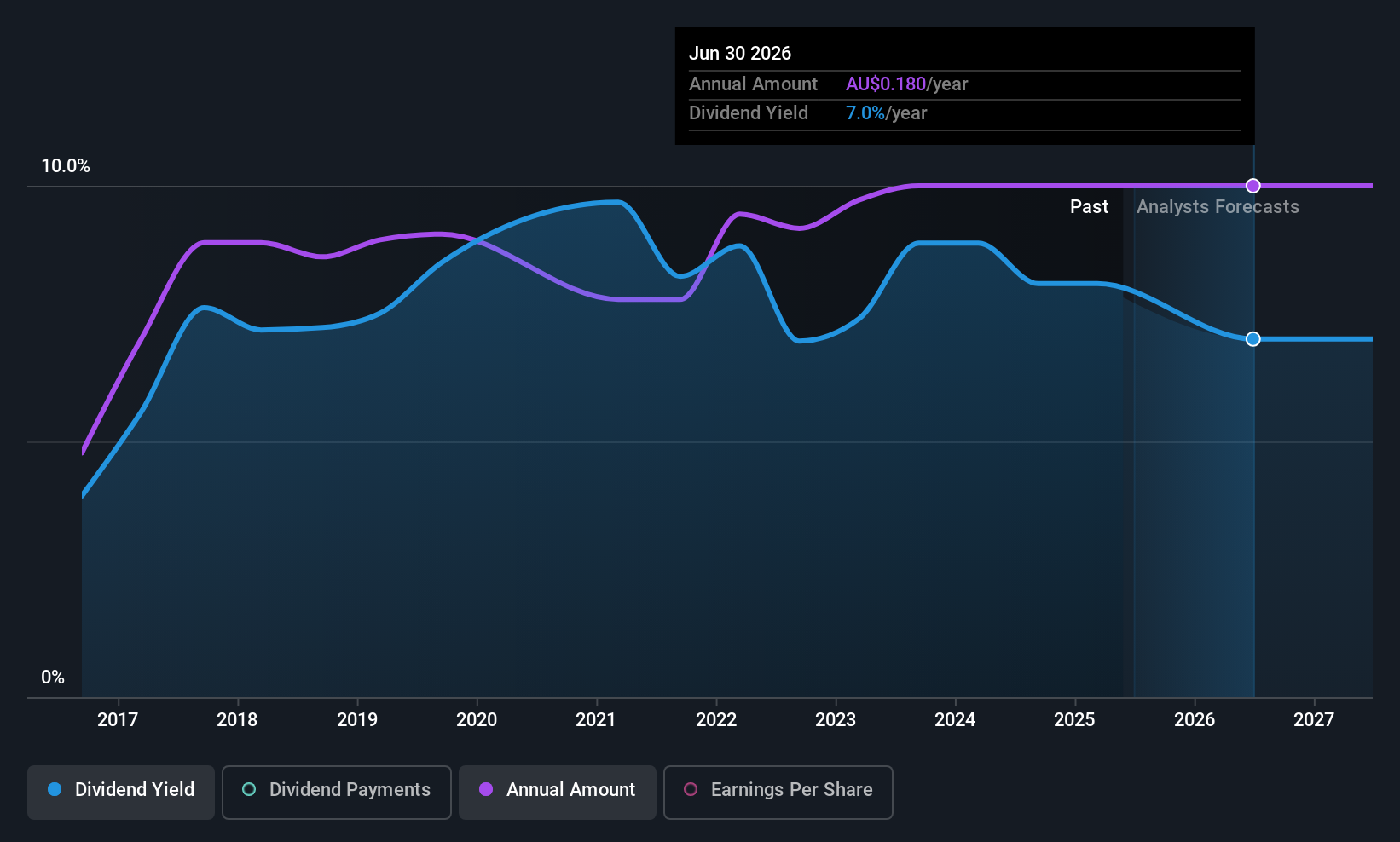

IVE Group (ASX:IGL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IVE Group Limited, along with its subsidiaries, operates in the marketing sector in Australia and has a market capitalization of A$439.55 million.

Operations: IVE Group Limited generates revenue from its advertising segment, amounting to A$959.25 million.

Dividend Yield: 6.3%

IVE Group's dividend yield of 6.29% is among the top 25% in Australia, supported by a reasonable payout ratio of 59.6% and a cash payout ratio of 34.9%, indicating sustainability from earnings and cash flows. However, its dividend history is less stable, with payments being volatile over its nine-year track record. Despite this, the company trades at an attractive valuation, significantly below estimated fair value, though it holds a high level of debt which may concern some investors.

- Delve into the full analysis dividend report here for a deeper understanding of IVE Group.

- Upon reviewing our latest valuation report, IVE Group's share price might be too pessimistic.

Next Steps

- Click this link to deep-dive into the 32 companies within our Top ASX Dividend Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Helia Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HLI

Helia Group

Helia Group Limited, together with its subsidiaries, is involved in the loan mortgage insurance business primarily in Australia.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026