Gumtree Australia Markets Limited (ASX:GUM) Stock's 28% Dive Might Signal An Opportunity But It Requires Some Scrutiny

The Gumtree Australia Markets Limited (ASX:GUM) share price has softened a substantial 28% over the previous 30 days, handing back much of the gains the stock has made lately. The recent drop has obliterated the annual return, with the share price now down 3.3% over that longer period.

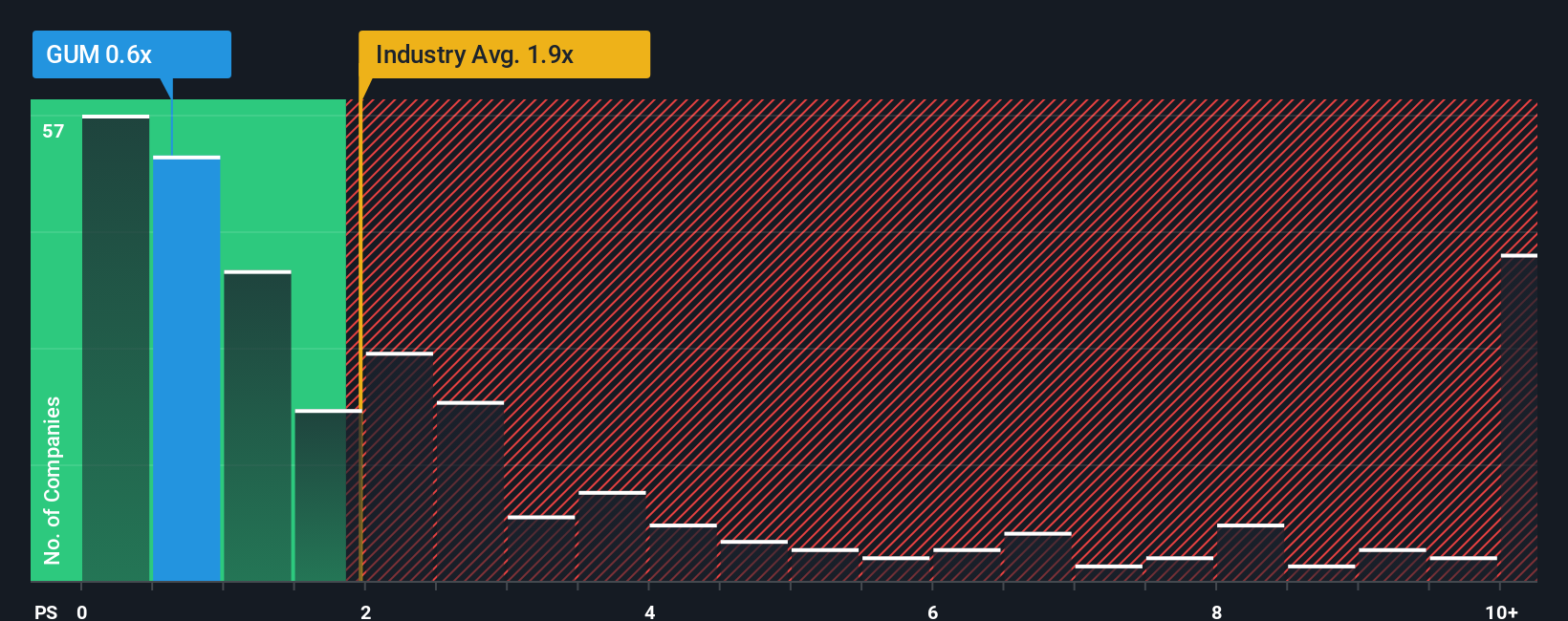

After such a large drop in price, Gumtree Australia Markets may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.6x, considering almost half of all companies in the Interactive Media and Services industry in Australia have P/S ratios greater than 2.8x and even P/S higher than 9x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Gumtree Australia Markets

How Gumtree Australia Markets Has Been Performing

For instance, Gumtree Australia Markets' receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Gumtree Australia Markets will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Gumtree Australia Markets' earnings, revenue and cash flow.How Is Gumtree Australia Markets' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Gumtree Australia Markets' is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a frustrating 7.5% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 189% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 2.4% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this in mind, we find it intriguing that Gumtree Australia Markets' P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Gumtree Australia Markets' P/S looks about as weak as its stock price lately. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We're very surprised to see Gumtree Australia Markets currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

Plus, you should also learn about these 4 warning signs we've spotted with Gumtree Australia Markets (including 3 which shouldn't be ignored).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:GUM

Gumtree Australia Markets

Operates a digital business news and investor relations platform in Australia and internationally.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives