- Australia

- /

- Metals and Mining

- /

- ASX:VAU

Vault Minerals (ASX:VAU) Valuation: Assessing the Impact of the Buyback and CEO Transition

Reviewed by Simply Wall St

Vault Minerals (ASX:VAU) is in the spotlight after announcing an on-market buyback of up to 10% of its shares. The company also reported an executive leadership transition as the current CEO plans to step down within the next year.

See our latest analysis for Vault Minerals.

Vault Minerals’ recent buyback news comes as the stock continues an impressive run, with a year-to-date share price return of 140.91% and a one-year total shareholder return of 152.38%. Momentum has accelerated sharply over the past quarter, likely fueled by renewed optimism around management’s strategy and the company’s robust production outlook.

If the surge in VAU has you curious about what else could offer big moves and smart management, now is a great time to discover fast growing stocks with high insider ownership

But with Vault Minerals’ stock already up sharply this year and trading just below analyst price targets, the question remains: are we looking at an undervalued resource opportunity, or has the market already priced in all the upside?

Price-to-Earnings of 22.8x: Is it justified?

Vault Minerals is trading at a price-to-earnings (P/E) ratio of 22.8x, notably lower than the peer average of 58.8x. This makes the stock appear attractively valued relative to its direct competitors.

The price-to-earnings ratio measures how much investors are willing to pay today for a dollar of earnings. In capital-intensive sectors like mining, the P/E ratio helps benchmark profitability against both industry norms and future growth prospects.

Despite this seemingly inexpensive multiple relative to peers, VAU’s P/E sits above the broader Australian Metals and Mining industry average of 21x and the estimated fair P/E of 21.2x. While Vault Minerals just became profitable and posts high-quality earnings, these figures suggest that market enthusiasm could already be reflected in its current share price.

Looking ahead, if the market reverts toward the fair value multiple, the stock’s valuation could reset accordingly. Investors should watch how growth materializes compared to these benchmarks to assess if current optimism is justified.

Explore the SWS fair ratio for Vault Minerals

Result: Price-to-Earnings of 22.8x (ABOUT RIGHT)

However, slower than expected revenue growth or a pause in net income gains could quickly dampen rising investor enthusiasm for Vault Minerals.

Find out about the key risks to this Vault Minerals narrative.

Another Perspective: What Does the DCF Model Say?

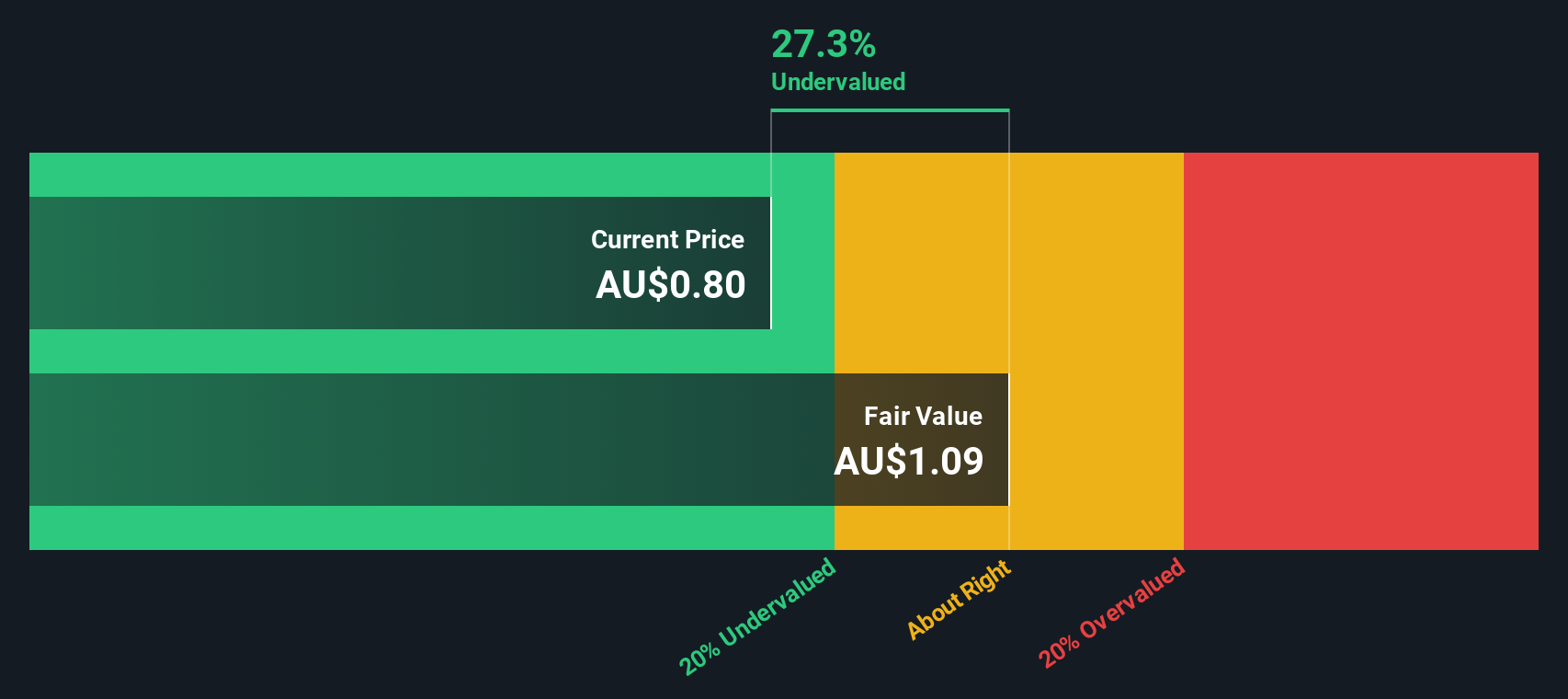

Looking beyond earnings ratios, our DCF model paints a different picture. It suggests Vault Minerals is trading at a 27% discount to its fair value. This could indicate a much larger margin of safety compared to what the P/E ratio shows. Could the market be underestimating its future cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vault Minerals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vault Minerals Narrative

If you see things differently or want to draw your own conclusions from the numbers, it's easy to put together your own view of Vault Minerals in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vault Minerals.

Ready for More High-Potential Stocks?

Seize your next big opportunity before the crowd by using Simply Wall Street’s powerful Screener to uncover stocks with real momentum, fresh ideas, and growth potential.

- Supercharge your portfolio with strong income by targeting these 14 dividend stocks with yields > 3% with yields above 3% and consistent distribution track records.

- Spot tomorrow’s leaders in artificial intelligence by tapping into these 27 AI penny stocks, where innovation meets long-term market growth.

- Get ahead of the curve and hunt for mispriced gems with these 881 undervalued stocks based on cash flows based on rigorous cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VAU

Vault Minerals

Engages in the exploration, mine development, mine operations and the sale of gold and gold/copper concentrate in Australia and Canada.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives