- Australia

- /

- Metals and Mining

- /

- ASX:SMI

Why Santana Minerals (ASX:SMI) Is Up 10.0% After Securing a 25-Year Permit for Bendigo-Ophir Project

Reviewed by Sasha Jovanovic

- Santana Minerals Limited has been granted a 25-year mining permit for its Bendigo-Ophir Gold Project in Central Otago, New Zealand, allowing full extraction and processing rights at the Rise & Shine deposit and neighboring areas.

- This milestone secures a pivotal regulatory step, setting the stage for potential construction and first gold production pending environmental approvals expected by mid-2026.

- We’ll now explore how obtaining this critical permit may influence Santana Minerals’ investment narrative, particularly with its anticipated timeline for project development.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Santana Minerals' Investment Narrative?

For those considering Santana Minerals, the investment story has often revolved around its progress at the Bendigo-Ophir Gold Project and the timeline to transition from explorer to producer. The new 25-year mining permit for the Rise & Shine deposit significantly shifts the short-term focus: with regulatory certainty now in hand, the major near-term catalyst pivots to securing environmental approvals and pushing toward construction, now anticipated by mid-2026. This permit addresses a core risk that previously loomed over the project, regulatory uncertainty, potentially shortening the timeline to initial gold production once the next approval is secured. Major risks now shift more toward timely permitting outcomes, capital management given past shareholder dilution, and the ability to control construction costs. The market’s recent strong move suggests investors are weighing this progress, but project execution and funding remain central from here. On the flip side, the timeline for environmental approvals could challenge expectations for near-term progress.

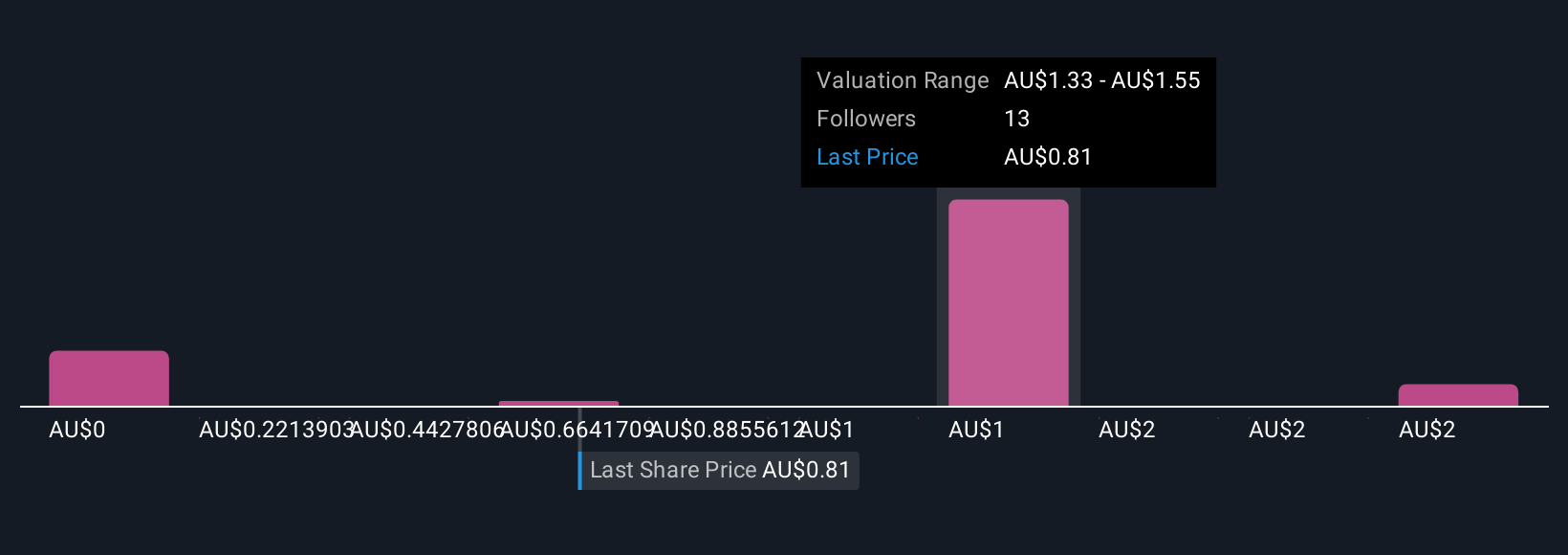

Santana Minerals' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 7 other fair value estimates on Santana Minerals - why the stock might be worth over 2x more than the current price!

Build Your Own Santana Minerals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Santana Minerals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Santana Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Santana Minerals' overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SMI

Santana Minerals

Engages in the exploration and evaluation of gold properties in New Zealand, Cambodia, and Mexico.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives