3 ASX Stocks That Could Be Trading Up To 41.6% Below Intrinsic Value Estimates

Reviewed by Simply Wall St

As the Australian market remains rangebound, with the S&P/ASX 200 index hovering around the 8,500-point mark and showing little sign of a Santa Rally on the horizon, investors are closely monitoring economic indicators like bond yields and CPI data. In such an environment, identifying undervalued stocks becomes crucial for those looking to capitalize on potential discrepancies between market prices and intrinsic value estimates.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Telix Pharmaceuticals (ASX:TLX) | A$14.45 | A$25.23 | 42.7% |

| Superloop (ASX:SLC) | A$2.68 | A$5.36 | 50% |

| Smart Parking (ASX:SPZ) | A$1.315 | A$2.26 | 41.9% |

| SenSen Networks (ASX:SNS) | A$0.098 | A$0.19 | 48% |

| LGI (ASX:LGI) | A$4.18 | A$7.75 | 46.1% |

| Guzman y Gomez (ASX:GYG) | A$22.22 | A$39.44 | 43.7% |

| Genesis Minerals (ASX:GMD) | A$6.55 | A$13.02 | 49.7% |

| Elders (ASX:ELD) | A$7.16 | A$12.56 | 43% |

| Cromwell Property Group (ASX:CMW) | A$0.475 | A$0.86 | 44.5% |

| Airtasker (ASX:ART) | A$0.355 | A$0.68 | 47.4% |

Let's review some notable picks from our screened stocks.

Infomedia (ASX:IFM)

Overview: Infomedia Ltd, with a market cap of A$639.58 million, is a technology company that develops and supplies electronic parts catalogues, service quoting software, and e-commerce solutions for the global automotive industry.

Operations: The company's revenue is primarily derived from its publishing segment, specifically periodicals, which generated A$146.51 million.

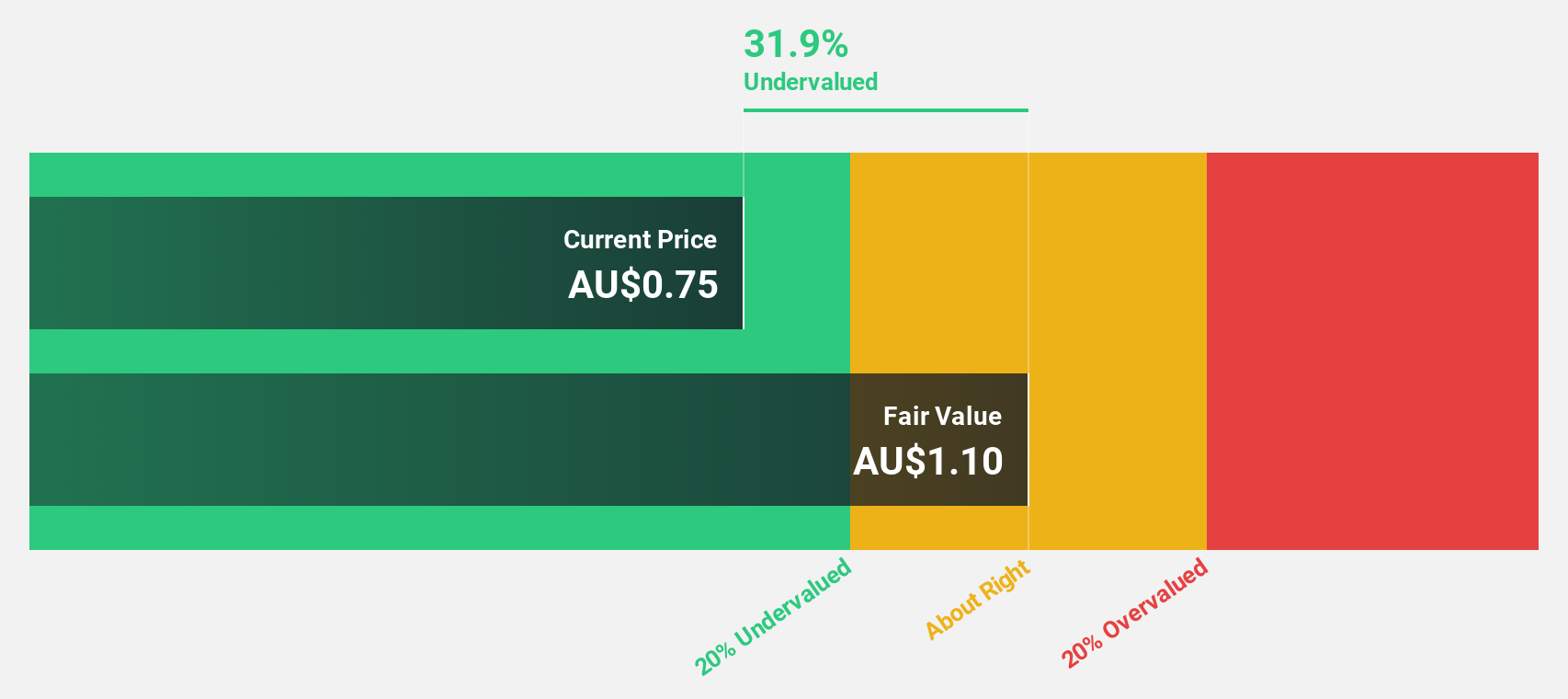

Estimated Discount To Fair Value: 21.2%

Infomedia's recent acquisition by TPG Growth Capital Asia Limited for A$650 million highlights its undervaluation based on cash flows, as it was trading at A$1.70 per share, below the estimated fair value of A$2.15. Despite being dropped from several indices, Infomedia's earnings are forecast to grow significantly at 20% annually, surpassing the market average. The company's strong cash flow potential is further underscored by a special dividend announcement following the acquisition completion.

- Our earnings growth report unveils the potential for significant increases in Infomedia's future results.

- Take a closer look at Infomedia's balance sheet health here in our report.

Immutep (ASX:IMM)

Overview: Immutep Limited is a biotechnology company focused on developing novel Lymphocyte Activation Gene-3 related immunotherapies for cancer and autoimmune diseases in Australia, with a market cap of A$412.14 million.

Operations: The company generates revenue of A$5.03 million from its immunotherapy segment.

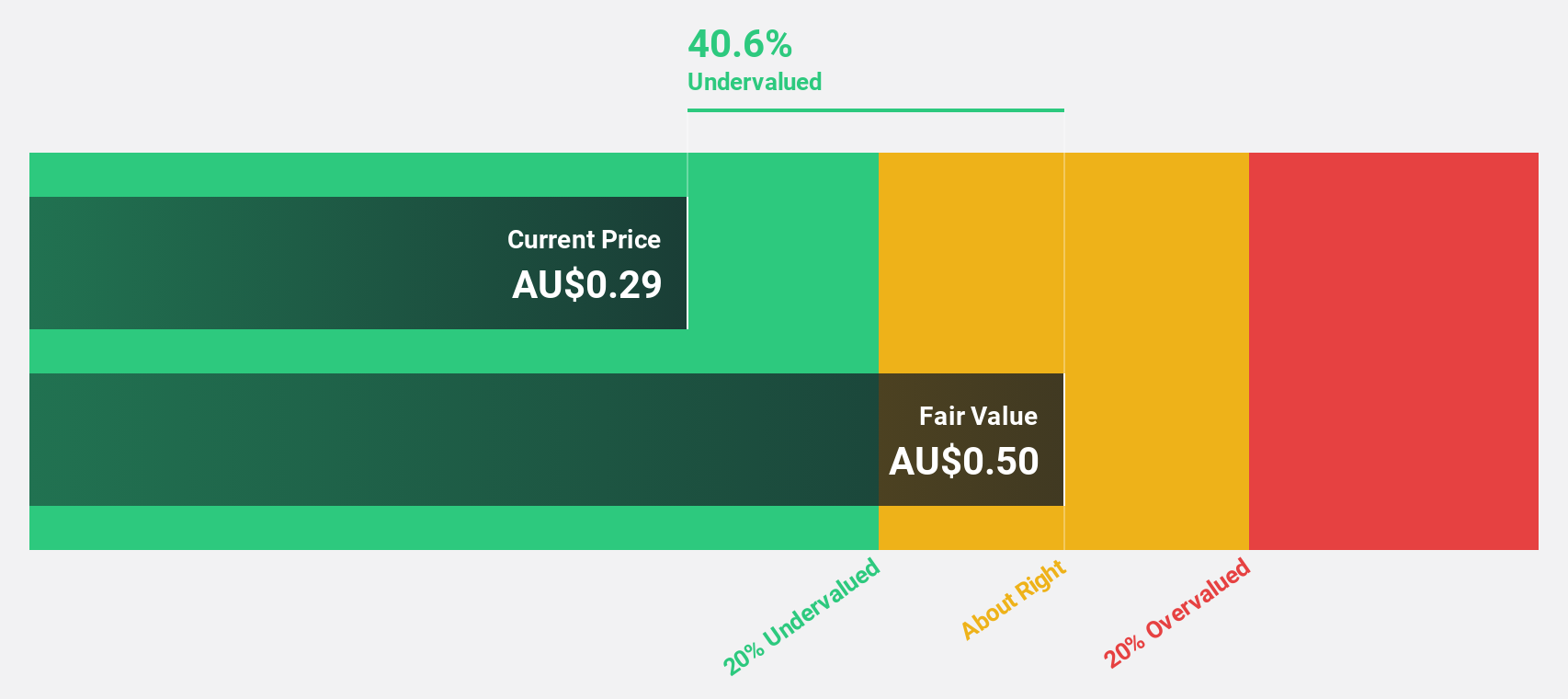

Estimated Discount To Fair Value: 41.6%

Immutep Limited appears undervalued based on cash flows, trading at A$0.28, significantly below its estimated fair value of A$0.48. Despite current unprofitability, it is expected to achieve profitability within three years with revenue forecasted to grow over 100% annually, outpacing the market's growth rate. Recent clinical trials in oncology have shown promising results for their lead product eftilagimod alfa (efti), enhancing its strategic position and potential future revenues in the immunotherapy sector.

- Our growth report here indicates Immutep may be poised for an improving outlook.

- Click here to discover the nuances of Immutep with our detailed financial health report.

Nickel Industries (ASX:NIC)

Overview: Nickel Industries Limited is involved in nickel ore mining and the production of nickel pig iron, cobalt, and nickel matte, with a market cap of A$3.08 billion.

Operations: The company's revenue segments include $120.89 million from nickel ore mining in Indonesia, $109.25 million from HPAL projects in Indonesia and Hong Kong, and $1.50 billion from RKEF projects in Indonesia and Singapore.

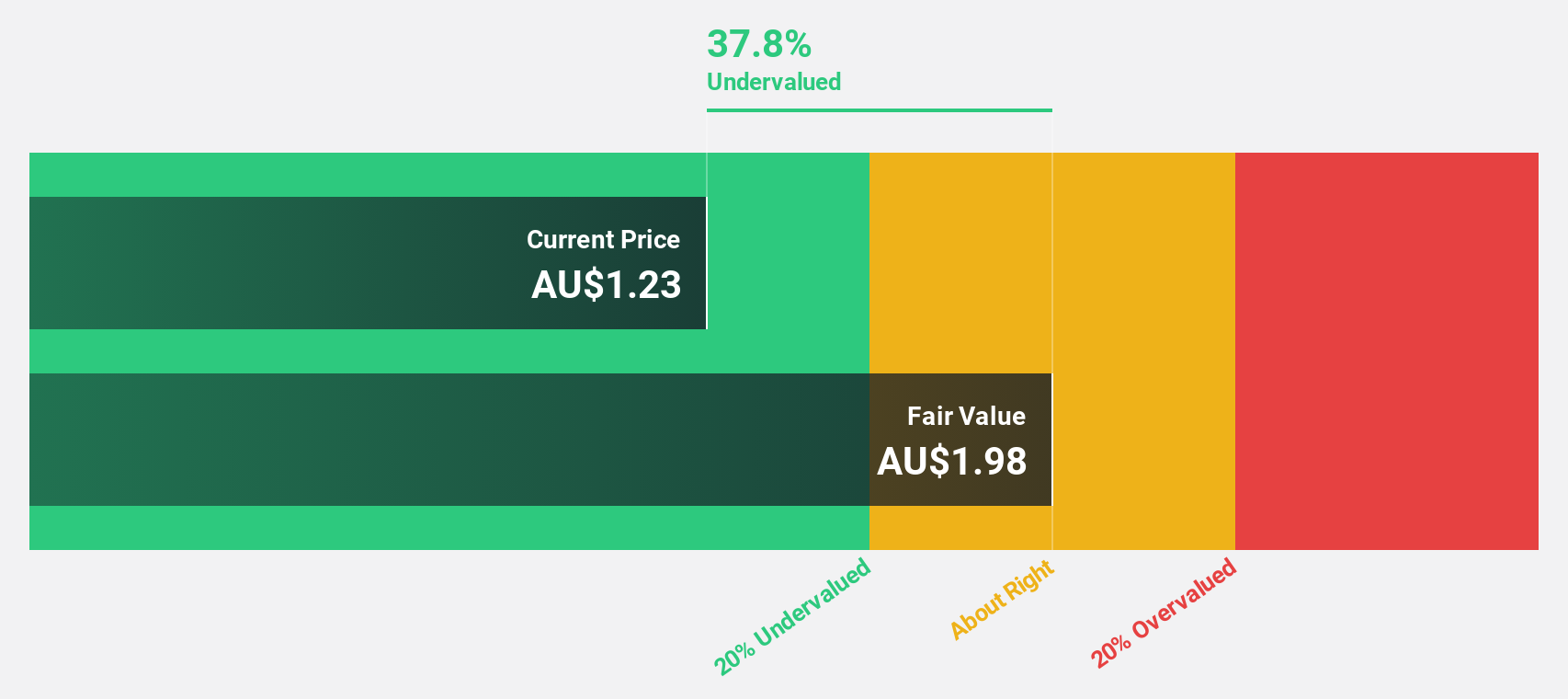

Estimated Discount To Fair Value: 37.6%

Nickel Industries is trading at A$0.71, approximately 37.6% below its estimated fair value of A$1.14, highlighting its undervaluation based on cash flows. The company recently completed an US$800 million bond issuance with a 9% coupon to extend debt maturity and repurchase higher-interest notes, strengthening financial flexibility. While revenue growth is expected at 13.1% annually—faster than the Australian market—profitability is anticipated within three years, offering potential for enhanced investor returns.

- Upon reviewing our latest growth report, Nickel Industries' projected financial performance appears quite optimistic.

- Navigate through the intricacies of Nickel Industries with our comprehensive financial health report here.

Where To Now?

- Discover the full array of 36 Undervalued ASX Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IFM

Infomedia

A technology company, develops and supplies electronic parts catalogues, service quoting software, and e-commerce solutions for the automotive industry worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026