- Australia

- /

- Metals and Mining

- /

- ASX:LYC

How Lynas Rare Earths’ (ASX:LYC) On-Site Hydrogen Peroxide Deal Could Boost Sustainability and Processing Efficiency

Reviewed by Sasha Jovanovic

- Earlier this month, Solidec announced a landmark partnership with Lynas Rare Earths to deploy a pilot on-site hydrogen peroxide generation system at Lynas’s Australian facility, aiming for more efficient and less carbon-intensive rare earths processing.

- This collaboration enables Lynas to integrate a novel chemical generation technology that could strengthen both its environmental credentials and its materials processing resilience.

- We’ll examine how the adoption of on-site low-carbon chemical production could further enhance Lynas Rare Earths’ investment outlook.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Lynas Rare Earths Investment Narrative Recap

Lynas Rare Earths has drawn investor attention as a major supplier outside China, with hopes pinned on government-backed demand for critical minerals and the successful scale-up of new facilities like Kalgoorlie. While the recent Solidec partnership reinforces Lynas’s push for a more resilient and low-carbon supply chain, it doesn’t directly shift the immediate spotlight from the company’s largest current risk: regulatory uncertainties and operational headwinds in Malaysia still loom over its near-term outlook.

Among recent developments, the MoU with Noveon Magnetics to develop a US-based rare earth magnet supply chain stands out. This directly ties to investor expectations for Western supply diversification and could affect Lynas’s ability to secure premium pricing and government procurement, both important drivers behind the company’s current investment thesis.

Yet, despite these positive steps, operational continuity in Malaysia remains a critical point investors should not overlook, especially as...

Read the full narrative on Lynas Rare Earths (it's free!)

Lynas Rare Earths is forecasted to achieve A$1.9 billion in revenue and A$732.6 million in earnings by 2028. This outlook is based on analysts projecting annual revenue growth of 50.1% and an increase in earnings of A$724.6 million from A$8.0 million today.

Uncover how Lynas Rare Earths' forecasts yield a A$15.94 fair value, a 12% upside to its current price.

Exploring Other Perspectives

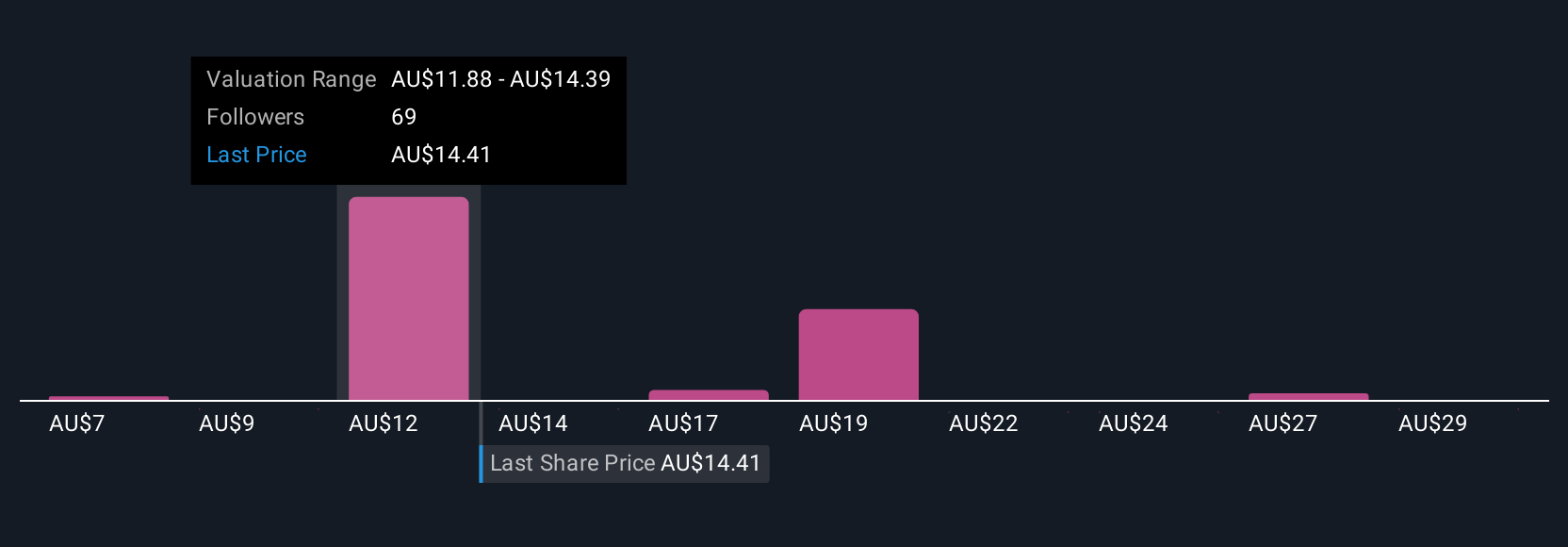

Eighteen Simply Wall St Community members have posted fair value estimates for Lynas Rare Earths ranging from A$8.90 to as high as A$34.56. With regulatory risk in Malaysia hovering over expectations for rapid expansion, there are plenty of viewpoints to explore and compare.

Explore 18 other fair value estimates on Lynas Rare Earths - why the stock might be worth 37% less than the current price!

Build Your Own Lynas Rare Earths Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lynas Rare Earths research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lynas Rare Earths research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lynas Rare Earths' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LYC

Lynas Rare Earths

Engages in the exploration, development, mining, extraction, and processing of rare earth minerals in Australia and Malaysia.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives