- Australia

- /

- Metals and Mining

- /

- ASX:LTR

Liontown Resources (ASX:LTR) Valuation in Focus as Metalshub Auction Launch Marks New Lithium Sales Phase

Reviewed by Simply Wall St

Liontown Resources (ASX:LTR) jumped after announcing it will use the Metalshub digital platform to auction its first Kathleen Valley lithium. Online sales are set to begin on November 19. Investors are watching how this transition to direct sales could influence market positioning and demand.

See our latest analysis for Liontown Resources.

Liontown’s move to online sales comes as its share price return has soared 130.7% year-to-date. Momentum has accelerated in recent weeks following the Metalshub news. The 1-year total shareholder return of 49.4% signals solid value creation, though longer-term holders have experienced a wild ride.

If you’re curious which other resource stocks might be gaining steam, it’s a great moment to branch out and discover fast growing stocks with high insider ownership

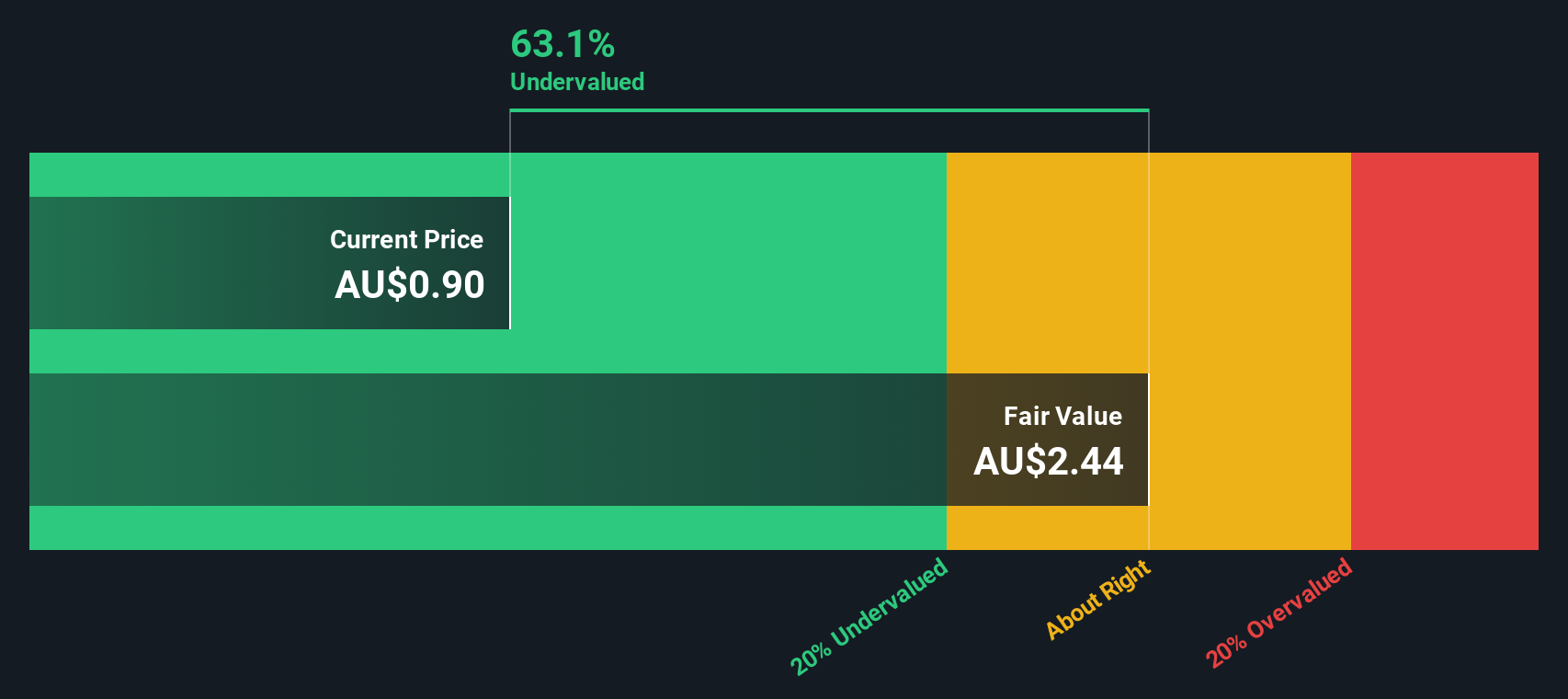

With shares surging and expectations high after the Metalshub auction news, the key question is whether Liontown is still undervalued by the market or if its recent gains already reflect the company’s future growth potential.

Most Popular Narrative: 68.4% Overvalued

According to the most widely followed narrative, Liontown’s last close is A$1.32 while the narrative fair value stands at just A$0.78. The gap signals concern that current pricing may already factor in ambitious growth assumptions. This sets the stage for a challenging debate around what is truly priced in.

The analysts have a consensus price target of A$0.626 for Liontown Resources based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$1.15, and the most bearish reporting a price target of just A$0.35.

What is behind this split in valuation? The narrative’s entire case rests on a blend of aggressive revenue growth, significant margin improvements, and a forward profit multiple rarely seen in mining. Wondering which forecasts and divisive opinions drive such a sharp mismatch with today’s price? You will want to unpack the full story.

Result: Fair Value of $0.78 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as unexpected rises in operating costs or declining lithium prices. Either of these factors could quickly shift Liontown’s outlook.

Find out about the key risks to this Liontown Resources narrative.

Another View: SWS DCF Model Signals Upside

Despite analyst narratives pointing to overvaluation, the SWS DCF model calculates a fair value of A$6.61 per share for Liontown—this is over 80% above the current price. This suggests the market may be overlooking long-term cash flow prospects. Could this major gap spotlight an opportunity or a risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Liontown Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 855 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Liontown Resources Narrative

If the numbers or stories above do not fully reflect your view, you can dig into the details yourself and shape your own perspective. Create yours in just a few minutes with Do it your way.

A great starting point for your Liontown Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t settle for just one stock. Step up your game by checking out handpicked opportunities crafted to match your style and ambition. The right screener could help you spot market movers before the crowd and sharpen your investing edge for the months ahead.

- Tap into growth by scanning these 855 undervalued stocks based on cash flows, offering real potential for undervalued returns and fresh upside across diverse sectors.

- Unlock steady income streams and get ahead with these 15 dividend stocks with yields > 3%, featuring strong yields from established market performers.

- Seize the future with these 25 AI penny stocks, leading the charge in artificial intelligence innovation and rapid technological breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LTR

Liontown Resources

Engages in the exploration, evaluation, and development of mineral properties in Australia.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives