- Australia

- /

- Metals and Mining

- /

- ASX:LTR

Can Liontown Resources' (ASX:LTR) Digital Lithium Auctions Reshape Its Global Sales Strategy?

Reviewed by Sasha Jovanovic

- In the past week, Liontown Resources announced it will begin auctioning the first 10,000 metric tons of lithium from its Kathleen Valley project using the German digital commodities platform Metalshub, with sales starting November 19.

- This move signals Liontown Resources’ entry into online lithium trading, positioning the company to access a wider global buyer base and adapt to evolving market demand.

- We'll explore how Liontown Resources’ adoption of digital lithium auctions could influence its sales strategy and growth outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Liontown Resources Investment Narrative Recap

Becoming a Liontown Resources shareholder means buying into the company’s ability to scale lithium production efficiently at Kathleen Valley, while contending with cost pressures and lithium price volatility. The recent announcement to auction its first major lithium shipment online is a shift in sales approach, and while positive for market access, it does not fundamentally change the near-term catalyst of ramping up underground output or the top risk of high operating costs against uncertain lithium prices.

One recent announcement that stands out is the start of underground production stoping at Kathleen Valley’s Mt Mann orebody, marking Australia’s first underground lithium mine. This is especially relevant as a successful ramp-up is vital for Liontown’s revenue growth and margin improvements, which will ultimately matter more to long-term investors than incremental trading method changes.

However, investors should be aware that if rising costs coincide with any prolonged weakness in lithium prices...

Read the full narrative on Liontown Resources (it's free!)

Liontown Resources' narrative projects A$725.1 million revenue and A$62.7 million earnings by 2028. This requires 93.1% yearly revenue growth and an increase in earnings of A$111.8 million from the current A$-49.1 million.

Uncover how Liontown Resources' forecasts yield a A$0.781 fair value, a 46% downside to its current price.

Exploring Other Perspectives

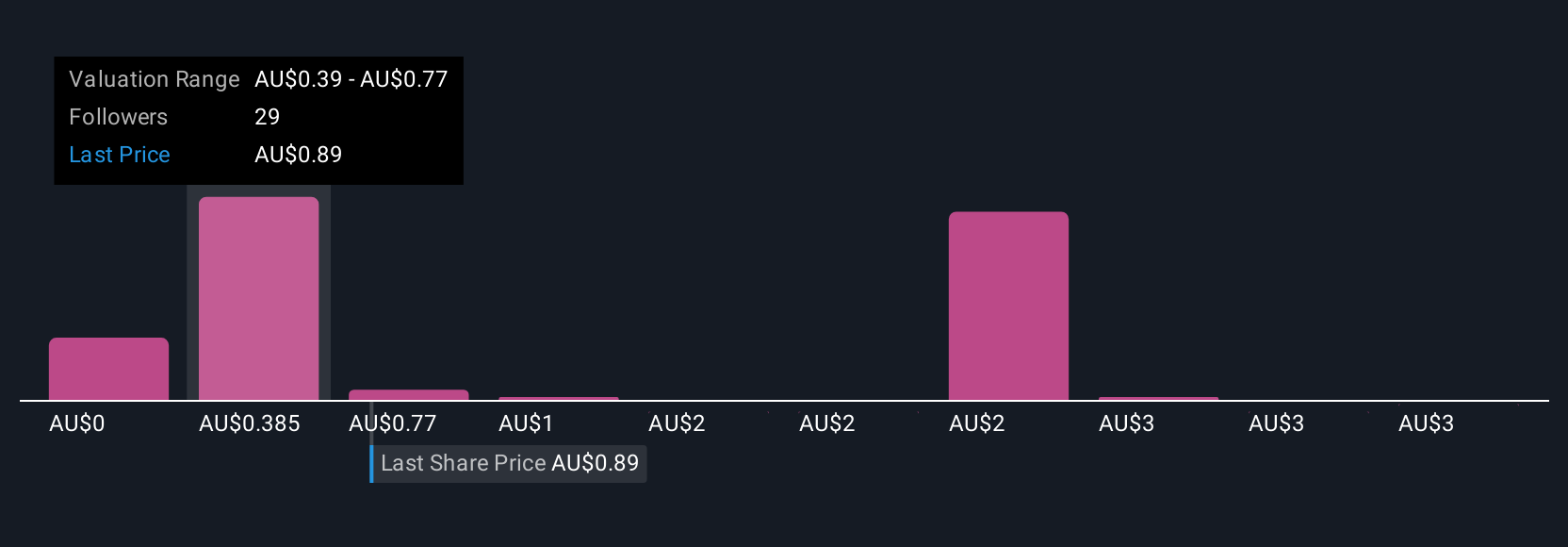

Fifteen members of the Simply Wall St Community set fair value estimates for Liontown Resources ranging from A$0.15 to A$6.64 per share. Many point to operational efficiency gains as a key factor, but there is clear debate about what these improvements could mean for future earnings and risk profile.

Explore 15 other fair value estimates on Liontown Resources - why the stock might be worth over 4x more than the current price!

Build Your Own Liontown Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Liontown Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Liontown Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Liontown Resources' overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LTR

Liontown Resources

Engages in the exploration, evaluation, and development of mineral properties in Australia.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives