As the Australian market faces a slight dip at open, influenced by U.S. economic data and anticipated rate cuts, investors are keeping a close eye on potential opportunities. Penny stocks, despite their somewhat outdated name, continue to attract attention for their affordability and growth potential. These smaller or newer companies can offer surprising value when backed by solid financial foundations; in this article, we explore several penny stocks that stand out for their financial strength and long-term promise.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.495 | A$141.86M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.20 | A$103.78M | ✅ 3 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.87 | A$54.17M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.84 | A$439.14M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.62 | A$267.18M | ✅ 4 ⚠️ 2 View Analysis > |

| Veris (ASX:VRS) | A$0.07 | A$36.24M | ✅ 4 ⚠️ 2 View Analysis > |

| SHAPE Australia (ASX:SHA) | A$4.35 | A$358.2M | ✅ 3 ⚠️ 1 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$4.46 | A$1.09B | ✅ 3 ⚠️ 2 View Analysis > |

| Praemium (ASX:PPS) | A$0.785 | A$375.39M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 441 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Ai-Media Technologies (ASX:AIM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ai-Media Technologies Limited offers technology-driven captioning, transcription, and translation services across several regions including Australia and North America, with a market cap of A$120.07 million.

Operations: The company generates revenue of A$64.86 million from its Internet Software & Services segment.

Market Cap: A$120.07M

Ai-Media Technologies Limited, with a market cap of A$120.07 million, reported A$64.86 million in revenue for the fiscal year ending June 2025. Despite being unprofitable, it has reduced losses over the past five years and maintains a positive cash runway exceeding three years due to growing free cash flow. The company's short-term assets surpass both its short- and long-term liabilities, indicating financial stability despite recent net losses of A$1.67 million. Recent changes include the impending retirement of an independent director, signaling potential shifts in board dynamics as they continue navigating market challenges.

- Take a closer look at Ai-Media Technologies' potential here in our financial health report.

- Evaluate Ai-Media Technologies' prospects by accessing our earnings growth report.

GWA Group (ASX:GWA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: GWA Group Limited researches, designs, manufactures, imports, and markets building fixtures and fittings for residential and commercial premises in Australia, New Zealand, the United Kingdom, and internationally with a market cap of A$686.53 million.

Operations: The company's revenue is primarily derived from its Water Solutions segment, which generated A$418.48 million.

Market Cap: A$686.53M

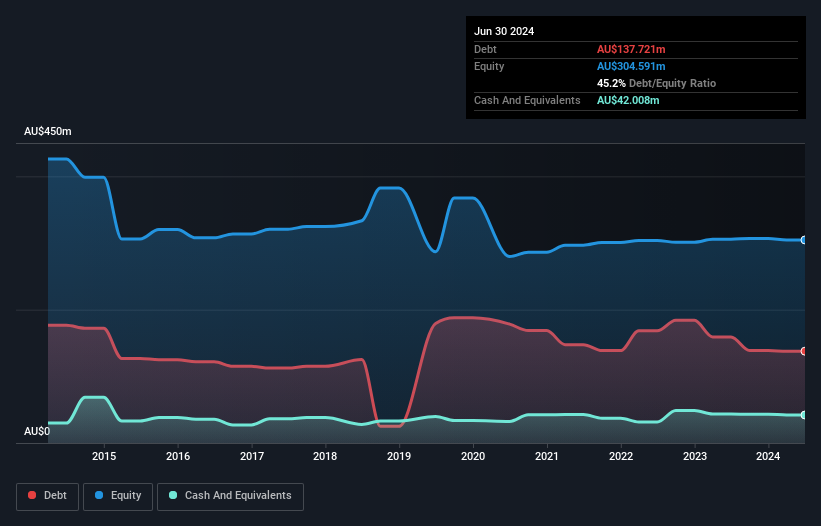

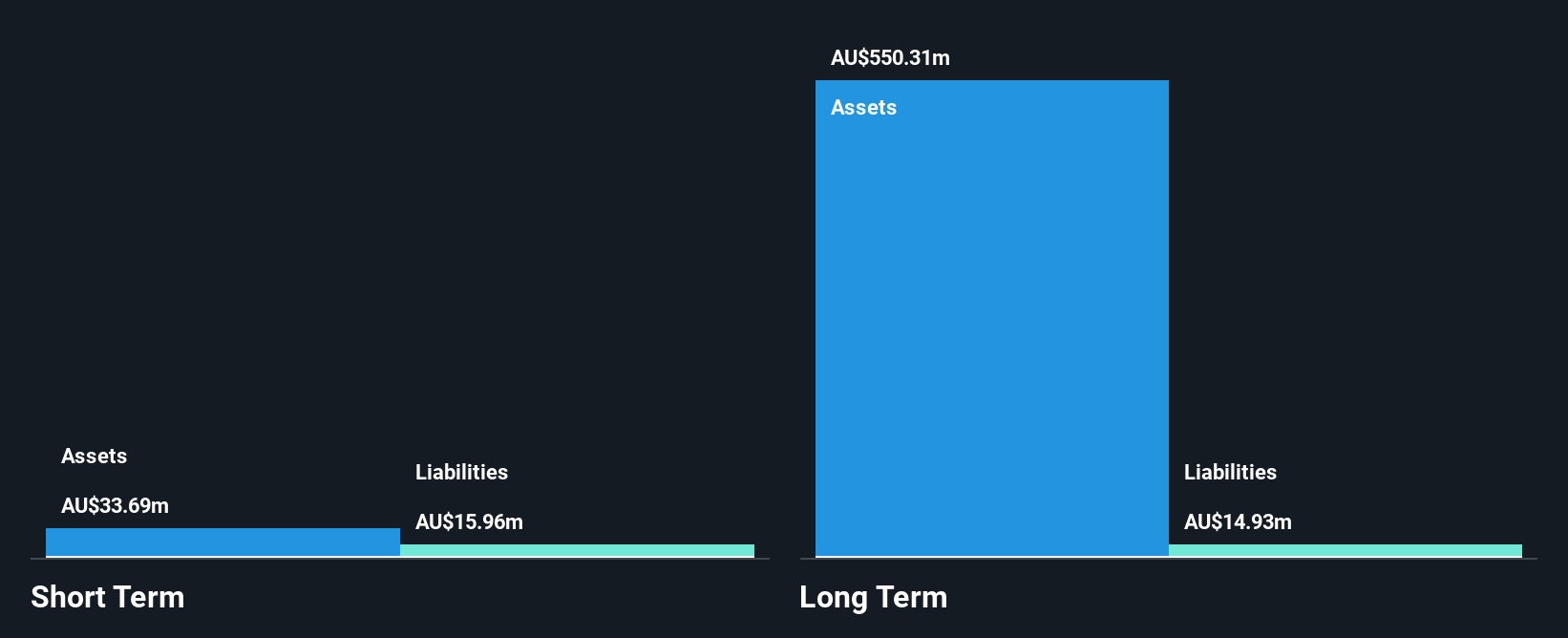

GWA Group Limited, with a market cap of A$686.53 million, has demonstrated stable weekly volatility and experienced earnings growth of 12.3% over the past year, outpacing the building industry's decline. The company reported A$418.48 million in revenue from its Water Solutions segment and net income of A$43.38 million for the fiscal year ending June 2025. GWA's debt to equity ratio has improved over five years, while its interest payments are well covered by EBIT at 9.7x coverage. However, short-term assets do not fully cover long-term liabilities, and dividends are not well covered by earnings despite a buyback plan aimed at capital management.

- Click here to discover the nuances of GWA Group with our detailed analytical financial health report.

- Gain insights into GWA Group's future direction by reviewing our growth report.

Jupiter Mines (ASX:JMS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jupiter Mines Limited is an independent mining company based in Australia, with a market capitalization of A$470.65 million.

Operations: Jupiter Mines generates revenue primarily from its manganese operations in South Africa, totaling A$9.43 million.

Market Cap: A$470.65M

Jupiter Mines Limited, with a market capitalization of A$470.65 million, has shown modest earnings growth of 3.1% over the past year, although it lags behind the broader Metals and Mining industry. The company remains debt-free and maintains a Price-To-Earnings ratio of 11.7x, which is below the Australian market average. Despite stable weekly volatility and no shareholder dilution in the past year, its dividend yield of 6.25% is not well covered by free cash flows. Recent financial results show an increase in sales to A$9.43 million for the fiscal year ending June 2025, alongside a net income rise to A$40.09 million.

- Get an in-depth perspective on Jupiter Mines' performance by reading our balance sheet health report here.

- Gain insights into Jupiter Mines' historical outcomes by reviewing our past performance report.

Make It Happen

- Click this link to deep-dive into the 441 companies within our ASX Penny Stocks screener.

- Contemplating Other Strategies? Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GWA

GWA Group

Research, designs, manufactures, imports, and markets building fixtures and fittings to residential and commercial premises in Australia, New Zealand, the United Kingdom, and internationally.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives