- Australia

- /

- Metals and Mining

- /

- ASX:MEK

ASX Growth Stocks With High Insider Ownership In November 2025

Reviewed by Simply Wall St

As the Australian market navigates a landscape marked by persistent high interest rates and economic uncertainties, investors are increasingly cautious, with sectors like real estate and IT feeling the pressure. In this environment, growth companies with high insider ownership can offer a compelling proposition, as they often signal strong internal confidence and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 12.6% | 88.5% |

| Titomic (ASX:TTT) | 11.2% | 74.9% |

| Polymetals Resources (ASX:POL) | 37.7% | 108% |

| Pointerra (ASX:3DP) | 19.8% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Lunnon Metals (ASX:LM8) | 10.9% | 31.4% |

| IRIS Metals (ASX:IR1) | 21.6% | 144.4% |

| IperionX (ASX:IPX) | 16.9% | 94.9% |

| Echo IQ (ASX:EIQ) | 19.1% | 49.9% |

| Adveritas (ASX:AV1) | 18.4% | 96.8% |

We're going to check out a few of the best picks from our screener tool.

IperionX (ASX:IPX)

Simply Wall St Growth Rating: ★★★★★★

Overview: IperionX Limited focuses on developing mineral properties in the United States and has a market capitalization of A$1.88 billion.

Operations: Revenue segments for IperionX Limited are not specified in the provided text.

Insider Ownership: 16.9%

IperionX is experiencing substantial insider buying, indicating confidence in its growth potential. The company trades significantly below its estimated fair value and forecasts suggest impressive revenue growth of 57% annually, outpacing the market. Despite a current net loss of US$35.35 million, strategic U.S. expansion supported by Department of Defense funding aims to position IperionX as a leading low-cost titanium producer, with profitability expected within three years and high return on equity forecasted at 61%.

- Delve into the full analysis future growth report here for a deeper understanding of IperionX.

- Our valuation report here indicates IperionX may be overvalued.

Meeka Metals (ASX:MEK)

Simply Wall St Growth Rating: ★★★★★★

Overview: Meeka Metals Limited focuses on the exploration and development of gold properties in Western Australia, with a market cap of A$686.75 million.

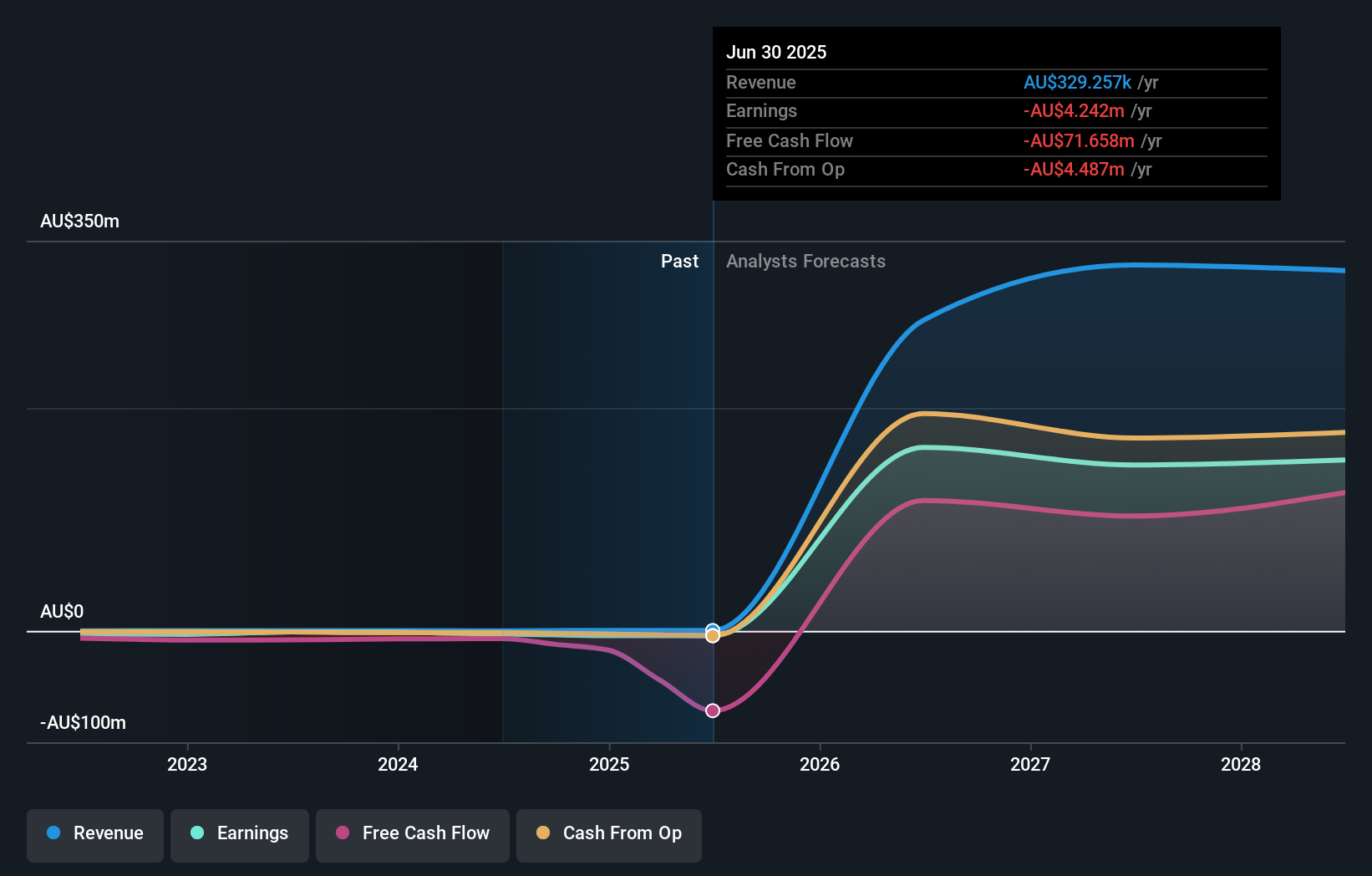

Operations: The company generates revenue primarily from its exploration activities, amounting to A$0.33 million.

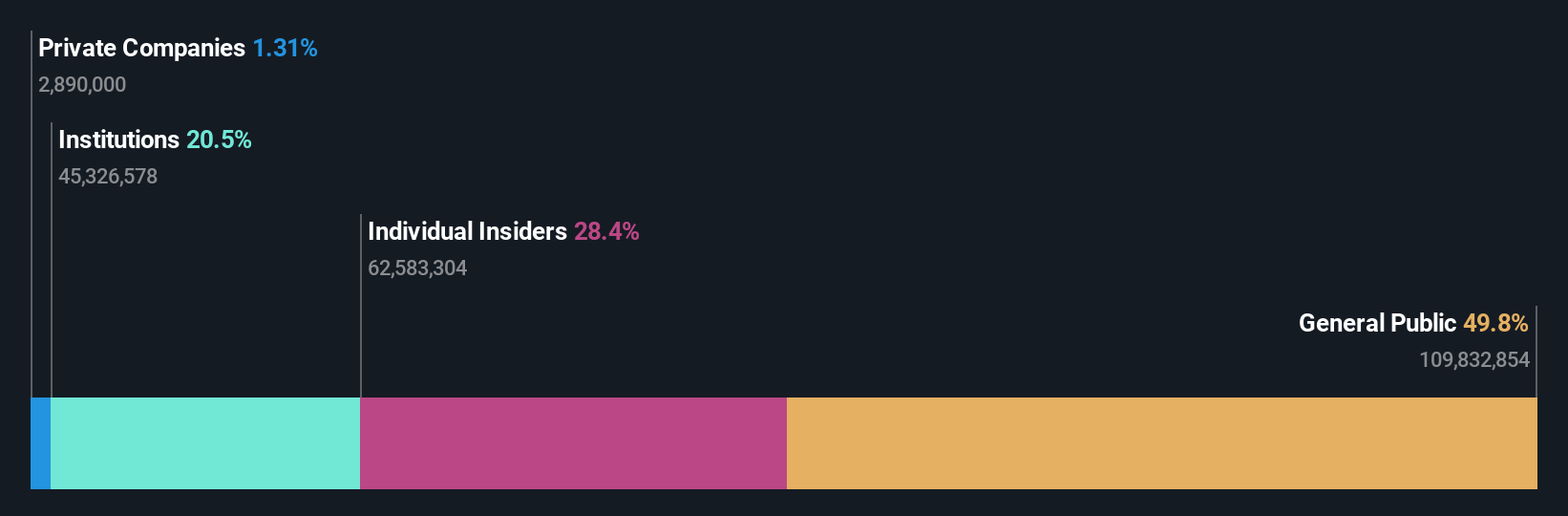

Insider Ownership: 11.9%

Meeka Metals is poised for growth with its revenue projected to increase by 43.7% annually, surpassing market expectations. Despite a net loss of A$4.24 million, the company aims for profitability within three years and anticipates a strong return on equity of 27.4%. Recent leadership changes, including Joe Belladonna's appointment as CFO, bring seasoned expertise in strategic finance and governance, potentially enhancing operational efficiency and supporting Meeka's ambitious growth trajectory.

- Click here and access our complete growth analysis report to understand the dynamics of Meeka Metals.

- Our comprehensive valuation report raises the possibility that Meeka Metals is priced higher than what may be justified by its financials.

Pinnacle Investment Management Group (ASX:PNI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pinnacle Investment Management Group Limited is an Australian investment management company with a market cap of A$3.88 billion.

Operations: Pinnacle Investment Management Group Limited generates revenue primarily through its Funds Management Operations, which amount to A$65.47 million.

Insider Ownership: 26.5%

Pinnacle Investment Management Group shows promising growth potential with its earnings projected to rise 14.2% annually, outpacing the broader Australian market. The company benefits from high insider ownership, with more shares bought than sold recently, indicating confidence in its future prospects. Despite a recent leadership change with Terence Kwong as the new Company Secretary, Pinnacle's revenue is expected to grow 10.8% per year and analysts predict a substantial stock price increase of 42.4%.

- Navigate through the intricacies of Pinnacle Investment Management Group with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Pinnacle Investment Management Group's current price could be inflated.

Turning Ideas Into Actions

- Click this link to deep-dive into the 109 companies within our Fast Growing ASX Companies With High Insider Ownership screener.

- Want To Explore Some Alternatives? We've found 14 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MEK

Meeka Metals

Engages in the exploration and development of gold properties in Western Australia.

Exceptional growth potential with mediocre balance sheet.

Market Insights

Community Narratives