- Australia

- /

- Metals and Mining

- /

- ASX:IGO

Will Dr Guthrie's Board Leadership Mark a Strategic Shift for IGO (ASX:IGO)?

Reviewed by Sasha Jovanovic

- IGO Limited has announced that Dr Vanessa Guthrie AO will join as Non-Executive Director and become incoming Chair of the Board, succeeding Michael Nossal following an orderly transition in early 2026.

- Dr Guthrie’s appointment brings extensive mining sector leadership and board experience, reinforcing IGO’s commitment to board renewal and succession planning.

- We’ll explore how Dr Guthrie’s industry expertise and leadership credentials shape IGO’s long-term investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is IGO's Investment Narrative?

The big picture for IGO hinges on the belief that the company's future will be defined by its ability to transition from current challenges, such as steep recent revenue declines and widening losses, to a position of renewed profitability and sector leadership. The incoming Chair, Dr Vanessa Guthrie, brings deep mining sector credibility and boardroom experience, but her appointment, while positive for signalling stability and long-term governance, does not fundamentally shift short-term catalysts like next year’s production targets or the urgent need to return to profitability. Likewise, I don't see this leadership change materially altering the most pressing risks: a highly inexperienced management team, liquidity concerns evidenced by dividend cuts, and ongoing litigation involving asset disposals. The market’s recent price rally seems more sentiment driven than reflective of any transformation in immediate business fundamentals, but the board renewal initiative hints at a greater emphasis on long-term accountability and succession. However, with analyst forecasts still calling for continued revenue pressure and a challenging road to sustained profitability, most immediate risks and opportunities remain as before, the leadership update is part of a broader strategy story, rather than a direct catalyst.

But while new leadership may signal renewal, key short-term risks still require close attention.

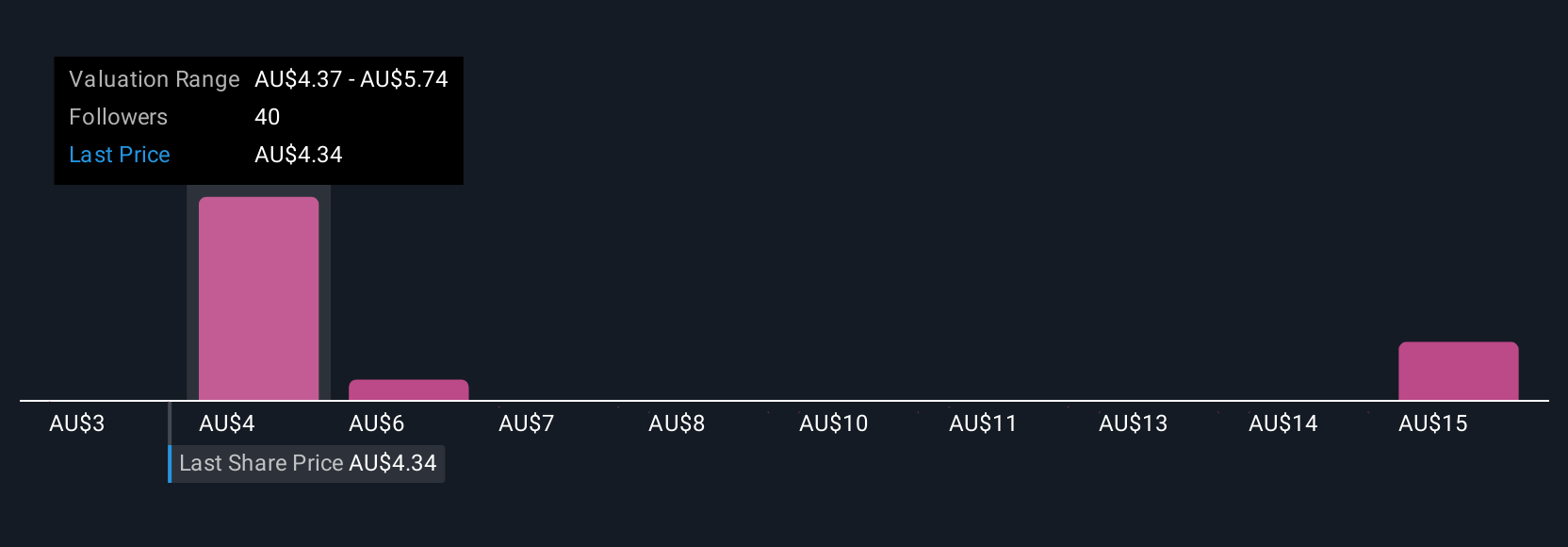

IGO's shares have been on the rise but are still potentially undervalued by 44%. Find out what it's worth.Exploring Other Perspectives

Explore 12 other fair value estimates on IGO - why the stock might be worth over 2x more than the current price!

Build Your Own IGO Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IGO research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free IGO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IGO's overall financial health at a glance.

No Opportunity In IGO?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IGO

IGO

IGO Limited, together with its subsidiaries, discovers, develops, and delivers battery minerals in Australia.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives