- Australia

- /

- Metals and Mining

- /

- ASX:DLI

ASX Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

The Australian market has been experiencing a mixed week, with positive developments overshadowed by concerns over interest rates and sector-specific challenges. Despite these broader market jitters, there remains potential in the realm of penny stocks—an area that continues to attract attention for its ability to uncover hidden value in smaller or newer companies. While the term "penny stock" might seem outdated, these investments can offer surprising opportunities when backed by solid financials and strategic growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.455 | A$130.4M | ✅ 4 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.85 | A$52.93M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.01 | A$462.61M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.63 | A$267.92M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| LaserBond (ASX:LBL) | A$0.50 | A$59.04M | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.28 | A$1.4B | ✅ 3 ⚠️ 1 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.67 | A$247.19M | ✅ 3 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.37 | A$131.64M | ✅ 3 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.42 | A$635.89M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 416 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Delta Lithium (ASX:DLI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Delta Lithium Limited focuses on exploring and developing lithium properties in Western Australia, with a market capitalization of A$147.03 million.

Operations: Currently, Delta Lithium Limited does not report any revenue segments.

Market Cap: A$147.03M

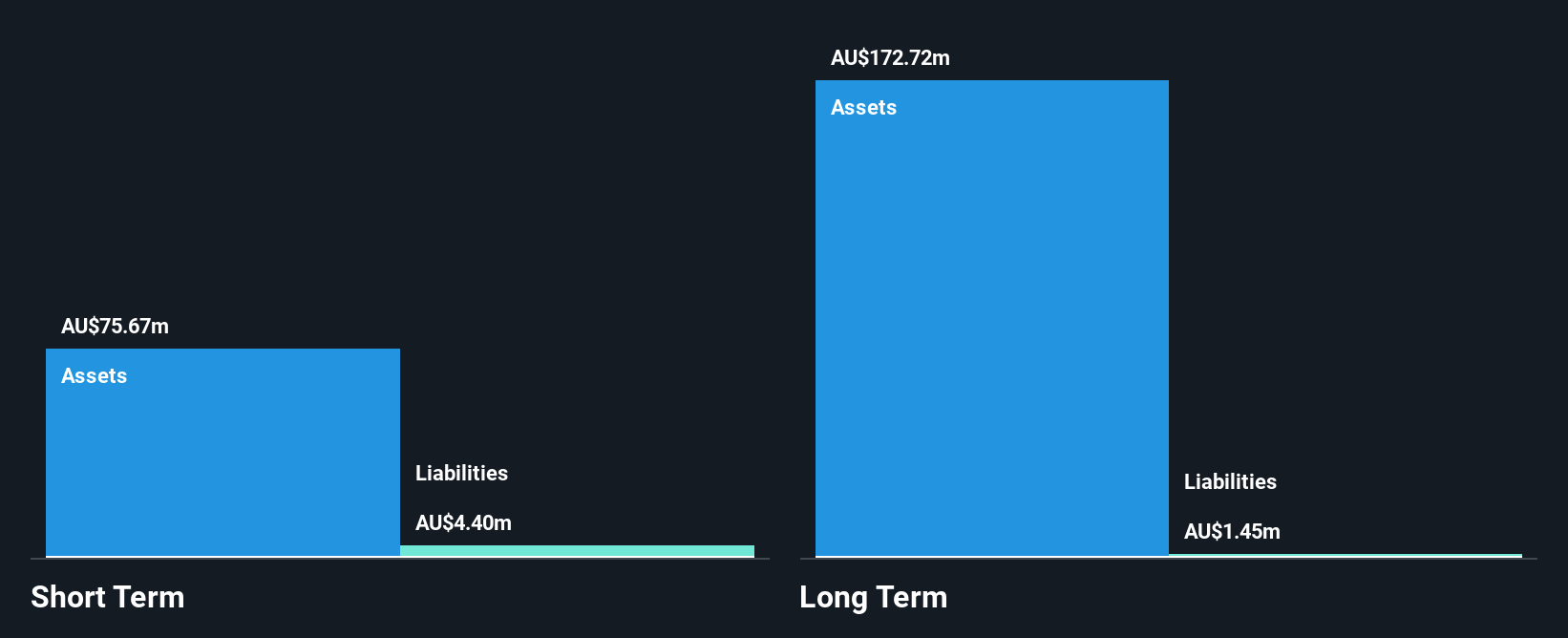

Delta Lithium Limited, with a market capitalization of A$147.03 million, focuses on lithium exploration in Western Australia and remains pre-revenue with minimal earnings of A$1.41 million. The company is debt-free and has a stable cash runway exceeding a year, supported by short-term assets significantly outweighing liabilities. Despite being unprofitable, Delta Lithium's net loss decreased to A$3.68 million from the previous year's A$12.49 million, indicating some cost management improvements. However, its earnings are forecast to decline over the next three years without expected profitability in sight, posing risks typical for penny stocks in this sector.

- Click to explore a detailed breakdown of our findings in Delta Lithium's financial health report.

- Assess Delta Lithium's future earnings estimates with our detailed growth reports.

GreenX Metals (ASX:GRX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GreenX Metals Limited focuses on the exploration and evaluation of mineral properties in Greenland and Germany, with a market cap of A$249.76 million.

Operations: The company's revenue segment is derived entirely from mineral exploration, amounting to A$0.27 million.

Market Cap: A$249.76M

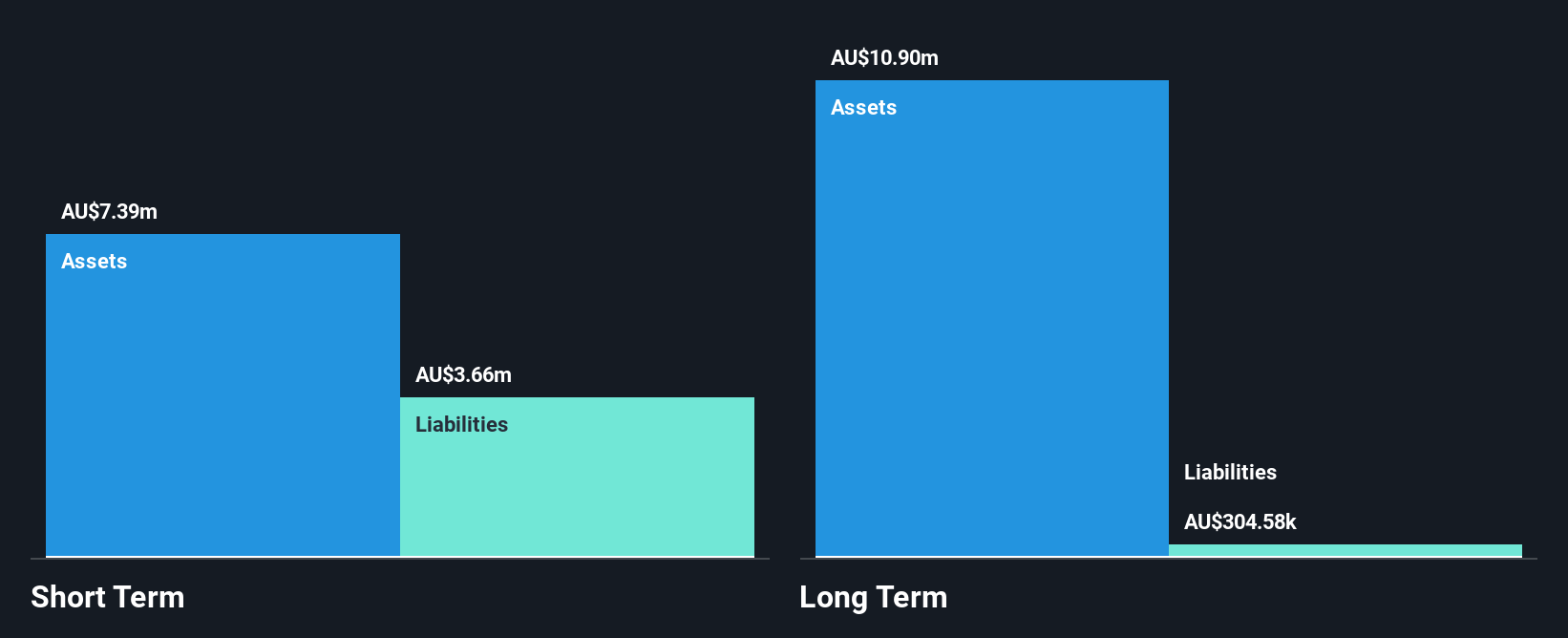

GreenX Metals Limited, with a market cap of A$249.76 million, focuses on mineral exploration in Greenland and Germany and is currently pre-revenue with earnings of A$0.27 million. The company is debt-free and has short-term assets of A$7.4 million exceeding its liabilities, providing a stable cash runway for over a year despite ongoing losses. Recent exploration at the Tannenberg Copper Project revealed historical estimates indicating significant copper reserves, which could enhance its geological prospects. However, GreenX remains unprofitable with declining earnings over five years, reflecting typical risks associated with penny stocks in this industry segment.

- Jump into the full analysis health report here for a deeper understanding of GreenX Metals.

- Understand GreenX Metals' track record by examining our performance history report.

Metals X (ASX:MLX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Metals X Limited is an Australian company focused on the production of tin, with a market capitalization of A$788.89 million.

Operations: The company generates revenue from its 50% interest in the Renison Tin Operation, amounting to A$271.38 million.

Market Cap: A$788.89M

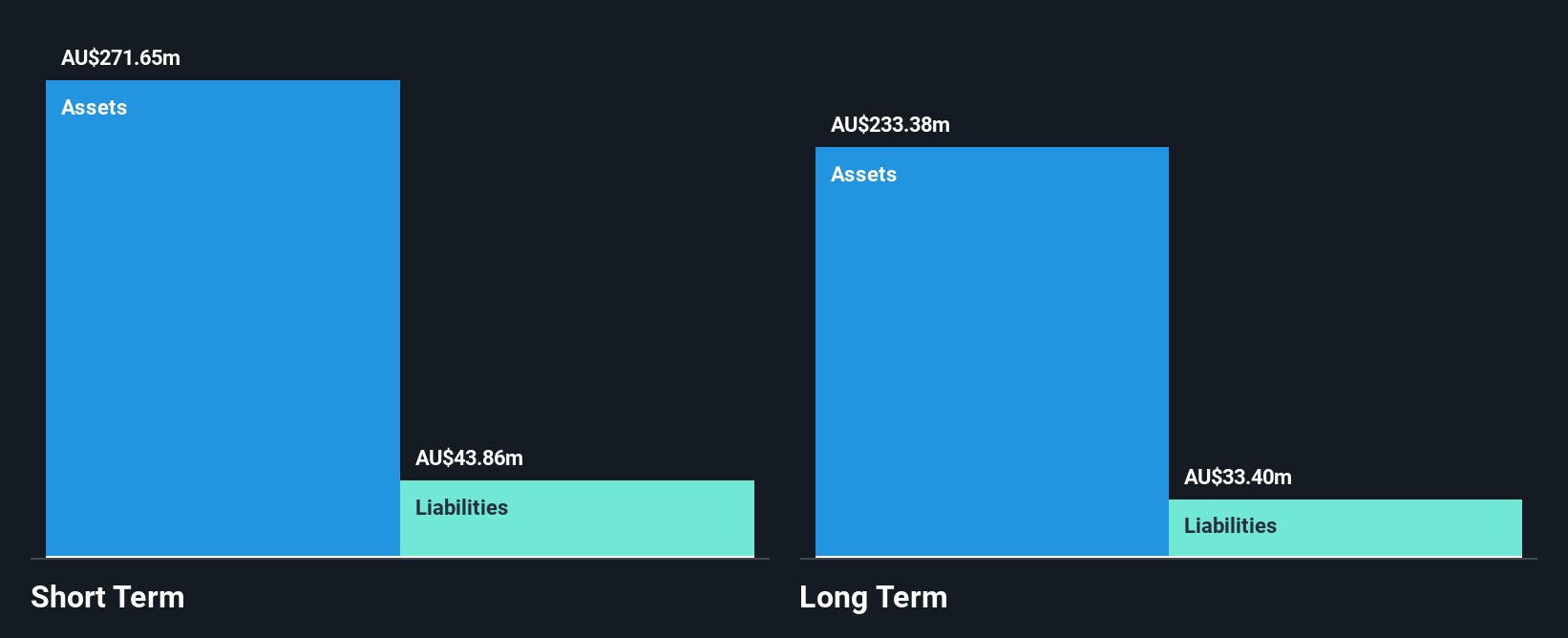

Metals X Limited, with a market cap of A$788.89 million, has demonstrated strong financial performance in recent periods. The company reported significant earnings growth of 708.2% over the past year, driven by its 50% stake in the Renison Tin Operation, which generated A$271.38 million in revenue for the year ending June 30, 2025. Despite this growth being influenced by a one-off gain of A$38.4 million, Metals X remains debt-free and exhibits high return on equity at 29.2%. Its price-to-earnings ratio stands at 5.6x, indicating good value relative to peers and the broader market.

- Unlock comprehensive insights into our analysis of Metals X stock in this financial health report.

- Learn about Metals X's future growth trajectory here.

Make It Happen

- Navigate through the entire inventory of 416 ASX Penny Stocks here.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DLI

Delta Lithium

Explores for and develops lithium properties in Western Australia.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives