- Australia

- /

- Metals and Mining

- /

- ASX:EMR

3 ASX Growth Stocks With High Insider Ownership And Up To 61% Revenue Growth

Reviewed by Simply Wall St

As the Australian market remains rangebound, with the XJO struggling to break past the 9,000-point mark since late October, investors are keeping a close eye on sectors like energy and materials which have recently led gains. In this environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong management confidence and alignment of interests with shareholders.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 10.4% | 96.4% |

| Titomic (ASX:TTT) | 11.2% | 74.9% |

| Pure Hydrogen (ASX:PH2) | 10.4% | 114.6% |

| Polymetals Resources (ASX:POL) | 37.7% | 108% |

| Pointerra (ASX:3DP) | 19.8% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| IRIS Metals (ASX:IR1) | 26% | 144.4% |

| IperionX (ASX:IPX) | 16.9% | 94.9% |

| Echo IQ (ASX:EIQ) | 19% | 51.4% |

| Adveritas (ASX:AV1) | 18.4% | 96.8% |

Let's review some notable picks from our screened stocks.

Emerald Resources (ASX:EMR)

Simply Wall St Growth Rating: ★★★★★★

Overview: Emerald Resources NL is involved in the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$3.55 billion.

Operations: The company's revenue is primarily derived from mine operations, totaling A$430.41 million.

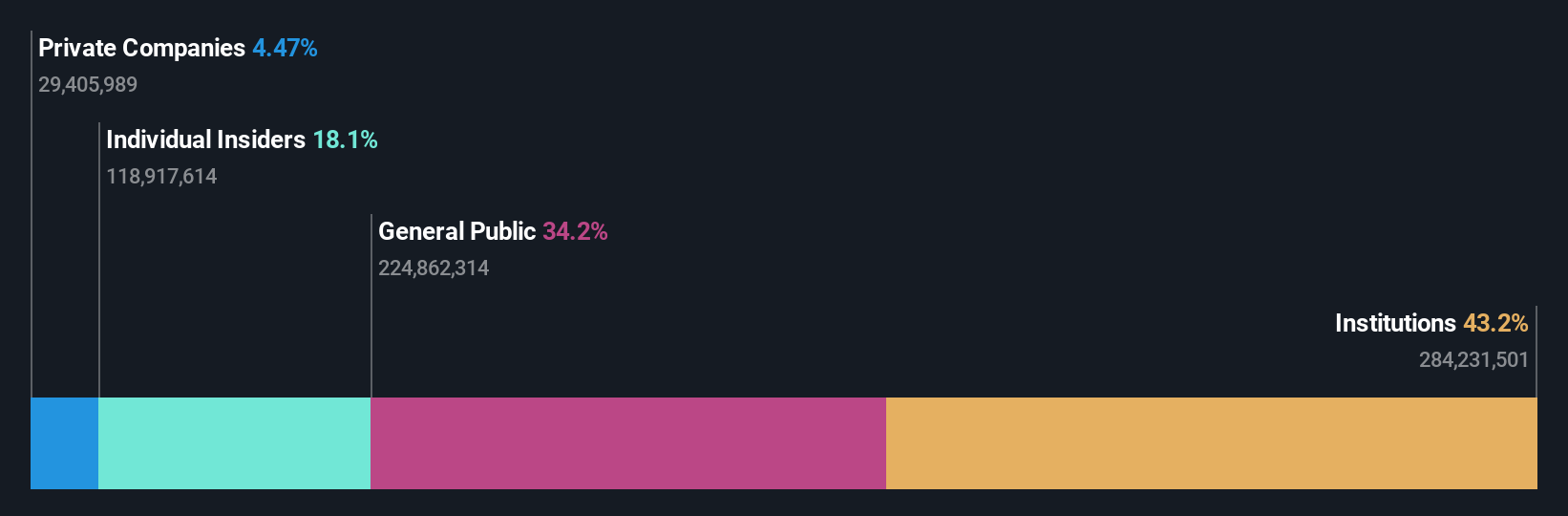

Insider Ownership: 18.4%

Revenue Growth Forecast: 44.4% p.a.

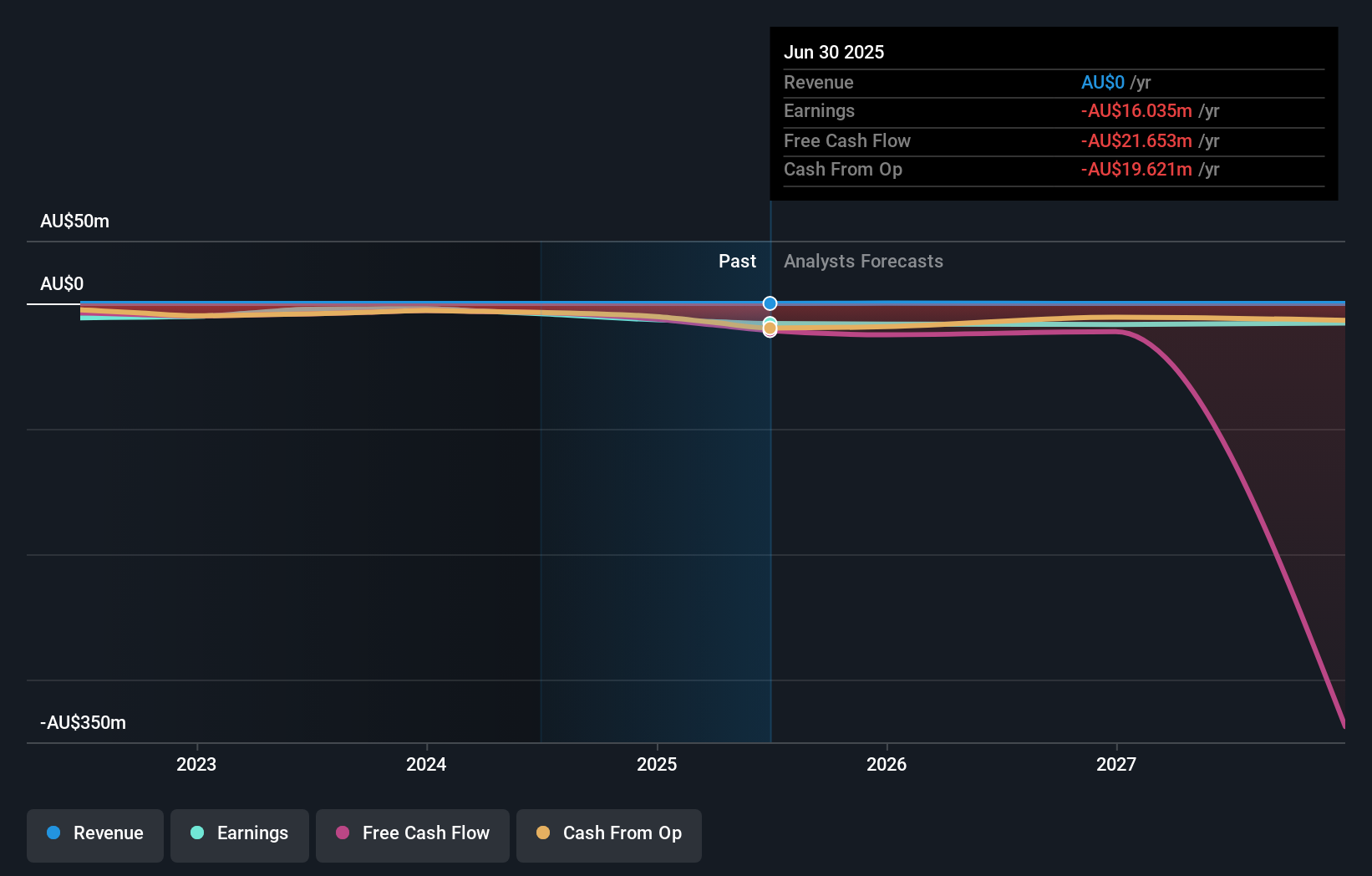

Emerald Resources, with substantial insider ownership, is positioned for significant growth. Despite recent production challenges at its Okvau Gold Mine due to weather conditions, the company reaffirmed its 2026 guidance. Revenue and earnings are forecasted to grow significantly faster than the Australian market average, with revenue expected to increase by 44.4% annually and earnings by 57.2%. Trading well below estimated fair value suggests potential upside if forecasts are realized.

- Dive into the specifics of Emerald Resources here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential undervaluation of Emerald Resources shares in the market.

Regal Partners (ASX:RPL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Regal Partners Limited is a privately owned hedge fund sponsor with a market cap of A$1.10 billion.

Operations: The company's revenue is primarily derived from the provision of investment management services, amounting to A$245.45 million.

Insider Ownership: 23.8%

Revenue Growth Forecast: 15.9% p.a.

Regal Partners, with significant insider ownership, is poised for growth despite recent challenges. The company is trading 39.3% below its estimated fair value and has been added to the S&P/ASX Small Ordinaries and 300 Indexes. Although profit margins have declined from last year, earnings are forecasted to grow at 31.51% annually, outpacing the Australian market average. However, recent significant insider selling may raise concerns about future prospects.

- Take a closer look at Regal Partners' potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Regal Partners is trading behind its estimated value.

Turaco Gold (ASX:TCG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Turaco Gold Limited is involved in the exploration of gold deposits in Côte d'Ivoire and has a market capitalization of A$610.61 million.

Operations: Turaco Gold Limited focuses on the exploration of gold deposits in Côte d'Ivoire, with its activities centered around mineral exploration.

Insider Ownership: 17.6%

Revenue Growth Forecast: 62% p.a.

Turaco Gold, experiencing substantial insider buying recently, is forecasted for significant growth with revenue expected to rise 62% annually, outpacing the Australian market. Despite a current net loss of A$8.87 million and past shareholder dilution, Turaco's potential profitability within three years is promising. The company trades significantly below its estimated fair value and was recently added to the S&P Global BMI Index, indicating increased visibility in global markets.

- Click to explore a detailed breakdown of our findings in Turaco Gold's earnings growth report.

- Upon reviewing our latest valuation report, Turaco Gold's share price might be too pessimistic.

Summing It All Up

- Click here to access our complete index of 110 Fast Growing ASX Companies With High Insider Ownership.

- Seeking Other Investments? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Emerald Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EMR

Emerald Resources

Engages in the exploration and development of mineral reserves in Cambodia and Australia.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026