- Australia

- /

- Metals and Mining

- /

- ASX:DVP

3 ASX Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

As the ASX 200 hits a new 20-day low, driven by global trade tensions and sector-wide declines, investors are navigating a challenging landscape with particular focus on sectors like Utilities and Health Care that have shown resilience. In such fluctuating market conditions, growth companies with high insider ownership can be appealing as they often indicate strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Medallion Metals (ASX:MM8) | 13.8% | 67.5% |

| Acrux (ASX:ACR) | 15.5% | 91.8% |

| Alfabs Australia (ASX:AAL) | 10.8% | 40.7% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| AVA Risk Group (ASX:AVA) | 15.8% | 77.3% |

| Pointerra (ASX:3DP) | 23.8% | 126.4% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Findi (ASX:FND) | 35.8% | 133.7% |

Let's dive into some prime choices out of the screener.

Aussie Broadband (ASX:ABB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aussie Broadband Limited is an Australian company offering telecommunications and technology services, with a market cap of A$1.18 billion.

Operations: The company generates revenue through several segments: Business (A$96.97 million), Wholesale (A$159.73 million), Residential (A$585.07 million), Symbio Group (A$69.93 million), and Enterprise and Government (A$88.04 million).

Insider Ownership: 11.1%

Earnings Growth Forecast: 22.4% p.a.

Aussie Broadband exhibits strong growth potential with earnings forecasted to grow significantly at 22.4% annually, outpacing the Australian market. Despite a slower revenue growth rate of 8.9%, it surpasses the market average and reflects robust business expansion. Insider ownership remains high, with co-founder Phillip Britt transitioning to a Non-executive Director role while maintaining substantial shareholding and advisory influence. Recent earnings showed solid performance, complemented by strategic initiatives like a share buyback program aimed at optimizing capital structure.

- Click here and access our complete growth analysis report to understand the dynamics of Aussie Broadband.

- Upon reviewing our latest valuation report, Aussie Broadband's share price might be too pessimistic.

Clinuvel Pharmaceuticals (ASX:CUV)

Simply Wall St Growth Rating: ★★★★★★

Overview: Clinuvel Pharmaceuticals Limited is a biopharmaceutical company that develops and commercializes treatments for genetic, metabolic, systemic, and life-threatening disorders across Australia, Europe, the United States, Switzerland, and internationally with a market cap of A$558.41 million.

Operations: The company generates revenue of A$88.18 million from its biopharmaceutical sector, focusing on treatments for various disorders globally.

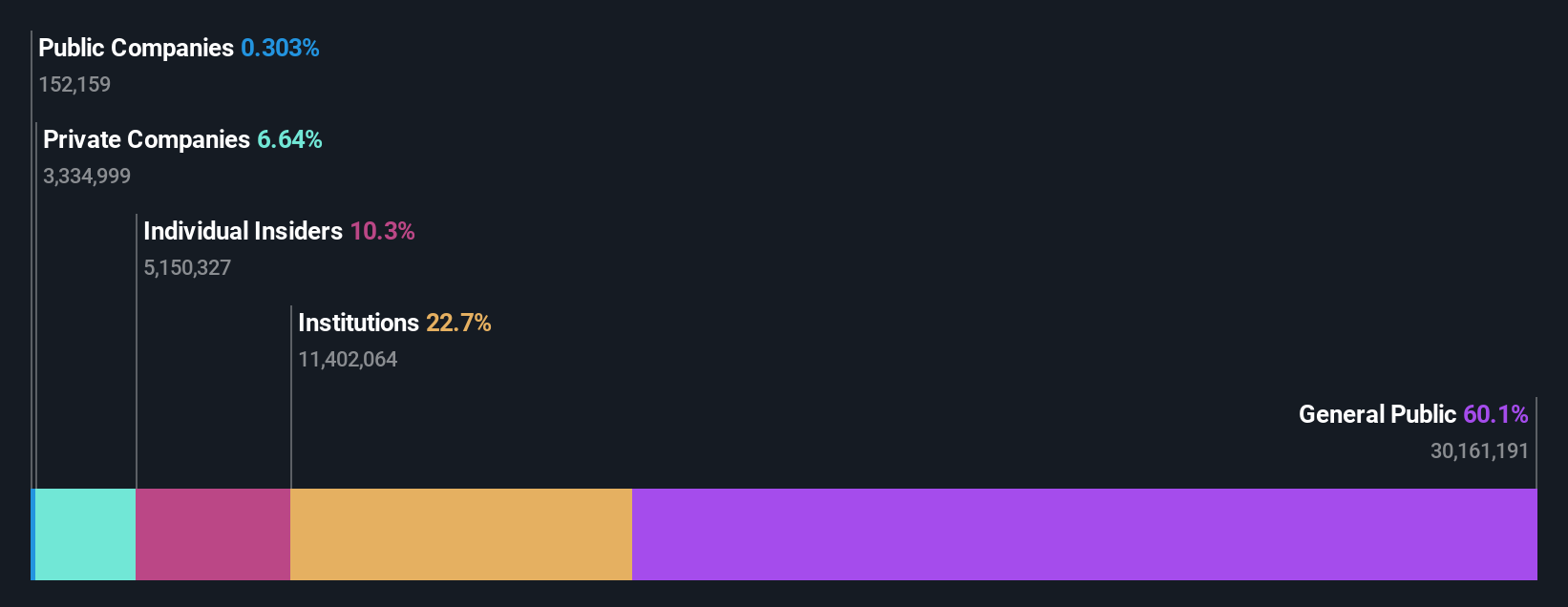

Insider Ownership: 10.4%

Earnings Growth Forecast: 26.2% p.a.

Clinuvel Pharmaceuticals is poised for significant growth, with earnings projected to rise 26.2% annually, outstripping the Australian market's pace. Insider ownership remains substantial, indicating strong internal confidence. The company trades at a notable discount to its estimated fair value and peers. Recent strategic shifts focus on expanding SCENESSE® therapy applications and launching the PhotoCosmetics line, including CYACELLE Radiant in 2025, enhancing market penetration amid challenging conditions while prioritizing high-impact projects for accelerated development.

- Unlock comprehensive insights into our analysis of Clinuvel Pharmaceuticals stock in this growth report.

- Our valuation report unveils the possibility Clinuvel Pharmaceuticals' shares may be trading at a discount.

Develop Global (ASX:DVP)

Simply Wall St Growth Rating: ★★★★★★

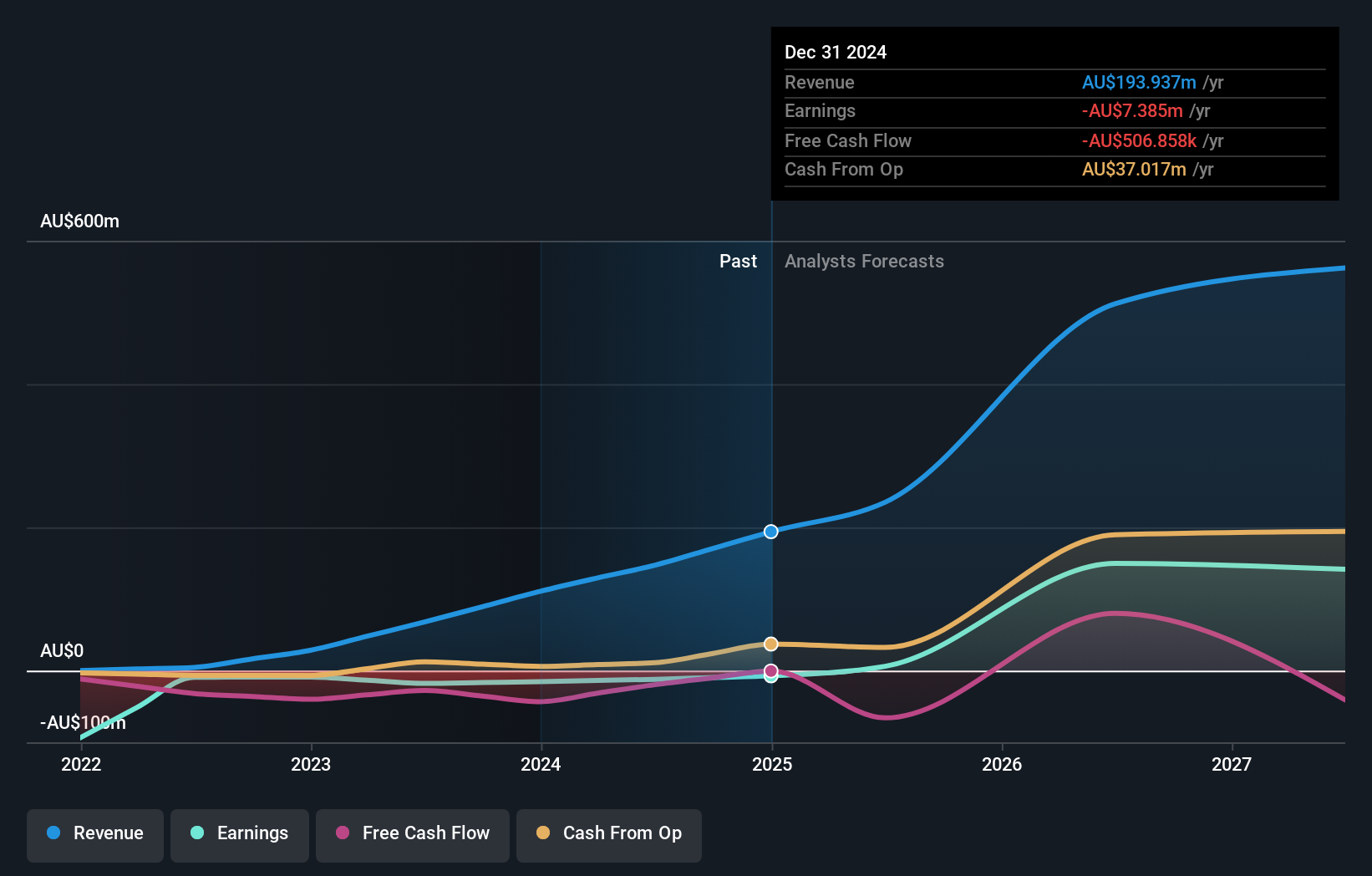

Overview: Develop Global Limited, with a market cap of A$784.94 million, is involved in the exploration and development of mineral resource properties in Australia through its subsidiaries.

Operations: The company's revenue is primarily derived from its mining services segment, which generated A$147.23 million.

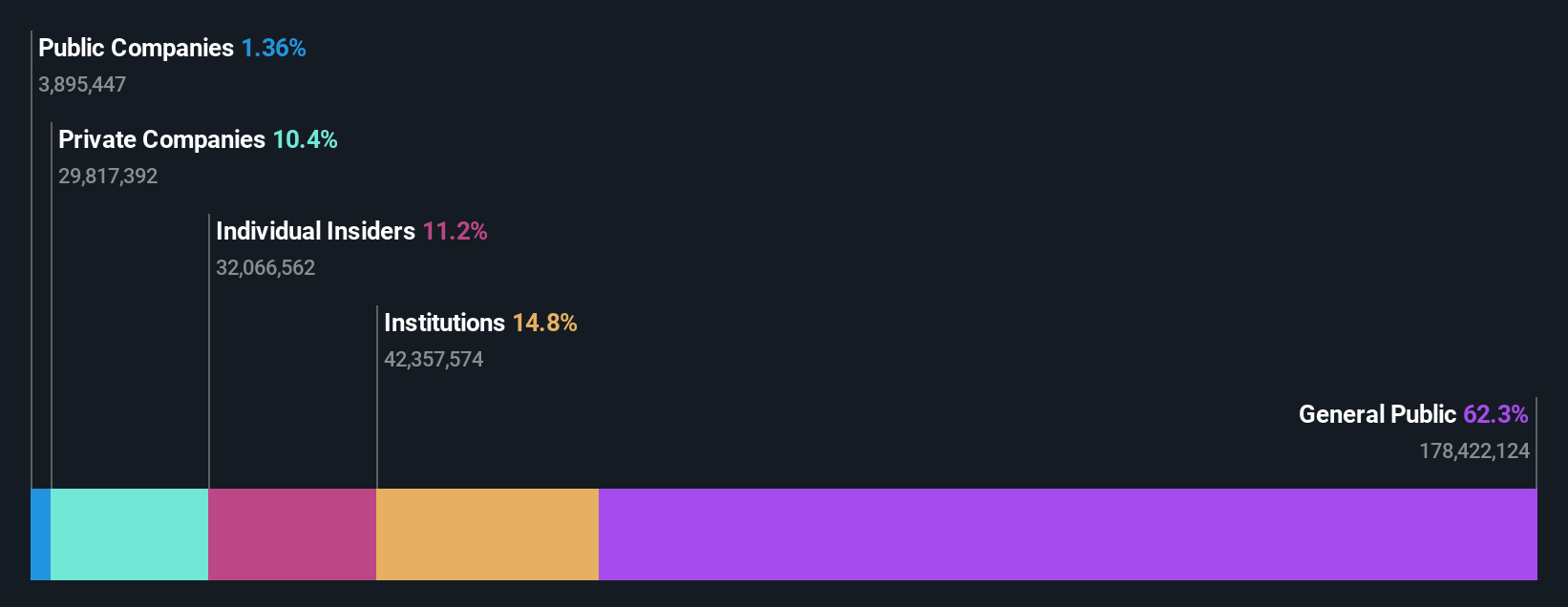

Insider Ownership: 20.4%

Earnings Growth Forecast: 93.1% p.a.

Develop Global is positioned for robust growth, with revenue anticipated to surge 57.5% annually, significantly outpacing the Australian market. The company is forecasted to achieve profitability within three years, reflecting above-average market growth expectations. Insider ownership suggests strong internal confidence, and the stock offers good value relative to peers. Recent presentations by Managing Director Bill Beament highlight strategic initiatives that may further bolster Develop Global's competitive stance in the industry.

- Take a closer look at Develop Global's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Develop Global is trading behind its estimated value.

Next Steps

- Delve into our full catalog of 100 Fast Growing ASX Companies With High Insider Ownership here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DVP

Develop Global

Engages in the exploration and development of mineral resource properties in Australia.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives