- United Kingdom

- /

- Diversified Financial

- /

- LSE:PAY

Exploring 3 Top Undervalued Small Caps In Global With Insider Activity

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a notable upswing, with small-cap stocks outperforming their larger counterparts as the Russell 2000 Index surged by 5.52%. This positive momentum comes amid dovish signals from the Federal Reserve and mixed economic indicators, such as declining consumer confidence and lower-than-expected retail sales growth. In this environment, identifying small-cap stocks with strong fundamentals and potential for growth can be particularly appealing to investors seeking opportunities in undervalued segments of the market.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Russel Metals | 13.7x | 0.5x | 33.43% | ★★★★★★ |

| Norcros | 13.3x | 0.7x | 44.14% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 33.20% | ★★★★★☆ |

| Senior | 23.9x | 0.8x | 30.09% | ★★★★★☆ |

| Eurocell | 16.2x | 0.3x | 40.75% | ★★★★☆☆ |

| Chinasoft International | 21.9x | 0.7x | -1211.16% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.57% | ★★★★☆☆ |

| Ever Sunshine Services Group | 6.6x | 0.4x | -440.01% | ★★★☆☆☆ |

| PSC | 9.9x | 0.4x | 18.94% | ★★★☆☆☆ |

| CVS Group | 46.2x | 1.3x | 26.00% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

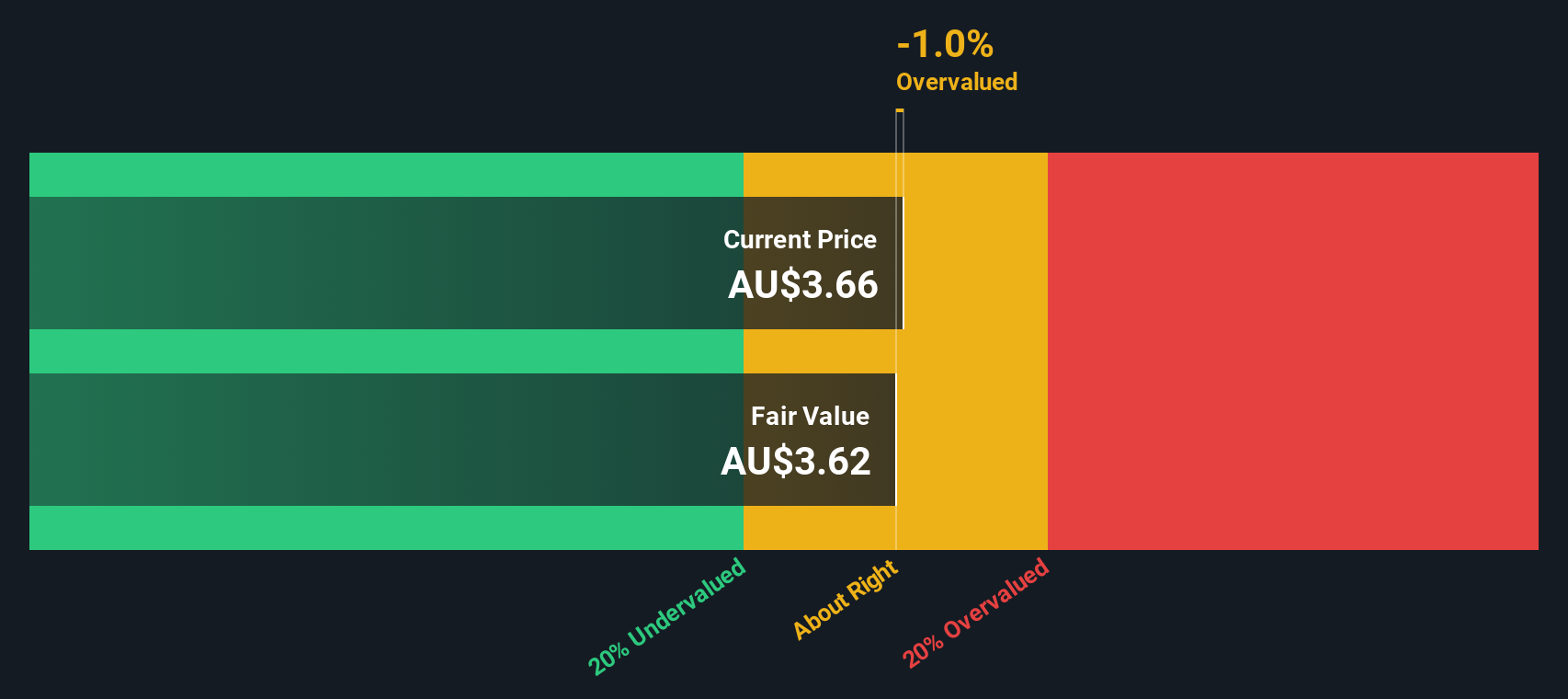

Deterra Royalties (ASX:DRR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Deterra Royalties is a company focused on managing and acquiring royalty assets, with a market cap of approximately A$2.26 billion.

Operations: The company's primary revenue streams are derived from bulk commodities, with a smaller contribution from precious resources. Over recent periods, the gross profit margin has shown a decreasing trend, moving from 97.12% in June 2022 to 95.40% by December 2025. Operating expenses have increased notably over time, impacting overall profitability despite robust revenue figures.

PE: 13.7x

Deterra Royalties, a company with international reach in the mining sector, is currently navigating executive transitions as its founding CEO steps down. Despite high debt levels and reliance on external borrowing, insider confidence is evident with recent share purchases. The company's upcoming earnings release on December 2 could provide further insights into its financial health. With revenue and earnings expected to decline by 5.6% annually over the next three years, potential investors should weigh these factors carefully.

- Delve into the full analysis valuation report here for a deeper understanding of Deterra Royalties.

Understand Deterra Royalties' track record by examining our Past report.

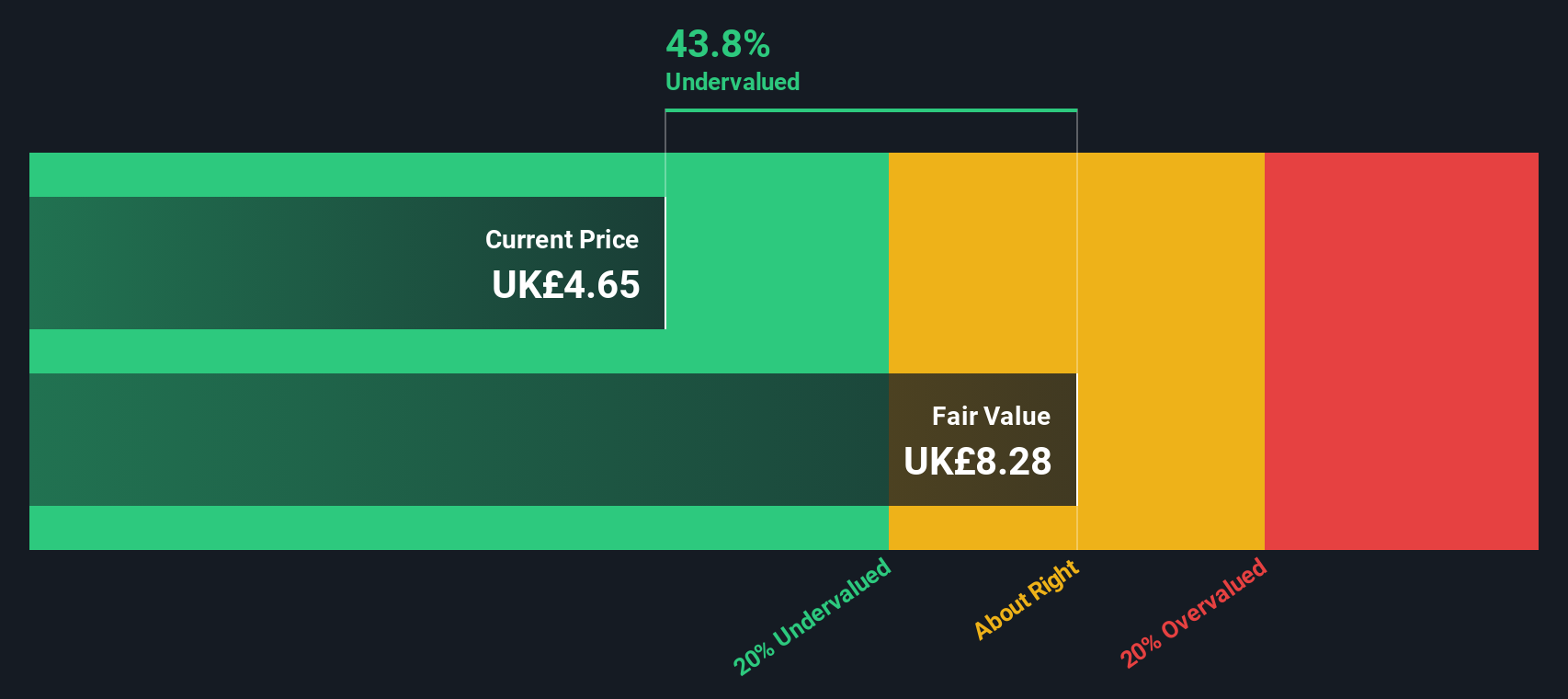

PayPoint (LSE:PAY)

Simply Wall St Value Rating: ★★★★☆☆

Overview: PayPoint is a company that provides payment services and solutions, including bill payments and retail services, with a market capitalization of approximately £0.5 billion.

Operations: The company generates revenue primarily from its Love2shop and Pay Point segments. Over the periods analyzed, the net income margin has shown variability, peaking at 28.72% in September 2017 and declining to 5.30% by September 2025. Operating expenses, largely driven by general and administrative costs, have consistently impacted profitability across these periods.

PE: 18.8x

PayPoint, a smaller stock, shows potential despite challenges. Recent earnings reveal increased sales at £133.02 million for H1 2025, up from £121.73 million the previous year, though net income dipped to £14.59 million from £17.31 million. The company declared an interim dividend increase to 19.8 pence per share and announced a special dividend of 50 pence following a strategic investment in Collect+. Insider confidence is evident with recent share purchases indicating belief in future growth prospects amidst volatile share prices and high debt levels.

- Dive into the specifics of PayPoint here with our thorough valuation report.

Gain insights into PayPoint's past trends and performance with our Past report.

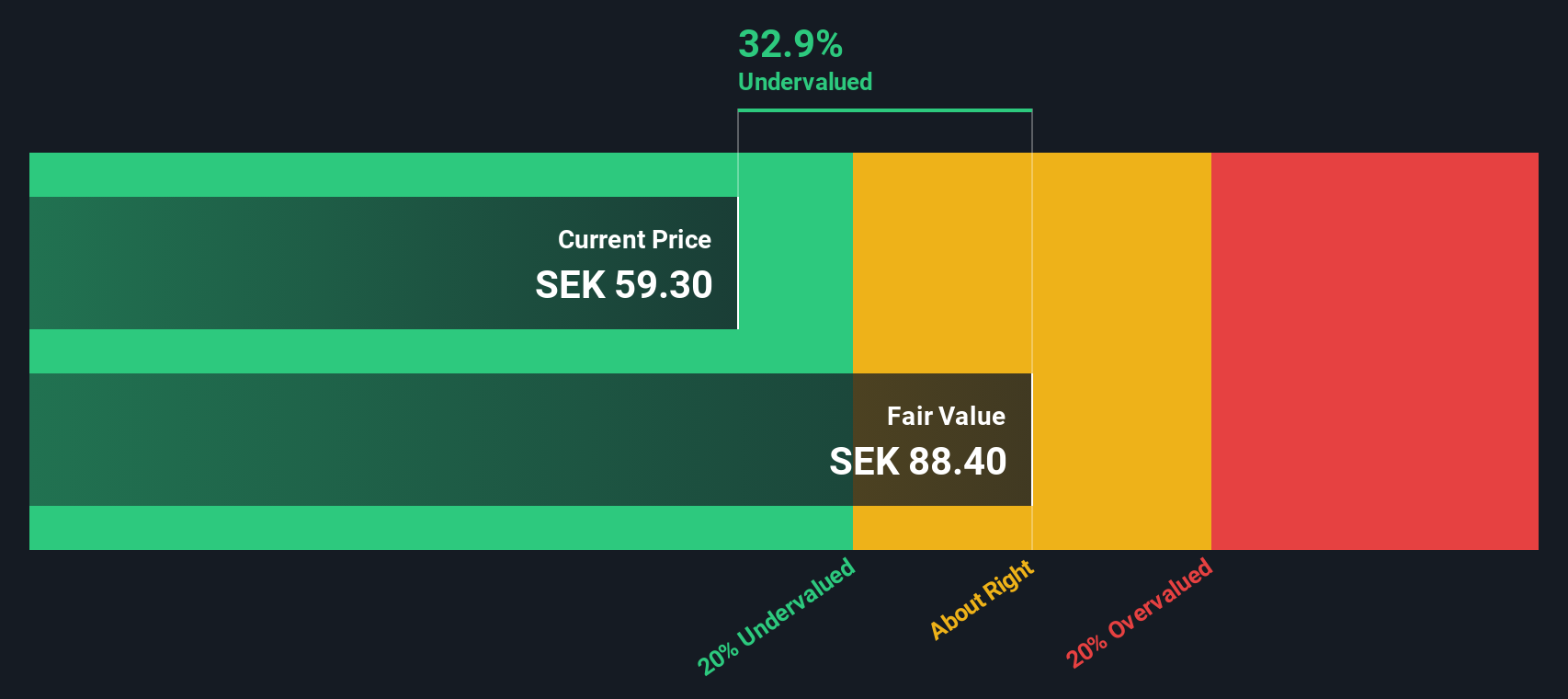

Nolato (OM:NOLA B)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Nolato is a Swedish company specializing in developing and manufacturing polymer product systems for the medical, automotive, and consumer electronics industries with a market cap of approximately SEK 9.34 billion.

Operations: Medical Solutions contributes SEK 5.42 billion and Engineered Solutions SEK 4.17 billion to the company's revenue, with a gross profit margin of 17.85% as of September 2025. Operating expenses include significant allocations for sales and marketing, as well as general and administrative activities, impacting overall profitability.

PE: 20.9x

Nolato's recent earnings report for Q3 2025 showed a rise in net income to SEK 215 million from SEK 164 million the previous year, with basic earnings per share increasing to SEK 0.8. The company's sales slightly dipped but remain substantial at SEK 2,342 million. Insider confidence is evident as the independent chairman purchased shares worth approximately US$270,900, boosting their holdings by over 26%. Despite relying entirely on external borrowing for funding, Nolato's projected annual earnings growth of over 10% suggests potential value in this small company.

- Navigate through the intricacies of Nolato with our comprehensive valuation report here.

Evaluate Nolato's historical performance by accessing our past performance report.

Where To Now?

- Discover the full array of 141 Undervalued Global Small Caps With Insider Buying right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PAY

PayPoint

Engages in the provision of payments and banking, shopping, and e-commerce services and products in the United Kingdom.

Moderate risk and good value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026