- Australia

- /

- Metals and Mining

- /

- ASX:DRR

Did Deterra Royalties' (ASX:DRR) CEO Transition Reset Its Leadership Vision for Investors?

Reviewed by Sasha Jovanovic

- Deterra Royalties Limited recently announced that its founding Managing Director and CEO, Julian Andrews, will step down for personal reasons by the end of 2025, with Non-executive Director Jason Neal appointed as interim CEO while the executive search is underway.

- This leadership change comes as Deterra prepares for a key investor conference presentation, underscoring a period of transition at the top of Australia's leading mining royalty enterprise with global operations.

- We'll explore how the CEO transition, featuring an interim leader with deep industry experience, may influence Deterra's investment outlook.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Deterra Royalties Investment Narrative Recap

At its core, being a Deterra Royalties shareholder means believing in the company’s ability to deliver strong, diversified royalty streams, anchored by Mining Area C, while maintaining a disciplined focus on capital allocation and asset expansion. The recent CEO transition is unlikely to significantly affect near-term catalysts such as commodity price movements or the immediate operational risk profile, though leadership stability always merits close attention when execution and integration remain key themes.

Among recent announcements, Deterra’s full-year earnings in August 2025 reflected continued resilience, with net income holding steady despite lower dividends. This provides context for investors assessing how management transitions could impact ongoing dividend sustainability, which is particularly relevant as short-term earnings now lean more on iron ore price cycles than production growth. However, any change at the top adds complexity just as the company works to manage...

Read the full narrative on Deterra Royalties (it's free!)

Deterra Royalties is forecast to generate A$235.1 million in revenue and A$140.1 million in earnings by 2028. This outlook reflects an annual revenue decline of 3.7% and a decrease in earnings of A$15.6 million from the current A$155.7 million.

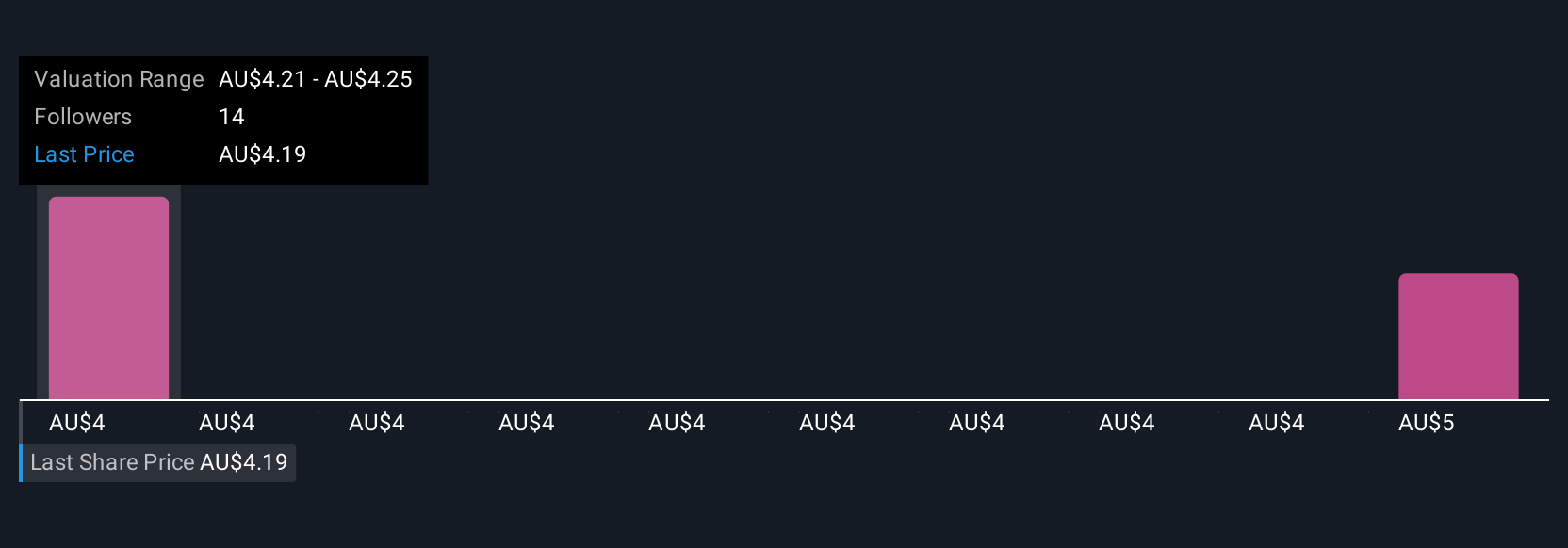

Uncover how Deterra Royalties' forecasts yield a A$4.28 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Community-sourced fair value estimates for Deterra Royalties range from A$4.09 to A$4.28, with two individual Simply Wall St Community perspectives featured. With overall earnings forecast to decline, understanding these differences is essential for evaluating the company's possible performance.

Explore 2 other fair value estimates on Deterra Royalties - why the stock might be worth as much as 8% more than the current price!

Build Your Own Deterra Royalties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Deterra Royalties research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Deterra Royalties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Deterra Royalties' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DRR

Deterra Royalties

Operates as a royalty investment company in Australia, the United States, Mexico, Zambia, Peru, Canada, Mali, Kenya, Brazil, Cote D’Ivoire, and South Africa.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives