- Australia

- /

- Metals and Mining

- /

- ASX:CYL

Catalyst Metals (ASX:CYL): Evaluating Valuation During Renewed Momentum in ASX Mining Stocks

Reviewed by Simply Wall St

Catalyst Metals (ASX:CYL) is getting extra attention lately as investors focus on Australia’s mining sector. This uptick comes amid favorable exploration results, steady operations, and renewed confidence in ASX-listed mining companies.

See our latest analysis for Catalyst Metals.

Catalyst Metals’ share price has pulled back 15.8% over the past month after an exceptional run, but momentum is far from lost. Its year-to-date price return stands at an impressive 161.2%, and the three-year total shareholder return is a huge 485.3%. The recent volatility is par for the course with exploration-driven mining stocks, and it follows on the back of sector-wide optimism rather than any single news event for the company. Overall, both short- and long-term performance reflect building momentum as confidence in the sector grows.

If this kind of momentum makes you curious about other standout opportunities, now’s the perfect time to broaden your perspective and discover fast growing stocks with high insider ownership

But does Catalyst Metals’ impressive share price rally truly signal an undervalued stock with more room to run, or is the market already priced for future growth, leaving little room for upside?

Price-to-Earnings of 18.8x: Is it justified?

Catalyst Metals’ share price of A$6.79 places it firmly in undervalued territory based on its current price-to-earnings (P/E) ratio of 18.8x. This figure is attractive both compared to peers and the broader industry average.

The price-to-earnings ratio tells investors how much they are paying for each dollar of company profits. For a mining business like Catalyst Metals, a lower P/E can reflect the market’s skepticism about future earnings, or it can signal a valuable buying opportunity if earnings are poised for high growth.

For Catalyst Metals, the valuation looks compelling. The company not only trades well below the Australian Metals and Mining industry average (21.7x), but also sits significantly under its estimated fair P/E ratio of 34.6x. This creates a meaningful margin for the stock to re-rate higher if current growth trends continue.

Explore the SWS fair ratio for Catalyst Metals

Result: Price-to-Earnings of 18.8x (UNDERVALUED)

However, a slowdown in annual revenue growth or weaker than expected net income gains could dampen future optimism for Catalyst Metals’ shares.

Find out about the key risks to this Catalyst Metals narrative.

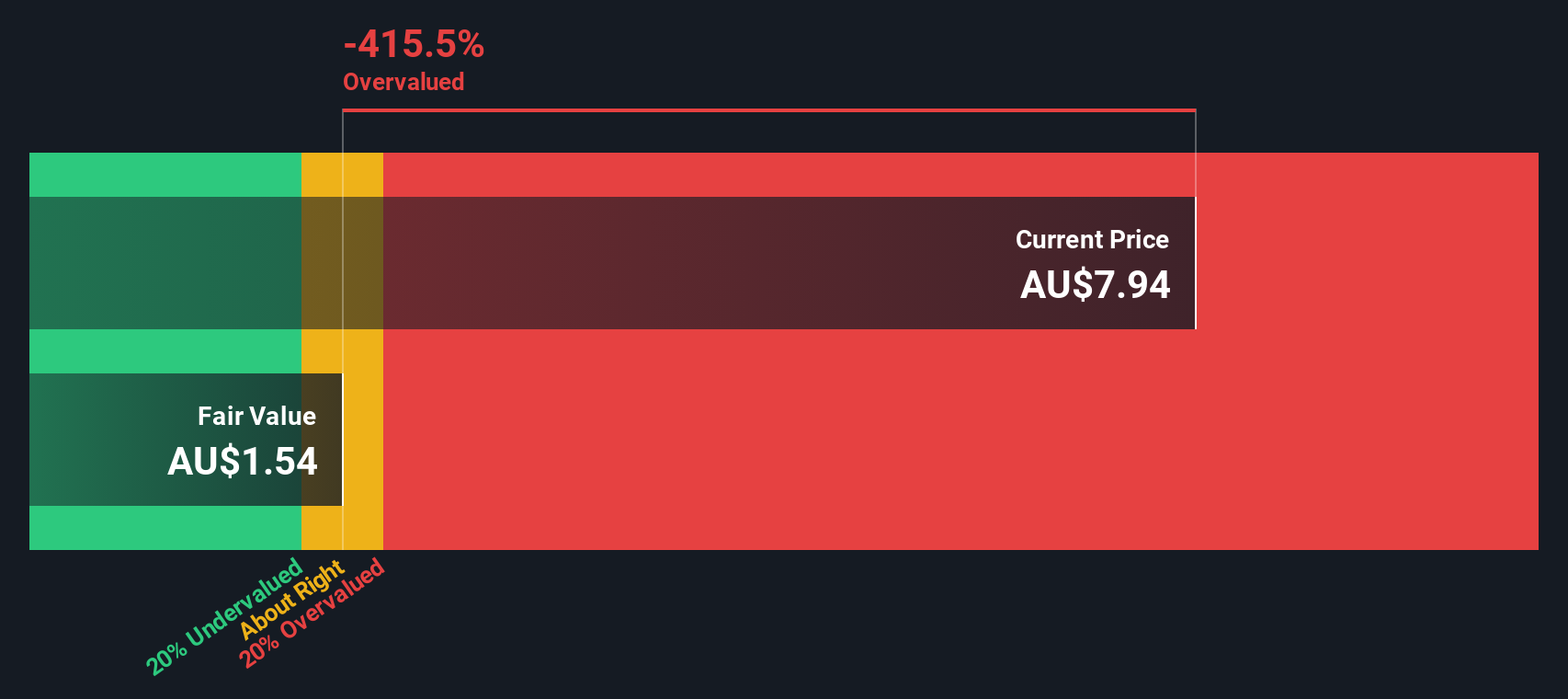

Another View: Discounted Cash Flow Perspective

Taking a fresh look using our DCF model, the numbers tell an even more dramatic story. The SWS DCF model estimates Catalyst Metals’ fair value at A$30.88, which is substantially above the current share price of A$6.79. This suggests that the stock may be trading at a significant discount to its estimated value.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Catalyst Metals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 832 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Catalyst Metals Narrative

If you have a different take or want to dig into the numbers yourself, you can craft a personalized analysis in just a few minutes, so why not Do it your way

A great starting point for your Catalyst Metals research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t stop at one opportunity. Put yourself ahead of the market by pinpointing stocks with the potential to shape tomorrow’s winning portfolio using these handpicked tools.

- Capitalize on disruptive market moves by exploring these 26 AI penny stocks that are creating powerful breakthroughs in artificial intelligence and automation.

- Boost your passive income by reviewing these 22 dividend stocks with yields > 3% with juicy yields, reliable payouts, and rock-solid financials.

- Catch the wave of borderless innovation by checking out these 81 cryptocurrency and blockchain stocks transforming finance and digital ecosystems worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CYL

Catalyst Metals

Engages in the mineral exploration and evaluation in Australia.

Exceptional growth potential and undervalued.

Similar Companies

Market Insights

Community Narratives