- Australia

- /

- Metals and Mining

- /

- ASX:BHP

Does the Recent Mining Project Progress Make BHP Shares a Bargain in 2025?

Reviewed by Bailey Pemberton

- Ever catch yourself wondering whether BHP Group’s current price tag actually matches its true worth? You are not alone, and today we are digging into exactly that.

- BHP Group's shares have edged up by 0.6% over the past week and climbed 7.1% year-to-date. These changes hint at subtle shifts in market sentiment and steady growth momentum.

- Just recently, BHP was in the spotlight after announcing progress in its major mining projects and responding to global commodity trends. Investor attention is focused on how these moves might shape future earnings potential and market position.

- Right now, BHP Group earns a valuation score of 4 out of 6. This puts its price and prospects under an intriguing spotlight, not just for the usual reasons. We will explore the traditional valuation checks next, but make sure to stick around because the best way to gauge value might surprise you at the end.

Find out why BHP Group's 9.1% return over the last year is lagging behind its peers.

Approach 1: BHP Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This approach helps investors gauge whether the current market price fairly reflects the business's ability to generate cash over time.

For BHP Group, the most recent Free Cash Flow stands at $10.35 billion. Analyst forecasts are available up to five years, with the 2030 projection at $10.23 billion. Further out years are extrapolated. Notably, these cash flows remain consistently above $9 billion through the decade, indicating a stable and mature business with robust cash generation.

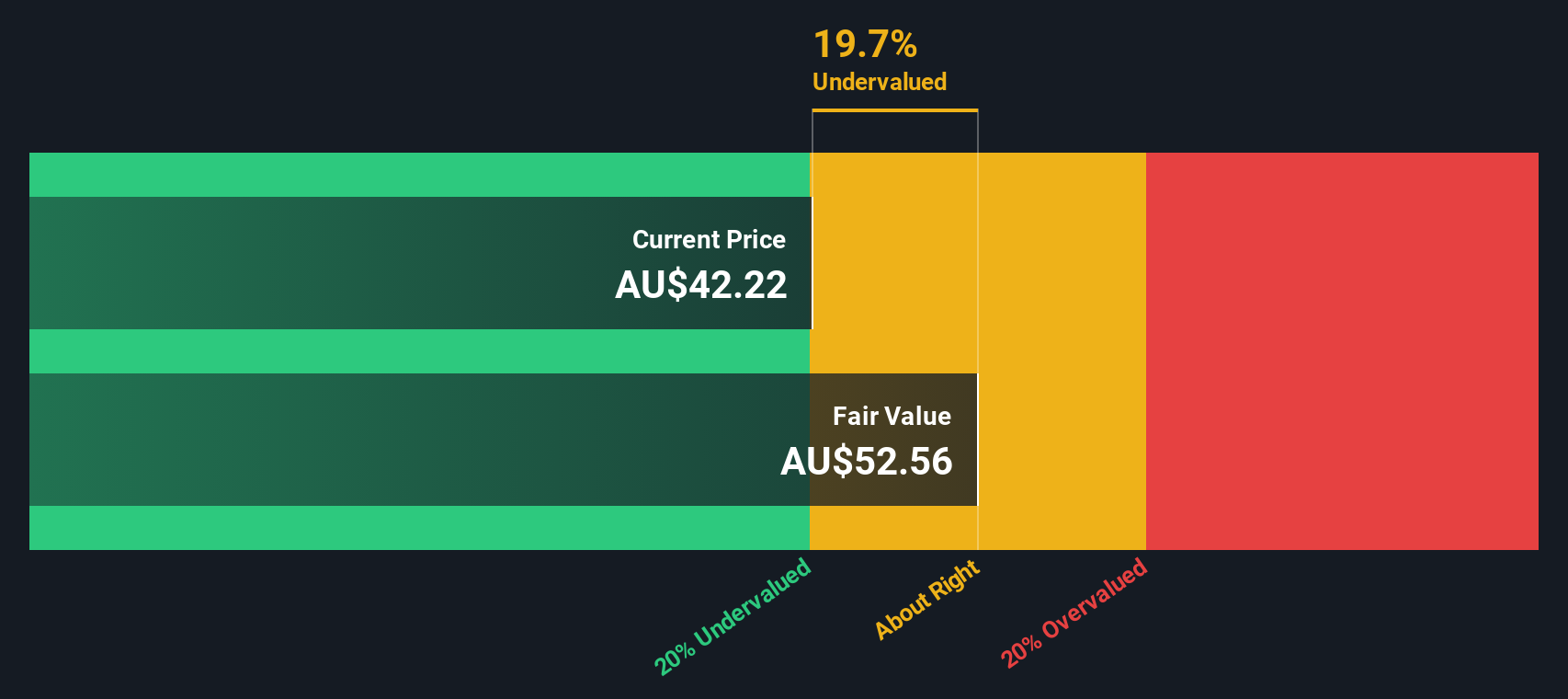

Based on these projections, the DCF model calculates BHP Group’s intrinsic value at $47.70 per share. Compared to the share price, this suggests the stock is trading at a 10.3% discount, implying it is undervalued according to this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BHP Group is undervalued by 10.3%. Track this in your watchlist or portfolio, or discover 872 more undervalued stocks based on cash flows.

Approach 2: BHP Group Price vs Earnings

The Price-to-Earnings (PE) ratio is widely used for valuing profitable companies like BHP Group because it shows what investors are willing to pay for each dollar of earnings. This makes it an effective metric for mature businesses with stable profit streams, allowing straightforward comparisons across sectors and time periods.

A “normal” or “fair” PE ratio for any given stock depends on various factors, particularly its future earnings growth potential and the risks specific to its industry and business model. Higher growth prospects and lower risk typically justify higher PE ratios. Lower growth or greater uncertainty might call for a discount.

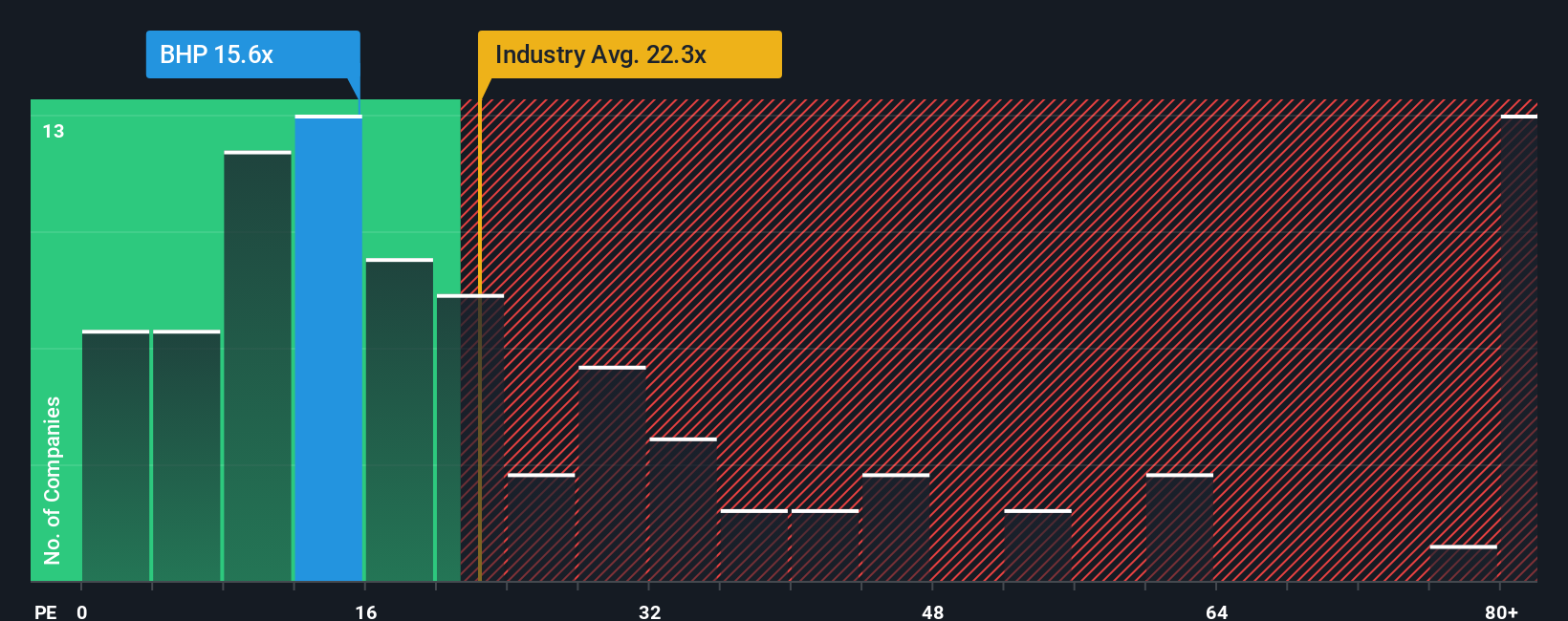

BHP Group’s current PE ratio sits at 15.7x. This is noticeably below both the peer average of 19.2x and the broader industry average of 21.5x for Metals and Mining. At first glance, this could suggest the stock is undervalued compared to its competitors.

However, Simply Wall St’s proprietary “Fair Ratio” takes valuation a step further. The Fair Ratio for BHP Group is calculated at 25.5x, carefully factoring in the company’s actual and expected earnings growth, profitability, business risks, size, and specific sector dynamics. This holistic measure often provides a more nuanced view than simply comparing to general industry or peer averages, as it adjusts for what truly sets BHP apart in the market.

Since BHP’s current PE is noticeably lower than its Fair Ratio, the stock appears to be undervalued when considering all company-specific factors and not just industry benchmarks.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1402 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BHP Group Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives, an innovative approach that empowers you to connect your own view of a company's story with the actual numbers behind valuation.

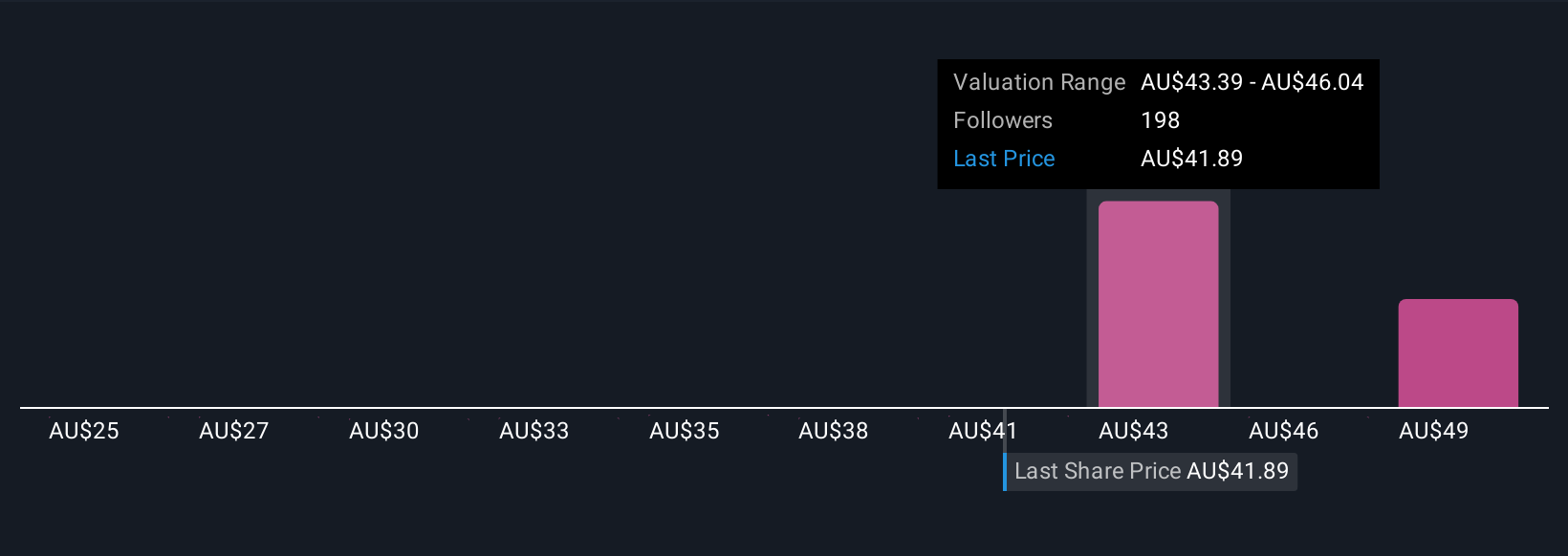

A Narrative is simply your personalized storyline for a company. It combines your assumptions about its future revenue, earnings, and profit margins with a transparent calculation of fair value. Instead of relying solely on rigid formulas or analyst targets, Narratives let you express your perspective—what you believe will drive BHP Group forward or hold it back—and see how those beliefs translate to a fair value and an investment decision.

Narratives are available on Simply Wall St’s Community page, where millions of investors collaborate and share perspectives. This tool is easy to use: create your Narrative, attach your key business drivers, and instantly see how fair value changes if new information, such as earnings results or project updates, appears.

Narratives help you decide whether to buy or sell by letting you compare your calculated Fair Value to the current market Price, all while staying up to date as fresh news or data flows in. For example, one BHP Group Narrative might forecast strong demand in Asia and resilient margins, leading to a bullish price target as high as A$46.55. Another may be cautious about commodity risks, projecting a fair value of just A$35.82.

Do you think there's more to the story for BHP Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BHP Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BHP

BHP Group

Operates as a resources company in Australia, Europe, China, Japan, India, South Korea, rest of Asia, North America, South America, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives