- Australia

- /

- Metals and Mining

- /

- ASX:BHP

BHP Group (ASX:BHP) Sets 2026 Copper Production Target Between 1.8 Mt and 2.0 Mt

Reviewed by Simply Wall St

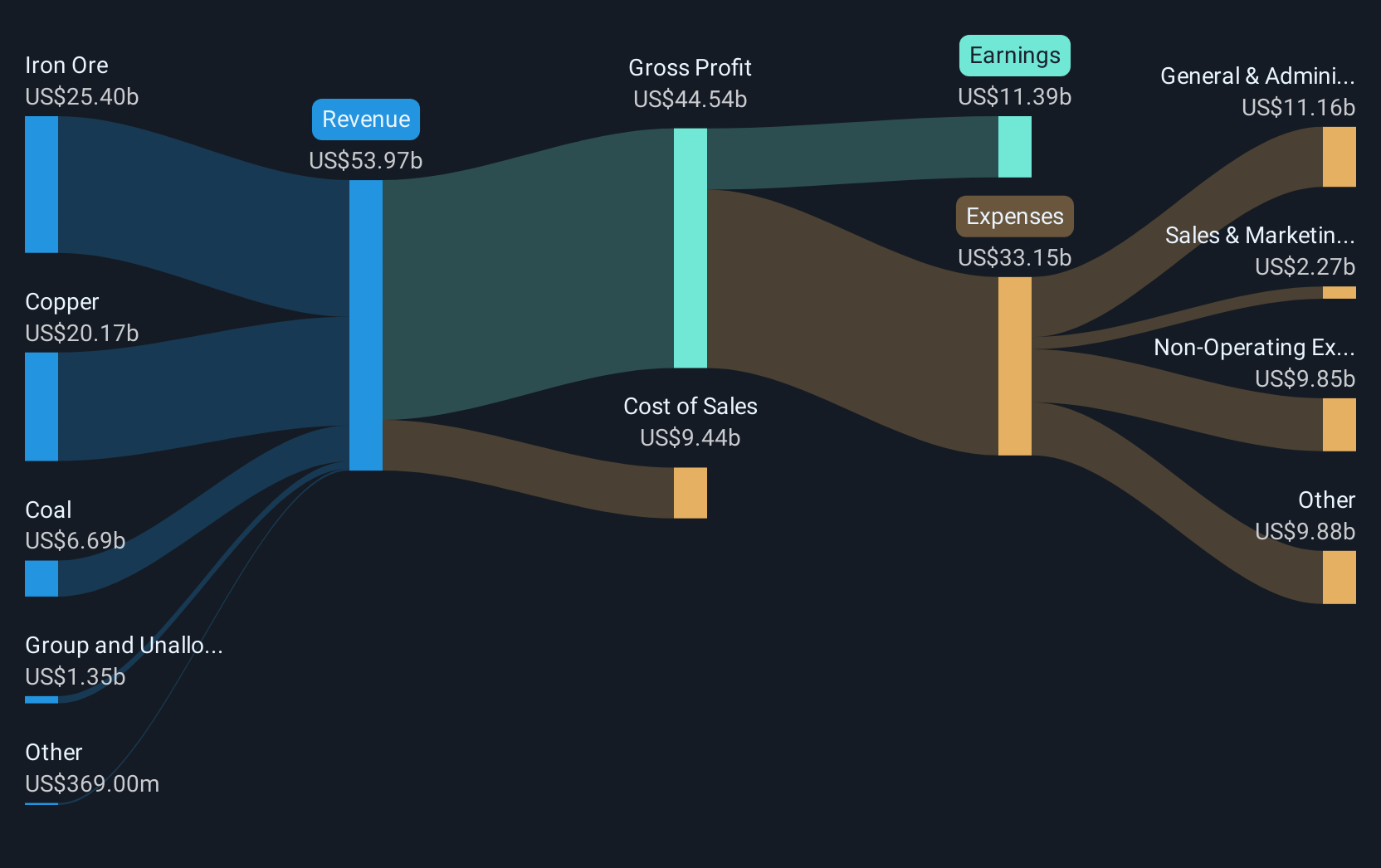

BHP Group (ASX:BHP) recently announced new corporate guidance, confirming stable copper production levels expected for fiscal year 2026, a positive signal of its commitment to market demand. Over the last quarter, BHP's share price increased by approximately 10%, aligning with broader market optimism driven by strong earnings reports and economic resilience. This performance occurred amidst a market environment where major indices reached record highs, supported by robust corporate results. BHP's commitment to maintaining steady production likely bolstered investor sentiment, contributing positively to its share price amidst generally favorable market conditions.

The recent announcement of stable copper production levels for fiscal year 2026 by BHP Group (ASX:BHP) could reinforce its narrative of maintaining strong operational performance and expanding into new markets like potash. This assurance on production levels may support a more optimistic outlook for revenue and earnings forecasts, despite current expectations of a 2.7% annual revenue decline over the next three years. Investors might view this stability in copper output positively against the backdrop of the company's efforts to diversify revenue through potash ventures.

Over the longer term, BHP's total return, including share price and dividends, soared 72.76% over five years. However, it recently matched the Australian Metals and Mining industry's performance, which saw a 4% decline over the past year, showing some alignment with broader sector challenges. The 10% share price increase in the recent quarter reflects improved sentiment but slightly trails the analysts' price target of A$42.10, with the current price of A$40.29 still presenting a potential upside.

Assess BHP Group's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BHP Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BHP

BHP Group

Operates as a resources company in Australia, Europe, China, Japan, India, South Korea, the rest of Asia, North America, South America, and internationally.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives