- Australia

- /

- Real Estate

- /

- ASX:FRI

3 Promising ASX Penny Stocks With Market Caps Below A$300M

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has dropped 1.1%, although it has risen by 11% over the past year, with earnings forecasted to grow annually by a similar margin. For investors willing to explore beyond well-known names, penny stocks—often smaller or newer companies—can offer intriguing opportunities. While the term might evoke earlier market trends, these stocks still hold relevance today as they can provide value and growth potential when backed by strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.495 | A$141.86M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.20 | A$103.78M | ✅ 3 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.87 | A$54.17M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.84 | A$439.14M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.62 | A$267.18M | ✅ 4 ⚠️ 2 View Analysis > |

| Veris (ASX:VRS) | A$0.07 | A$36.24M | ✅ 4 ⚠️ 2 View Analysis > |

| SHAPE Australia (ASX:SHA) | A$4.35 | A$358.2M | ✅ 3 ⚠️ 1 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$4.46 | A$1.09B | ✅ 3 ⚠️ 2 View Analysis > |

| Praemium (ASX:PPS) | A$0.785 | A$375.39M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 440 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Altair Minerals (ASX:ALR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Altair Minerals Limited focuses on the exploration of natural resources in Australia and Canada, with a market capitalization of A$73.04 million.

Operations: Altair Minerals Limited has not reported any specific revenue segments.

Market Cap: A$73.04M

Altair Minerals Limited, with a market cap of A$73.04 million, is pre-revenue and debt-free, but faces challenges such as increased volatility and unprofitability with losses growing at 23.7% per year over the past five years. The company recently raised A$3.2 million through a follow-on equity offering to extend its cash runway beyond the current 7 months based on free cash flow estimates. Although short-term assets comfortably exceed liabilities, the board's inexperience and high share price volatility could pose risks for investors seeking stability in this penny stock investment.

- Navigate through the intricacies of Altair Minerals with our comprehensive balance sheet health report here.

- Gain insights into Altair Minerals' past trends and performance with our report on the company's historical track record.

Finbar Group (ASX:FRI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Finbar Group Limited, along with its subsidiaries, is involved in property development and investment in Australia with a market cap of A$216.34 million.

Operations: The company's revenue is primarily derived from Residential Apartment Development at A$262.62 million, supplemented by income from Rental of Property at A$10.15 million, Corporate and Overheads at A$8.15 million, and Commercial Office/Retail Development at A$9.81 million.

Market Cap: A$216.34M

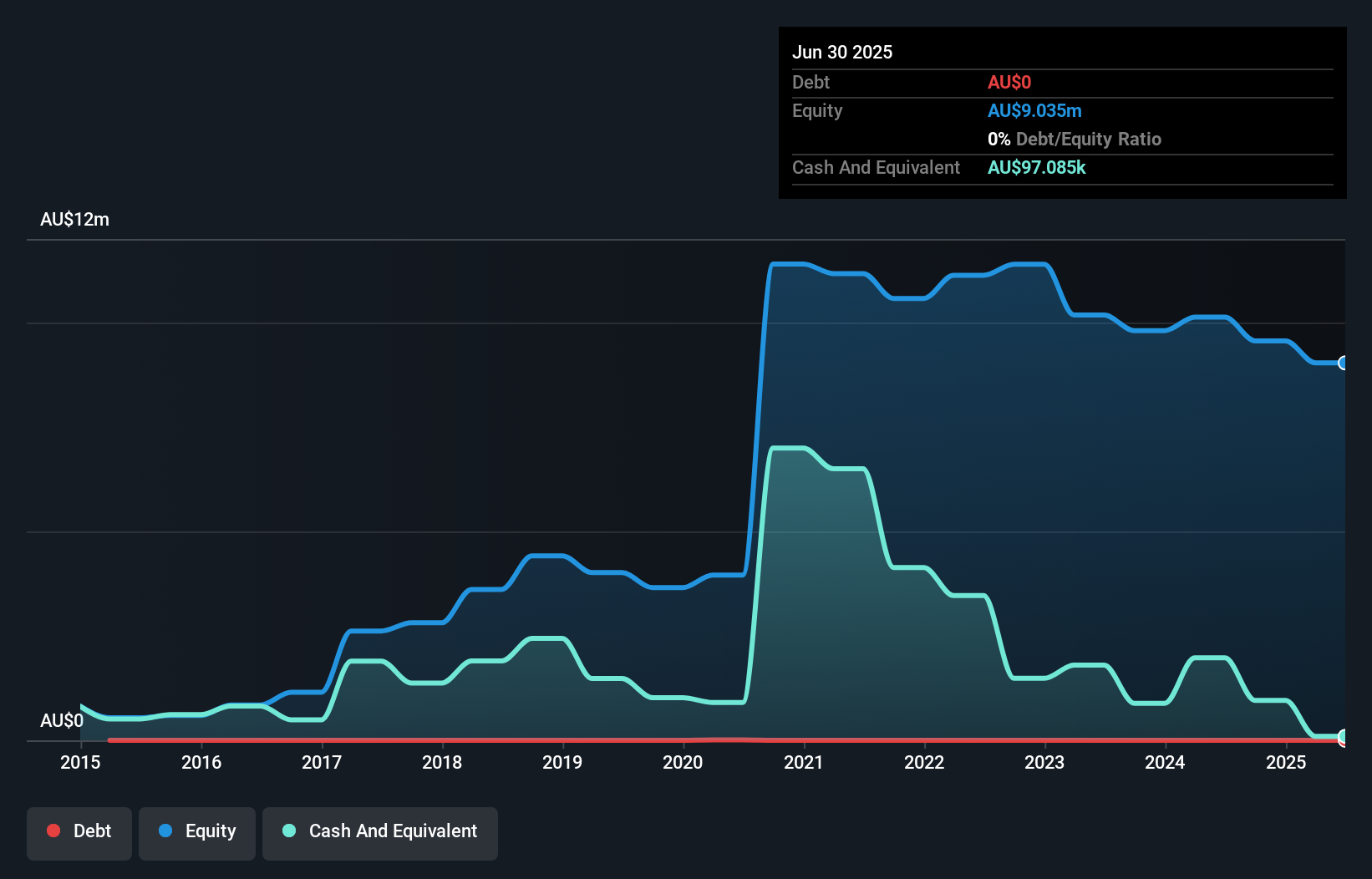

Finbar Group Limited, with a market cap of A$216.34 million, primarily generates revenue from residential apartment development, contributing A$262.62 million annually. Recent earnings show sales growth to A$284.47 million but a decline in net income to A$14.38 million compared to the previous year. The company has reduced its debt-to-equity ratio over five years and maintains strong interest coverage with EBIT at 43 times interest payments. Despite negative earnings growth last year and lower profit margins at 5.1%, Finbar's operating cash flow covers its debt well, while short-term assets exceed both short- and long-term liabilities significantly.

- Click to explore a detailed breakdown of our findings in Finbar Group's financial health report.

- Review our historical performance report to gain insights into Finbar Group's track record.

Rand Mining (ASX:RND)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rand Mining Limited is involved in the exploration, development, and production of mineral properties in Australia with a market cap of A$119.44 million.

Operations: The company's revenue is primarily derived from its Metals & Mining segment, specifically focusing on Gold & Other Precious Metals, which generated A$41.11 million.

Market Cap: A$119.44M

Rand Mining Limited, with a market cap of A$119.44 million, has demonstrated solid financial health and growth in its Metals & Mining segment, generating A$41.11 million from Gold & Other Precious Metals. The company's earnings growth of 16.8% over the past year surpasses industry averages and highlights its profitability trajectory over five years at 19.5% annually. Rand's short-term assets significantly cover both short- and long-term liabilities, while maintaining a debt-free status enhances financial stability. Despite lower net profit margins compared to last year, the company trades substantially below estimated fair value, presenting potential investment appeal within the penny stock domain in Australia.

- Click here to discover the nuances of Rand Mining with our detailed analytical financial health report.

- Understand Rand Mining's track record by examining our performance history report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 440 ASX Penny Stocks by using our screener here.

- Interested In Other Possibilities? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FRI

Finbar Group

Engages in the property development and investment business in Australia.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives