The Australian market recently faced a setback with an ASX announcement outage, affecting numerous companies and causing a slight downturn in the indices. In such fluctuating conditions, growth companies with high insider ownership can be appealing as they often signal confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 10.4% | 96.4% |

| Titomic (ASX:TTT) | 11.2% | 74.9% |

| Polymetals Resources (ASX:POL) | 37.7% | 108% |

| Pointerra (ASX:3DP) | 19.8% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Lunnon Metals (ASX:LM8) | 11% | 31.4% |

| IRIS Metals (ASX:IR1) | 26% | 144.4% |

| IperionX (ASX:IPX) | 16.9% | 94.9% |

| Echo IQ (ASX:EIQ) | 19% | 51.4% |

| Adveritas (ASX:AV1) | 18.4% | 96.8% |

We'll examine a selection from our screener results.

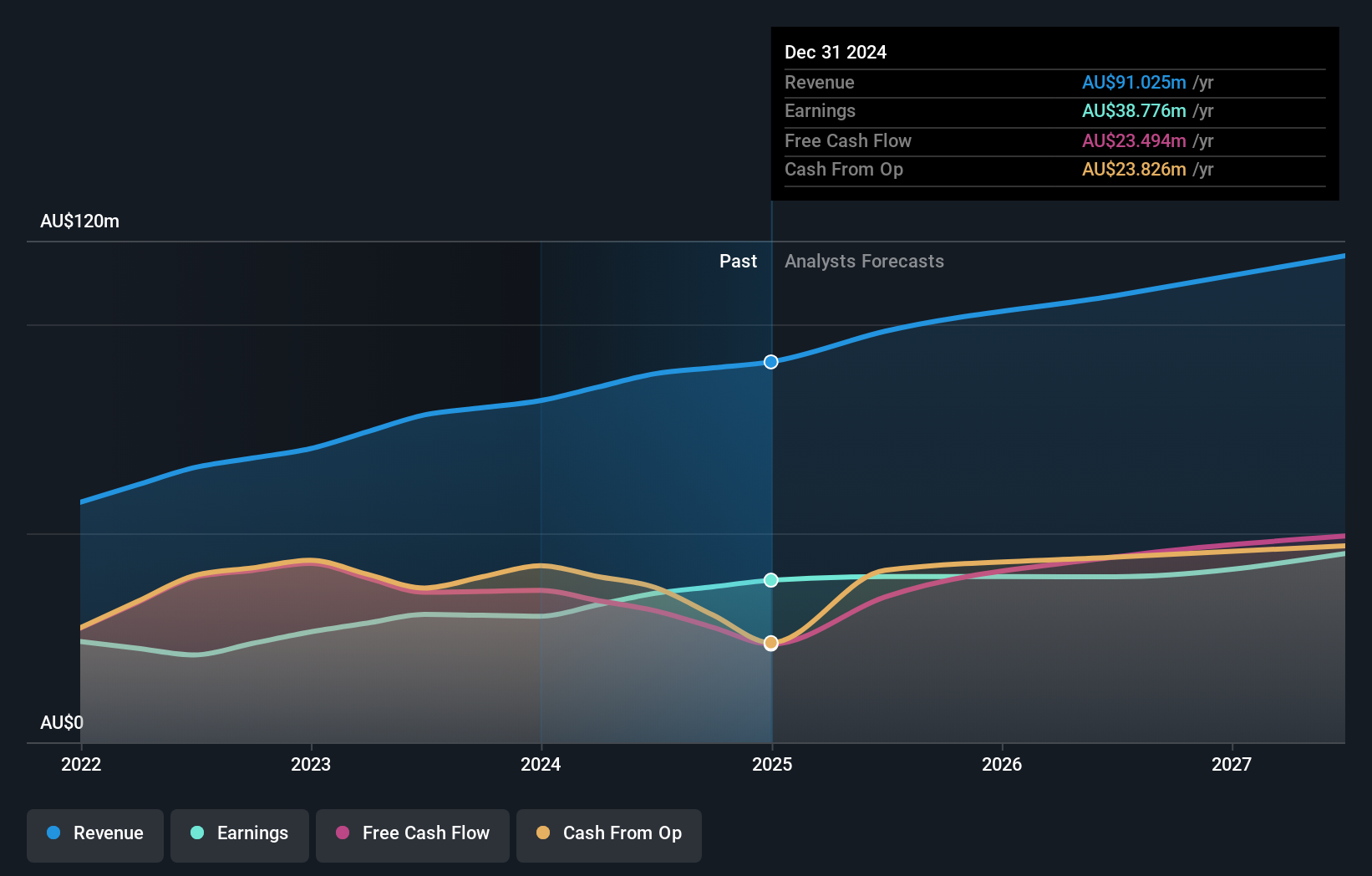

Clinuvel Pharmaceuticals (ASX:CUV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Clinuvel Pharmaceuticals Limited is a biopharmaceutical company that develops and commercializes treatments for genetic, metabolic, systemic, and life-threatening disorders across various regions including Australia, Europe, the United States, and Switzerland with a market cap of A$596.38 million.

Operations: The company's revenue is primarily derived from its Biopharmaceutical Sector, amounting to A$95.02 million.

Insider Ownership: 10.3%

Clinuvel Pharmaceuticals demonstrates strong growth prospects, with revenue expected to grow at 22% annually, surpassing the Australian market's forecast. Despite trading significantly below estimated fair value, its earnings are projected to increase by 26.15% per year. The company maintains a disciplined approach to acquisitions in North America, prioritizing risk-adjusted returns and reinvesting in its pipeline. Recent executive changes and ongoing strategic initiatives underscore Clinuvel's commitment to sustained growth and operational resilience.

- Navigate through the intricacies of Clinuvel Pharmaceuticals with our comprehensive analyst estimates report here.

- Our valuation report here indicates Clinuvel Pharmaceuticals may be undervalued.

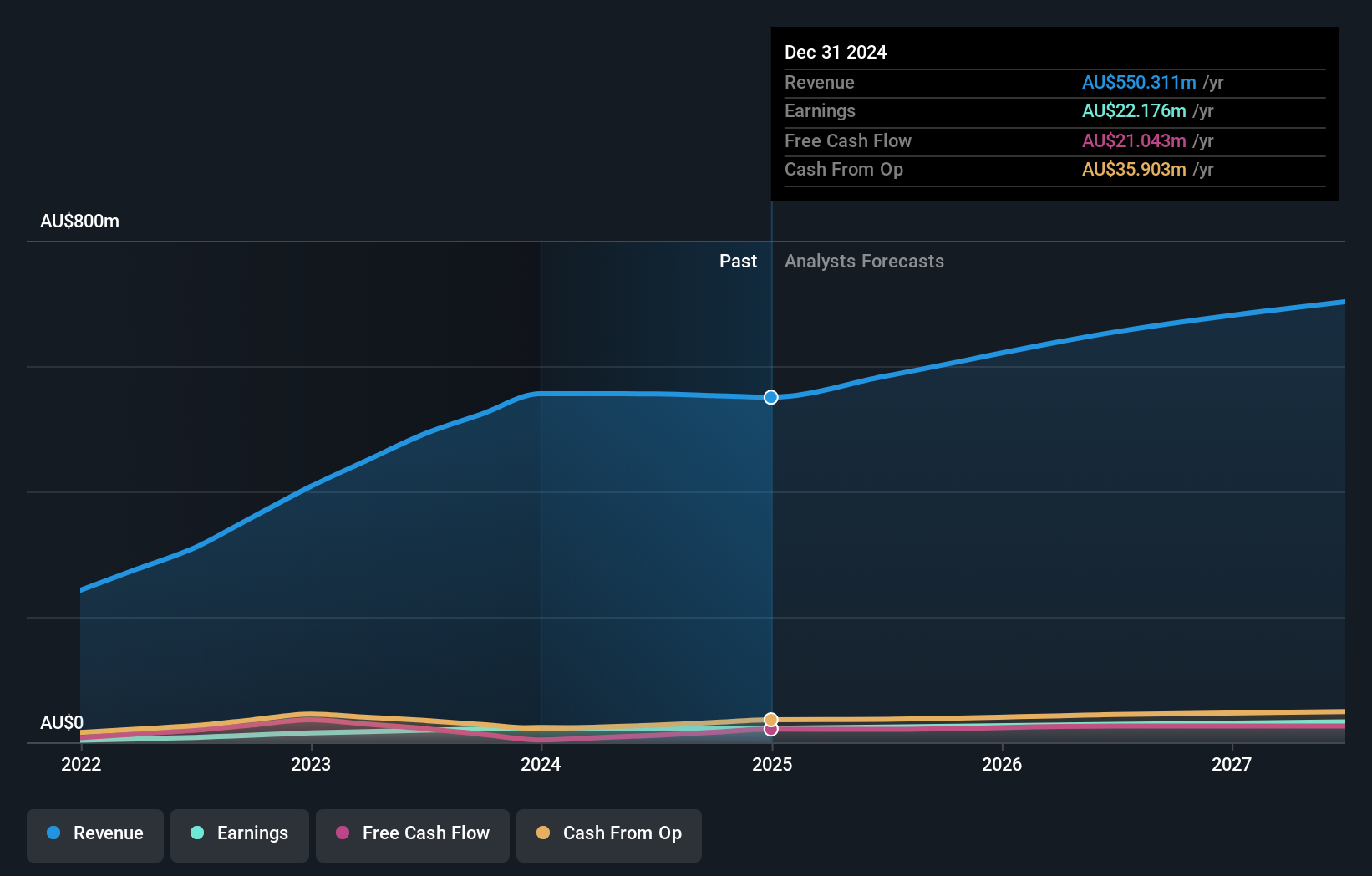

Duratec (ASX:DUR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Duratec Limited, with a market cap of A$457.68 million, provides assessment, protection, remediation, and refurbishment services for steel and concrete infrastructure assets in Australia.

Operations: The company's revenue is derived from various segments, including Energy (A$82.51 million), Defence (A$181.36 million), Buildings & Facades (A$111.87 million), and Mining & Industrial (A$136.65 million).

Insider Ownership: 29.3%

Duratec Limited is strategically positioned for growth, with a focus on diversification through acquisitions and organic expansion. The company is actively seeking strategic investments, supported by strong funding and a robust team. Its earnings are forecast to grow at 13.1% annually, outpacing the Australian market's 12.2%. Although revenue growth of 7.7% per year is moderate, it exceeds the market average of 6%. Trading below its fair value estimate enhances its investment appeal.

- Dive into the specifics of Duratec here with our thorough growth forecast report.

- According our valuation report, there's an indication that Duratec's share price might be on the expensive side.

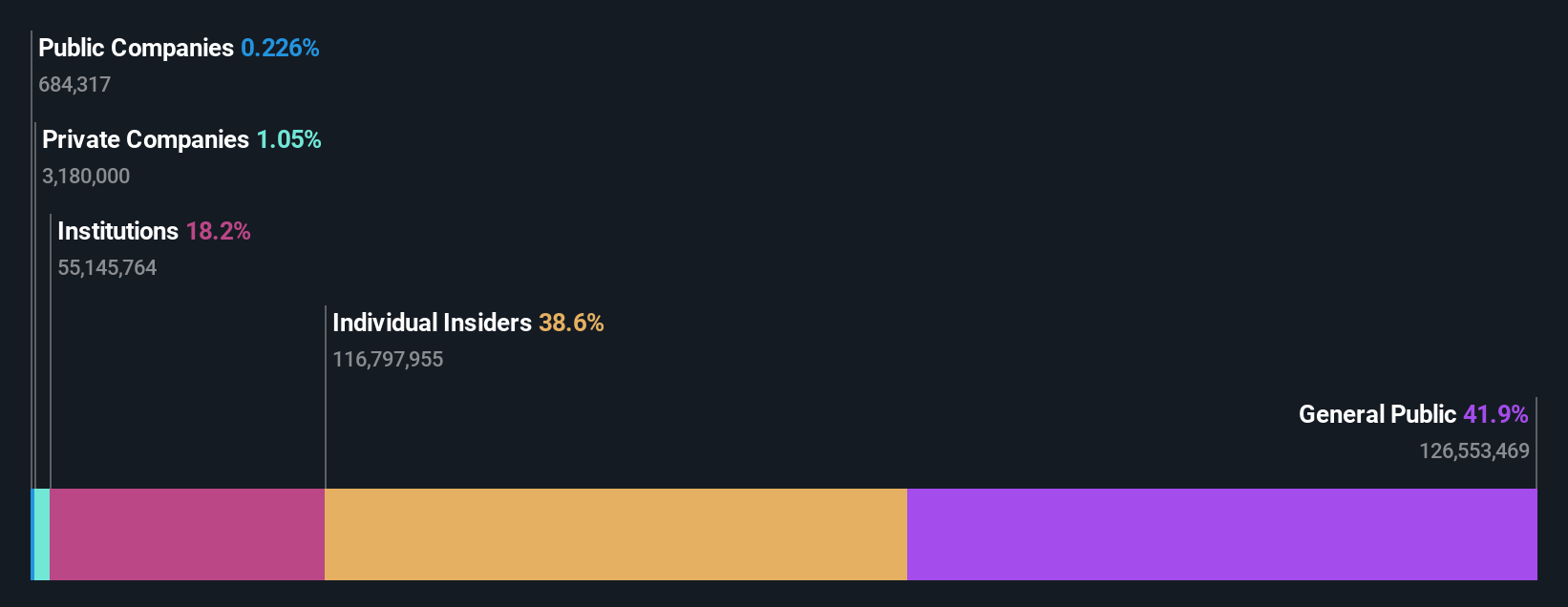

Regis Healthcare (ASX:REG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Regis Healthcare Limited provides residential aged care services in Australia and has a market capitalization of A$2.39 billion.

Operations: The company's revenue is primarily derived from its residential aged care, home care, and retirement living services, totaling A$1.16 billion.

Insider Ownership: 38.6%

Regis Healthcare is poised for growth, trading at 59.3% below its estimated fair value. While earnings are forecast to grow 19.1% annually, surpassing the market's 12.2%, revenue growth of 8.2% also exceeds the market average of 6%. The company recently became profitable and is actively pursuing strategic acquisitions to enhance its portfolio, aiming for modern assets that align with its goal of operating 10,000 beds by 2028.

- Get an in-depth perspective on Regis Healthcare's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Regis Healthcare shares in the market.

Seize The Opportunity

- Navigate through the entire inventory of 109 Fast Growing ASX Companies With High Insider Ownership here.

- Interested In Other Possibilities? Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CUV

Clinuvel Pharmaceuticals

A biopharmaceutical company, focuses on developing and commercializing treatments for patients with genetic, metabolic, systemic, and life-threatening disorders in Australia, Europe, the United States, Switzerland, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026