The Australian market has remained flat over the last week despite a 3.6% gain in the Financials sector, and it is up 10% over the past year with earnings expected to grow by 12% annually over the next few years. In this context, identifying undervalued stocks that have strong fundamentals and growth potential can be a strategic move for investors looking to capitalize on future gains.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Elders (ASX:ELD) | A$9.08 | A$18.11 | 49.9% |

| Hansen Technologies (ASX:HSN) | A$4.37 | A$8.23 | 46.9% |

| Genesis Minerals (ASX:GMD) | A$2.07 | A$4.05 | 48.9% |

| Ansell (ASX:ANN) | A$30.05 | A$57.18 | 47.4% |

| HMC Capital (ASX:HMC) | A$8.32 | A$15.48 | 46.3% |

| MLG Oz (ASX:MLG) | A$0.64 | A$1.19 | 46% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Clover (ASX:CLV) | A$0.3925 | A$0.72 | 45.8% |

| Superloop (ASX:SLC) | A$1.69 | A$3.31 | 49% |

| Sandfire Resources (ASX:SFR) | A$8.04 | A$15.03 | 46.5% |

Here we highlight a subset of our preferred stocks from the screener.

Ingenia Communities Group (ASX:INA)

Overview: Ingenia Communities Group (ASX:INA) is a leading operator, owner, and developer offering quality residential communities and holiday accommodation with a market cap of A$2.12 billion.

Operations: Ingenia Communities Group generates revenue from several segments, including A$19.26 million from Fuel, Food & Beverage, A$134.84 million from Tourism - Ingenia Holidays, A$23.67 million from Residential - Ingenia Gardens, A$86.50 million from Residential - Lifestyle Rental, and A$205.81 million from Residential - Lifestyle Development.

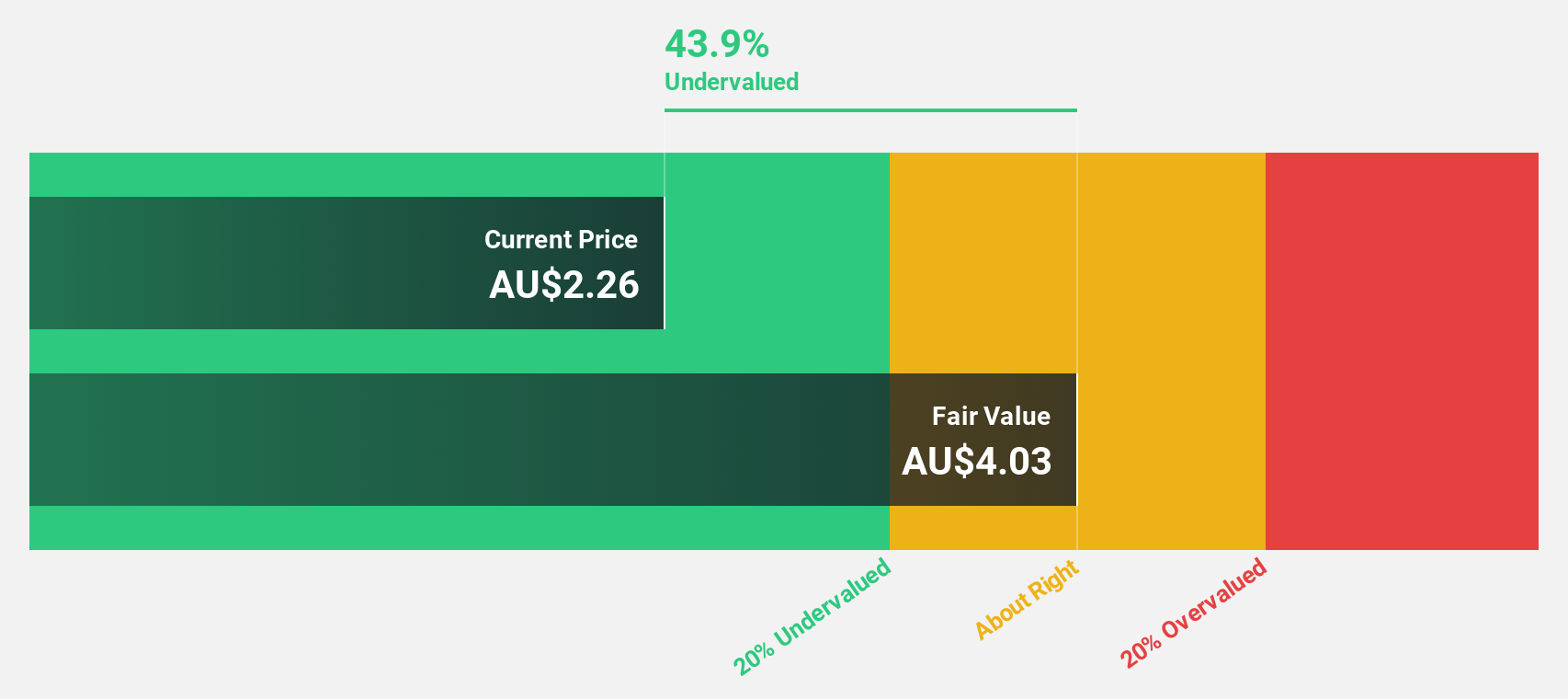

Estimated Discount To Fair Value: 44.8%

Ingenia Communities Group appears undervalued based on cash flows, trading at A$5.19 compared to an estimated fair value of A$9.4. Despite recent earnings showing a decline in net income to A$14.02 million from A$64.37 million, revenue increased from A$394.47 million to A$472.29 million year-over-year. The company’s earnings are forecasted to grow by 25.7% annually, outpacing the Australian market average of 12.1%.

- According our earnings growth report, there's an indication that Ingenia Communities Group might be ready to expand.

- Click to explore a detailed breakdown of our findings in Ingenia Communities Group's balance sheet health report.

Nuix (ASX:NXL)

Overview: Nuix Limited provides investigative analytics and intelligence software solutions across the Asia Pacific, the Americas, Europe, the Middle East, and Africa with a market cap of A$1.61 billion.

Operations: The company's primary revenue segment is Software & Programming, generating A$220.62 million.

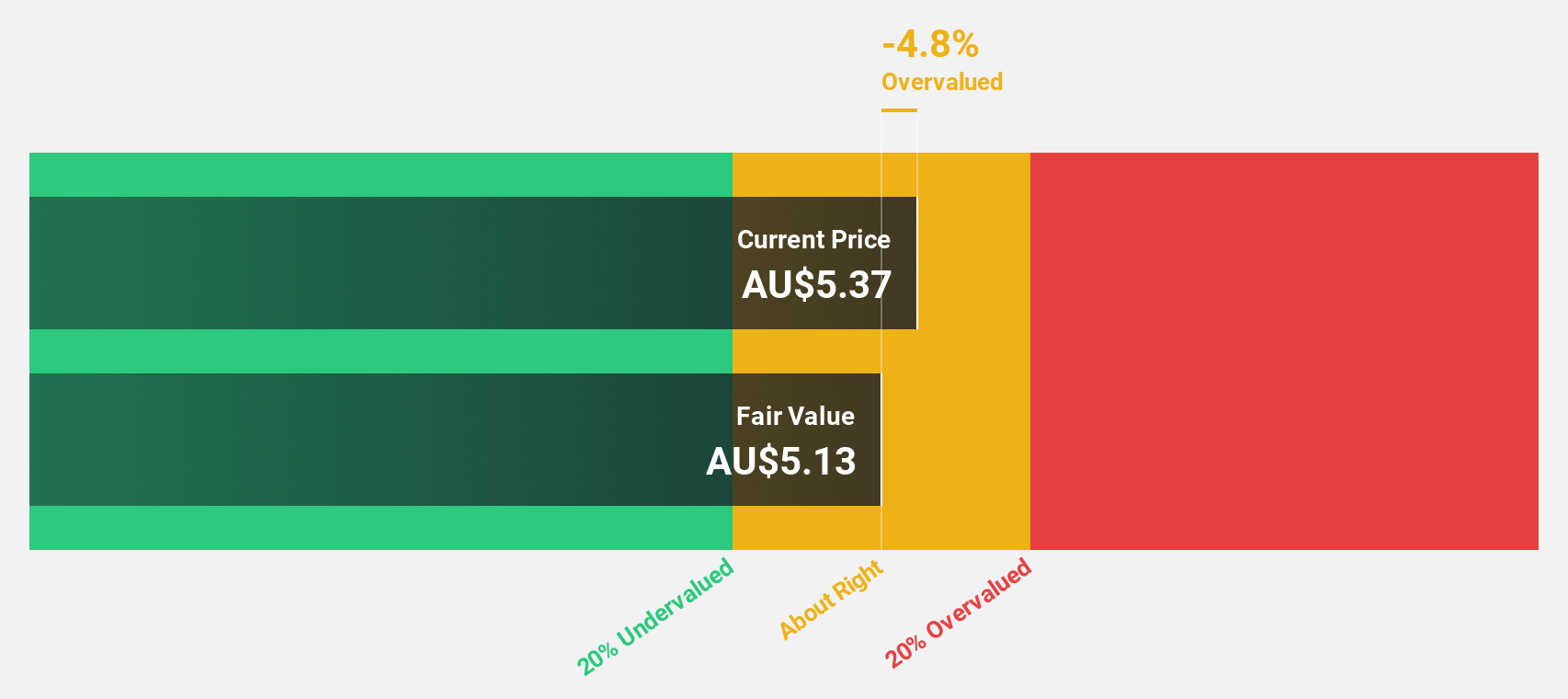

Estimated Discount To Fair Value: 14.0%

Nuix, trading at A$4.89, is undervalued based on cash flows with an estimated fair value of A$5.69. Recent earnings show a turnaround with net income of A$5.03 million compared to a net loss of A$5.59 million last year, supported by revenue growth from A$182.47 million to A$220.62 million. The company's earnings are forecasted to grow significantly at 40% annually, and the recent strategic partnership with Veritone aims to enhance their data privacy and compliance solutions portfolio further boosting prospects.

- Upon reviewing our latest growth report, Nuix's projected financial performance appears quite optimistic.

- Dive into the specifics of Nuix here with our thorough financial health report.

Paragon Care (ASX:PGC)

Overview: Paragon Care Limited (ASX:PGC) distributes medical equipment, devices, and consumables to the healthcare markets in Australia, New Zealand, and Asia with a market cap of A$695.23 million.

Operations: Paragon Care's revenue segment includes the distribution of pharmaceuticals and medical consumables to the healthcare market, generating A$2.19 billion.

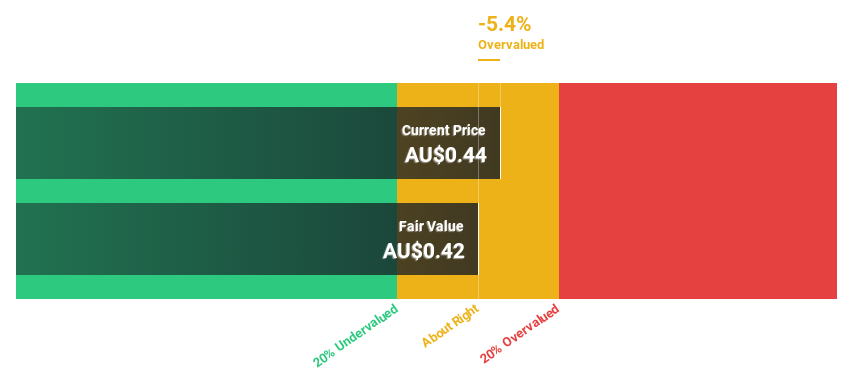

Estimated Discount To Fair Value: 20.2%

Paragon Care, trading at A$0.42, appears undervalued based on cash flows with an estimated fair value of A$0.53. The company’s earnings are forecasted to grow significantly at 31.51% per year, outpacing the Australian market's average growth rate of 12.1%. However, despite its promising revenue growth forecast of 12.8% annually and recent earnings increase by 68.4%, Paragon Care carries a high level of debt which may impact its financial flexibility moving forward.

- Our expertly prepared growth report on Paragon Care implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Paragon Care stock in this financial health report.

Taking Advantage

- Discover the full array of 46 Undervalued ASX Stocks Based On Cash Flows right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nuix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NXL

Nuix

Provides investigative analytics and intelligence software solutions in the Asia Pacific, the Americas, Europe, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.