- Australia

- /

- Healthtech

- /

- ASX:AYA

Can Anticipation Around Artrya (ASX:AYA)'s Earnings Call Reveal Shifts in Investor Confidence?

Reviewed by Sasha Jovanovic

- Artrya Limited has announced its upcoming Q1 2026 earnings call, scheduled for October 29, 2025, signaling a key moment for stakeholders awaiting developments from the company.

- This earnings call has captured increased user attention, reflecting heightened anticipation in the absence of other major company announcements in recent weeks.

- We'll explore how anticipation around Artrya's upcoming earnings call shapes the company's investment narrative and investor expectations.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Artrya's Investment Narrative?

For shareholders in Artrya, the big picture hinges on the company’s ability to translate fast product development and regulatory milestones into meaningful commercial traction. The upcoming Q1 2026 earnings call, now set for late October, comes after a string of FDA approvals and new leadership appointments that have stoked hopes for faster US market expansion. Recently, substantial capital was raised through fresh equity offerings, pointing to a stronger cash position to pursue growth, but also to further dilution as a short-term risk. While losses have been widening and the company remains well short of profitability, the business narrative has shifted somewhat with these product clearances and commercial partnerships. Unless this earnings call brings a significant upside surprise or guidance shift, however, it is unlikely to materially impact the main catalysts: adoption rates, operating leverage, and gross margin trends. That said, ongoing volatility and execution risk remain top-of-mind for anyone following Artrya’s story. On the other hand, high share price volatility is an important risk investors have to weigh.

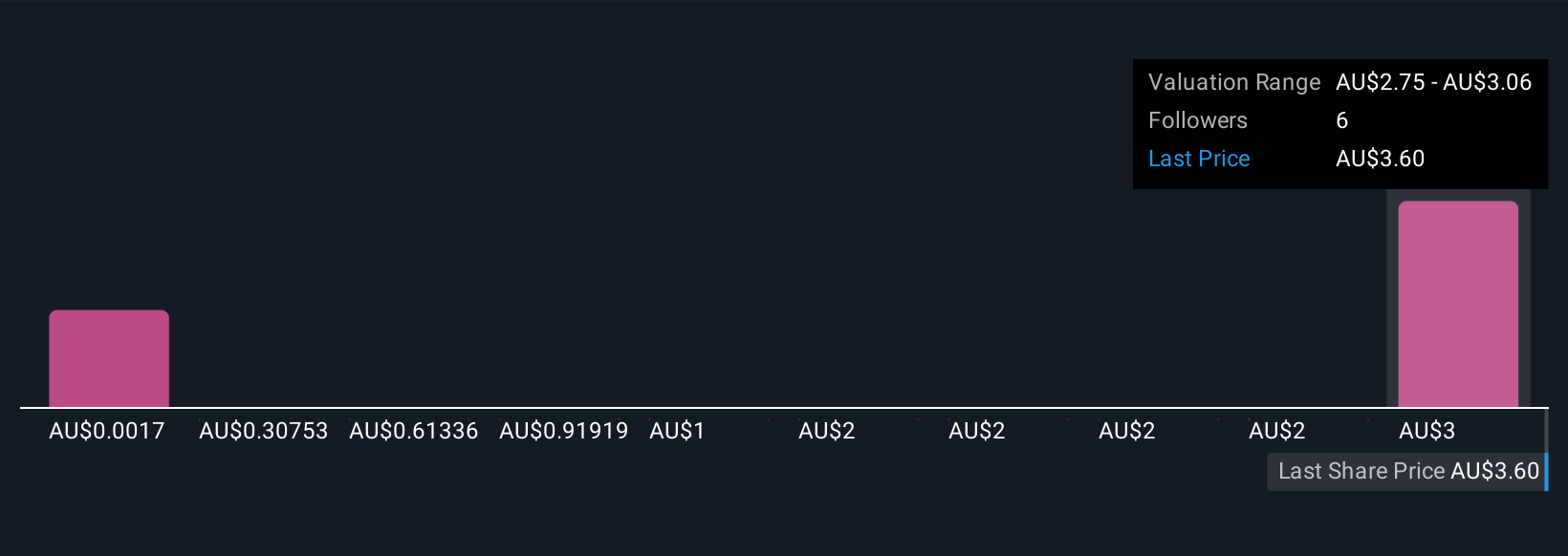

Our expertly prepared valuation report on Artrya implies its share price may be too high.Exploring Other Perspectives

Explore 4 other fair value estimates on Artrya - why the stock might be worth as much as A$3.06!

Build Your Own Artrya Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Artrya research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Artrya research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Artrya's overall financial health at a glance.

No Opportunity In Artrya?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AYA

Artrya

A medical technology company, engages in the development and commercialization of artificial intelligence platform that detects, diagnoses, and address coronary artery disease in Australia.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives