- Australia

- /

- Metals and Mining

- /

- ASX:PTN

ASX Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

The Australian market is facing a challenging period, with the ASX 200 futures indicating a significant drop following recent U.S. economic disruptions and domestic political shifts affecting investor sentiment. Despite these hurdles, opportunities still exist for investors willing to explore less conventional avenues such as penny stocks. Although the term 'penny stocks' might seem outdated, these smaller or newer companies can offer unique growth potential when backed by strong financials; we'll explore three such stocks that stand out in the current market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.455 | A$130.4M | ✅ 4 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.85 | A$52.93M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.01 | A$462.61M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.63 | A$267.92M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| LaserBond (ASX:LBL) | A$0.50 | A$59.04M | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.28 | A$1.4B | ✅ 3 ⚠️ 1 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.67 | A$247.19M | ✅ 3 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.37 | A$131.64M | ✅ 3 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.42 | A$635.89M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 416 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Australian Clinical Labs (ASX:ACL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Australian Clinical Labs Limited offers pathology diagnostic services in Australia and has a market cap of approximately A$523.12 million.

Operations: The company generates revenue primarily from its Pathology/Clinical Laboratory Services segment, amounting to A$741.27 million.

Market Cap: A$523.12M

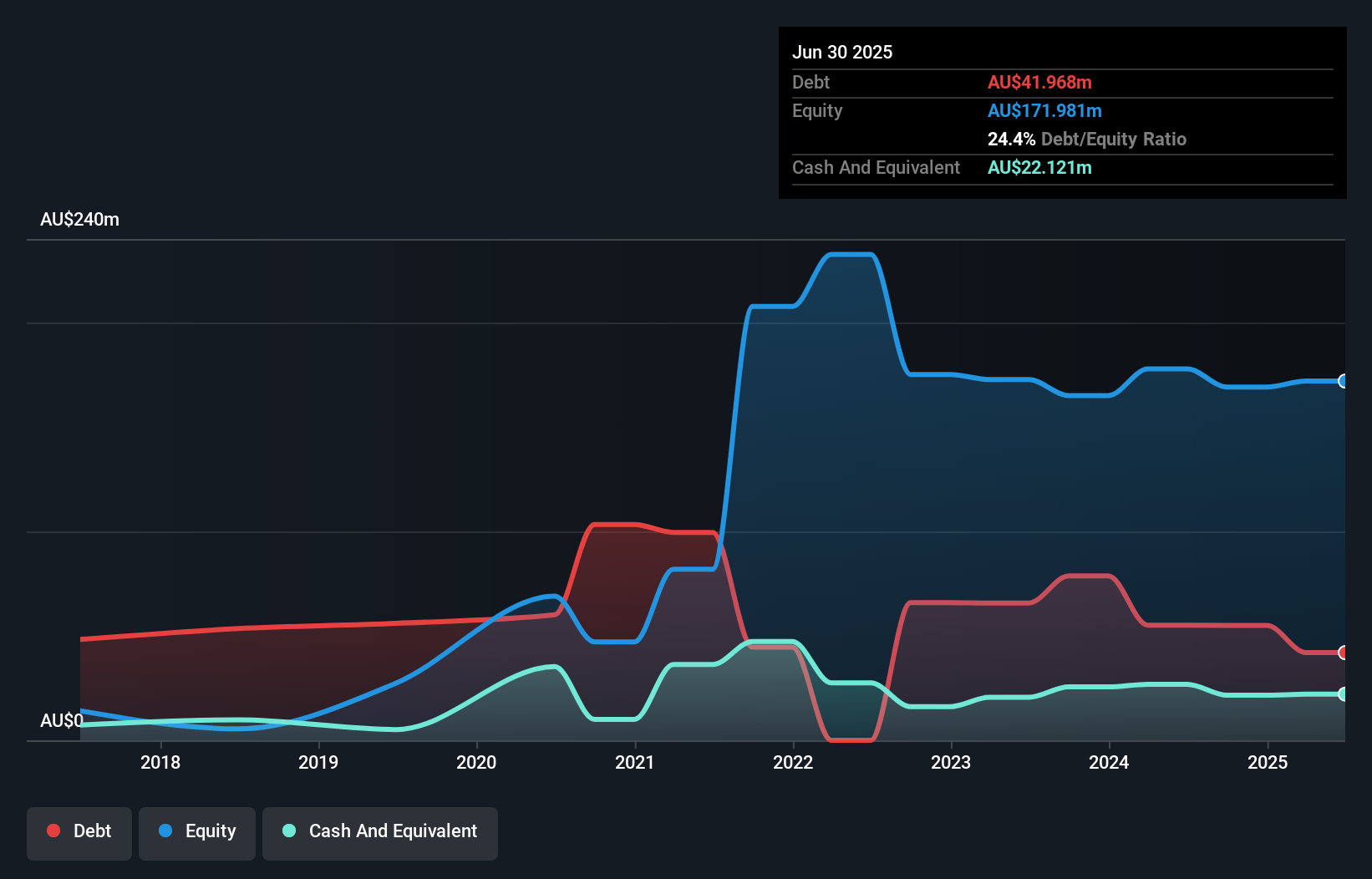

Australian Clinical Labs Limited, with a market cap of A$523.12 million, has seen significant profit growth over the past year, outpacing both its five-year average and the broader healthcare industry. Despite this positive trajectory, the company faces challenges such as short-term asset coverage issues and an inexperienced board. Recent strategic moves include a share buyback program and plans for acquisitions to bolster growth. The company's debt management is commendable with a reduced debt-to-equity ratio and well-covered interest payments by EBIT. However, its dividend track record remains unstable, warranting cautious consideration for investors interested in penny stocks.

- Click here to discover the nuances of Australian Clinical Labs with our detailed analytical financial health report.

- Learn about Australian Clinical Labs' future growth trajectory here.

Argosy Minerals (ASX:AGY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Argosy Minerals Limited, with a market cap of A$87.55 million, is involved in the exploration and development of lithium properties in Argentina and the United States.

Operations: Argosy Minerals Limited does not currently report any revenue segments.

Market Cap: A$87.55M

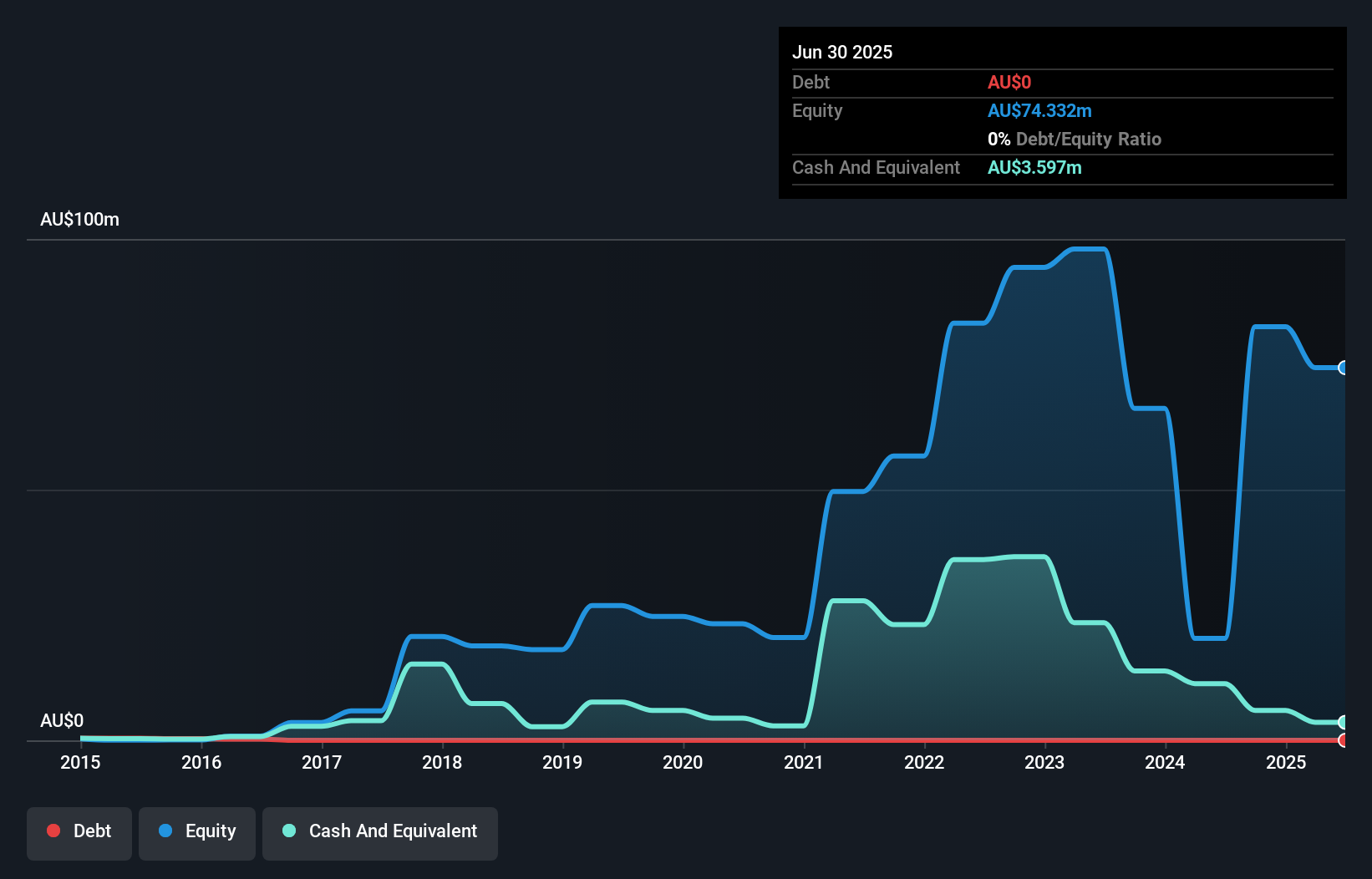

Argosy Minerals Limited, with a market cap of A$87.55 million, operates in the lithium exploration sector and remains pre-revenue, reporting less than US$1 million in revenue. The company has become profitable recently, though its earnings growth is difficult to compare historically due to this transition. Argosy's stock shows high volatility but maintains a strong return on equity at 66.2%, considered outstanding. The firm is debt-free with short-term assets exceeding liabilities and an experienced board averaging 3.6 years tenure. Its price-to-earnings ratio of 1.8x suggests potential value compared to the broader Australian market average.

- Get an in-depth perspective on Argosy Minerals' performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Argosy Minerals' track record.

Patronus Resources (ASX:PTN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Patronus Resources Limited focuses on the exploration and development of mineral properties in Australia, with a market capitalization of A$121.30 million.

Operations: No specific revenue segments are reported for Patronus Resources Limited.

Market Cap: A$121.3M

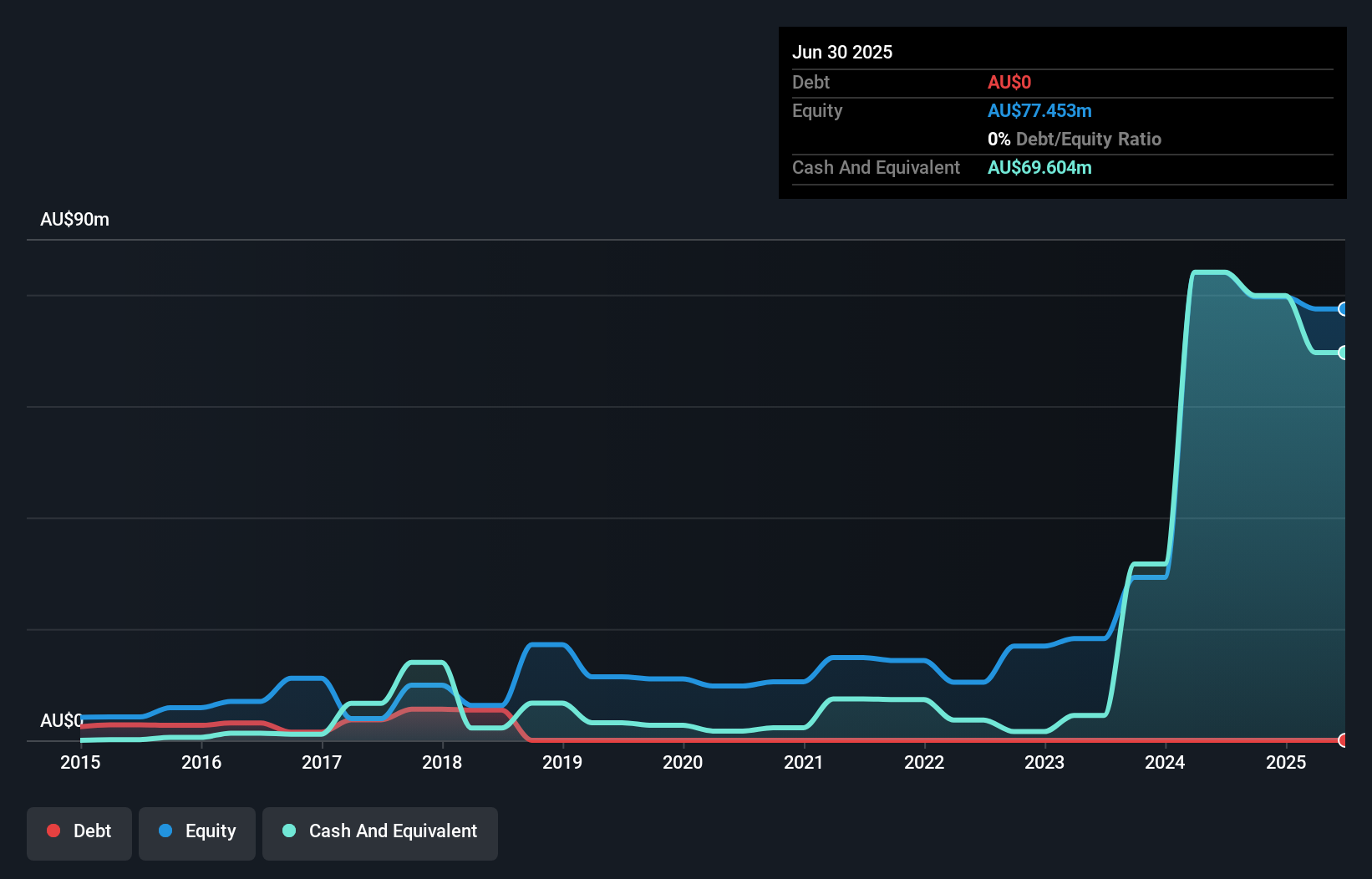

Patronus Resources Limited, with a market cap of A$121.30 million, is pre-revenue and focuses on mineral exploration in Australia. The company has no debt and possesses sufficient cash runway to sustain operations for over three years. Its short-term assets of A$80.5 million comfortably cover both short- and long-term liabilities, totaling A$3.9 million combined. Despite being unprofitable with a negative return on equity of -46.29%, losses have decreased annually by 27.7% over five years. Recent activities include significant share buybacks worth A$9.17 million, indicating potential confidence in the company's future prospects despite current challenges.

- Dive into the specifics of Patronus Resources here with our thorough balance sheet health report.

- Assess Patronus Resources' previous results with our detailed historical performance reports.

Taking Advantage

- Explore the 416 names from our ASX Penny Stocks screener here.

- Searching for a Fresh Perspective? Uncover 15 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PTN

Patronus Resources

Engages in the exploration and development of mineral properties in Australia.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives