- Australia

- /

- Real Estate

- /

- ASX:UOS

Exploring Catalyst Metals And 2 Other Promising Small Caps with Robust Fundamentals

Reviewed by Simply Wall St

As the Australian market remains rangebound, with key indices like the XJO struggling to regain past highs, investors are closely monitoring economic indicators such as bond yields and inflation data that suggest a cautious outlook. In this environment, small-cap stocks with robust fundamentals can offer intriguing opportunities, particularly those in sectors like energy and materials which have shown resilience. Exploring Catalyst Metals and two other promising small caps highlights companies that may stand out due to their sound financial health and strategic positioning amidst these broader market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Joyce | NA | 9.93% | 17.54% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Euroz Hartleys Group | NA | 1.82% | -25.32% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Energy World | NA | -47.50% | -44.86% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

| Reef Casino Trust | 19.84% | 6.96% | 10.88% | ★★★★☆☆ |

We'll examine a selection from our screener results.

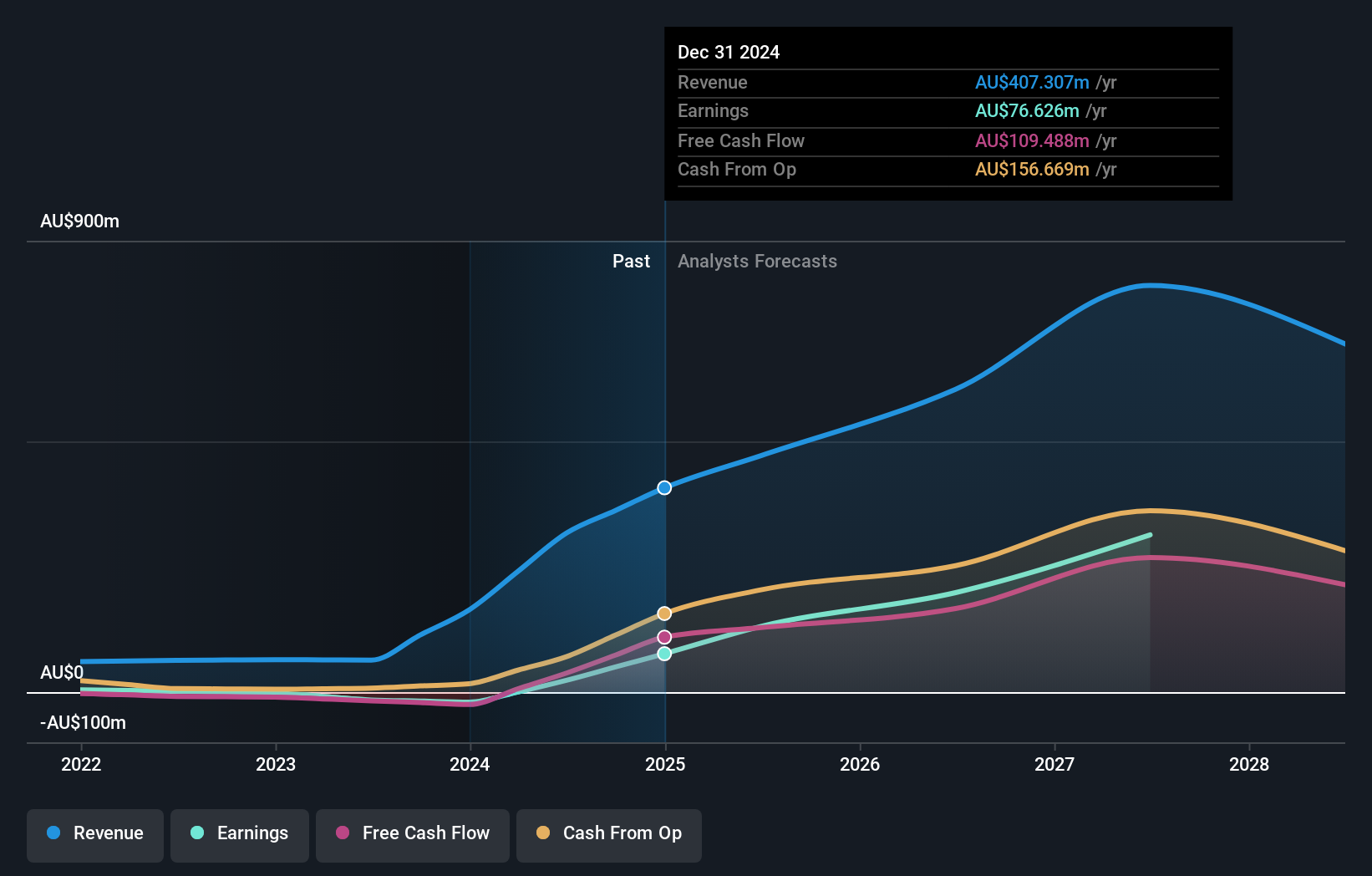

Catalyst Metals (ASX:CYL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Catalyst Metals Limited focuses on mineral exploration and evaluation in Australia, with a market cap of A$1.72 billion.

Operations: Catalyst Metals Limited generates revenue primarily from its operations in Western Australia, amounting to A$361.41 million. The company's financial structure is focused on mineral exploration and evaluation activities within this region.

Catalyst Metals, a smaller player in the mining sector, has shown impressive earnings growth of 394.9% over the past year, significantly outpacing the industry average of 10.1%. With its debt-to-equity ratio modestly increasing from 0% to 0.2% in five years, it seems to be managing its financial leverage carefully. Trading at an attractive value—86% below estimated fair value—this company offers potential upside for investors. Despite some recent insider selling and shareholder dilution, Catalyst's profitability and strong cash position suggest a stable runway for future operations.

- Click to explore a detailed breakdown of our findings in Catalyst Metals' health report.

Gain insights into Catalyst Metals' historical performance by reviewing our past performance report.

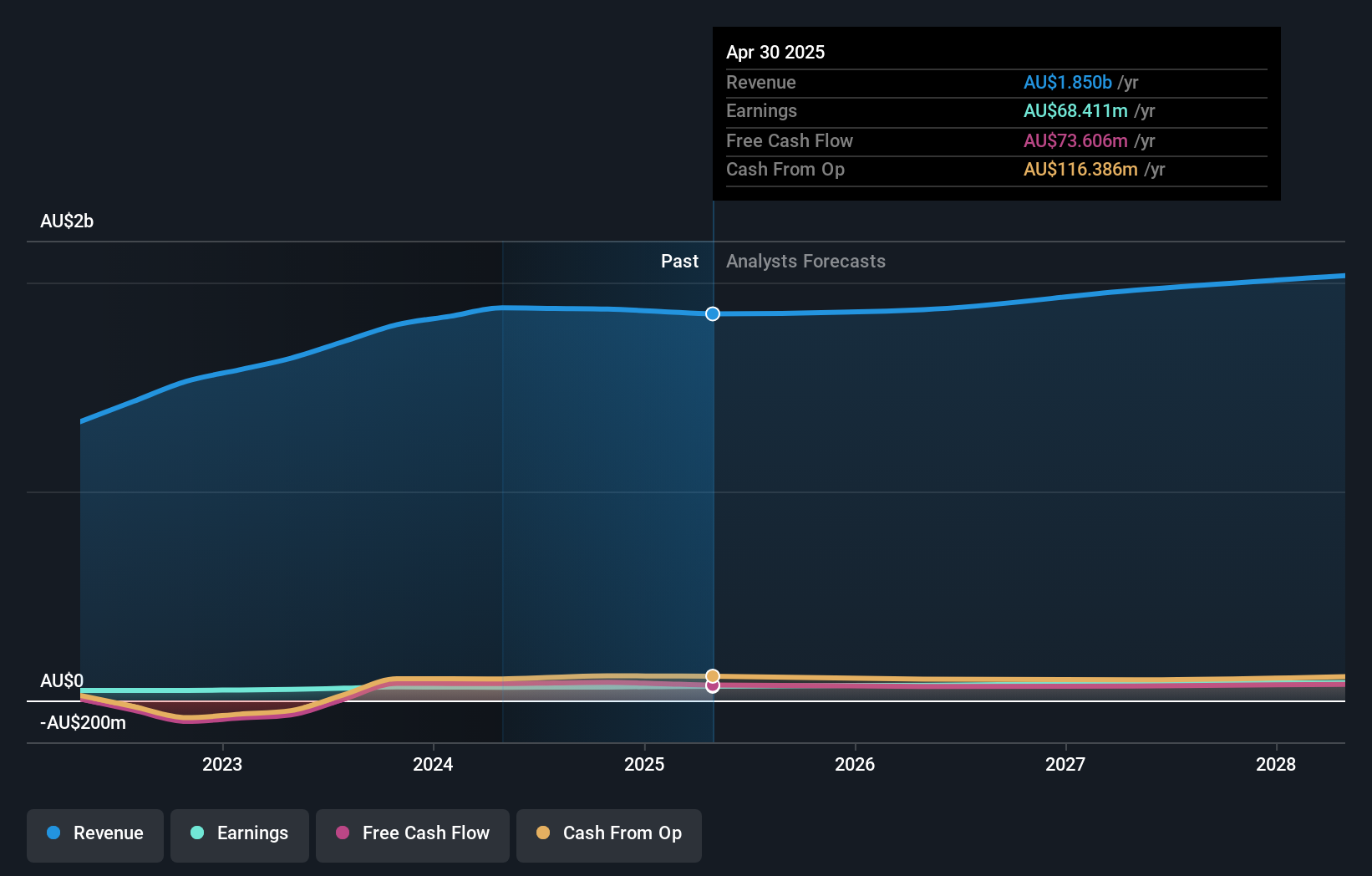

Ricegrowers (ASX:SGLLV)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ricegrowers Limited is a rice food company with operations across Australia, New Zealand, the Pacific Islands, Europe, the Middle East, Africa, Asia, and North America; it has a market cap of A$1.09 billion.

Operations: Ricegrowers generates revenue primarily from its International Rice segment (A$860.96 million) and Rice Pool segment (A$481.87 million), with additional contributions from Cop Rice (A$250.64 million) and Riviana (A$231.14 million). The company's cost structure is influenced by various operational segments, impacting its overall profitability metrics such as gross profit margin or net profit margin, which are not specified here but play a crucial role in financial performance analysis.

Ricegrowers, a dynamic player in the rice industry, is making waves with strategic expansions into the Middle East and U.S., aiming to leverage increasing demand. Their focus on innovation is clear with over 40 new product launches targeting higher-margin branded sales. The company’s financial health looks solid, boasting a net debt to equity ratio of 31.3%, well-covered interest payments at 6.8x EBIT, and earnings growth of 23.4% annually over five years. Recent index inclusions could boost visibility, though challenges like competition and crop yield issues remain significant hurdles for future growth prospects.

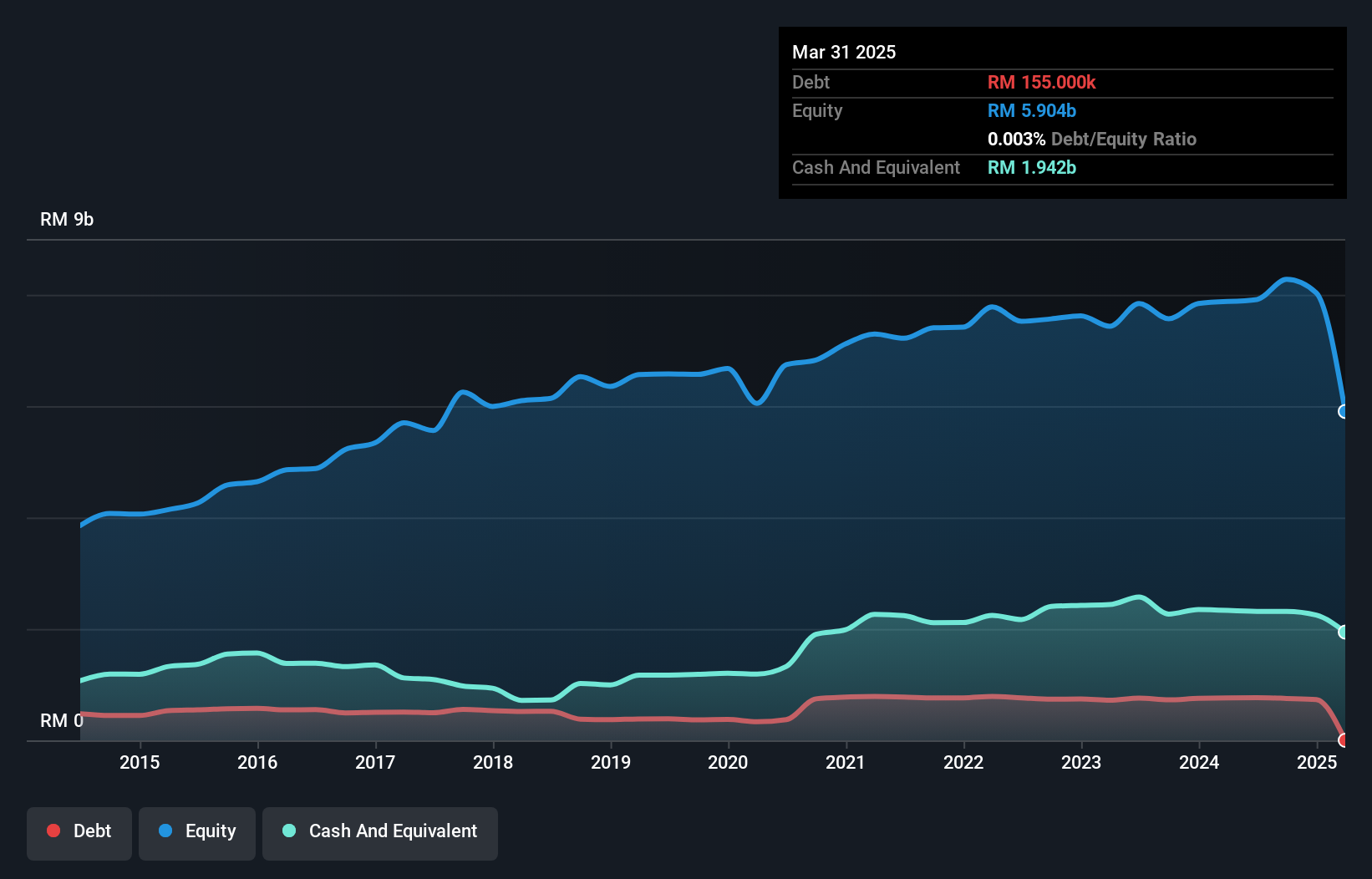

United Overseas Australia (ASX:UOS)

Simply Wall St Value Rating: ★★★★★☆

Overview: United Overseas Australia Ltd, with a market cap of A$1.11 billion, operates in the development and resale of land and buildings across Malaysia, Singapore, Vietnam, and Australia.

Operations: United Overseas Australia's primary revenue stream is derived from its land development and resale segment, generating A$438.18 million. The investment segment contributes A$257.51 million to the company's revenue.

United Overseas Australia, a smaller player in the real estate sector, offers an intriguing mix of financial stability and growth potential. With a price-to-earnings ratio of 10.8x, it stands as a good value compared to the broader Australian market's 21.2x. Over the past five years, earnings have grown at an annual rate of 1.7%, though recent growth at 27.5% lagged behind industry peers' 31.8%. The debt-to-equity ratio has risen from 5.5% to 8.8%, yet the company holds more cash than total debt, suggesting robust financial health and flexibility for future endeavors in A$.

Turning Ideas Into Actions

- Investigate our full lineup of 59 ASX Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:UOS

United Overseas Australia

Engages in the development and resale of land and buildings in Malaysia, Singapore, Vietnam, and Australia.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026