Bega Cheese (ASX:BGA) Valuation in Focus After Swing to Loss and Surprise Dividend

Reviewed by Simply Wall St

Bega Cheese (ASX:BGA) just released its full year results, and there is a lot for investors to unpack. The headline is tough: after posting a profit last year, Bega reported a net loss of A$8.5 million this time. Yet, in a move that is sparking conversation, the company also declared an interim dividend. This could signal confidence and perhaps an effort to reassure shareholders, even in the face of a weaker result. This combination of a loss and a dividend payout creates an interesting scenario as the market considers what comes next for Bega Cheese.

Looking at the bigger picture, Bega’s share price has not been stagnant. Over the past year it has climbed 33%, outpacing the broader market despite this latest setback in results. Momentum picked up in the past month, with a 10% gain following a period of more choppy trading earlier in the year. These moves occurred alongside ongoing sector headwinds, previous earnings updates, and management changes, which have put valuation in focus for investors evaluating their next moves.

After another year of volatility and a swing from profit to loss, some investors may be wondering if Bega Cheese represents a bargain opportunity, or if the market is already factoring in a potential rebound in growth.

Most Popular Narrative: 6.5% Undervalued

According to community narrative, Bega Cheese is currently trading below consensus estimates of fair value. Analysts argue that ongoing transformation and international expansion could justify a higher valuation, provided key business milestones are achieved.

The company's focus on transforming into a genuine branded business and investing in leading brands may lead to stronger future revenue growth as brand equities are leveraged and expanded. This strategic direction is expected to yield higher margins because of brand strength and consumer loyalty.

Want to know what powers this valuation call? See which key growth levers, along with bold forecasts for margins and earnings, are behind this analyst price target. Interested in how much financial upside this scenario implies? Discover the surprising projections that could make Bega Cheese a value play in the next few years.

Result: Fair Value of $6.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, weaker Australian consumer sentiment and intense competition from retailer-owned brands could limit Bega’s growth trajectory in the near term.

Find out about the key risks to this Bega Cheese narrative.Another View: Discounted Cash Flow Perspective

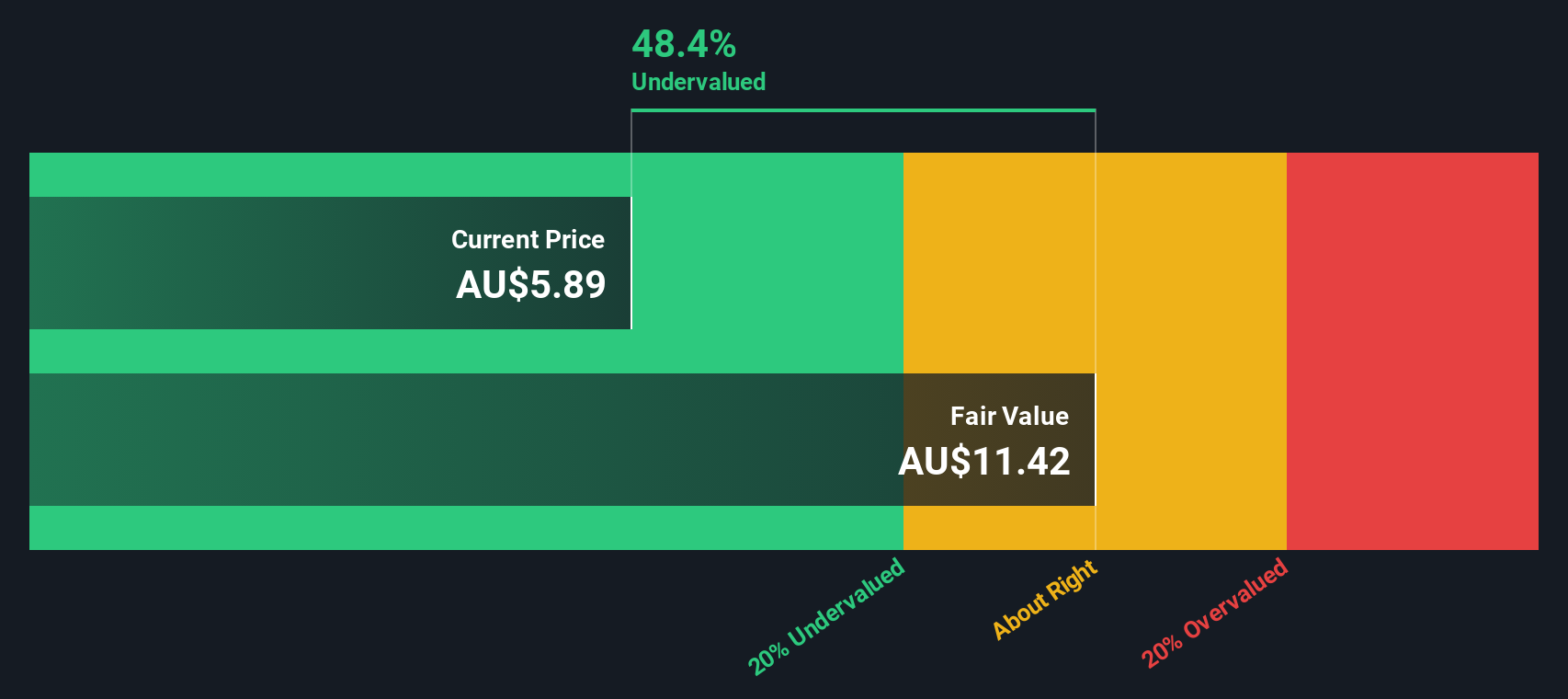

Looking from a different angle, our DCF model also finds Bega Cheese to be undervalued based on future expected cash flows. While both methods signal opportunity, an important question remains: can forward-looking projections withstand today's business volatility?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bega Cheese for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bega Cheese Narrative

If you want to dig into the numbers yourself or take a different angle from the consensus, you have the tools to form your own view in just minutes. do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Bega Cheese.

Looking for More Investment Ideas?

Opportunity does not stop at one stock. Step up your investing game by exploring these timely ideas. Each offers a different angle to help you capture the next wave of growth, technology, or stability in the market. Smart moves start with knowing where to look.

- Unlock the potential of reliable income and stability when you scan for companies offering dividend stocks with yields > 3%.

- Tap into the biggest breakthroughs in healthcare by searching for cutting-edge healthcare AI stocks.

- Fuel your portfolio with innovation and future-leading growth by checking out top picks among cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bega Cheese might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BGA

Bega Cheese

Bega Cheese Limited receives, processes, manufactures, and distributes dairy and other food-related products in Australia.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives