- Australia

- /

- Oil and Gas

- /

- ASX:BOE

Will Boss Energy’s (ASX:BOE) Conference Spotlight Reveal More on Leadership’s Strategic Vision?

Reviewed by Sasha Jovanovic

- Boss Energy Limited is set to present at the Global Uranium Conference in Adelaide on October 21, 2025, with CEO Matthew Dusci scheduled as a featured speaker.

- Investor focus is heightened as such conference presentations often provide updates or signals about company direction and industry outlook directly from leadership.

- We'll explore how anticipation around the CEO's upcoming conference appearance may influence Boss Energy's overall investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Boss Energy's Investment Narrative?

Owning shares in Boss Energy Limited requires confidence in the company's ability to execute its uranium production strategy while managing current unprofitability and a rapidly changing leadership team. The upcoming presentation by the new CEO at the Global Uranium Conference arrives at a moment when investors are seeking clarity on both the next phase of operational ramp-up at the Honeymoon project and broader corporate governance reforms, including constitutional changes flagged for the AGM. While such conferences can provide useful context and directional cues, the immediate impact on the key short-term catalysts, namely, earnings stabilization and evidence of production growth, may be limited, unless new strategic initiatives are revealed. Board inexperience and challenging recent returns remain prominent risks, and these are only more pronounced given ongoing financial losses and the company’s valuation still trading above key multiples. Yet, not all risks are visible at first glance, especially when it comes to sudden management transitions.

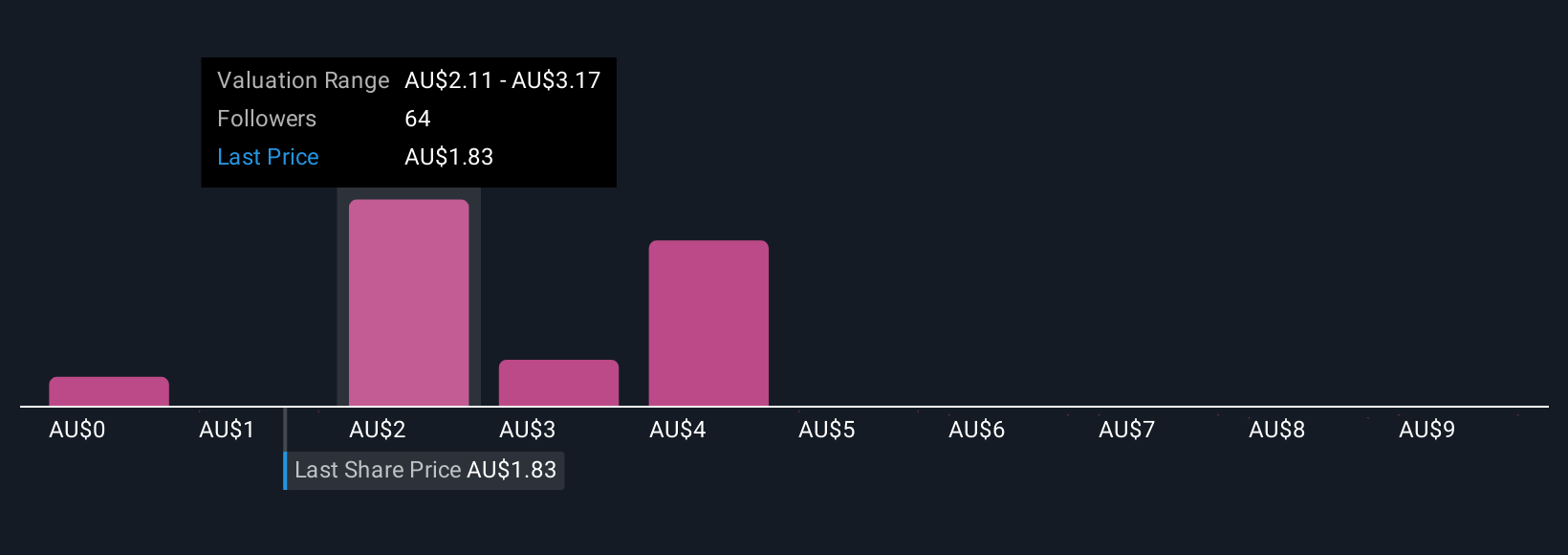

Boss Energy's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 28 other fair value estimates on Boss Energy - why the stock might be worth 47% less than the current price!

Build Your Own Boss Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boss Energy research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Boss Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boss Energy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boss Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BOE

Boss Energy

Explores for and produces uranium deposits in Australia and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives