Over the last 7 days, the Australian market has remained flat, though it is up 10% over the past year with earnings forecast to grow by 12% annually. In this context, identifying dividend stocks yielding over 4.6% can be a strategic move for investors seeking reliable income and potential growth in a stable market environment.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Perenti (ASX:PRN) | 8.08% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.67% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.32% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 6.62% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.94% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.55% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.55% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 3.90% | ★★★★★☆ |

| Grange Resources (ASX:GRR) | 7.84% | ★★★★☆☆ |

| Australian United Investment (ASX:AUI) | 3.51% | ★★★★☆☆ |

Click here to see the full list of 34 stocks from our Top ASX Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Ampol (ASX:ALD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ampol Limited purchases, refines, distributes, and markets petroleum products in Australia, New Zealand, Singapore, and the United States with a market cap of A$6.90 billion.

Operations: Ampol Limited's revenue segments include A$5.49 billion from New Zealand, A$5.97 billion from Convenience Retail, and A$34.46 billion from Fuels and Infrastructure.

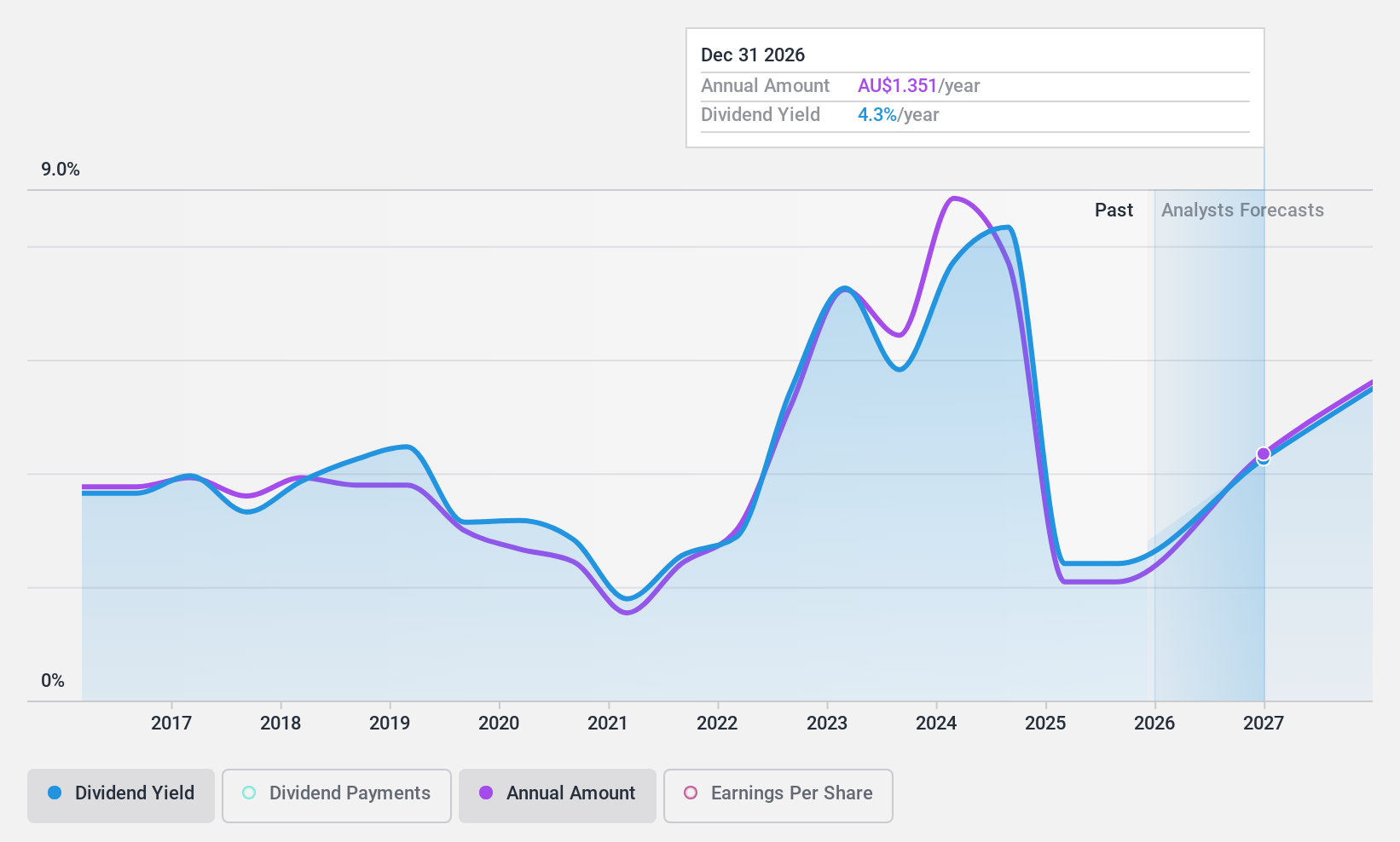

Dividend Yield: 8.3%

Ampol's dividend yield of 8.29% is among the top 25% in the Australian market, but its sustainability is questionable due to a high cash payout ratio (115.2%) and volatile past payments. Despite recent earnings growth, with net income rising from A$79.1 million to A$235.2 million for H1 2024, dividends remain inadequately covered by cash flows and earnings. The interim dividend was reduced to A$0.60 per share, reflecting a cautious approach amid strategic shifts towards renewable fuels development in Australia.

- Click to explore a detailed breakdown of our findings in Ampol's dividend report.

- Our valuation report unveils the possibility Ampol's shares may be trading at a discount.

nib holdings (ASX:NHF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: nib holdings limited, with a market cap of A$3.03 billion, operates in underwriting and distributing private health, life, and living insurance to residents, international students, and visitors in Australia and New Zealand.

Operations: nib holdings limited generates revenue from several segments, including Australian Residents Health Insurance (A$2.65 billion), New Zealand Insurance (A$373.10 million), International (Inbound) Health Insurance (A$203.50 million), NIB Travel (A$96.80 million), and Nib Thrive (A$51.30 million).

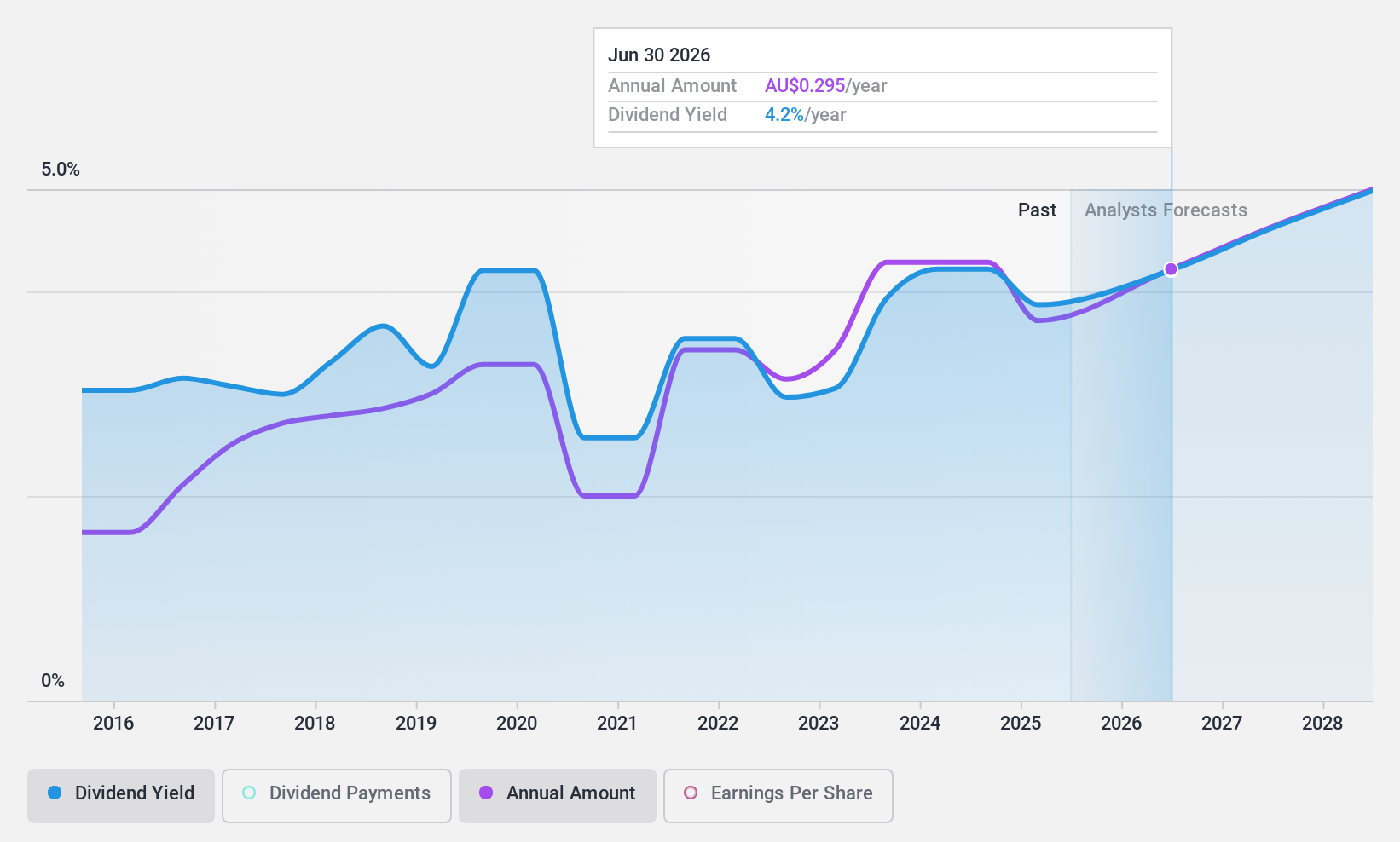

Dividend Yield: 4.6%

nib holdings reported a significant increase in net income to A$185.6 million for the full year ending June 30, 2024, up from A$114.4 million the previous year. The company declared a full-year dividend of 29 cents per share, representing a payout ratio of 75.7%. Despite this growth, nib's dividend history has been volatile and less reliable over the past decade. The incoming CEO may influence future strategies impacting dividends further.

- Click here and access our complete dividend analysis report to understand the dynamics of nib holdings.

- The valuation report we've compiled suggests that nib holdings' current price could be quite moderate.

Ricegrowers (ASX:SGLLV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ricegrowers Limited, with a market cap of A$558.10 million, operates as a rice food company serving markets in Australia, New Zealand, the Pacific Islands, the Middle East, the United States, and internationally.

Operations: Ricegrowers Limited generates revenue from several segments, including Riviana (A$222.01 million), Cop Rice (A$252.75 million), Rice Food (A$121.03 million), Rice Pool (A$498.11 million), Corporate Segment (A$45.79 million), and International Rice (A$894.03 million).

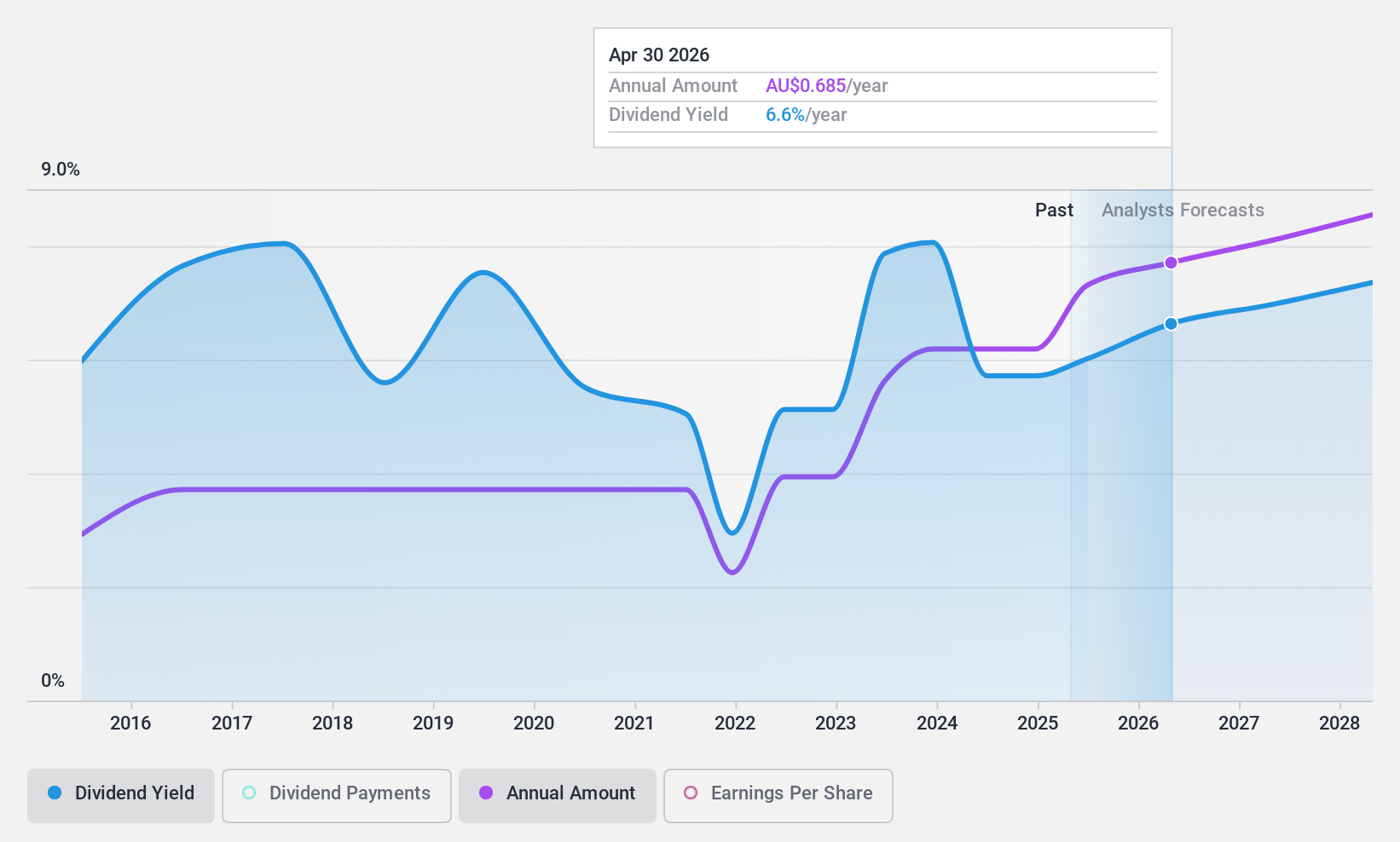

Dividend Yield: 6.4%

Ricegrowers Limited reported full-year earnings of A$63.14 million, up from A$52.55 million the previous year, with sales reaching A$1.87 billion. The company declared a regular dividend of A$0.40 and a special dividend of A$0.05 per share in July 2024, covered by earnings and cash flows with payout ratios of 56.4% and 44%, respectively. Despite a strong recent performance, its dividend history has been volatile over the past nine years.

- Delve into the full analysis dividend report here for a deeper understanding of Ricegrowers.

- Insights from our recent valuation report point to the potential undervaluation of Ricegrowers shares in the market.

Next Steps

- Gain an insight into the universe of 34 Top ASX Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SGLLV

Ricegrowers

Operates as a rice food company in Australia, New Zealand, the Pacific Islands, the Middle East, the United States, and internationally.

Undervalued with excellent balance sheet and pays a dividend.