- Australia

- /

- Capital Markets

- /

- ASX:SEC

ASX Penny Stocks To Watch In December 2025

Reviewed by Simply Wall St

With the Reserve Bank of Australia expected to maintain its current interest rate, Australian shares are experiencing another dip, influenced by overnight declines in major U.S. indices. Despite these broader market movements, opportunities still exist within specific sectors and stocks. Penny stocks—once a buzzword but now more of a niche—continue to offer growth potential by providing access to smaller or newer companies that may possess strong financial health and long-term prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.385 | A$110.34M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.56 | A$73.59M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.79 | A$49.19M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.88 | A$442.63M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.25 | A$240.05M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.074 | A$38.98M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.76 | A$3.15B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.22 | A$1.36B | ✅ 3 ⚠️ 2 View Analysis > |

| Perenti (ASX:PRN) | A$2.80 | A$2.63B | ✅ 3 ⚠️ 3 View Analysis > |

| GWA Group (ASX:GWA) | A$2.47 | A$647.83M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 416 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Navigator Global Investments (ASX:NGI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Navigator Global Investments, trading under ASX:NGI, is a fund management company based in Australia with a market capitalization of A$1.39 billion.

Operations: The company generates revenue primarily through its Lighthouse segment, which accounts for $122.84 million.

Market Cap: A$1.39B

Navigator Global Investments, with a market capitalization of A$1.39 billion, has shown strong earnings growth, significantly outpacing the industry over the past year. Despite this impressive performance, its Return on Equity is considered low at 15%. The company trades below its estimated fair value and has more cash than debt, indicating financial stability. However, short-term liabilities exceed assets slightly. Recent board changes highlight a focus on leadership continuity with Roger Davis as Chair. While revenue is projected to grow annually by 15.5%, earnings are expected to decline by 5.5% per year over the next three years due to large one-off gains impacting past results.

- Click here to discover the nuances of Navigator Global Investments with our detailed analytical financial health report.

- Gain insights into Navigator Global Investments' outlook and expected performance with our report on the company's earnings estimates.

Spheria Emerging Companies (ASX:SEC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Spheria Emerging Companies Limited is an Australian investment company with a market capitalization of A$168.83 million.

Operations: The company generates revenue through investment activities, amounting to A$24.25 million.

Market Cap: A$168.83M

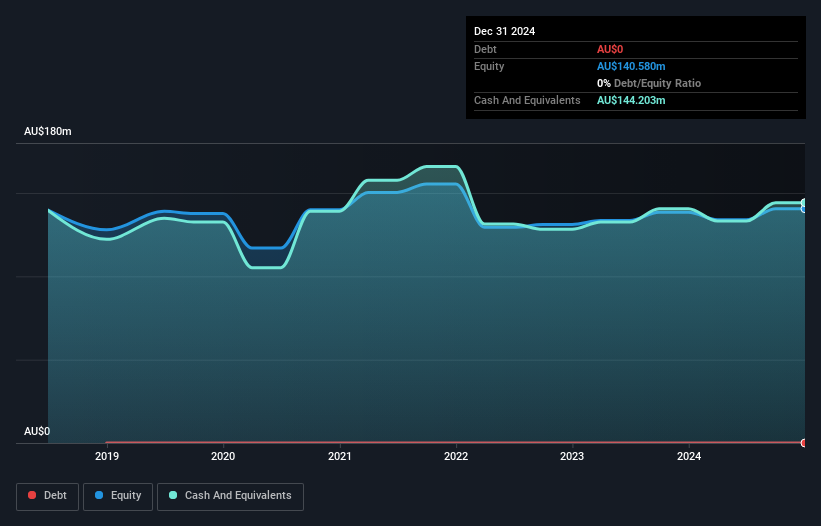

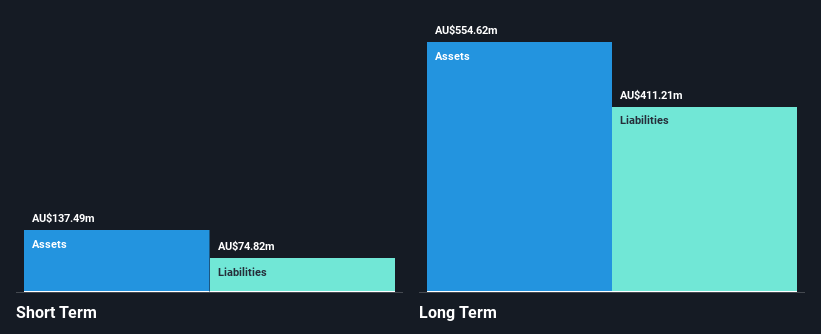

Spheria Emerging Companies Limited, with a market capitalization of A$168.83 million, demonstrates robust financial health characterized by no debt and short-term assets significantly exceeding liabilities. The company has achieved impressive earnings growth of 116% over the past year, surpassing industry averages. Its Price-To-Earnings ratio of 10.3x suggests it is undervalued compared to the broader Australian market. Despite this growth, its Return on Equity remains low at 11.5%. Recent board changes include the appointment of Marcus Burns as director, enhancing leadership expertise with his extensive financial markets experience. The company's dividend policy aligns with shareholder interests but isn't fully covered by free cash flows.

- Click here and access our complete financial health analysis report to understand the dynamics of Spheria Emerging Companies.

- Assess Spheria Emerging Companies' previous results with our detailed historical performance reports.

Southern Cross Media Group (ASX:SXL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Southern Cross Media Group Limited, with a market cap of A$199.12 million, creates audio content for distribution across broadcast and digital networks in Australia.

Operations: The company generates revenue through its digital audio segment, which contributes A$45.11 million, and its broadcast radio segment, which brings in A$376.76 million.

Market Cap: A$199.12M

Southern Cross Media Group Limited, with a market cap of A$199.12 million, has recently navigated significant shareholder activism and board changes. Despite a low Return on Equity of 3%, the company maintains high-quality earnings and has become profitable this year. Its financial structure shows improvement, with debt levels reduced to a satisfactory net debt to equity ratio of 31.8%. Short-term assets cover short-term liabilities but fall short against long-term obligations. The company's interest coverage is weak at 1.5 times EBIT, while operating cash flow effectively covers its debt at 63.6%. Earnings are forecasted to grow by 13.76% annually.

- Dive into the specifics of Southern Cross Media Group here with our thorough balance sheet health report.

- Evaluate Southern Cross Media Group's prospects by accessing our earnings growth report.

Summing It All Up

- Gain an insight into the universe of 416 ASX Penny Stocks by clicking here.

- Ready To Venture Into Other Investment Styles? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SEC

Spheria Emerging Companies

Operates as an investment company in Australia.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026